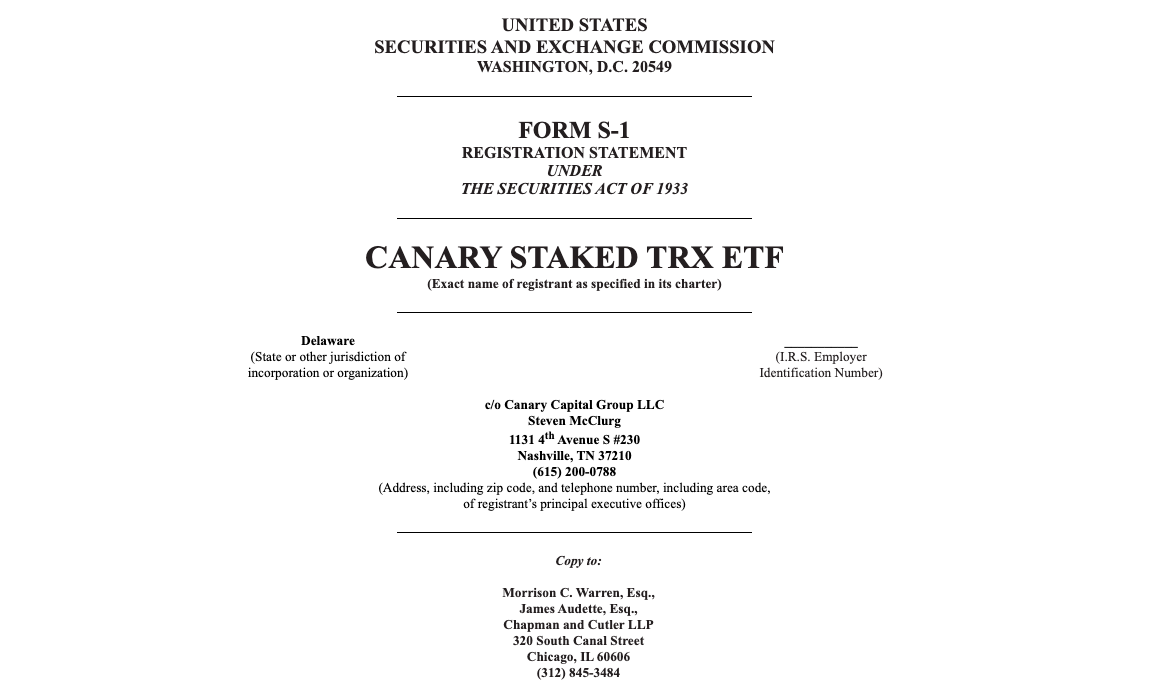

Earlier this month, Canary Capital, a prominent U.S. asset management firm, officially filed an S-1 registration statement with the U.S. Securities and Exchange Commission (SEC) for a TRX ETF. This marks the first time TRON has attempted to enter the U.S. capital markets through a fully compliant pathway — a high-stakes regulatory bet and a strategic rebranding move for the network.

source: https://www.sec.gov/Archives/edgar/data/2064768/000199937125004423/canary-s1_041825.htm

Reflecting on the cryptocurrency market from 2017 to today, some projects have capitalized on meme coin hype to gain traction, while others achieved rapid wealth through regulatory arbitrage. Numerous others have circumvented SEC oversight via ‘indirect listings.’ In contrast, Justin Sun has steadfastly upheld the principles of ‘inheritance, perseverance, and building’ for over a decade, firmly believing that ‘market longevity depends on regulatory compliance and industry faith.’ This conviction has cemented TRON’s leading position as the ‘on-chain dollar’ authority—its network’s USDT issuance commanding over 30% of the stablecoin market share.

But TRX is only one part of a much larger playbook.

Behind the scenes, Justin Sun has been assembling a triad of infrastructure, liquidity, and stability — all rooted in a commitment to compliance: TRON , the HTX exchange, and the USDD stablecoin — a three-pronged strategy designed to create a self-sustaining Web3 ecosystem.

HTX Exchange: The Engine Driving Ecosystem Growth

TRON may be the foundational layer, but HTX is the gateway.

As the primary user onboarding platform in Sun’s ecosystem, HTX serves as both traffic hub and liquidity driver. And despite Q1 2025 being a down period for the market, HTX defied gravity.

According to CoinGecko’s Q1 2025 Crypto Industry Report, HTX was the only top-10 exchange to register spot trading growth. While the total crypto market cap fell 18.6%, HTX saw a 11.4% quarter-over-quarter increase in spot volume — outperforming peers who faced declines ranging from 1.8% to 34.0%.

Beyond trading, HTX’s product suite — derivatives, earn, staking — has seen rapid enhancements. By optimizing fees, expanding yield options, and diversifying offerings, the platform has significantly improved user retention.

Security and compliance are also front and center. Recent collaborations with Fireblocks and other institutional-grade infrastructure providers further reinforce HTX’s commitment to safe, compliant trading.

Perhaps most impressively, HTX has become the launchpad for Sunpump, TRON’s Meme ecosystem. Through tightly integrated token launches, staking rewards, and airdrops, HTX now enables a full go-to-market funnel for emerging Web3 projects, converting curiosity into actual user participation.

This kind of resilience in a bear market isn’t just about business — it’s about ecosystem durability.

USDD: The Decentralized Dollar with Global Ambitions

No ecosystem is complete without a stablecoin, and Sun has made his move here as well.

USDD is a decentralized stablecoin project on the TRON blockchain. Officially launched on May 5, 2022, it was upgraded to USDD 2.0 on January 25th this year. USDD 2.0 relies on over-collateralization, liquidation auctions, risk management modules, PSM (Peg Stability Module), and decentralized governance to maintain a 1:1 USD peg. Furthermore, USDD possesses stability and multiple security measures.

As of April 21, USDD 2.0 has surpassed 350 million in circulation, reflecting growing global adoption. This widespread user adoption indicates USDD’s steadily growing prominence within the DeFi community.

USDD is more than just a token; it’s Sun’s answer to financial sovereignty — a decentralized alternative to traditional payments and cross-border asset flows.

Breaking the Web3 Trilemma?

Justin Sun has long been called the “engine of contrarian growth.” Ever since gracing the cover of Forbes, he’s positioned himself as someone seeking to solve the impossible trinity of crypto: regulatory compliance, technical decentralization, and mass adoption.

With the TRX ETF targeting traditional finance, HTX capturing crypto-native liquidity, and USDD anchoring real-world utility — he may finally be close.

Compliance vs Decentralization

Growth vs Bear Market Fatigue

Token Utility vs Institutional Acceptance

The TRX ETF filing isn’t just paperwork. It’s a signal that TRON, and by extension Sun’s broader empire, is ready to bridge Web3 with Wall Street.

If this bet pays off, Sun’s oft-repeated vision — “Achieve financial freedom for 8 billion people on Earth,” — may evolve from slogan to strategy, and eventually, to reality.

The post first appeared on HTX Square.