The Do's & Don'ts Of Crypto Trading

Crypto trading. The wild-west of the investment world. There's no denying it, the cryptocurrency markets can be a volatile place.

The value of cryptocurrencies such as Bitcoin, Ethereum, and Litecoin skyrocketed back in 2017, plummeted in 2018, and have seen a jagged-edged rise in their value during 2019.

Making sure you have a proper, well-thought-out strategy is crucial if you're ever going to make a profit for trading digital currencies.

In this article, we're going to give you a rundown of the top do's and don'ts when it comes to trading crypto.

The Don'ts

Trade Without A Plan

You leave the house. Get in your car. You want to travel to the beach, but have no idea how to get there. So, you start your engine and being aimlessly driving without looking at maps, road signs, or asking the guy walking his dog with a newspaper under his arm. How long will it take? You'll be lucky to even get close.

You wouldn't aimlessly start a journey without looking at your map, so why would you aimlessly throw money into crypto trading without having a plan?

The foundation of any successful trader, whether they're into crypto or not, is having a solid plan that details where they are, where they want to go, and how they're going to get there.

Before you place a single trade, you need to ask yourself what your main objective is and how you're going to complete it.

Yes, this will take some time to construct - research will be involved. But if you're trading without a plan, what you're doing is simple - gambling! It might seem boring to some, but this step is crucial - failure to prepare, prepare to fail.

Trade Without A Stop Loss

A Stop Loss.

Your seatbelt on the road to victory. Avoid placing one, and you won't be a crypto trader for very long. There's bound to be a few hiccups when you're investing for profits.

I'm sure this is pretty obvious. Setting a stop loss will remove you out of any trades that aren't going your way. For example, you buy 1 Bitcoin at $9000 - you set your stop loss to $8000. If the value of BTC drops below the $8000 mark, you'll be automatically pulled out of the trade before you lose any more. When it comes to setting a stop loss, you want to keep in mind that you only want to lose around 1-2% of your capital per trade - if you're starting with $1000, then you only want to be losing $10-$20 per trade.

Choose Cryptos You Haven't Researched

Ah right, so your mate's cousin found this crypto that gonna do "masssssive mooovez" over the next month. Perfect!

Your mate's cousin must be an expert, so go ahead and buy up as much a possible. *Insert Loud Noise and Big Red ‘X'*.

Before investing in anything, you need to know everything about the asset. Who's behind it? What's its purpose? What plans do the team behind it have for the future?

Don't buy any crypto-asset without knowing all the details about it. Again, taking the time to research will enable you to make a well-informed decision as opposed to blindly following the crowd.

Be Impulsive - Buying The Hype

FOMO.

Not to be confused with the stuff on the top of your cappuccino. This stuff can be lethal.

"The fear of missing out" has led many people down the dark and gloomy road to disaster. Avoid this like the plague.

It's all too easy to become that dog who chases cars down the highway, only to find an unfortunate fate. I mean, who doesn't love the sight of a crypto skyrocketing and imagining the huge profits you could rake in by jumping on the gravy train without a moment's thought.

The key is to be on board the gravy train before it leaves the platform. So ensure you've thoroughly researched the crypto you want to invest in before buying, instead of acting on impulse - trust me, you'll get caught out big time in the long-run.

The Do's

Diversify

Variety is the spice of life. Diversity is the spice of the crypto investing world. Spreading your investments across a range of different assets is key to being successful in the crypto trading world.

As your mum says "Do not put all your eggs in one basket." Trust what she's saying to you. When you're placing trades, don't go all-in on one crypto. Instead, place smaller positions on an array of different digital currencies. This way, if one crypto tanks, you won't risk losing out completely.

The likelihood is that your other investments will keep just fine, and you'll be giving yourself more opportunities to profit.

Risk Management

We've touched on this already. Managing the amount of risk you're taking when trading cryptocurrencies is vital for survival in the markets.

Risk management techniques, including setting a stop loss, will enable you to limit the amount of risk you're taking per trade.

Remember, you only want to be risking 1-2% of your trading capital per trade. $1000 in your trading account? Great!

Only risk losing $10-$20 per trade. Another way to manage your risk and keep yourself comfortably trading crypto is to take a break from trading after suffering 3 consecutive losses.

Let's say you place 3 separate trades in one week, all of which have a stop loss set to $20 maximum.

All these trades end up hitting the stop loss, losing you a total of $60. After experiencing defeat, it's human nature to try and win back what you've just lost - this is why gambling addiction is a worldwide problem.

Remember, we're not in the game of gambling, we're here to trade. So when consecutive losses occur, take a step back and overlook your strategy - it may need refining.

