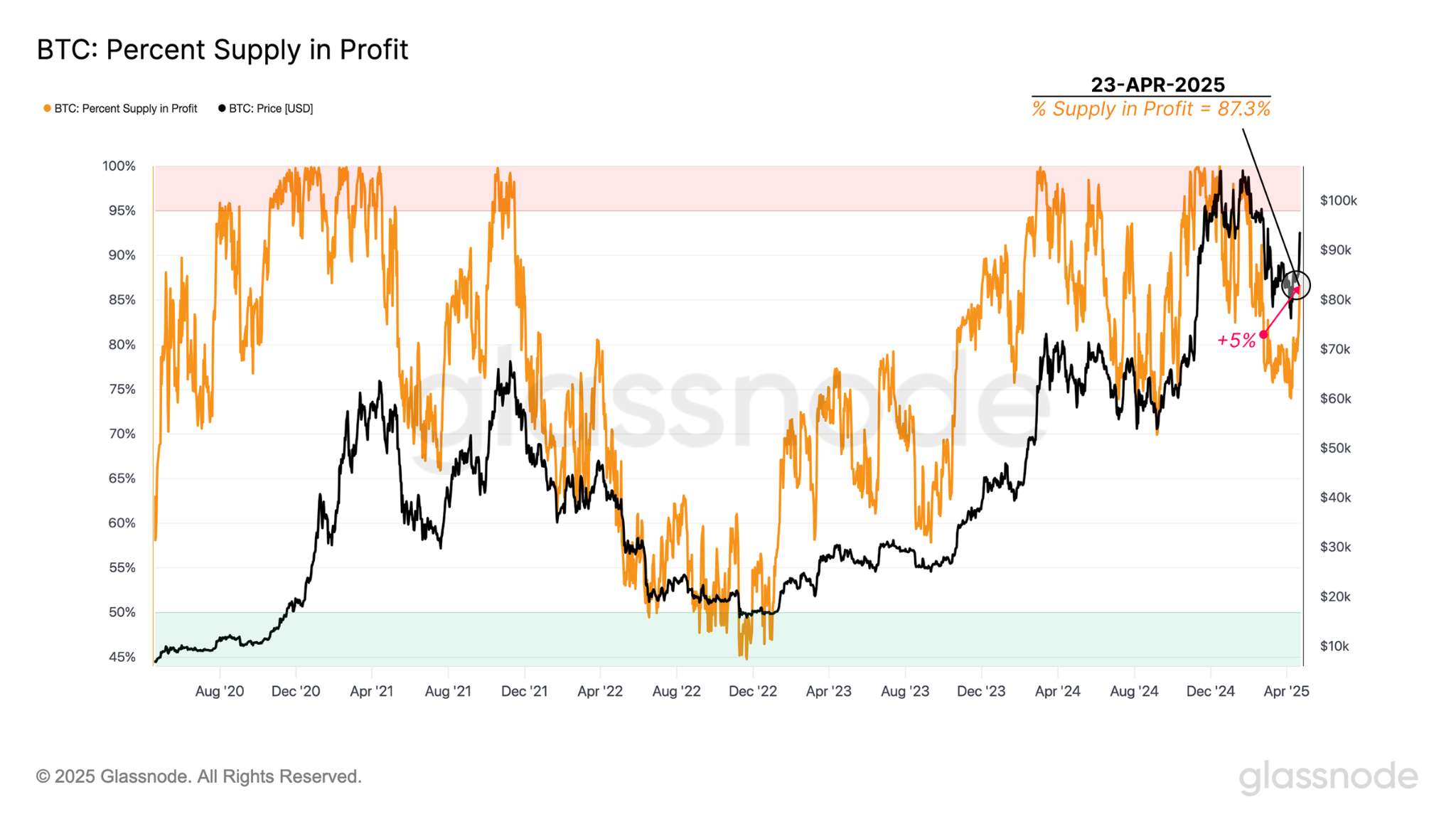

Bitcoin has now also reclaimed the Short-Term Holder Cost Basis level at around $92,900, a critical on-chain pivot level that typically separates corrective phases from renewed bullish momentum. Adding to the positive market structure, the Percent Supply in Profit metric has also rebounded to 87.3 percent, indicating improving market health and investor profitability.

The next few weeks will be crucial. We are not yet at full euphoria levels, and Bitcoin’s ability to maintain these gains in the coming weeks will be key to determining whether a new leg higher toward all-time highs is achievable, or if another pullback is in store.Recent US trade policies, especially the imposition of high tariffs on imports from China and other countries, are beginning to strain the economy. Although initial jobless claims remain low and unemployment stands at 4.2 percent, there are signs of weakening confidence in the labour market.

Wage satisfaction and minimum acceptable salary expectations (reservation wages) have fallen sharply, indicating growing concerns about long-term job security and wage growth.

Meanwhile, durable goods orders rose significantly in March, driven largely by a surge in commercial aircraft demand. However, core capital goods orders — a better indicator of business investment — showed almost no growth, reflecting cautious corporate sentiment amid tariff uncertainty. Companies are delaying major investments, raising concerns about a potential slowdown in economic momentum later this year.

The US dollar has also weakened, driven by reduced confidence in US economic leadership, sharply downgraded GDP forecasts, and stronger global competition, particularly from Europe. The decline in consumer sentiment and the risk of interest rate cuts by the Federal Reserve could accelerate the dollar’s depreciation. Potential repatriation flows from Japanese investors and interventions by the Bank of Japan may further complicate the dollar’s trajectory.

On a positive front, however, The Federal Reserve has eased crypto-asset rules by withdrawing prior supervisory requirements for the US banking sector, aiming to promote innovation and simplify procedures for banks who want to engage in crypto and dollar token activities. This move signals a more supportive and adaptive regulatory stance toward the digital asset sector.

In a parallel development, Securitize and Mantle launched the MI4 crypto index fund with a $400M commitment, offering regulated, diversified exposure to major cryptocurrencies for institutional investors. The partnership reflects the growing integration of blockchain into traditional finance and the advancement of asset tokenization.

CME Group also announced the launch of XRP futures. This expansion beyond Bitcoin and Ether futures highlights increasing institutional interest in altcoins and aims to boost XRP’s liquidity, price discovery, and mainstream financial adoption following Ripple’s settlement with the SEC.

The post appeared first on Bitfinex blog.