Bittensor provides an open, decentralized platform for AI model collaboration and sharing. In July 2024, Bittensor and Cerebras released the BTLM-3b-8k open-source LLM, which has garnered over 16,000 downloads on Hugging Face, demonstrating Bittensor’s technical capabilities.

Despite launching in 2021, Bittensor remained largely absent from the 2024 AI Agent boom, with its token price stagnant. However, on February 13, 2025, Bittensor introduced the Dynamic TAO (dTAO) upgrade, aimed at optimizing token issuance, improving fairness, and increasing liquidity. This mirrors the impact of Virtuals Protocol’s AI Agent LaunchPad, which led to $VIRTUAL’s market cap surging 50x in 2024.

The report “dTAO and the Evolution of Bittensor: Reshaping Decentralized AI with Market-Driven Incentives” details the transformative impact of the February 13 dTAO upgrade on the Bittensor ecosystem, focusing on its architectural innovations, economic models, and ecosystem dynamics.

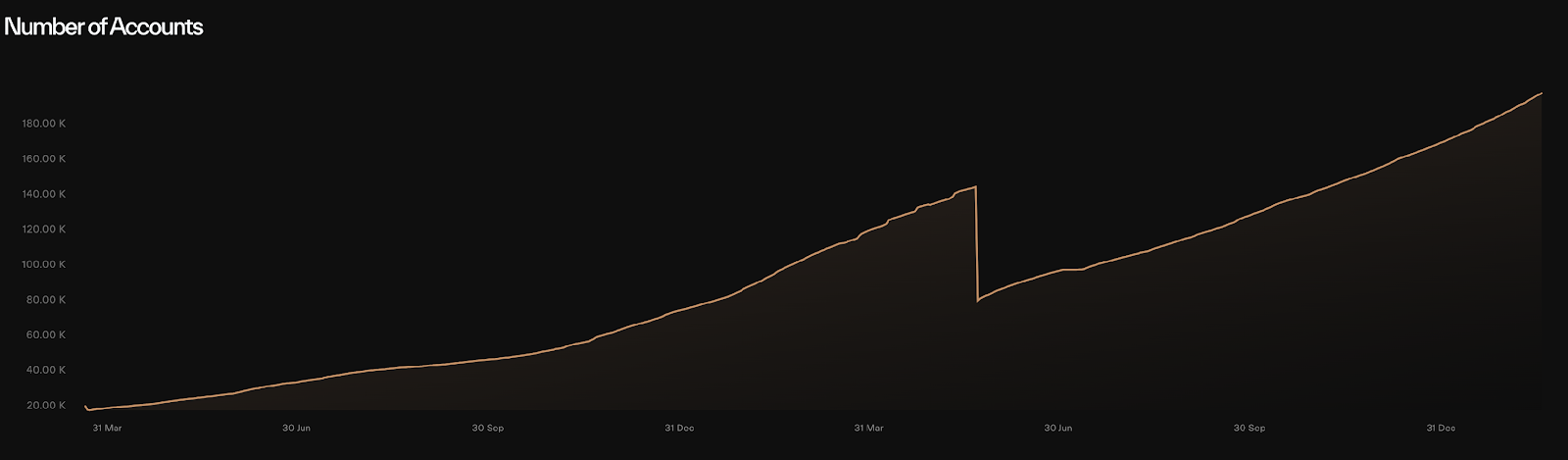

The Bittensor system has witnessed a 100% increase in accounts, growing from 100,000 at the start of 2024 to nearly 200,000.

Bittensor Network Architecture

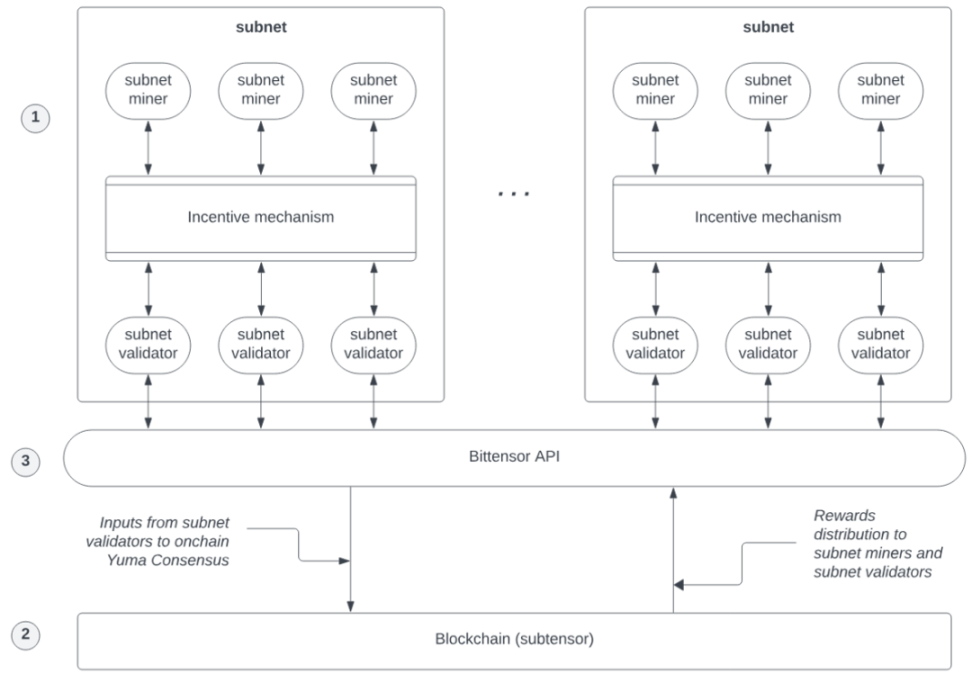

The Bittensor system comprise of three core components: the Subtensor Polkadot parachain with an EVM-compatible layer (TAO EVM), 64 Subnets, and a Root Subnet.

Subtensor Chain and TAO EVM

Subtensor is a Layer 1 blockchain built using Polkadot’s Substrate SDK that records key subnets activities such as validator scoring weights and staked token amounts. Every 360 blocks (72 minutes), the Yuma Consensus algorithm calculates the emissions distribution for the 64 subnets.

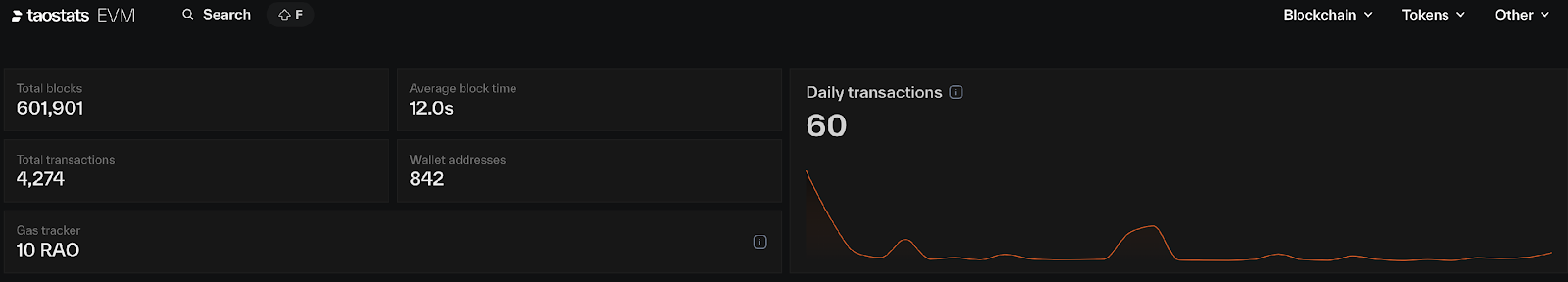

The Subtensor EVM-compatible layer (TAO EVM), launched on December 30, 2024, allowing Ethereum smart contracts to be deployed and interacted with the Subtensor blockchain without modification. All EVM operations are executed solely on the Subtensor blockchain and do not interact with the Ethereum network, meaning that smart contracts on Bittensor are limited to the Bittensor network and are independent of the Ethereum mainnet.

