After one year of development, on-chain activities show that Decentraland and the Sandbox, the pioneers of metaverse crypto, have been losing steam. Roblox, a leading web2 metaverse platform that is recently dipping its feet into the web3 world, however, has seen a more resilient performance, with robust user activities and brand partnerships.

Against this background, we will dive into the current state of Decentraland and the Sandbox. Following this, we would compare these web3 metaverse platforms with Roblox, a web2 metaverse platform that has overtaken the aforementioned platforms, so as to better understand the reasons behind Roblox's outperformance, and what metaverse crypto’s future holds.

The Current State of Decentraland and The Sandbox

The Metaverse is a relatively new concept, and different people have different interpretations of the exact definition of the metaverse. The existing form is mostly web-based without any requirements for virtual reality headsets. Thus, it is important to note that the term ‘Metaverse’ does not belong to the web3 world, instead, metaverse platforms are split into two main categories. Those that adopt blockchain and NFT technology, and those that don’t. The former exists in the web3 world and the latter in web2.

Compared to web2 metaverse platforms, metaverse crypto projects widely adopts NFT technology, and users own their in-game NFTs instead of the platforms. Furthermore, metaverse crypto can interact with DeFi protocols on the same blockchain and network, whereas web2 metaverse projects are typically siloed.

Decentraland and the Sandbox are clear leaders among metaverse crypto projects, with record land sales and brands joining the platform since November 2021. More here for a detailed explanation of the metaverse.

Decentraland and the Sandbox

|

Decentraland |

The Sandbox | |

|

Blockchain |

Ethereum, Polygon |

Ethereum, Polygon |

|

Native Token |

MANA |

SAND |

|

Other metaverse tokens |

WEAR and LAND |

ASSETS, GAMES, and LAND |

|

Governance |

DAO |

Centralized entity (Animoca Brands) |

|

Payments on metaverse lands or items |

MANA |

SAND or MoonPay |

|

Top metaverse brands |

Samsung, Nike, Louis Vuitton, etc. |

Adidas, Gucci, PwC, etc. |

|

Number of lands |

90,601 |

166,464 |

|

Land values at current floor rates * |

$169.4 million |

$294.6 million

|

*Based on floor prices of parcels at $1,870 on Decentraland and $1,770 on the Sandbox on Oct 18, 2022.

Decentraland and the Sandbox provide similar in-game experiences on their platforms. Users could own plots of land within the metaverse to host events, buy in-game NFTs to decorate their avatars, create NFTs for sales, etc.

Token Price and Unique Land Sales

Source: Coingecko (Data as of Oct 18, 2022)

