Well, it's all in the name! Simply put, Copy Trading allows you to copy another trader's trades. You decide the amount you'd like to invest, and our platform automatically opens and closes positions for you in real-time by imitating trades made by your chosen Master Trader. It gives you an opportunity to turn a profit without having expert trading skills nor extensive knowledge about financial markets.

The concept sounds simple enough, but I'm sure you're thinking: How profitable is it? Is it THAT simple?

Today, Liya Xiang, Copy Trading Product Manager, is here to answer that and more!

Hi Liya, can you share with us what Copy Trading is all about?

Sure! Copy Trading allows Bybit users to copy and execute their Master Trader's trade orders. Followers get to copy trades from more experienced traders, and these Master Traders will receive a portion of their profits in return.

In 30 seconds, can you explain how a user can get started with Copy Trading?

To get started, simply visit Bybit's Copy Trading page and choose your ideal Master Trader.

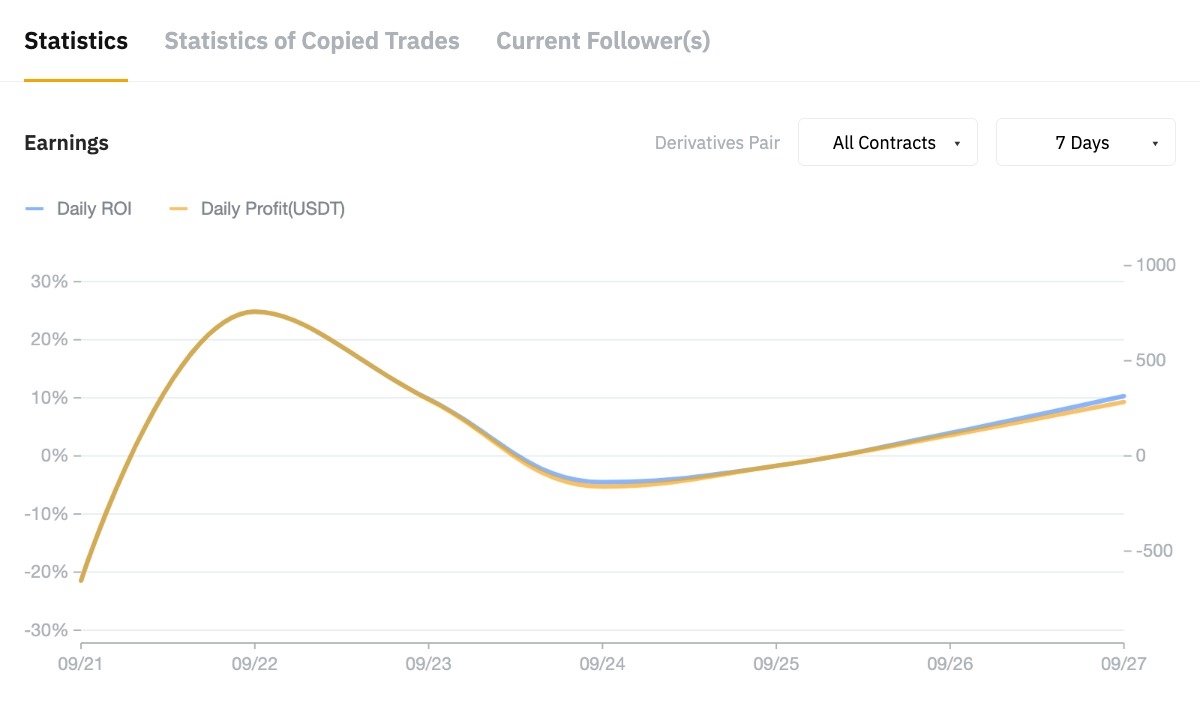

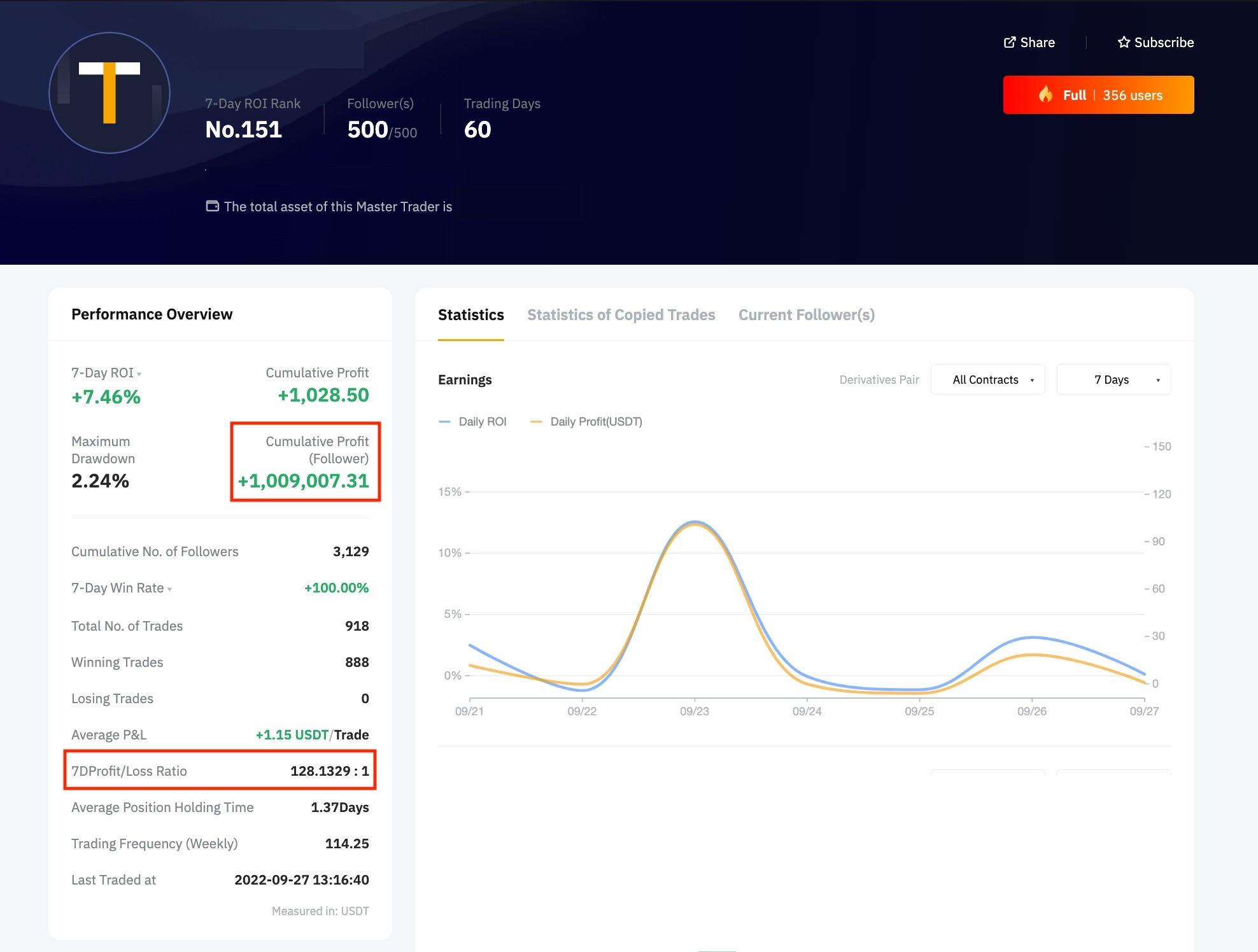

You'll be able to view their commonly traded pairs, 7-day return-on-investment (ROI), drawdown statistics, and other performance metrics to help you make an informed decision. There's also a search function if you already have a Master Trader in mind!