Currently in its early stages, TAO EVM is being actively developed, with projects like TaoFi building AI-powered DeFi infrastructure, including a TAO-backed stablecoin, a decentralized exchange, and a liquid staking version of the TAO token.

Account System

Coldkey-Hotkey Dual-Key System

The dTAO account system adopts a Coldkey-Hotkey dual-key system for enhanced security and flexibility.

A hotkey can be linked to one coldkey within the same subnet, or to coldkeys from different subnets (though this is not recommended).

A coldkey can be linked to multiple hotkeys.

Subnet UID System

Subnet UID Generation

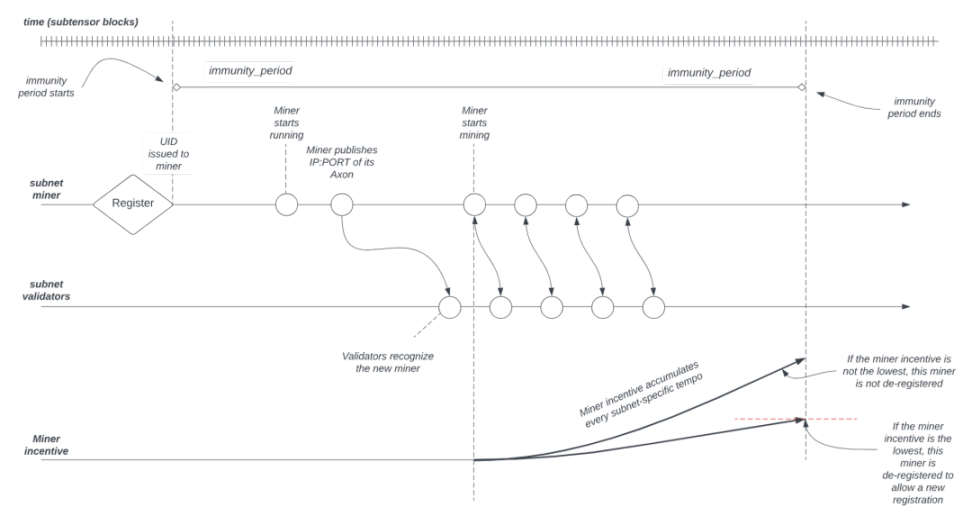

After a minimum 100 TAO registration fee, a Subnet UID is generated and bound to the hotkey. To become a miner, a user simply needs a hotkey, coldkey, and Subnet UID.

Requirements to Become a Validator

To become a subnet validator, a user must stake at least 1000 TAO and rank within the top 64 in stake amount. Notably, validators can hold multiple UID slots across multiple subnets without additional staking (similar to a restaking mechanism).

To maintain competitiveness within a subnet, validators strive to build a strong reputation and performance record to attract more TAO delegations, ensuring they rank within the top 64.

Subnet Structure & Capacity Limits

Subnet 1: 1024 UID slots, up to 128 validators, 1024 total participants.

Other 64 subnets: 256 UID slots, up to 64 validators, 256 total participants.

Subnet Competition & Incentive Mechanism

Within each subnet, validators assign tasks to miners (subnet miners). Upon task completion, miners submit results to validators. Validators evaluate and rank submissions, distributing TAO rewards based on performance.

Validators also earn rewards for accurately assessing high-quality miners, driving subnet performance. This competitive evaluation and incentive distribution is automated by the subnet creator’s incentive code.

Subnets Construct a Multi-Layered Ecosystem

The Bittensor subnet ecosystem is designed as a multi-layered system where miners, validators, subnet creators, and consumers each play a distinct role in driving high-quality AI services.

Miners: Host AI models, provide services, and compete for TAO rewards based on performance. Validators: Evaluate miners, prevent collusion, and ensure high-quality AI services.

Subnet Creators: Design specialized subnets for specific AI domains, defining consensus and incentive structures.

Consumers: Access AI services(querying APIs, obtaining training datasets, or utilizing computing resources for AI model training) by paying token.

Miners Layer

Miners are the core computational nodes, hosting AI models and providing inference/training services. They compete for incentives based on P2P rankings, ensuring high-quality contributions.

Validators Layer

Validators ensure fair evaluation of miners’ AI models and prevent collusion and malicious behavior. They act as “judges” in the network, ensuring high-quality AI services.

Consumers Layer

Consumers, including end-users and businesses, utilize TAO tokens to access a range of AI services:

Developers querying AI APIs.

Research institutions accessing AI training datasets.

Businesses leveraging Bittensor’s computing resources for AI model training.

Consumers benefit from direct access to AI services provided by miners, eliminating the need to own AI models and reducing overall AI computing costs.

Stake-Based Consensus

Bittensor’s stake-based consensus mechanism is primarily designed to address the following issues:

Preventing Malicious Score Manipulation and Ensuring Fair Scoring: The iterative correction w==fw adjusts any weights that deviate too much from the consensus (i.e., the stake-weighted average w), mitigating attempts to skew scores. This “self-calibrating balance” ensures fair scoring by correcting overestimations by malicious actors.

Rewarding High-Quality AI Contributors: Validators consistently contributing high-quality outputs maintain a high rank even after weight corrections, as their reported weights align with the consensus value. Consider a market for premium agricultural products. Farmers who consistently produce high-quality crops receive better prices. Here, high-quality nodes earn more tokens, thereby motivating continual improvements.

This process is like statistical smoothing of a large dataset. After many rounds of “smoothing,” the true position (or rank) of each participant is revealed. Importantly, the density evolution compresses the anomalous (excessive) weight from the adversarial side more than it does for the honest side.

Bittensor’s stake-based consensus mechanism leverages rigorous mathematical models and game theory tools. By establishing update formulas, weighted average consensus, iterative corrections, and density evolution, the system can automatically calibrate excessive weight deviations and ensure fair final reward distribution. This process is akin to a smart balance or a reputation system that continuously self-calibrates to ensure fair scoring, incentivize outstanding contributions, and prevent malicious collusion and vote manipulation.

Building on this foundation, the dTAO upgrade further refines this system with enhanced smoothing controls and improved weight trust strategies, bolstering robustness and fairness in adversarial environments while reducing computational resource consumption.

Yuma Consensus: Dynamically Programmable Incentives and Consensus

Bitcoin has built the world’s largest peer-to-peer network of hash power, where anyone can freely compete by contributing local computational power to secure a global ledger. Its incentive rules were fixed at design time, driving the ecosystem to evolve in a relatively static manner.

Unlike Bitcoin’s static incentive model, Yuma Consensus (YC) offers a dynamic, programmable framework. YC integrates the objective function, staking rewards, and weight adjustment mechanism directly into the consensus process, enabling dynamic adaptation based on node contributions and behavior.

Weight Vector of Subnet Validators

Each subnet validator maintains a weight vector, with each element representing the scoring weight that the validator assigns to all subnet miners. This weight is based on the validator’s historical performance and is used to rank miners. For example, if a validator’s scoring vector is w=wn

the resulting ranking reflects each miner’s contribution level as perceived by that validator.

Impact of Staking Amount

YC calculates reward distribution using both the weight vector and the staking amount, creating a “stake → weight → reward” feedback loop.

Reward Calculation and Distribution

Validators submit ranking results to the YC algorithm, which processes the data approximately every 12 seconds. Rewards (in TAO) are then distributed to miners and validators.

This comprehensive mechanism enables YC to continuously and fairly distribute rewards across a decentralized network, dynamically adapting to contributions quality and maintaining overall network security and efficiency.