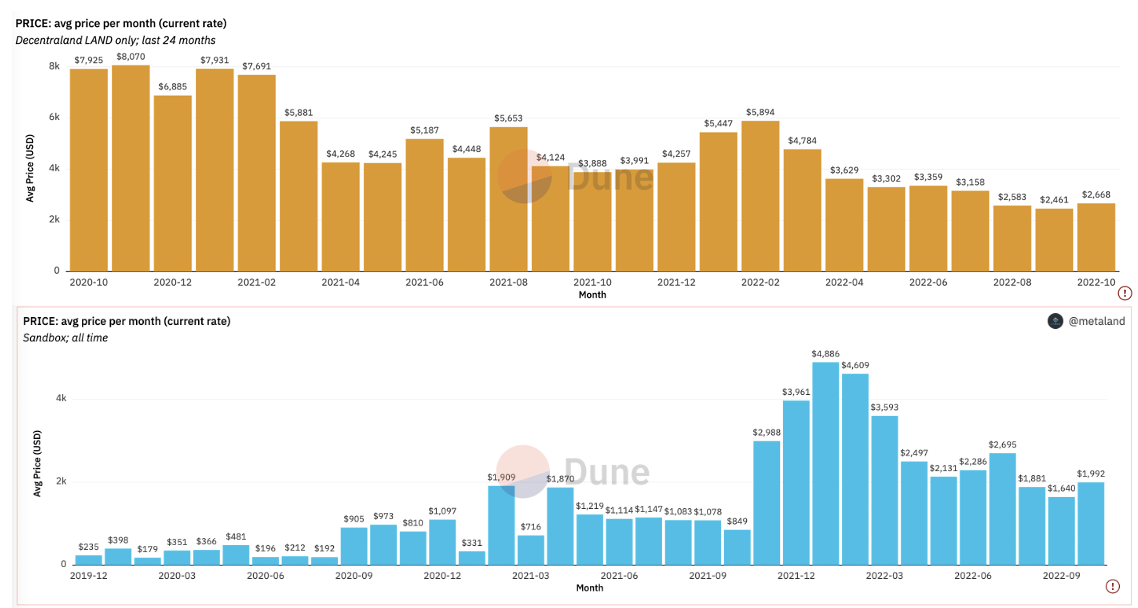

Land sales at current ETH price

Source: Dune Analytics (@metaland) (data as of Oct 19, 2022)

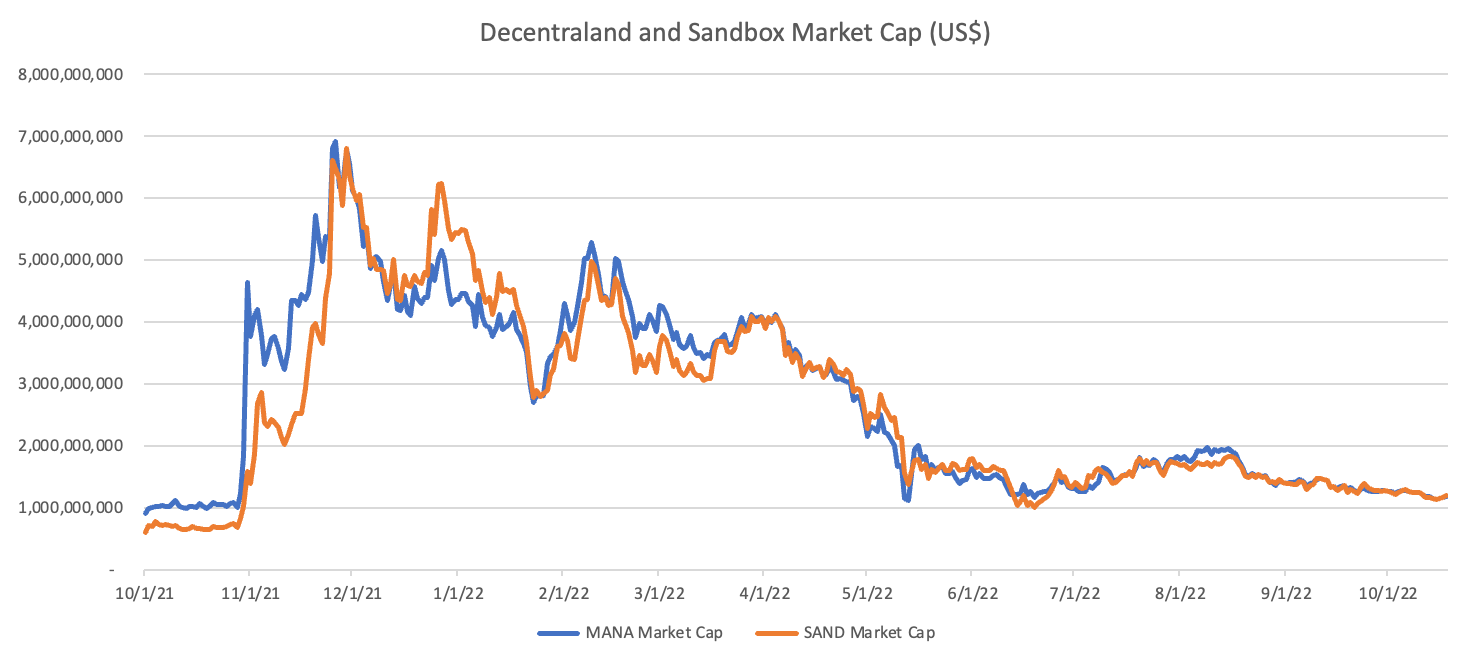

The outstanding market capitalization of both MANA and SAND took a dive in April this year, wiping out almost all the gains for the aforementioned projects since the metaverse hype in November 2021. With market capitalization evaporating more than 90% since their peaks, Decentraland and the Sandbox have underperformed the broader cryptoverse that has also plunged by 67.7% in the same timeframe.