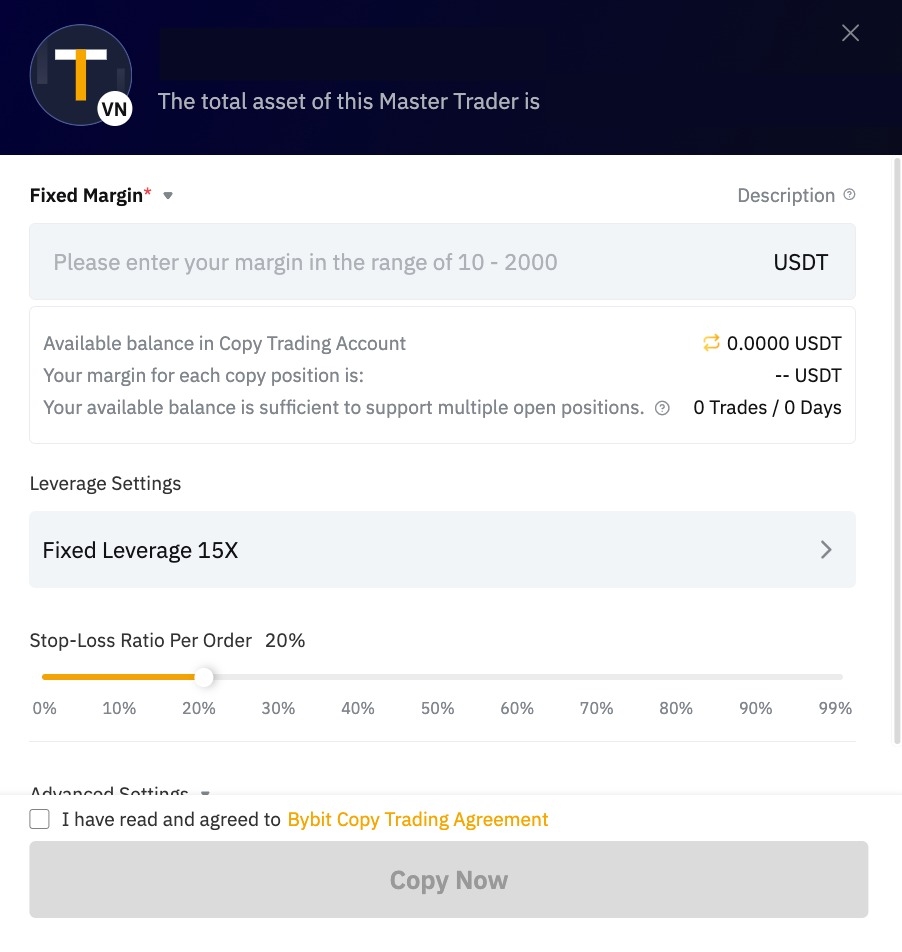

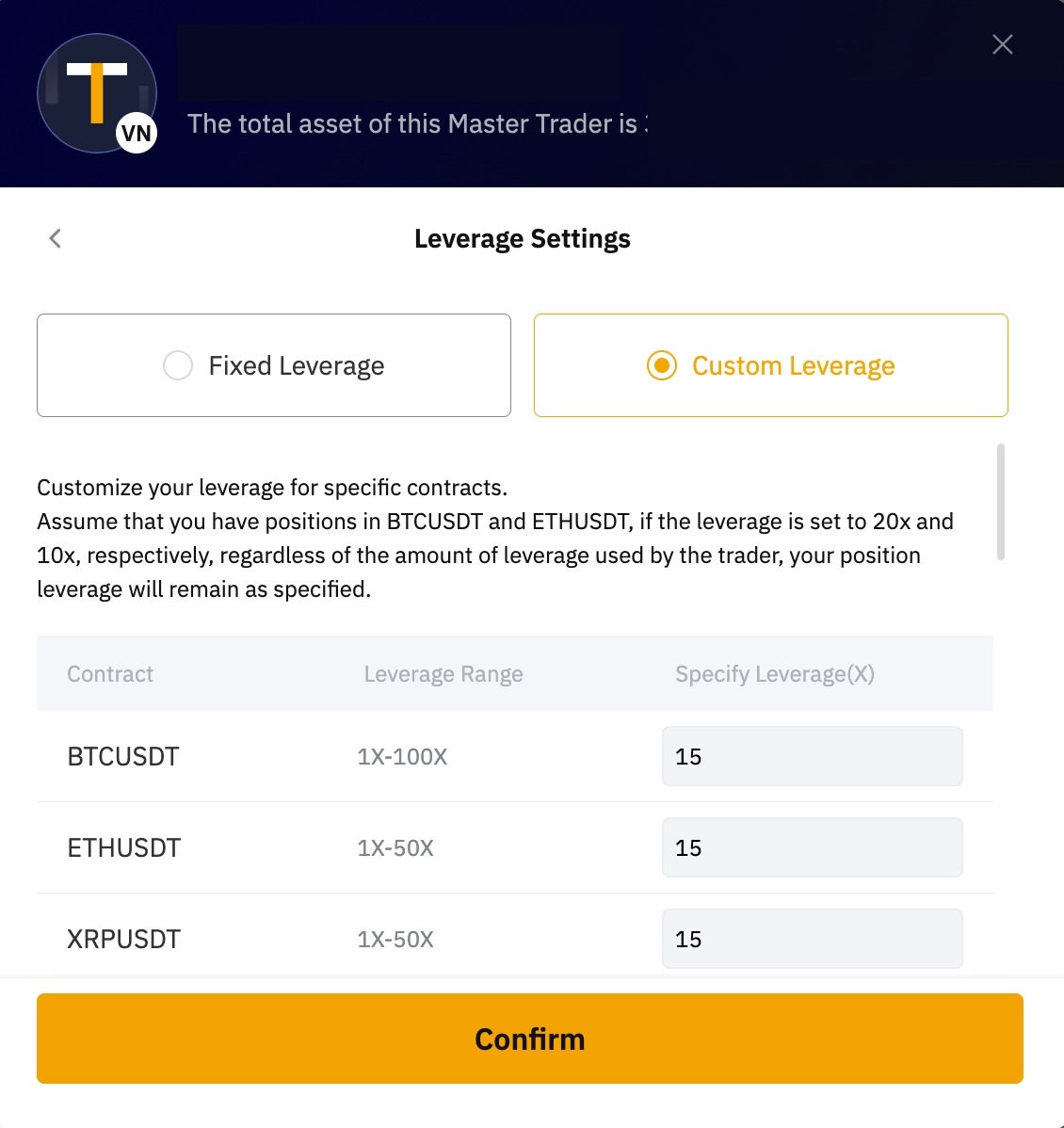

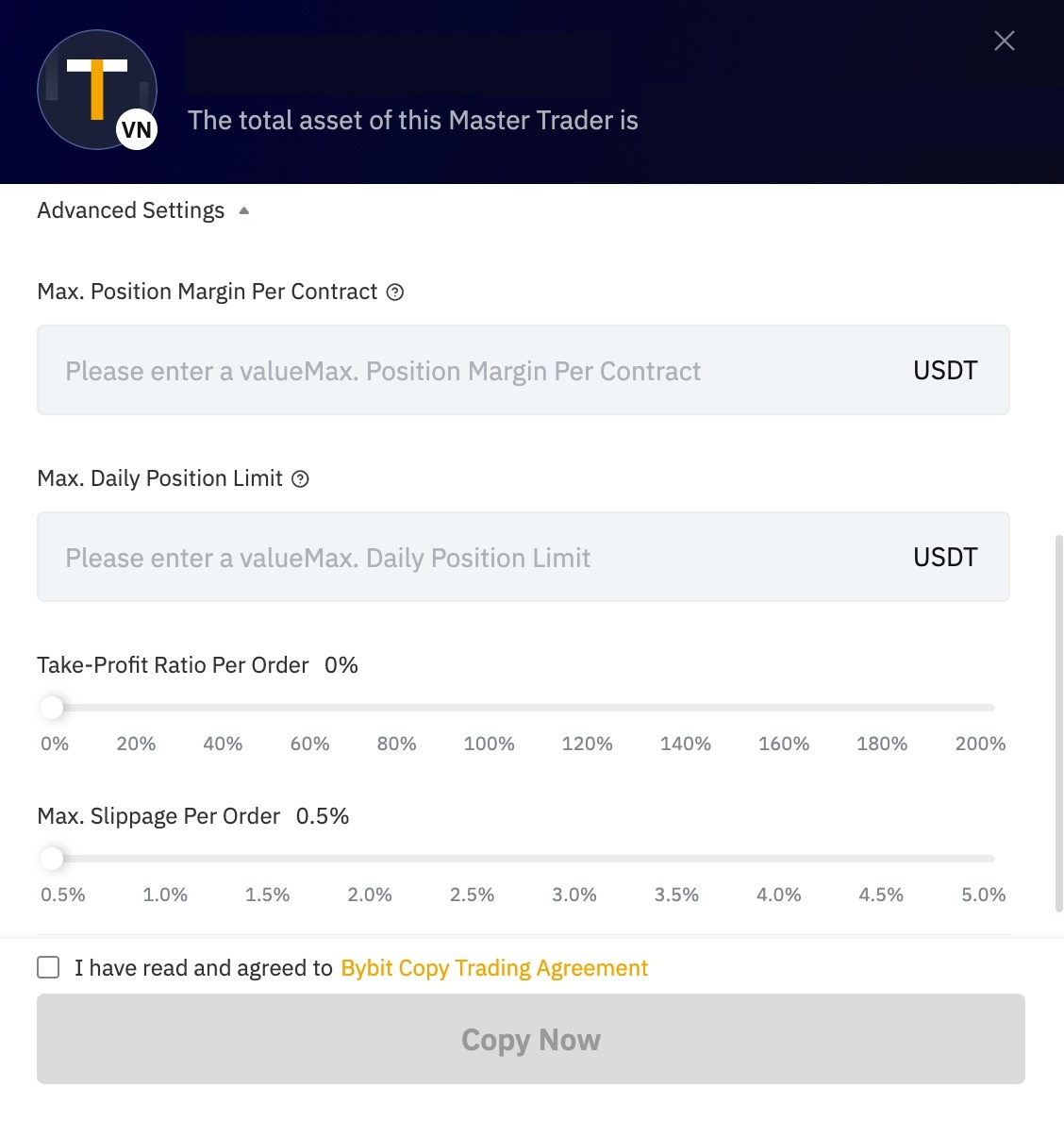

Once you've selected your Master Trader, transfer funds to your Copy Trading account and select a comfortable leverage and order size for your desired trading pairs. Advanced traders can even customize their leverage for different trading pairs, maximum position margins, maximum daily order sizes, maximum slippage, take-profit and stop-loss levels. Confirm your choices and voilà! You've now officially begun your Copy Trading journey.

Who is Copy Trading suitable for?

Copy Trading is great for beginners! Even the most inexperienced traders can dive into crypto trading and level up their skills in a shorter time in comparison to traditional methods.

If you're a trader who has little time to manage your trading portfolio, Copy Trading is an excellent gateway to discover new trading strategies that you may not have considered before.

How does Copy Trading on Bybit differ from other platforms?

For Followers:

Our platform provides minimal barriers to entry so that Followers can easily participate. With just one click, they can follow, learn and even communicate directly with top-tier Master Traders.

Not only do we screen each Master Trader carefully before bringing them onboard, we also provide a wide range of performance statistics so our Followers can pick the best and most suitable trader to follow. Extensive order settings also allow them to tap on their Master Traders' expertise while customizing for their own risk appetite.

For Master Traders:

Master Traders on Bybit get access to one of the largest Follower pools in the industry, allowing them to supercharge their income when others copy their trading strategies. They also have access to a wide array of smart trading tools right at their fingertips, so they can mix and match various trading strategies to efficiently generate profits for themselves and their Followers.