Safeguarding your capital is what will keep you in the crypto trading world. So keep in mind your maximum loss per trade and the number of consecutive losses you'll accept before taking a break and revising your strategy

Check BTC's Movements

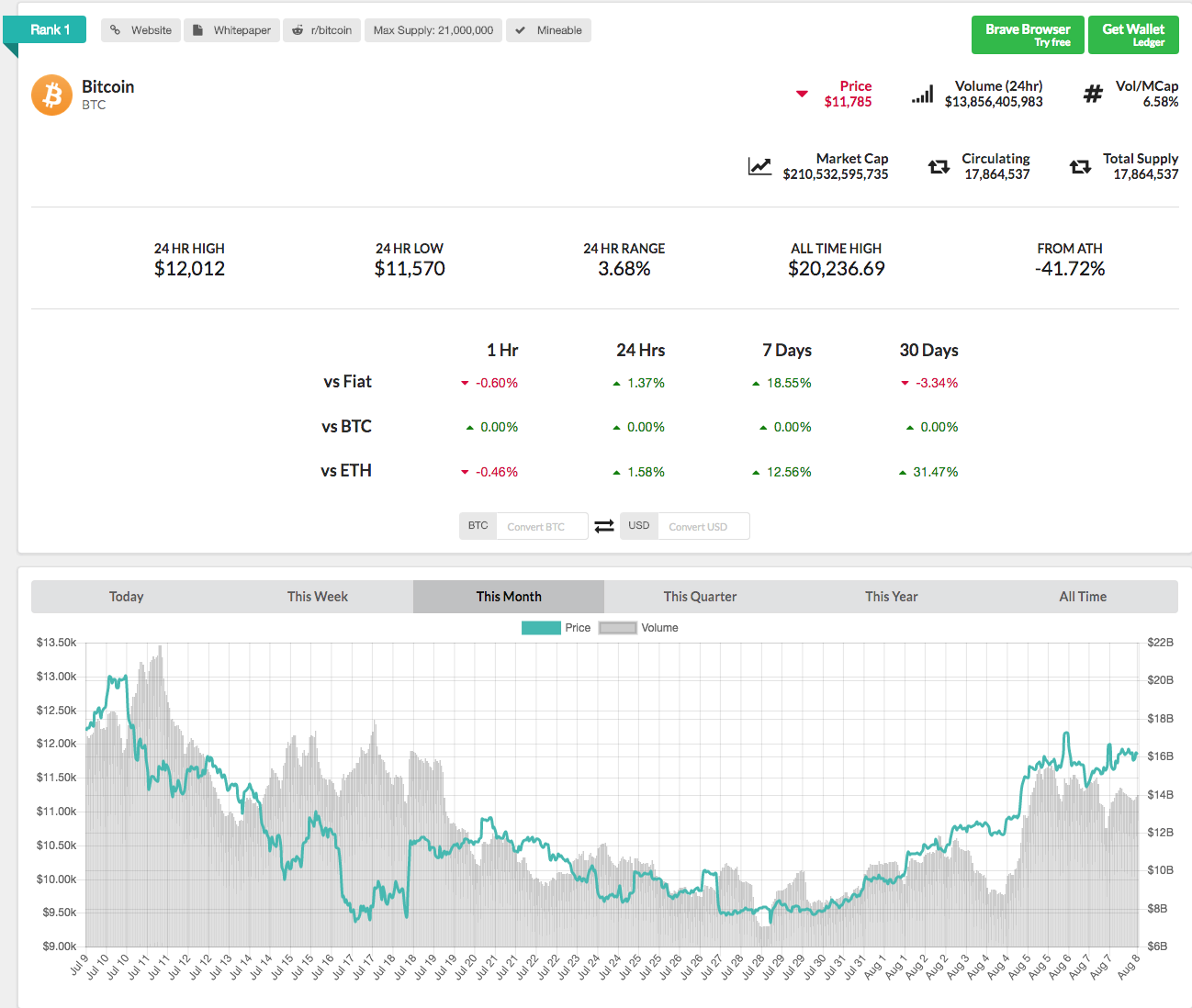

Bitcoin is undoubtedly the flagship cryptocurrency.

This is why you must always check in on how it's performing. BTC is the market leader, and most other altcoins closely follow its movements. If Bitcoin is rocketing, then most relevant altcoins will likely rocket with it - and vice versa.

Many suggest that the reason Bitcoin has such influence is that it's the most widely used crypto by exchanges.

Although many exchanges have their native crypto, such as Binance's BNB token, a lot of crypto pairs that are available to trade are Bitcoin-based.

For example, BTC/ETH, BTC/LTC, BTC/ADA, BTC/TRX - you get the picture, BTC is essential if you want to trade a wide variety of cryptocurrencies.

Before each trading day, just quickly check in Bitcoin's price action. Maybe look at what the technical indicators are showing, its trend over the last 24 hours, and also search for fundamental factors that may affect how the value of BTC.

Determine Your Strategy

Are you trading short term, or going long? What technical indicators will you be using - Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), Exponential Moving Average (EMA)? Will you be using a trading bot?

This is something you must decide before each trade. Deciding this will enable you to clearly choose what your strategy is.

Whether you're trading short-term or long-term, you need to decide on what your ideal profit target is.

We recommend starting by using the 2:1 ratio - for every $1 you're prepared to lose, you'll want to profit by $2.

As you gain confidence trading crypto, you may want to up this ratio to 3:1 or even 4:1.

Deciding on what technical indicators to use as part of your strategy is also key to becoming a successful crypto trader. Find the ones that work best for you - maybe it's MACD, RSI, Slow Stochastic, or a combination of all 3.

Find the indicators that feel right to you, and make them a part of your trading strategy.

Conclusion

When it comes to trading crypto, you must follow a strict set of rules to ensure longevity and to ultimately profit from the markets.

To ensure success when you’re trading cryptocurrencies, always follow a well-structured plan, manage your risk, diversify, and avoid FOMO at all costs!

Check out our last blog: The Top Two Issues Facing Cryptocurrency Traders Today.