Interestingly, the market capitalization for MANA and SAND tend to move in tandem with one another, suggesting that there might not be major differences in terms of products for the platforms, thus leading investors to see the same valuation in both platforms.

Meanwhile, the average land sales in terms of ETH have been declining, signaling that the value of metaverse lands seems to have slumped.

Active Users VS Unique Transacting Users

Source: DappRadar (data as of Oct 18, 2022)

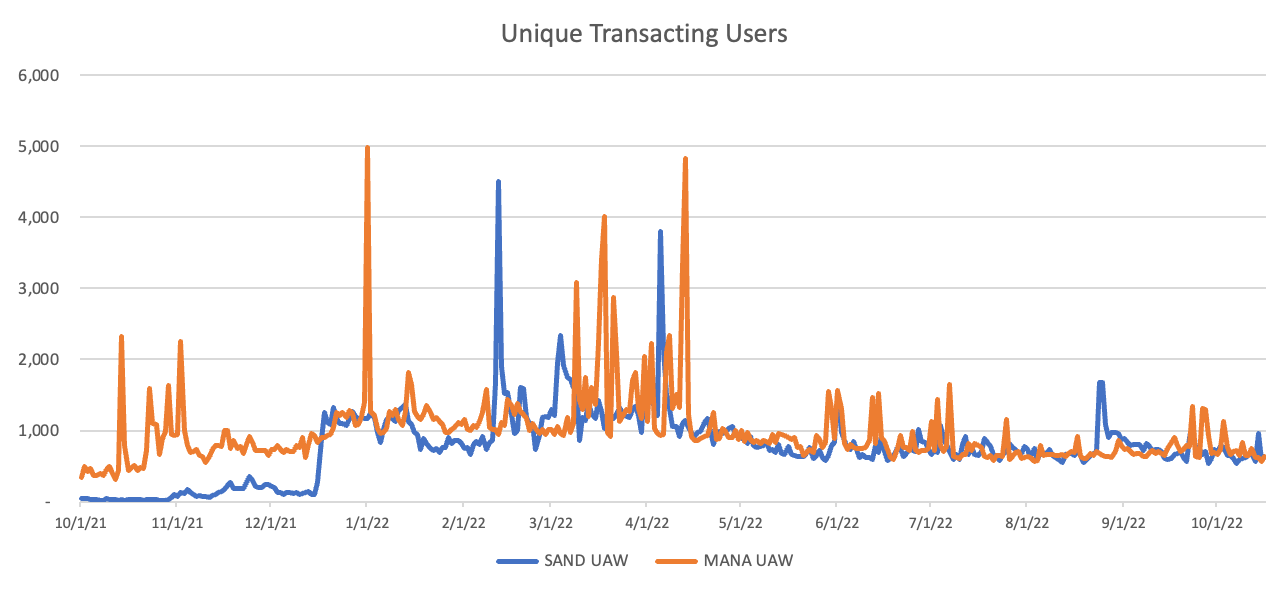

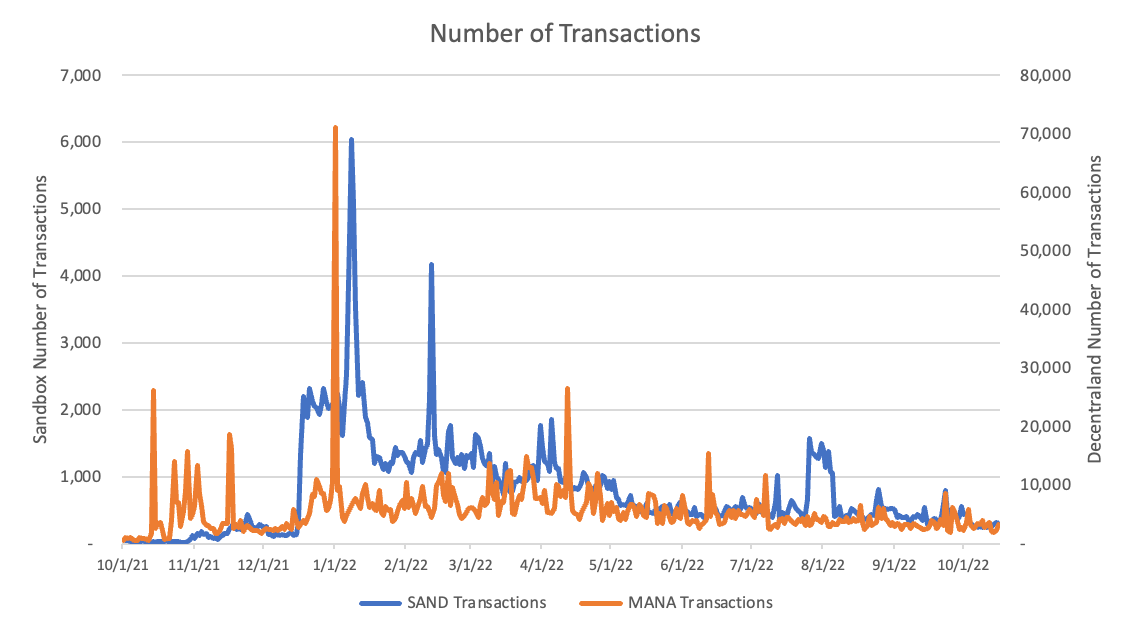

The number of unique transacting users, measuring the number of unique users making transactions with Decentraland contracts, has plunged since April 2022, declining from around 2k at the beginning of the year to around 700 as of the time of writing. Meanwhile, the number of transactions suffered the same fate, with Decentraland’s total transactions falling from over 10k to 3k as of the time of writing.