Can anyone be a Master Trader? How do you verify them?

Any proficient trader is welcome to apply and join us as a Master Trader. We review applicants' past trading performance across various metrics to ensure that our Followers are picking from a pool of top-notch Master Traders. Click here to register if you're interested!

What should Followers look out for when selecting Master Traders?

There are four key things you should consider when selecting your Master Trader.

1. Return-on-Investment, otherwise known as ROI. This is the most straightforward measure a trader's profitability. A smooth, ascending profit trend indicates that a trader is consistently profitable.

2. 7-day profit/loss ratio. This ratio is similar to ROI, but it tells you exactly how profitable a trader is. For example, a $250 7-day profit/loss ratio indicates that for every $250 earned over the past seven days, the trader sustained a $1 loss.

3. Cumulative Follower profits. This gives you an idea of how much profit a particular Master Trader has helped their Followers to earn. However, do take note that this figure is cumulative, so the more Followers a Master Trader has, the higher this figure would be.

4. Trading history. By review their trading history, you will have a better understanding of a Master Trader's trading habits and the underlying logic behind each trade. From there, you can determine if their trading style aligns with your trading goals. One important thing to consider is whether a Master Trader uses stop-losses to manage their positions!

Lastly, and perhaps most importantly, it goes without saying that there's no one metric that's better than the other. For a more comprehensive view of a Master Trader trading competency, you can check out their profile page for other statistics such as trading frequency, average position holding time and commonly traded pairs.

What risks or pitfalls should users look out for?

When you copy trade, you place your profit and loss (P&L) in someone else's hands. Hence, it's very important to choose a compatible Master Trader who aligns with your trading goals. Not only do you have to be comfortable with their trading strategies, you should also take note to set proper stop-losses and order size limits on your copy trades.

Will Copy Trading be extended to other Bybit products?

The next few months are going to be exciting! Copy Trading will soon be available on Spot, and we're also looking to introduce Grid Bot trading as a new feature. We're also planning to support more trading strategies such as Time-Weighted Average Price (TWAP) orders and Volume-Weighted Average Price (VWAP) orders next quarter, so keep a look out for them!

Do you have any other tips to share with our readers?

Always manage your risk! If you're using leverage, set it at a comfortable level for you and ensure that you have sufficient margin in your Copy Trade account. Use a stop-loss whenever appropriate to avoid losing your investments due to potential missteps by Master Traders.

Thanks for your insights, Liya.

There you have it! We hope this will be the push you needed to embark on your Copy Trading journey. If you're feeling confident in your trading skills, feel free to join us as a Master Trader too!

Still have some burning questions? You can learn more about Copy Trading through our educational resources:

- Read useful guides on Bybit Learn

- Watch our video guide on Youtube