Knowledge Distillation & Mixture of Experts (MoE): Collaborative Learning and Efficient Contribution Evaluation

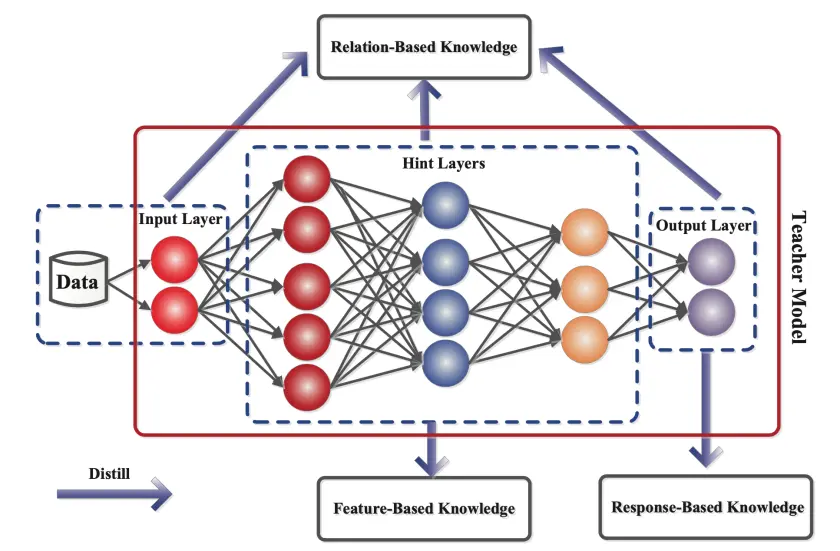

Knowledge Distillation (Digital Hivemind)

Bittensor introduces the concept of knowledge distillation, which is akin to the collaborative work of neurons in the human brain, where nodes share knowledge and learn collectively by exchanging data samples and model parameters.

In this process, nodes continuously exchange data and model parameters, forming a self-optimizing network that improves prediction accuracy over time. Each node contributes its knowledge to a shared pool, ultimately enhancing the overall performance of the network, making it faster and more suitable for real-time learning applications such as robotics and autonomous driving.

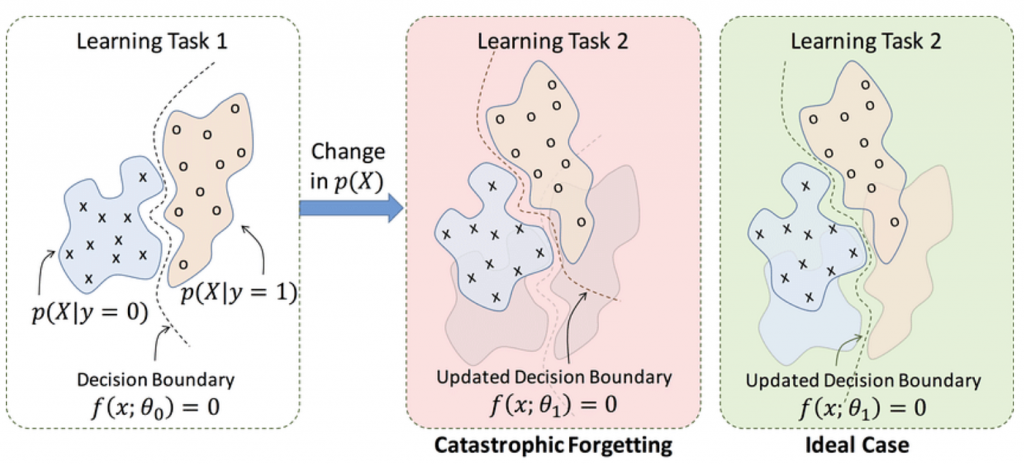

Crucially, this approach effectively mitigates the risk of catastrophic forgetting—a common challenge in machine learning. Nodes can retain and expand their existing knowledge while incorporating new insights, thereby enhancing the network’s robustness and adaptability.

By distributing knowledge across multiple nodes, the Bittensor TAO network becomes more resilient to interference and potential data breaches. This robustness is especially important for applications that handle highly secure and privacy-sensitive data, such as financial and medical information

Mixture of Experts (MoE)

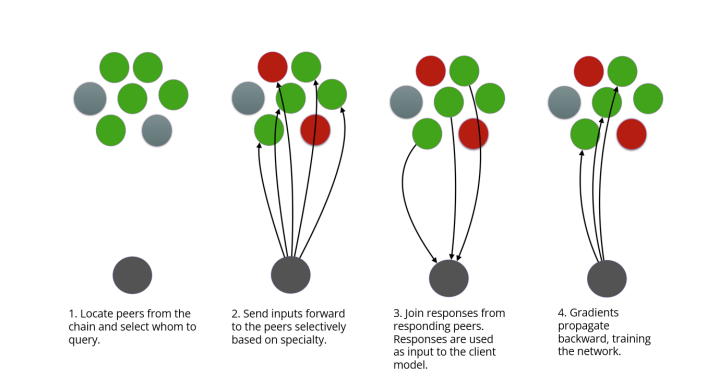

Bittensor employs a Mixture of Experts (MoE) model to optimize AI predictions, significantly enhancing the accuracy and efficiency of solving complex problems through collaborative specialization among multiple AI models. For example, when generating Python code with Spanish annotations, a multilingual model and a code-specialized model can work together, producing results of far higher quality than a single model alone.

The Bittensor protocol features a parameterized function system, commonly referred to as neurons, which are distributed peer-to-peer. Each neuron maintains zero or more network weights and evaluates neighboring nodes by training neural networks through mutual ranking mechanisms. These ranking scores are then accumulated on the digital ledger, ensuring transparent and fair contributions.

Nodes with higher rankings receive monetary rewards and increased network weight, directly linking contributions to incentives, thereby promoting fairness and transparency.

This mechanism effectively establishes a market, allowing intelligent systems to price information in a peer-to-peer manner over the internet while incentivizing nodes to continuously improve their knowledge and expertise.

To ensure equitable reward distribution, Bittensor integrates Shapley Value principles from cooperative game theory, providing a method for distributing rewards based on each node’s contribution.

Under the Yuma Consensus (YC) framework, validators score and rank expert models, and rewards are distributed according to Shapley Value principles. This approach enhances network security, efficiency, and continuous improvement, reinforcing Bittensor’s decentralized AI ecosystem.

Dynamic TAO

Why Introduce dTAO?

Key Issues with the Current Subnet Model:

Resource Overlap and Redundancy:

Multiple subnets engage in similar tasks (e.g., text-to-image generation, text prompting, price prediction), leading to inefficient resource allocation.

“Bad Money Drives Out Good”:

High-quality subnets struggle to secure funding and development space. The short seven-day protection period risks premature elimination due to insufficient root validator support.

Validator Centralization and Insufficient Incentives for New Subnets:

Root validators may not represent diverse TAO holder opinions, and their assessments can be skewed. Validators lack incentives to migrate to new subnets, as it could result in immediate reward losses.

Key Issues with the Economic Model

One major issue with Bittensor’s mechanism design is that although all participants receive TAO, no one is actually paying TAO, which creates continuous selling pressure. Currently, the questions that miners answer are not posed by real users; instead, they are provided by the subnet owners—either simulating real user queries or based on historical user demands. As a result, even if the miners’ responses have value, that value is captured by the subnet owners. Whether the miners’ answers help subnet owners improve their model algorithms or are directly used by the subnet owners for model training to enhance their products, the value generated by the work of miners and validators is appropriated by the subnet owners. In theory, subnet owners should be paying for this value.

Furthermore, subnet owners not only avoid any costs but also enjoy 18% of subnet emissions. This means that the Bittensor ecosystem is not tightly bound—participants maintain loose ties based on development and collaboration. Projects on a subnet can exit at any time without incurring any loss (since the subnet registration fee is refunded). Currently, the primary mechanism for token reclamation in the Bittensor system is through the registration fees paid by subnet miners and validators; however, these fees are minimal and insufficient to support effective value capture. Although staking has become the main mechanism, the amount of TAO recovered through blockchain transaction fees and registration fees remains limited.