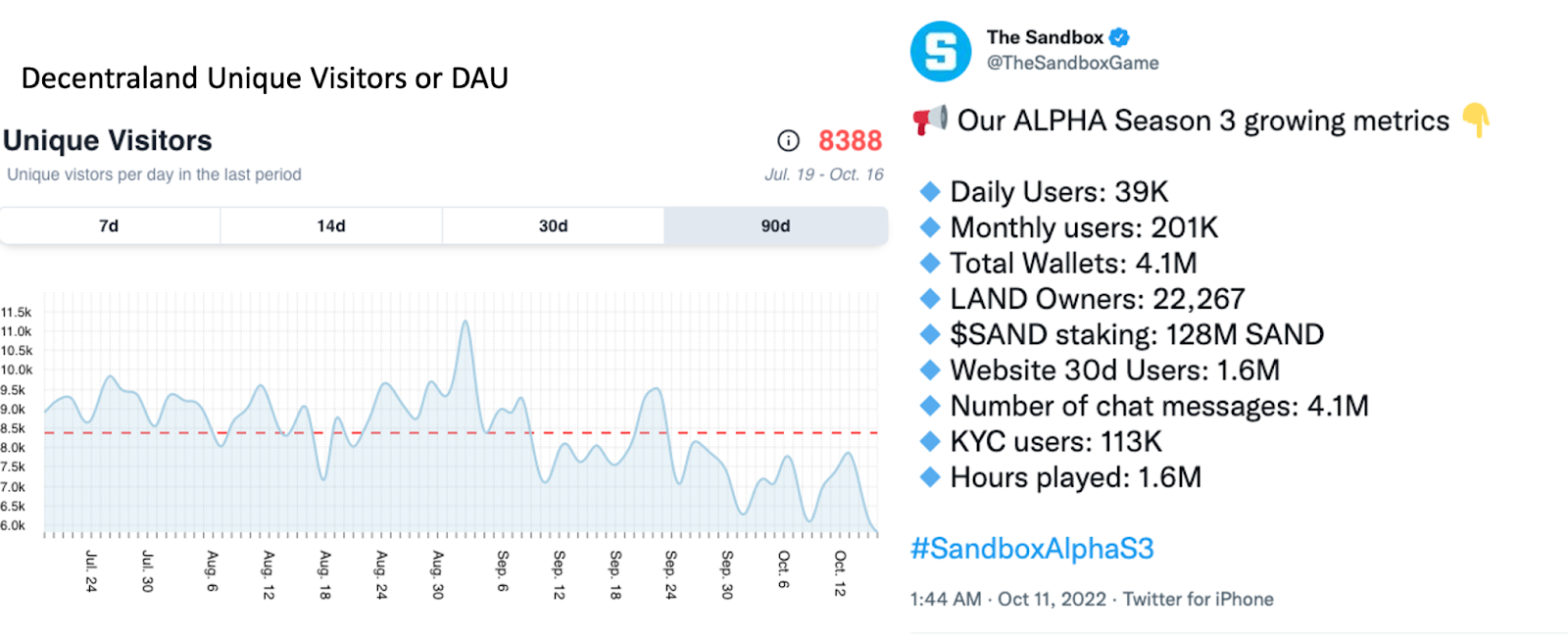

Source: DCL metrics, Twitter (data as of Oct 18, 2022)

As the word around the significant drop in unique transacting users started to spread, Decentraland and the Sandbox took to Twitter that their daily users are, in fact, far more than transacting users. Decentraland and Sandbox view daily visitors to their platform as a more accurate gauge of active users as compared to daily transactions. Based on the disclosures by the teams, the daily unique visitors to Decentraland are around 8k, while the Sandbox registered 39k daily users. While the number of daily visitors is well above the daily transacting users, the 90-day visitor data from Decentraland still indicates that user activities are on a downward trend. With the correlation between the number of transacting users and the number of active users, it is estimated that the number of daily visitors has probably slumped compared to its peak.

Recent Developments

Apart from events and contests, such as Metaverse Art Week and Decentraland Game Jam, major developments on Decentraland in the past few months include the launch of a software development kit – SDK 7, and integration with Double Protocol for NFT rental functionality.

SDK 7 is a key strategic move for Decentraland to upgrade its open-code tools and attract potential creators to the ecosystem. SDK 7 made significant improvements in terms of usability, performance, and portability from the previous version that was developed over four years ago. The launch of SDK 7 might lead to better scene building, smoother user experience, and better adaptability with other platforms. In addition, SDK 7 paves the way for the potential release of Decentraland Editor, a powerful scene builder that can be used by even non-technical content creators. The Sandbox, on the other hand, has already been offering tools for users to create avatars, in-game items, and even make rendering the whole game more convenient. As such, the possible release of Decentraland Editor is a significant step for Decentraland to catch up with the Sandbox.

The Sandbox has more active and diverse brand partnerships as compared to Decentraland. The Sandbox Alpha Season 3, was launched in August and has seemingly gained traction in terms of users and transactions, registering a total of 39k daily users, as disclosed by the team.

Both leading metaverse crypto platforms have actively launched new events, new partnerships, and new integrations with industrial facilities, as well as the continuous building of existing integrations.

In Summary

It is likely that transactions and user activities on Decentraland and the Sandbox have been losing steam compared to their peak last October. In addition, plunging token prices and unit land prices have indirectly reflected investors’ lack of confidence in the development of metaverse crypto.

