From the bear market lows of $15,487 in November 2022, Bitcoin has surged over 573 percent, with its price appreciating 130 percent year-to-date. The current bull market reflects strong institutional demand, led by ETFs and spot accumulation. Historical data suggests we are mid-cycle, following the April 2024 halving, with the market likely to peak around Q3–Q4 2025, approximately 450 days post-halving.

Cycle Indicators

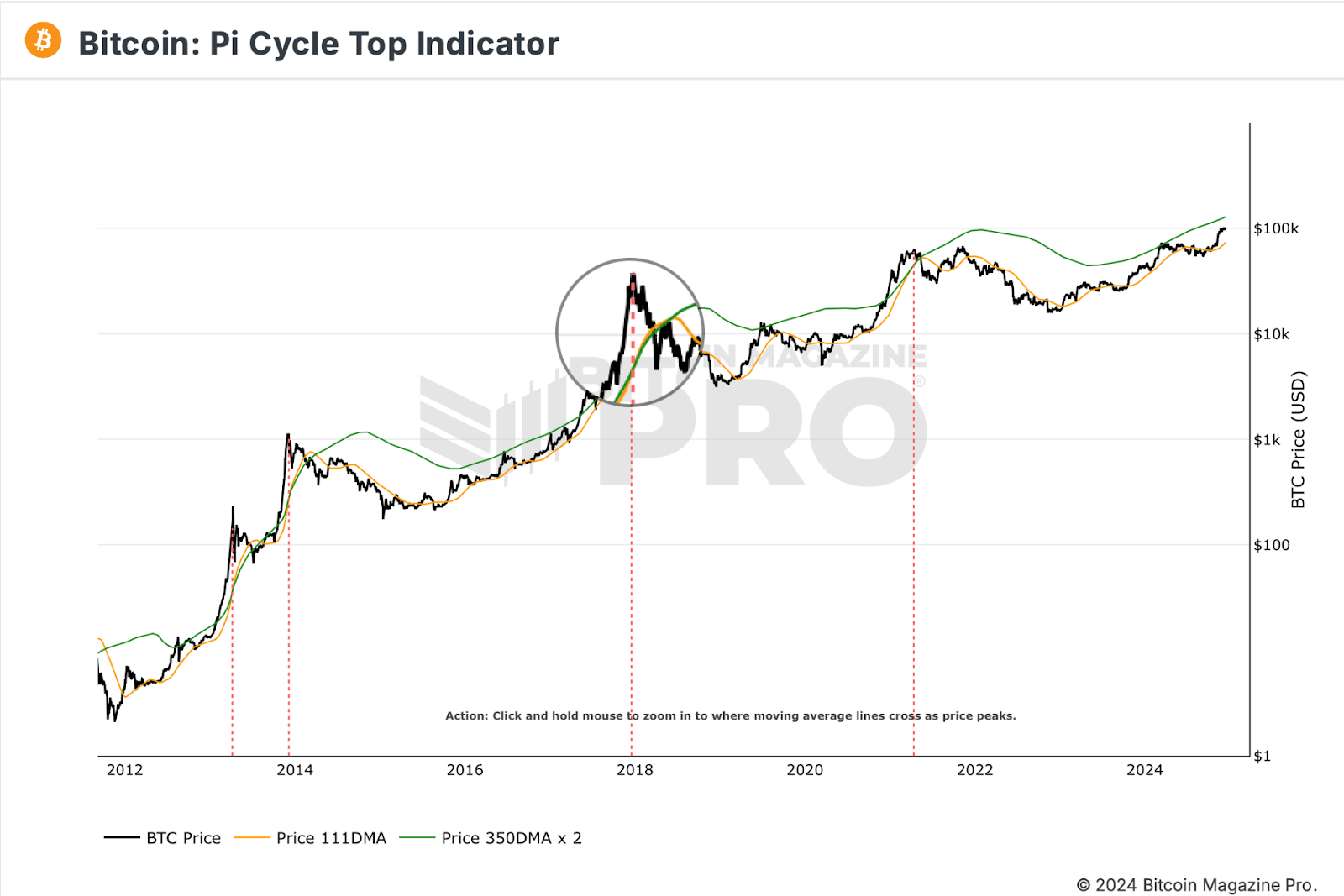

Metrics like MVRV, NUPL, and the Bull-Bear Market Cycle Indicator indicate we remain in the bull phase but far from euphoric peaks. The Pi Cycle Top and 4-Year Moving Average models project potential cycle tops between $145,000 and $189,000. On a historical basis, diminishing returns are moderating the kind of explosive gains we saw for BTC in previous cycles.

Key Trends and Future Outlook

– Our view is that any corrections in 2025 will remain mild, thanks to institutional inflows.

– Halving Year Effect: Historically, post-halving years have seen the strongest rallies.

– Cycle Targets: Minimum price estimates stand at $145,000 by mid-2025, potentially stretching to $200,000 under favourable conditions.

While volatility is expected in Q1 2025, the broader trend points to further price appreciation, supported by ETFs, institutional adoption, and Bitcoin’s increasing prominence as a global asset. Investors should however remain vigilant for signs of overbought conditions as Bitcoin approaches its cycle top.

BTC price performance in 2025 also takes place against the backdrop of a US economy that is seeing gradual normalisation across key sectors. The labour market continues its steady adjustment, with a modest rise in unemployment to 4.2 percent driven by increased supply of workers, rather than job losses. Wage growth remains robust at 4 percent annually, supporting consumer spending, while gains in sectors like healthcare and leisure highlight the economy’s resilience. The Federal Reserve is expected to proceed cautiously with rate cuts, balancing the cooling job market and persistent inflationary pressures.