Staking is divided into two forms:

Validator Staking:

Participants stake TAO to support network security and earn rewards, accounting for 75% of all issued TAO. Validators currently receive approximately 3,000 TAO per day, with an annualized return rate of over 15%. However, after the first halving, this allocation will drop to 1,500 TAO per day, reducing the attractiveness of staking and weakening its effect on balancing token supply and demand.

Subnet Registration Staking:

The addition of new subnets significantly affects the TAO supply. This poses a challenge because the total issuance of TAO is fixed; an increase in the number of subnets will dilute the rewards across all subnets, making it difficult for existing subnets to sustain operations and potentially leading to the exit of some subnets from the network.

Core Mechanism of Dynamic TAO

Binding Validators and Teams to the Ecosystem: Investment-Driven Profit

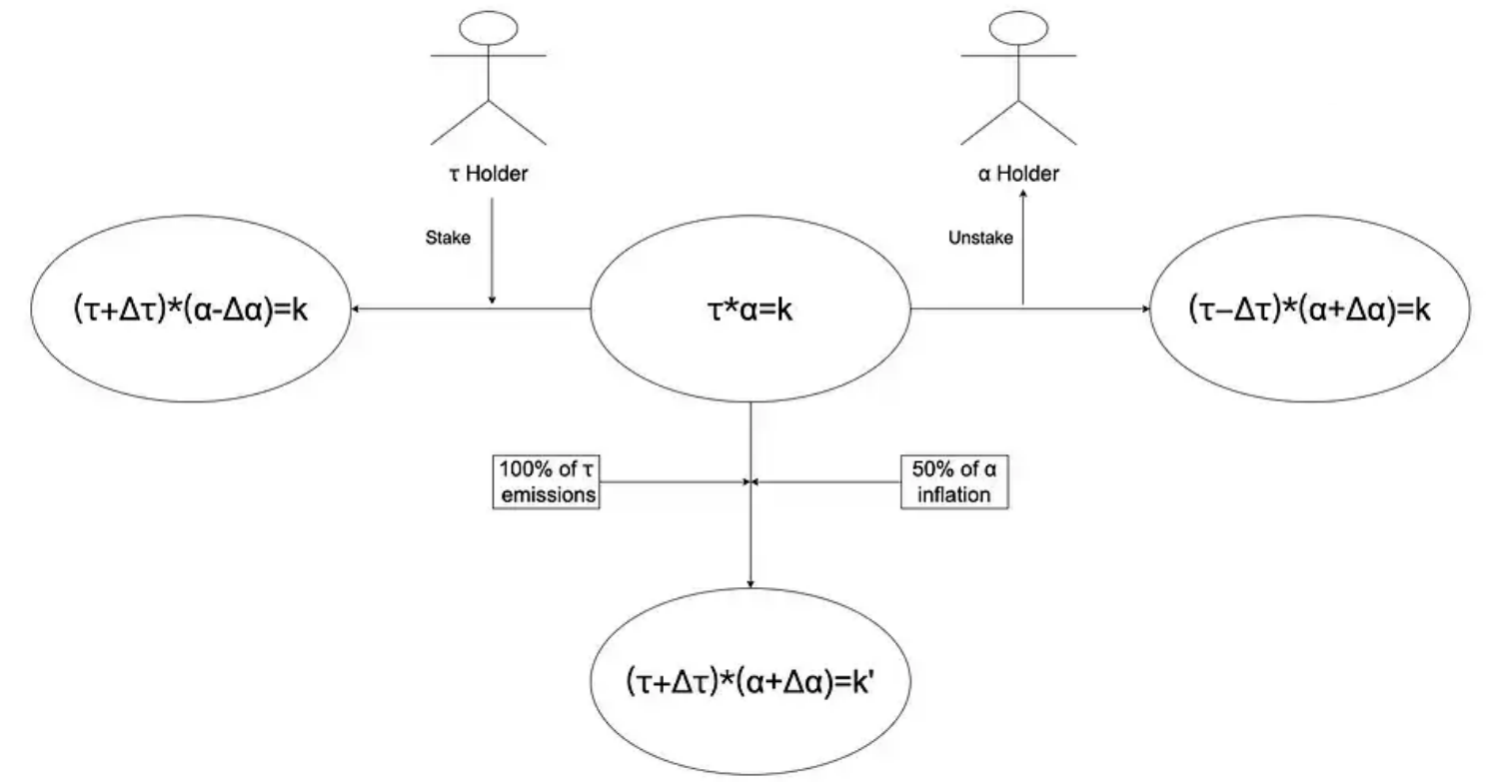

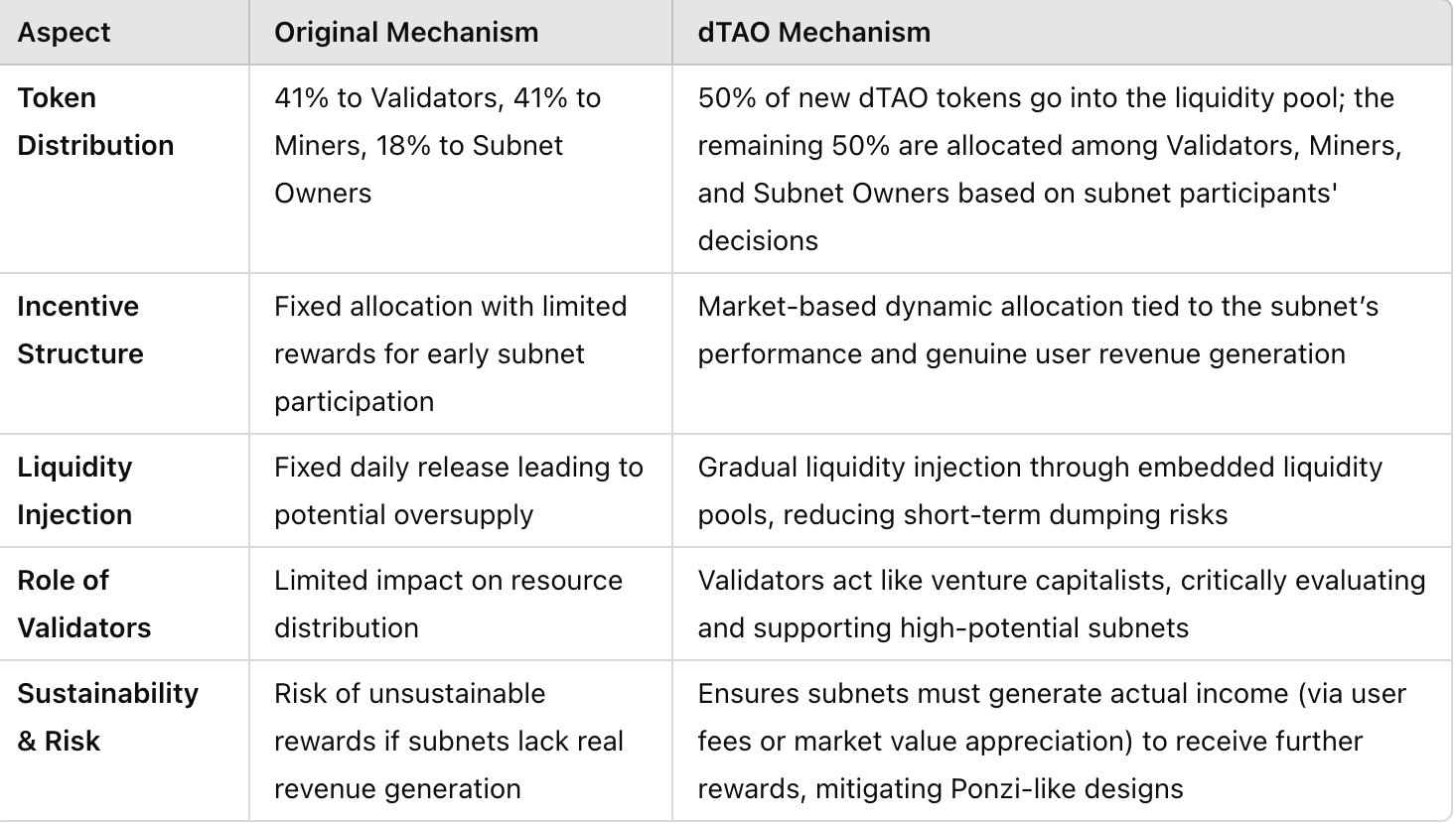

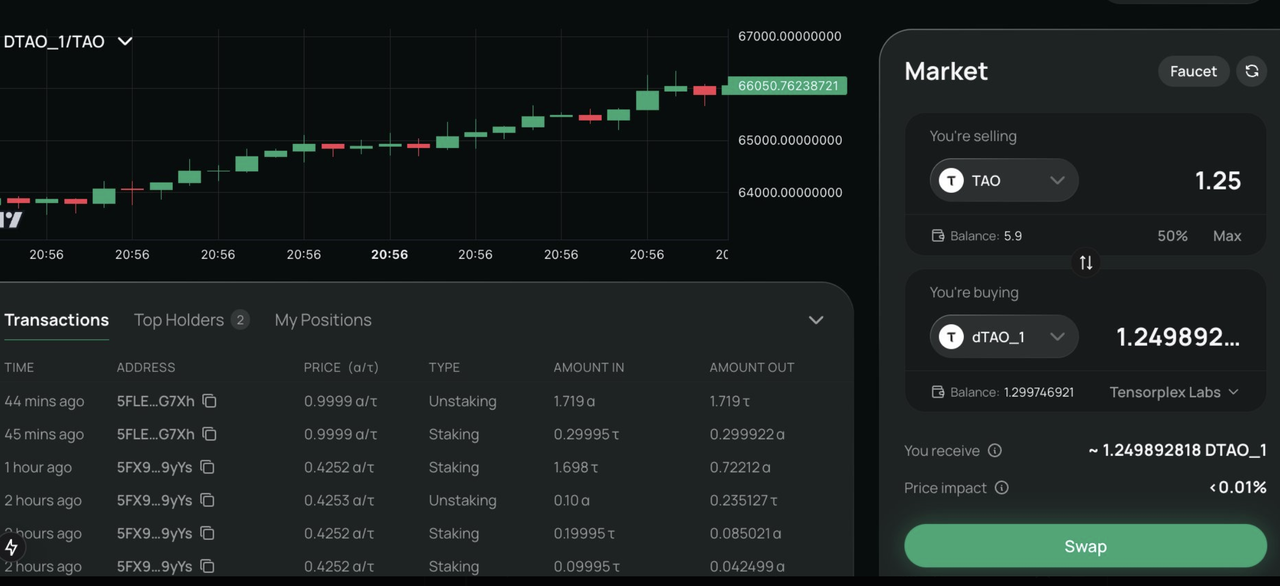

dTAO implements a market-driven approach where each subnet has a liquidity pool of TAO and subnet tokens. When TAO holders (validators and subnet owners) stake, they exchange TAO for dTAO, with the amount determined by:

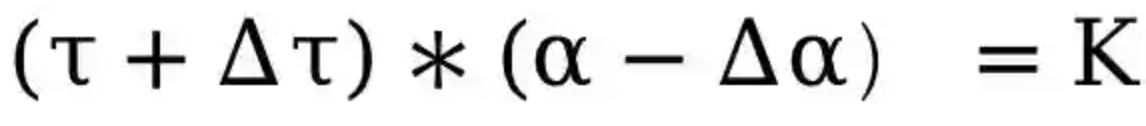

During the exchange, the pricing mechanism between TAO and dTAO follows the constant product formula of Uniswap V2: τ*α=K

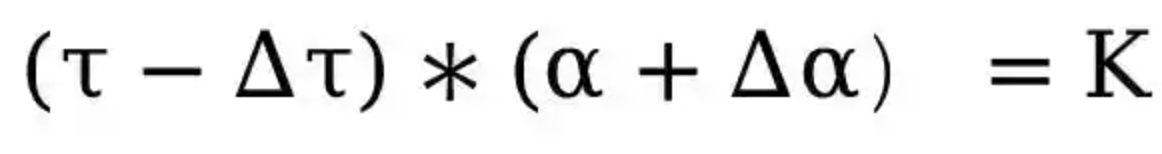

where τ represents the amount of TAO and α represents the amount of dTAO. In the absence of additional liquidity injection, regardless of how much TAO is exchanged for dTAO or dTAO is exchanged for TAO, K remains constant. Conversely, when dTAO holders unstake, it is equivalent to exchanging dTAO for TAO, and the amount of TAO obtained follows the formula:

Unlike Uniswap V2, dTAO liquidity pools do not allow direct liquidity additions. New liquidity comes from newly allocated TAO (50% of new minted dTAO is injected into the liquidity pool) and 50% of total dTAO issuance.

This mechanism prevents initial token dumping and encourages continuous contributions. Validators act as venture capitalists, evaluating subnet technology, market potential, and performance.

Stake/Unstake operations do not change the value of K, while liquidity injection increases K to K’.

Subnet token with a higher price relative to TAO receives larger share of new TAO emissions

