Record Drop in Ethereum Gas Fees Signals Potential Bullish Trend

Ethereum's gas fees have plummeted to a five-year low, falling over 95% from March's levels. This sharp decrease is being viewed by some analysts as a bullish signal for ETH, potentially indicating a mid-term price rebound.

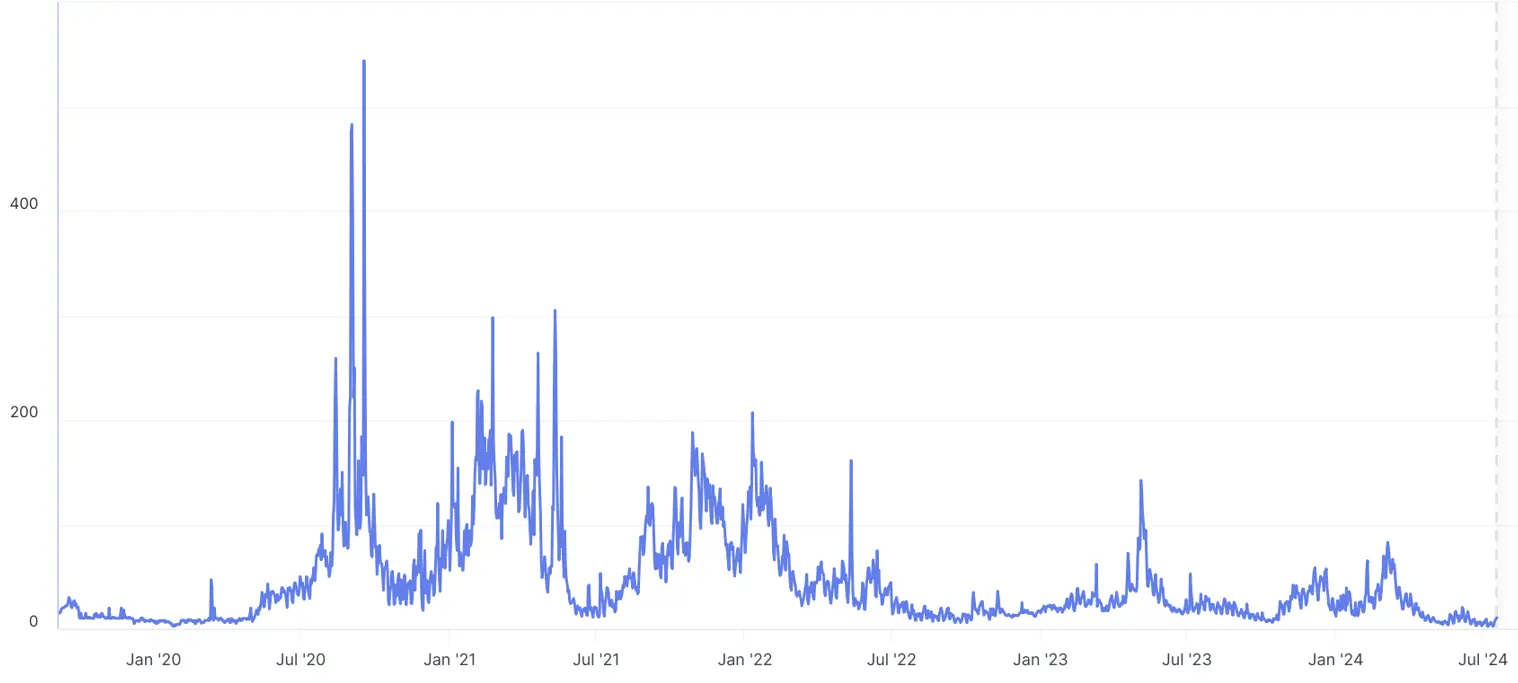

Ethereum's gas fees have recently plunged to a five-year low, marking a significant shift from the 83.1 gwei levels seen in March, when network activity surged. This dramatic reduction, exceeding 95%, is being interpreted by some as a historically bullish sign for ETH.

Ethereum Historical Patterns

Analyst Ryan Lee from Bitget Research points to historical patterns suggesting that such a substantial drop in gas fees often precedes a mid-term price rebound for Ethereum. In a note to CoinDesk on Friday, Lee stated, “Every time ETH gas fees reach rock bottom, it has frequently indicated a price bottom in the mid-term. ETH prices typically experience a strong rebound after these periods, especially when coupled with an interest rate cut cycle, which could significantly enhance the market’s wealth effect.”

Gas fees represent the cost required to conduct transactions on the Ethereum network. This week, fees fell as low as 0.6 gwei, with low-priority transactions costing 1 gwei or less—an unprecedented low in recent years. This marks a dramatic decline from the March levels of 83.1 gwei.

Lee attributes this fee drop to several factors: reduced demand for Ethereum’s block space, user migration to faster and cheaper blockchains like Solana and Layer 2 solutions, and the Dencun upgrade, which has improved network efficiency and lowered gas fees. The Dencun upgrade, which includes major changes from March, has enhanced how transactions are processed and validated on Ethereum.

Additionally, since July, Solana-based application Pump has occasionally generated more fees in a single day than the entire Ethereum network, most recently on August 13.

Bottom Line: The decrease in transaction fees has also resulted in less ether (ETH) being burned, leading to an increase in the token’s total supply. Over the past week, approximately 16,000 ETH—valued at nearly $42 million—has been added to Ethereum’s supply, marking a 0.7% increase in supply for the year.