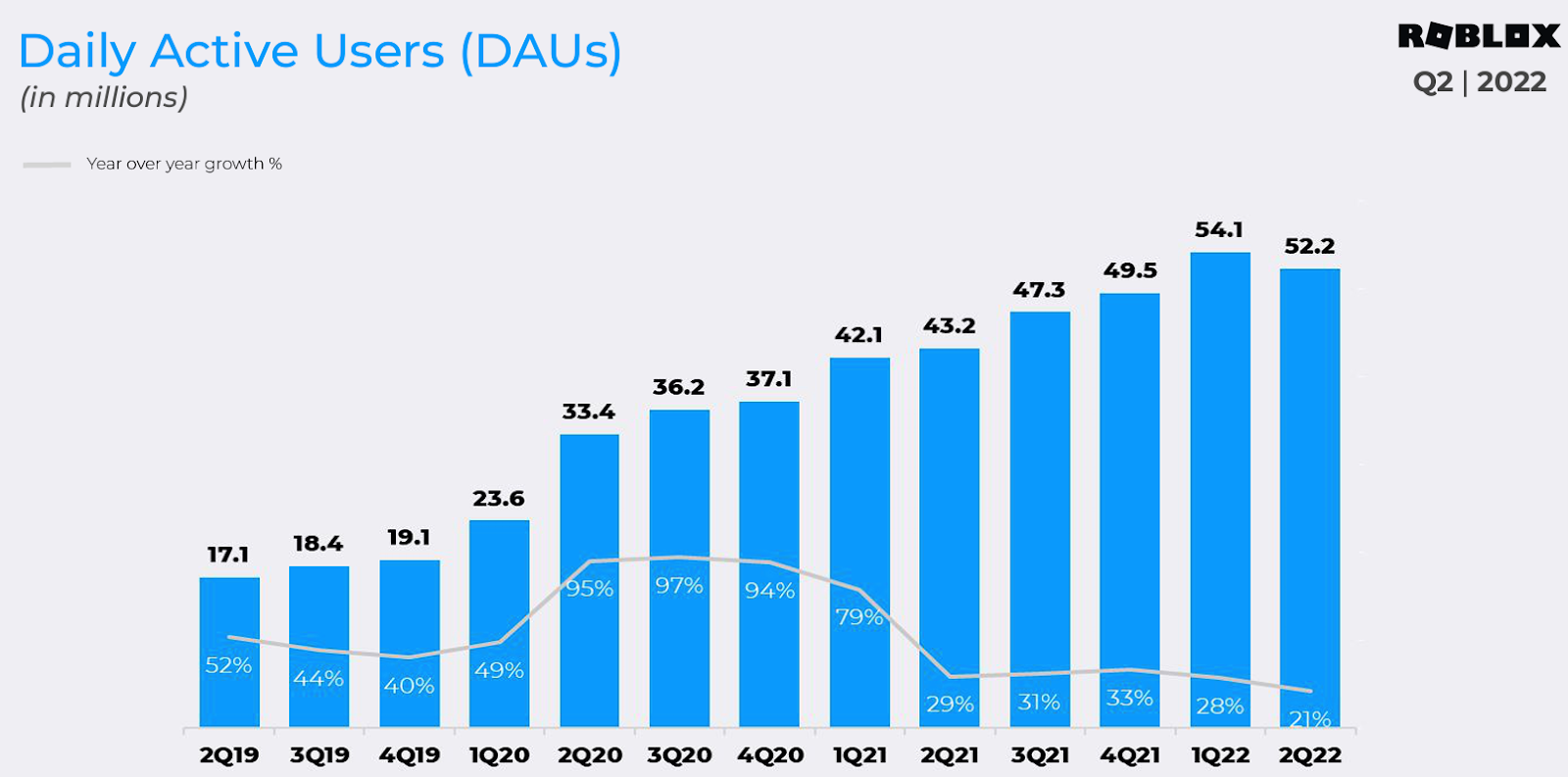

Meanwhile, Walmart Land, launched on Roblox, has registered 6.3 million visits since its launch on Sep. 26, 2022. Roblox has also reported the platform's daily active users (DAU) at 59.9 million. As such, web2’s metaverse platform Roblox has seemingly found its footing with its robust user activities. As such, we will explore what sets Roblox apart from Decentraland and the reasons for the outperformance of Roblox’s web2 metaverse platform.

Roblox VS Decentraland

|

Roblox |

Decentraland | |

|

Release Year |

2006 (Windows) |

2020 |

|

Access |

Web, App |

Web |

|

Technology Backing |

Private environment |

Blockchain and open-source |

|

Daily Active Users * |

59.5 million |

7.5k |

|

Total Sales (30D) * |

$591.2 million |

$389.5k |

|

Total Transactions (30D) |

NA |

4.8k |

*based on the latest data from quarterly filings.

Source: Roblox, Decentraland (data as of Oct 18, 2022)

The above table indicates that the number of daily active users and total sales have dwarfed Decentraland. In addition, Decentraland and the Sandbox have seen a remarkable drop in daily users since the beginning of the year, whereas Roblox only registered a slight dip in the DAUs. The comparison has revealed that Roblox is seeing more stable user traffic as compared to the two leading platforms. Apart from a longer operating history, differences in user composition and user accessibility possibly explain Roblox’s outperformance.