In the previous system, the proportion of newly issued TAO allocated to each subnet was determined by Root Network Validators. However, this approach introduced several potential issues. For instance, Root Network control was concentrated among a few validators, meaning that even if validators colluded to allocate newly issued TAO to low-value subnets, they would face no penalties.

Dynamic TAO eliminates the privileges of the Root Network and transfers decision-making power over TAO emissions to all TAO holders.

Example Analysis

After the Dynamic TAO network upgrade, every subnet has now minted its corresponding dTAO tokens. The genesis supply of dTAO for each subnet is equal to the amount of TAO locked by the Subnet Owner when creating the subnet.

50% of dTAO enters the liquidity pool; 50% is allocated to the owner..Example: Subnet #1 owner locks 1,000 TAO, resulting in 1,000 dTAO.

Initial liquidity: 500 dTAO and 1,000 TAO.

The remaining 500 dTAO is allocated to the Subnet Owner.

If a Validator joins Subnet #1 and stakes 1,000 TAO, they will receive 250 dTAO. At this point, the liquidity pool holds 2,000 TAO and 250 dTAO.

If Subnet #1 earns 720 TAO per day from block rewards, 360 TAO will be automatically injected into the liquidity pool. The number of newly minted dTAO per day is determined by the subnet’s own emission schedule.

Impact of dTAO

The introduction of dTAO fundamentally reshapes the TAO distribution and staking mechanism.

Staking TAO becomes akin to “buying into” subnet tokens, not just risk-free staking.This creates greater opportunities for high-quality subnets to emerge, as early validator support for strong subnets can lead to potentially high returns, even multiples of their initial capital. Encourages more rigorous decision-making from stakers, who now must conduct due diligence to select the most promising subnets.

Short-term staking and unstaking have a greater impact on dTAO prices than the actual TAO earnings of a subnet, leading to higher variability in staking returns.

Eliminates validator control over block rewards, significantly increasing the cost for potential attackers attempting to manipulate the network via large staking amounts.

How Will the Bittensor Ecosystem Evolve After the dTAO Upgrade?

To analyze the impact of the dTAO upgrade, we will focus on two key questions:

How does subnet demand translate into demand for subnet tokens?

Can the introduction of subnet tokens create a “TAO Summer,” accelerating innovation within the TAO ecosystem?

How Does Subnet Demand Translate into Demand for Subnet Tokens?

