Curve Finance was founded by physicist Michael Egorov in 2020 on the premise of being able to swap stablecoins without suffering from high fees and something called slippage- the difference between a price one expects to get from a swap, and the final executed price. This simple concept has allowed Curve to become a dominant DeFi player. Curve launched with its first crypto pool TriCrypto, which contains USDT/WBTC/WETH on Ethereum.

Curve has found enormous success because its low slippage and fees makes it especially useful for moving assets between protocols and exchanges. The larger the swap someone wants to make, the more that using Curve makes a lot of sense. The platform is also very attractive for yield farmers because of its algorithm for concentrating liquidity around the current pricing of an asset. Yield farming is an investment avenue that involves depositing one’s assets into a liquidity pool to earn rewards.

TL;DR

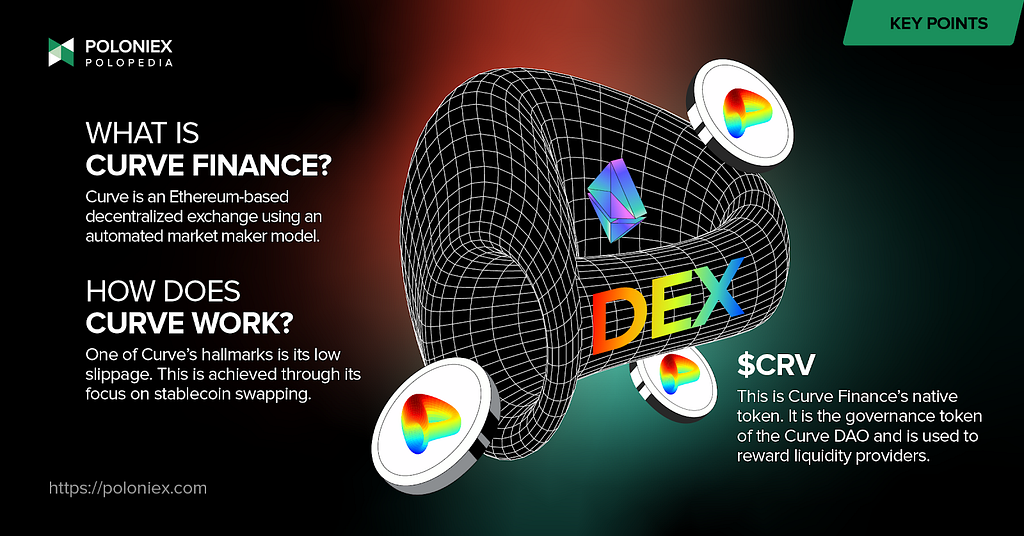

Curve is a DEX AMM a lá Uniswap that focuses on facilitating the swapping of stablecoins. It utilizes specific algorithms that mitigate slippage as well as concentrate liquidity around current price points, making Curve a very attractive option for moving large amounts of crypto across networks and platforms.

How does Curve Finance work?

Curve prices assets and executes trades according to a pricing algorithm which means it doesn’t use an order book or a market maker, unlike centralized exchanges like Poloniex which use both. What is unique about this formula is that it is made to allow for swaps of assets that remain in a similar price range with each other. Because of this specialization, Curve excels at mitigating slippage. This becomes apparent when comparing its slippage to that of other DEX AMMs like Uniswap, Sushiswap, and Balancer.

The pools available for swapping on Curve are referred to as “stable pools”. Stable pools are just collections of assets that are stable relative to each other. We describe it this way because stable pools don’t just refer to something like a USDT/USDC pool. It can also refer to a wBTC/BTC pool, where one wBTC (wrapped BTC) is always equal to one BTC. Although the price of BTC itself may be volatile, the value of wBTC is always pegged to it.

In order to utilize liquidity effectively, Curve uses an algorithm to concentrate it at an asset’s current price. When trades happen, the crypto pool readjusts itself in a way that doesn’t incur losses. Curve is able to keep very low fees (ranging from 0.04% to 0.4%) because liquidity providers are rewarded with CRV rather than the platform having to raise fees to compensate them.

Providing liquidity on Curve

Like any other DEX AMM, liquidity providers can earn a proportional reward percentage of swap fees when they deposit an amount of two tokens on either side of a trading pair. These rewards come in the form of the platform’s native token $CRV, discussed in the next section.

$CRV, the Curve DAO token

Like other DeFi platforms, the $CRV token is used for different purposes on Curve Finance all in service of keeping the whole operation running. Because it is a governance token, it helps decentralize the decision-making process on Curve. And to incentivize liquidity provision and active participation in the betterment of the platform, rewards are distributed to participants in the form $CRV. In all, $CRV can be used to vote on platform changes, staked to receive trading fees, and vote locked to boost rewards on provided liquidity.

What voting looks like on Curve: on Curve, users don’t vote directly with a token amount. Instead, tokens are locked in a voting escrow on the platform. The longer and more CRV that is locked, the more a user has voting power. As tokens approach their unlock time, the veCRV weight, and thus voting power, decreases. And

What staking looks like on Curve: when one stakes their CRV, they lock them up for a fixed period of time to earn what is called vote-escrowed CRV, or veCRV. The amount of veCRV earned is of course dependent on the amount of time one opts to lock their CRV up for. For example, if you lock your CRV up for one year, 1CRV=0.25veCRV. If you lock your CRV up for four years, 1CRV=1veCRV. So what does veCRV get you? In short, voting power on how CRV is distributed as well as proportional revenue from the platform’s swap fees.

Boosting on Curve: when one vote locks (mentioned above) their CRV, they can earn a boost to their rewards from providing liquidity.

How to acquire $CRV?

$CRV is available on multiple exchanges like Poloniex! You can acquire $CRV through trading a CRV/USDT trading pair.

Feeling ready to get started? Sign-up is easy! Just hop on over to https://poloniex.com/signup/ to start your crypto journey🚀

was originally published in The Poloniex blog on Medium, where people are continuing the conversation by highlighting and responding to this story.