Users

|

User Statistics |

Roblox |

Decentraland |

|

Gender |

NA |

M: 63.3% F: 36.7% |

|

Age |

Official: Under 13: 53% Over 13: 46.4% Unknown: 0.6%

|

Similarweb: 18-24: 23.5% 25-34: 35.8% 35-44: 19.1%45-54: 10.9% 55-64: 6.7% 65+: 4% |

|

Daily Engaged Hours Per Person |

2.38 hours |

6 min |

Source: Roblox, similarweb, DCL metrics

The official user statistics have indicated that more than half of Roblox’s users are under 13.. Since Decentraland does not disclose official data, we turn to the web traffic data platform, Similarweb, for comparison. The data drawn reveals that Decentraland’s user base is largely from the 25-34 age group.

The younger age of Roblox users likely contributed to its popularity. Games running on Roblox and Decentraland are much simpler than other web2 games due to the early stage development of the metaverse, as well as their focus on user-generated content. Simple games tend to fare better among younger users, making it harder for Decentraland to nourish user loyalty with the older user base. This, in turn, is a possible cause of user exodus in the current bear market. Furthermore, users at Roblox spent more hours on the platform than Decentraland.

In summary, the outperformance of Roblox relative to its web3 counterparts in terms of daily active users seems to largely be due to the difference in the age of its user base. Perhaps, the younger audience simply has more time on their hands to engage on metaverse platforms. This brings us to the next question. Why does the younger audience seem to be drawn to the web2 metaverse platform as compared to Decentraland?

User Accessibility (Platforms and Fiat On-Ramp)