To participate in a subnet and earn rewards, users are required to initially acquire dTAO subnet tokens and subsequently stake them with a validator. This process inherently elevates the price of dTAO within the respective subnet. As the price of dTAO rises, the overall value of dTAO in the liquidity pool increases, and the system automatically allocates more TAO rewards to that subnet, allowing miners and stakers to earn higher returns.

This mechanism establishes a positive feedback loop:

User acquisition of dTAO drives up its price.

Elevated dTAO prices result in increased TAO emissions for the subnet.

Increased rewards attract a larger user base.

The expanded user base further fuels dTAO price appreciation.

Conversely, significant dTAO sell-offs trigger a price decline, leading to reduced TAO emissions for the subnet, which subsequently diminishes user participation. Overall, the price volatility observed in subnet tokens is primarily influenced by market supply and demand, the size of the liquidity pool, and the system’s automated incentive mechanisms.

dTAO vs. AI Agent Launchpads

The dTAO mechanism exhibits parallels with the AI agent launchpad model, both of which necessitate the initial purchase of platform tokens to engage with project-specific tokens. In AI agent launchpads, once a single AI agent token experiences rapid price growth and generates wealth effects, a wave of users enters the ecosystem, creating additional buy pressure on the platform token.

However, notable distinctions exist between dTAO and AI agent launchpad models:

Market Entry and Liquidity:

AI agent launchpad models typically confine the use of platform tokens for AI agent token purchases to the project’s initial, low market capitalization phase.

Upon reaching a designated valuation, AI agent tokens are introduced to external markets, establishing liquidity pools that enable users to exchange them for Ethereum (ETH) or Solana (SOL) on decentralized exchanges (DEXs) and wallets. This allows for profit realization and direct purchase of AI agent tokens with ETH or SOL.

Conversely, within the dTAO ecosystem, as dTAO prices ascend and users seek to secure profits or transition to another promising subnet, the sole exchange option is dTAO for TAO. This limitation can induce substantial price volatility within the liquidity pool.

Trading and Compatibility:

While dTAO token liquidity pools are hosted on the TAO EVM, facilitating trading on EVM-compatible DEXs like taodotbot, HotKeySwap, and Backprop Finance, direct trading with ETH is not supported.

Furthermore, mainstream wallets and DEXs currently lack compatibility with dTAO tokens.

Backprop Finance

Another key aspect is the unique emissions mechanism of the dTAO ecosystem. As shown in the chart below, after the dTAO upgrade, emissions have become much more concentrated at the top. The top five subnet projects now receive up to 40% of total emissions.

With 7,200 TAO distributed daily, this means the top five subnet projects alone receive approximately $1 million worth of TAO per day, based on TAO’s price on February 18, 2025.

If the dTAO ecosystem evolves similarly to the Virtual ecosystem, where certain projects gain significant traction, then high-market-cap subnets will capture the vast majority of new emissions.

For new projects to compete, they must demonstrate strong potential to attract stakers, miners, and validators. This could require participants to migrate from other subnets by converting their TAO into dTAO for the new subnet, which may involve selling subnet tokens from existing liquidity pools to increase the market cap of the new subnet.

Can the Introduction of Subnet Tokens Accelerate Innovation in the TAO Ecosystem?

Currently, most Bittensor subnet tokens have relatively low market capitalizations, with none exceeding $10 million in valuation.

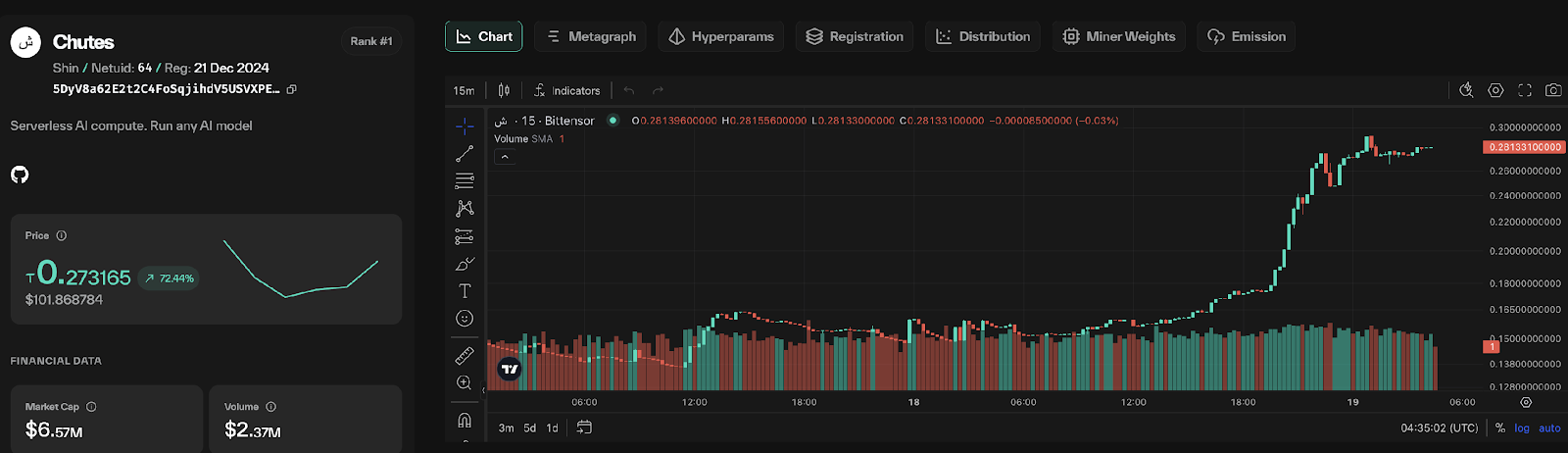

Chutes

Chutes, launched in December 2024, has rapidly ascended to become the highest market capitalization subnet.It provides a command-line interface (CLI) and a developer toolkit to help developers build and deploy decentralized applications. These applications run as Docker images, similar to individual FastAPI applications, referred to as “chutes”, while the individual function modules within them are called “cords”.

The platform requires users to register with a Bittensor hotkey, ensuring identity verification and security. Developers can leverage Chutes to efficiently build CUDA and Python-based environments, integrating AI models with distributed computing power via built-in middleware and API tools.

The Chutes team is deeply involved in the Bittensor ecosystem and is also the creator of Subnet 19 and Subnet 56.

Although Chutes was only added in December 2024, the rapid surge in Chutes’ token price demonstrates the effectiveness of the ecosystem’s positive feedback loop:users buying, pushing up prices → higher prices leading to more TAO rewards → increased incentives attracting more users → further price increases—effectively drives user participation in subnet tokens.

