Overall, the cryptocurrency market capitalization rose for four straight days after the Sept. 23 sell-off, returning to levels around $350 billion, as per CoinGecko’s data.

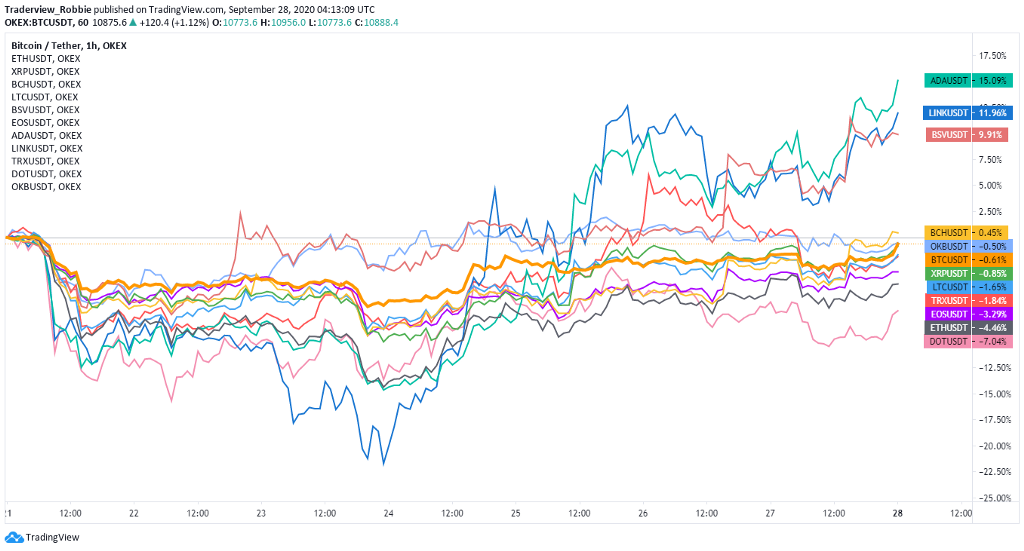

While Bitcoin was strong, major altcoins were a mixed bag last week. Cardano ( ADA) led the way with a weekly gain of 15.09%, and Chainlink ( LINK) and Bitcoin SV ( BSV) posted gains of about 10%.

Polkdot ( DOT) lost another 7% last week, falling from $4.70 to as low as $3.90 before bouncing back to $4.30. The price of Ether ( ETH) plunged due to a mid-week sell-off in the decentralized finance sector, and it did not rebound as strongly as Bitcoin, falling 4.46% for the week. Notably, the one-month realized volatility of Ether has now increased sharply to 112%, while the one-month implied volatility has fallen to 61%, which speaks to the price fluctuations on display in the markets.

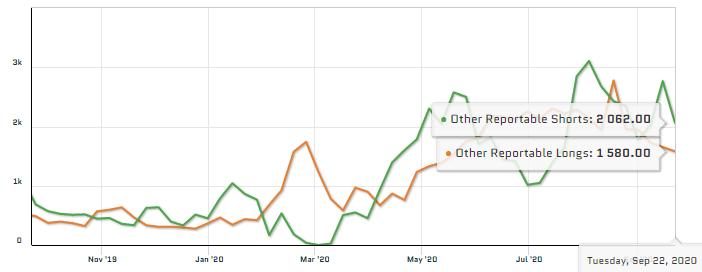

CME also released the latest (as of Sept. 22) Bitcoin futures position data on Sept. 26. Bitcoin prices took a big hit during this reporting period, and open interest dropped from an all-time high of 9,383 to 8,426, in which the long positions held by asset manager accounts fell sharply from 717 to 285. This shows that the short-term price correction significantly impacted market optimism.

According to the report, leveraged fund accounts saw their long positions fall from 2,819 to 2,280, while short positions dropped from 5,224 to 4,480. Meanwhile, in terms of other reportable accounts, long positions fell from 1,653 to 1,580, and short positions decreased from 2,766 to 2,062. The large reduction in the shorts was likely triggered by profit-taking activities.

Overall, we can see that the sharp price correction in the last reporting period triggered risk-control actions by institutional investors, and a large number of long positions were closed. We will continue to watch how institutions respond to the weekend’s price rally in the next reporting period.

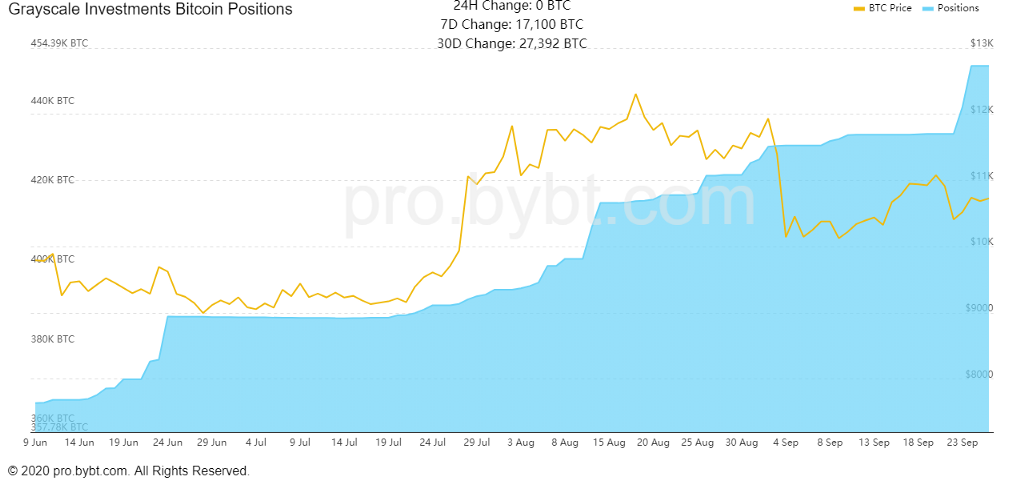

Moreover, data from Bybt shows Grayscale Bitcoin Trust (GBTC) bought 17,100 BTC in the last seven days, increasing its aggregate Bitcoin position to 449,900 BTC. This accumulation does explain, to some extent, why Bitcoin’s price didn’t dip further despite strong bearish market expectations last week.

Visit https://www.okex.com for the full report.

Disclaimer: This material should not be taken as the basis for making investment decisions, nor be construed as a recommendation to engage in investment transactions. Trading digital assets involve significant risk and can result in the loss of your invested capital. You should ensure that you fully understand the risk involved and take into consideration your level of experience, investment objectives and seek independent financial advice if necessary. OKEx Insights presents market analyses, in-depth features, original research & curated news from crypto professionals.

Not an OKEx Trader Yet? Sign up, start trading and claim up to $80 rewards!

was originally published in OKEx Blog on Medium, where people are continuing the conversation by highlighting and responding to this story.