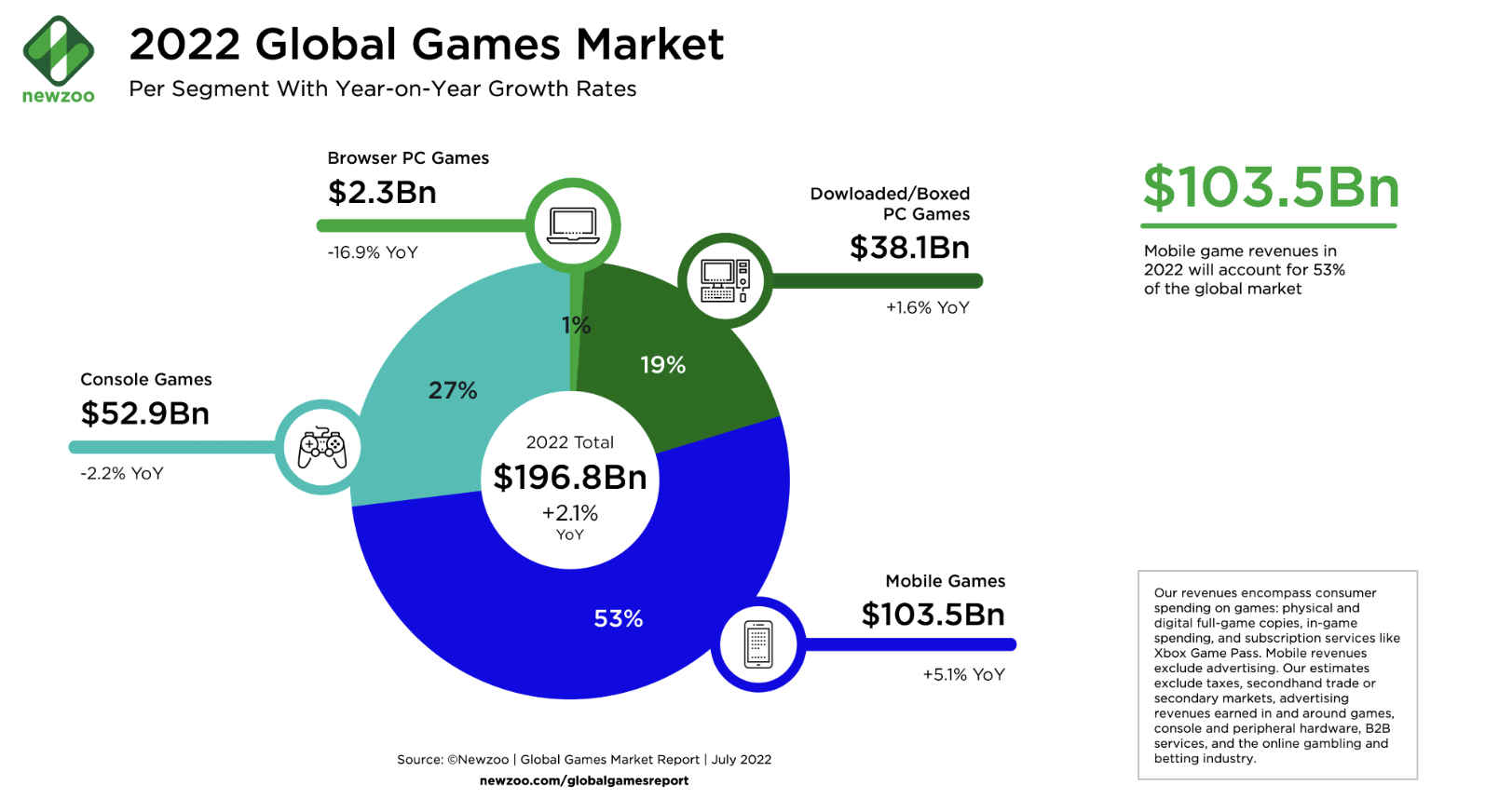

Roblox offers web and mobile access to its users, while most web3 metaverse platforms only offer their services through web applications, making it easier for users of all ages to engage in the platform.

2022 global games market from the research company Newzoo indicated that mobile games are currently the main driver of the global games market’s growth, with 53% of the market share expected in 2022. Drawing from these insights, it is clear that the lack of mobile application development might have been one of the main reasons for dragging down the user acquisition for Decentraland or the Sandbox.

In addition, lacking fiat on-ramp choices leads to difficulties in user acquisition. As mentioned above, the main payment methods for Decentraland and the Sandbox are in crypto. While the Sandbox offers choices of fiat on-ramp through moon-pay, Decentraland and other web3 metaverse platforms have yet to embrace payments through credit cards. Most young users, as well as their parents, are not crypto-native, thus the lack of fiat on-ramp choices creates an entry barrier for those potential users.

It is, however, important to note that despite taking payments in terms of crypto, Decentraland and the Sandbox do not require their users to sign up with a wallet. Thus, users of all ages are still able to play and engage in games on the platform without knowledge of crypto.

If so, it seems that the disappointing performance of the web3 platforms is the cause of something greater than just barriers to entry. Perhaps, wider accessibility and improved gameplay should be taken into consideration to increase the performance of web3 metaverse platforms.