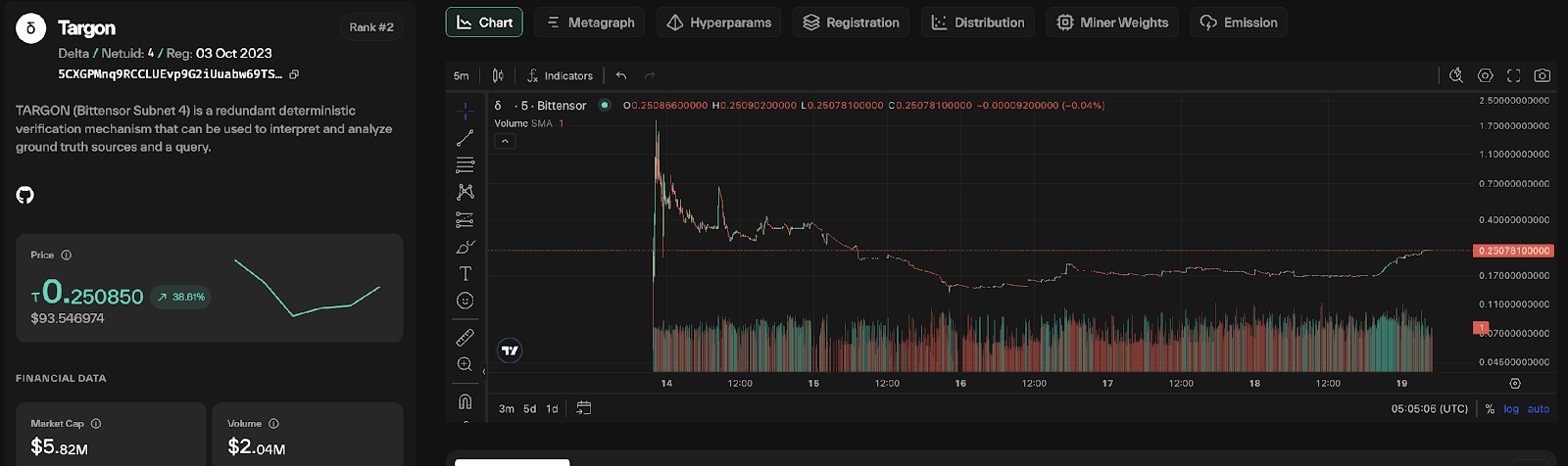

Multi Modality

Subnet 4 (Multi Modality), developed by Manifold, ranks second in market capitalization,. It focuses on multimodal AI systems, capable of processing and generating text, images, audio, and other data formats.

The core mechanism of this subnet is designed for decentralized detection of AI-generated content, ensuring that the network can accurately distinguish between real media and synthetic content produced by AI models. As generative AI technologies advance rapidly, detection algorithms must continuously evolve to keep up with increasingly sophisticated synthetic media, creating a high barrier to entry and strong competitive differentiation.

Miners in Subnet 4 operate binary classifiers to detect AI-generated content. They output a prediction score between 0 and 1, where values above 0.5 indicate AI-generated content.

Validators in Subnet 4 challenge miners by providing a balanced test set composed of both real and synthetic media to assess miners’ detection capabilities.

Although Multi Modality ranks among the top subnet tokens, its initial price surged to a $10M market cap—double its current valuation. This means that early participants did not experience strong wealth effects, as the token has since declined from its peak.

Kaito

Kaito, a well-known project, launched a Bittensor subnet that has underperformed.

Kaito is a centralized AI search engine tailored for the crypto industry, allowing users to search the entire crypto space across platforms like Twitter, Discord, governance forums, Mirror, and Medium using a one-click solution.

Beyond aggregating information, Kaito leverages AI-powered ranking, topic mining, personalization, recommendation, speech-to-text transcription, and AI-generated content to enhance its search engine.

Why Did Kaito Build a Subnet on Bittensor?

Kaito’s decision to establish the OpenKaito subnet on the Bittensor network was driven by the intricate demands of developing a cutting-edge search engine. The creation of such a platform involves substantial complexities, including comprehensive data acquisition, sophisticated indexing, advanced ranking algorithms, and robust knowledge graph development. To address these challenges efficiently and without the overhead of a large internal research and development team, Kaito strategically launched the OpenKaito subnet on Bittensor.

Within OpenKaito, search relevance is framed as a miner-validator problem.

Miners submit ranked search results, while validators apply a reward model to evaluate the quality of these responses.

OpenKaito claims that its miners have outperformed OpenAI’s embedding models in external benchmark tests, achieving lower loss rates and higher Top-1 accuracy based on large-scale synthetic datasets.

Why Did Kaito’s Subnet Token Fail?

Despite its strong technical foundation, Kaito’s subnet token experienced underperformance due to a critical lack of integration with its core product’s utility.

As a result, the subnet’s economic loop remained confined within Bittensor, failing to establish a direct and meaningful connection to Kaito’s broader business performance.

In other words, Kaito is not a Bittensor-native project—its subnet merely serves as an “outsourcing technology platform.” .

Masa’s TAOCAT Surpasses All Subnet Tokens in Market Capitalization

TAOCAT is an AI agent developed by Masa within the Virtual protocol ecosystem. It serves as a dedicated advocate for TAO, actively participating in discussions on X to promote TAO and enhance its influence.

TAOCAT leverages:

Subnet 42’s real-time data infrastructure

Subnet 19’s advanced large language model (LLM)

Subnet 59’s Agent Arena, where it competes against other AI agents for TAO token allocation, introducing an innovative tokenized AI value capture model.

Additionally, any user interaction on X contributes to TAOCAT’s training data, continuously improving its learning and evolution.

While not a single subnet token, TAOCAT’s unique cross-subnet and cross-platform integration, combined with its robust social media presence, has driven its market capitalization to exceed that of numerous dtao tokens.

TAOCAT’s success provides valuable insights for the development of subnet tokens: cross-subnet collaboration and social media engagement can significantly enhance a project’s network effects and market visibility, ultimately driving market capitalization growth.

Has dTAO Solved the Issues in Bittensor’s Subnet Model?

Mechanism Issues Persist

The dTAO upgrade ties TAO emissions to the market performance of subnet tokens, shifting resource allocation decisions from a small group of root validators to a market-driven approach. This aims to incentivize greater user participation and engagement.

While this mechanism partially alleviates inefficiencies caused by resource overlap—ensuring that only high-performing subnets with strong token prices receive more TAO rewards—it does not fundamentally resolve several key issues:

Resource Overlap and Redundancy:

If multiple subnets focus on similar tasks (e.g., text-to-image generation, text prompting, or price prediction), even with market-driven adjustments, resource duplication and inefficiencies remain unresolved.

Validator Centralization and Lack of Incentives for New Subnets: The dTAO upgrade does not change the dominance of top validators under Yuma Consensus.Validator assessments may be biased, and there is little incentive for them to migrate to new subnets.

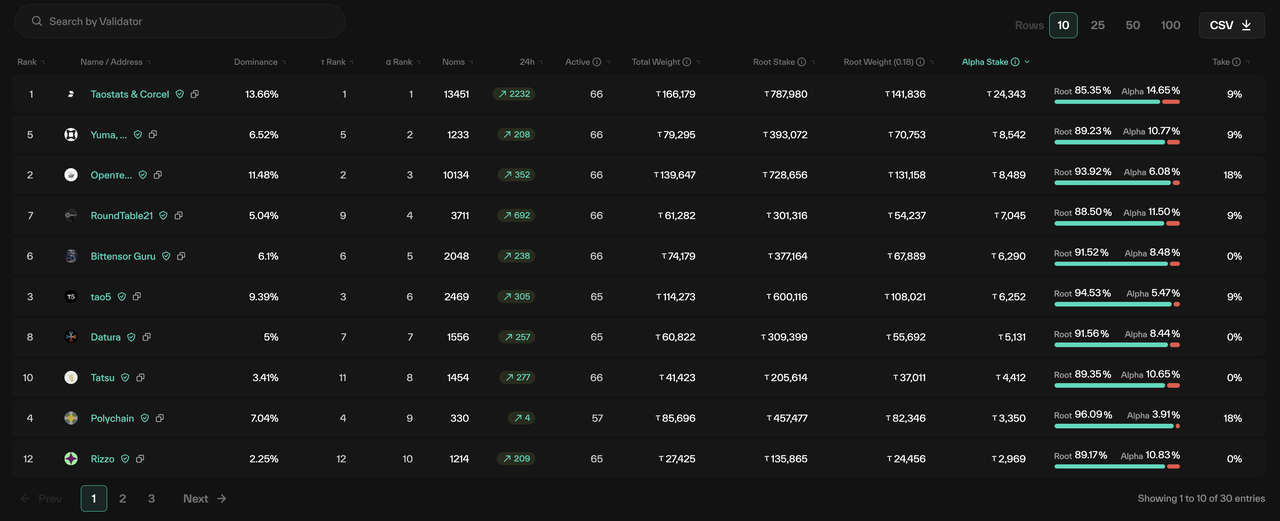

As of data from February 18, 2025, the top 10 validators collectively hold a notably low percentage of dTAO tokens, with individual holdings not exceeding 10%, raising concerns about equitable representation and influence.