In the housing market, a projected 2.4 percent increase in home prices signals stable demand despite elevated mortgage rates, which, while declining slightly, remain restrictive for affordability. Improvements in housing supply and rental inventory aim to address structural shortages, but affordability challenges persist, particularly for first-time buyers. These dynamics create opportunities for construction-related industries while constraining high-end market segments.

Inflation remains a central focus, with core CPI steady at 3.3 percent YoY, reflecting persistent pressures in vehicle prices and durable goods. The Fed’s restrictive stance, despite planned rate cuts, underscores the difficulty of achieving its 2 percent inflation target. Strong economic growth, including a projected 3.8 percent Q4 annualised rate, supports cautious monetary easing but leaves room for recalibration should inflation persist.

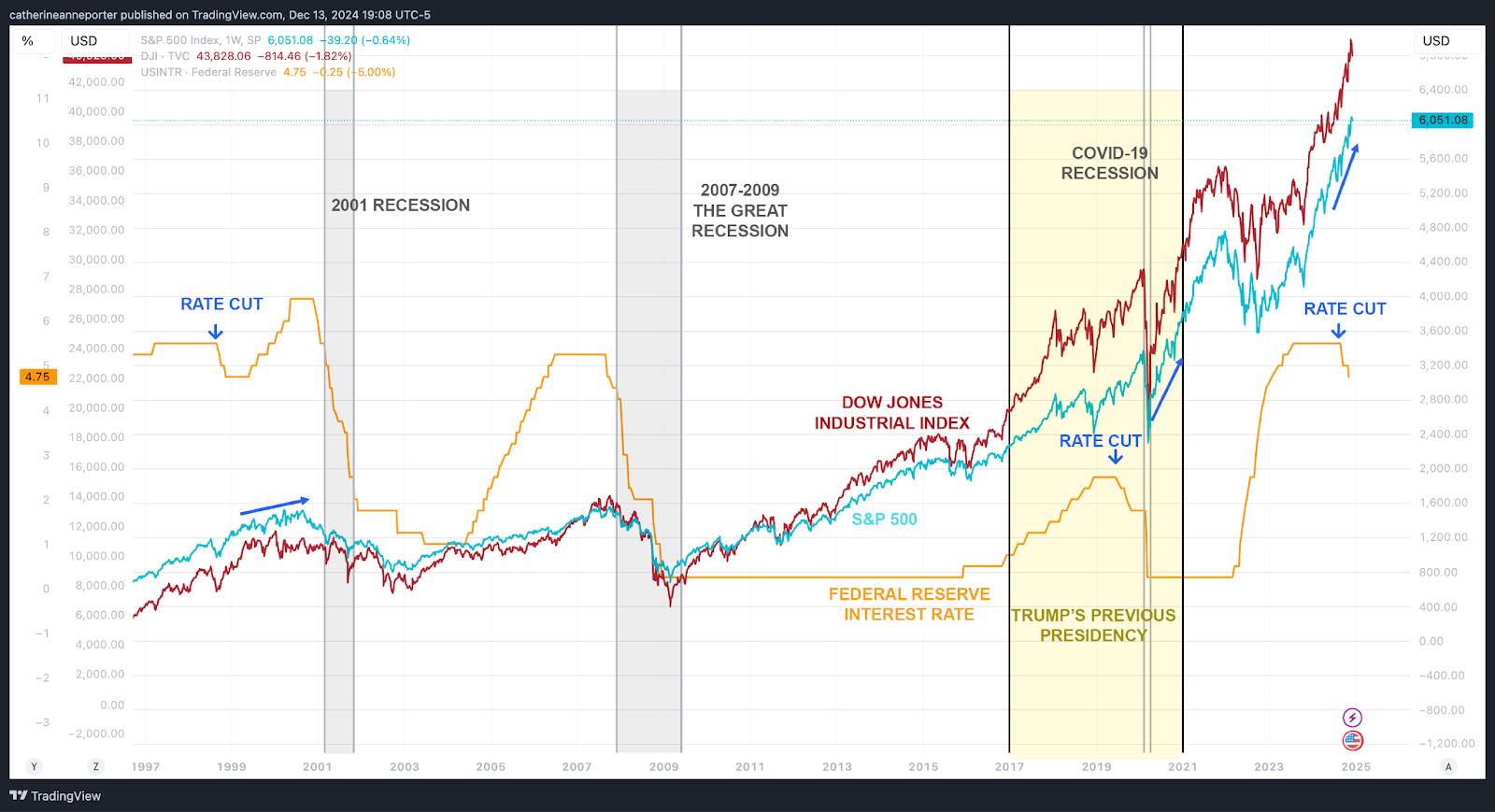

The stock market outlook under President-elect Donald Trump is buoyed by pro-growth policies, including tax cuts and deregulation, which benefit industrials, financials, and consumer discretionary sectors. The housing market’s moderate growth and supply improvements could also support equities that are exposed to the sector, though high borrowing costs may limit gains in affordability-sensitive segments. Historical trends suggest potential market optimism following Fed rate cuts, with the S&P 500 and Dow Jones Industrial Average already posting strong post-cut gains. However, risks like inflationary pressures, geopolitical tensions, and fiscal constraints could temper long-term market performance.

In sum, 2025 presents a cautiously optimistic economic environment marked by steady growth, persistent structural challenges, and strategic policy adjustments. While normalisation across sectors offers stability, external risks and inflationary pressures will remain critical considerations for sustained momentum.

We would like to wish all our readers a highly enjoyable holiday season and we look forward to coming back in the New Year with continued analysis and insight. Happy Holidays!

The post appeared first on Bitfinex blog.