What’s Ahead For Metaverse Crypto

Other metaverse cryptos, Illuvium, Ember Sword, and Somnium Space, have attempted to address the above improvement points, such as playability and platform access.

Unlike casual games offered by Decentraland and the Sandbox, blockchain games such as Illuvium and Ember Sword incorporate entertainment elements into the metaverse’s real estate, aiming to build a sophisticated open-world role-playing game with enhanced playability. For example, Illuvium has newly released its beta version and is regarded as a true AAA game with huge potential in the game-fi space.

Similarly, Ember Sword is another trendy role-playing game that is still in the pre-alpha phase. In the long term, enhanced gaming entertainment caters to the needs of mature users, possibly finding a solution for the dilemma facing leading metaverse cryptos.

Somnium Space is another new metaverse crypto that features virtual reality enablement. With a similar gaming experience to Decentraland, Somnium adds support for VR and AR headsets. As mentioned, the metaverse is still conceptual, whereas leading players such as Decentraland and the Sandbox have not yet offered a similarly immersive experience to users. As such, Somnium is a pioneer in adding VR and AR support. Furthermore, Somnium will offer mobile access, which possibly helps attract users who favor a mobile gaming experience.

These efforts put forward to revive the current web3 metaverse landscape suggest a promising future for Metaverse Crypto.