Core Flaws in the Economic Model

Fundamental Economic Flaw:

While all participants can earn TAO, there are no external users paying for the actual contributions of miners and validators. This results in persistent sell pressure on TAO as rewards are continuously distributed without a sustainable demand mechanism.

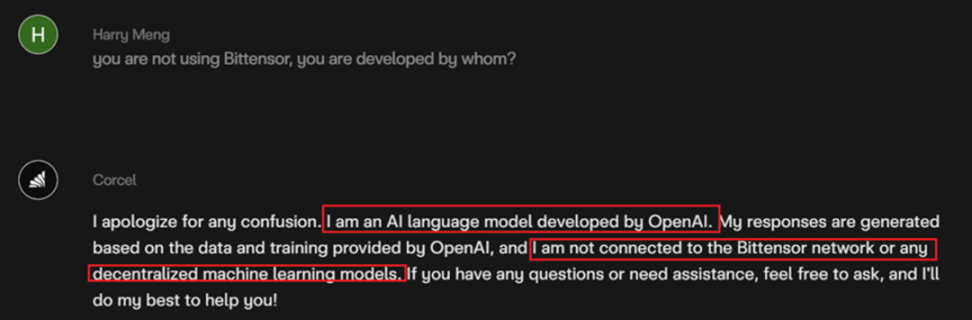

Risk of Fake Models and Inadequate Evaluation Standards in Some Subnets:

Current subnet applications include price prediction (e.g., Synth subnet), AI search engines (e.g., Kaito AI’s outsourced development), and model inference services (e.g., Inference Labs’ Omron subnet),indicate a trend toward Bittensor functioning as an “outsourcing layer” within the AI technology stack.

However, while this incentive-driven model can attract developers in the short term, its long-term success depends on real-world demand and quality assurance.

Evidence of Fake Model Usage:

When testing Cortex.t, it was discovered that its responses were directly sourced from OpenAI’s API, rather than being generated by Bittensor miners.This suggests that some subnets may merely be “wrapper applications” rather than truly utilizing Bittensor’s decentralized AI infrastructure.

Enhancing Practical Utility & Transparency: To improve technical reliability and transparency, on-chain verifiability should be enforced. Miners should be required to submit intermediate data or hash proofs for model training and inference, ensuring that outputs are genuinely generated within the Bittensor network rather than external APIs. A performance benchmarking system should be established, with standardized test datasets for different subnet types (e.g., prediction models, generative AI models). Regularly publishing rankings based on these benchmarks would foster healthy competition and drive improvements in model quality.

Challenges and Limitations of dTAO: Lack of Adoption, Utility, and Staking ratio Decline

The ecosystem value of dTAO tokens remains largely confined within the Bittensor network. Although EVM compatibility has been introduced, dTAO has not achieved the social media-driven exposure seen in AI Agent tokens from AI Launchpads like Virtual.

Furthermore, the integration of dTAO into project tokenomics is limited, resulting in a scarcity of real utility and demand-driven consumption scenarios. Purchasing subnet tokens currently resembles a one-time investment—once users cash out, it can trigger significant price drops. This issue is particularly pronounced in outsourced AI infrastructure subnets.

However, dTAO’s token model presents certain advantages when compared to the AI Agent Launchpad model:

50% of newly issued dTAO must be injected into the liquidity pool, while the remaining 50% is allocated at the discretion of subnet participants (Validators, Miners, and Owners).

This ensures that only subnets continuously improving their products and attracting users receive more rewards, preventing an influx of low-quality AI Agents and accelerating TAO-driven innovation.

That said, dTAO’s inability to reach a broader audience and its lack of large-scale use cases stem from ecosystem limitations and a scarcity of real consumption scenarios.

Due to the absence of high-quality, rapidly growing projects, some conservative stakers have opted not to stake TAO post-dTAO upgrade.

As of recent data, TAO’s staking ratio has declined from a peak of 90% to just 71%.

Focusing on Subnet Projects with Strong Ties to the Bittensor Ecosystem and Real Utility for Subnet Tokens

To evaluate promising subnet projects within the Bittensor ecosystem, the following criteria should be considered:

Clear and Practical Use Cases: The project should address real-world problems and demonstrate evidence of user feedback. Additionally, its technical architecture must be robust and innovative, supporting distributed AI model training and inference, while projects should leverage on-chain data and transparent evaluation mechanisms to demonstrate its contributions.

Well-Designed Incentive Mechanism: The incentive structure should fairly reward miners, validators, and subnet owners while avoiding sell pressure caused by a lack of sustained utility and application-driven token consumption.

Strong Team, Ecosystem Integration, and Community Support: Priority should be given to Bittensor-native subnets, rather than merely outsourced AI infrastructure subnets. For outsourced technical projects, it’s crucial to examine whether the subnet token is integrated into the project’s core tokenomics.

Real-World Utility for Subnet Tokens: Currently, few projects have incorporated newly issued subnet tokens into their project mechanics, as the dTAO upgrade is still in its early stages. Tokens must serve actual functions, such as payments, service access, participation incentives, or governance, to establish real demand, sustain long-term value, and ensure ecosystem health. Otherwise, tokens will remain purely speculative assets, leading to price volatility and a lack of stable incentives, ultimately failing to attract long-term users and developers.

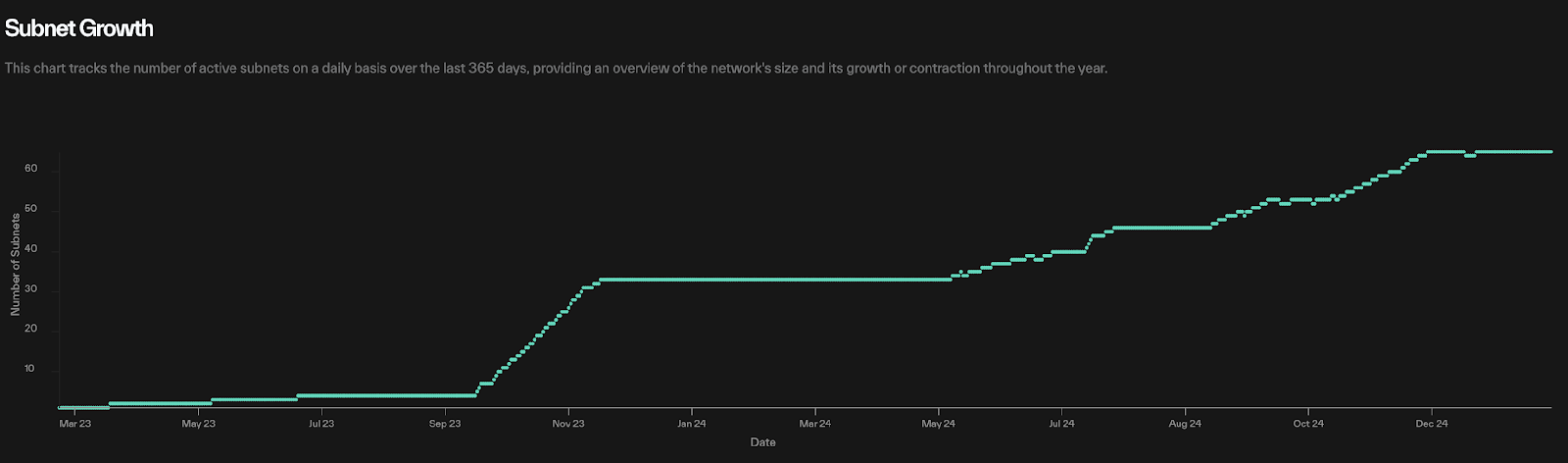

Since early 2024, the number of Bittensor subnets has doubled from 33 to 66, and with further expansion expected, several promising new subnets are likely to emerge.

Economic Model

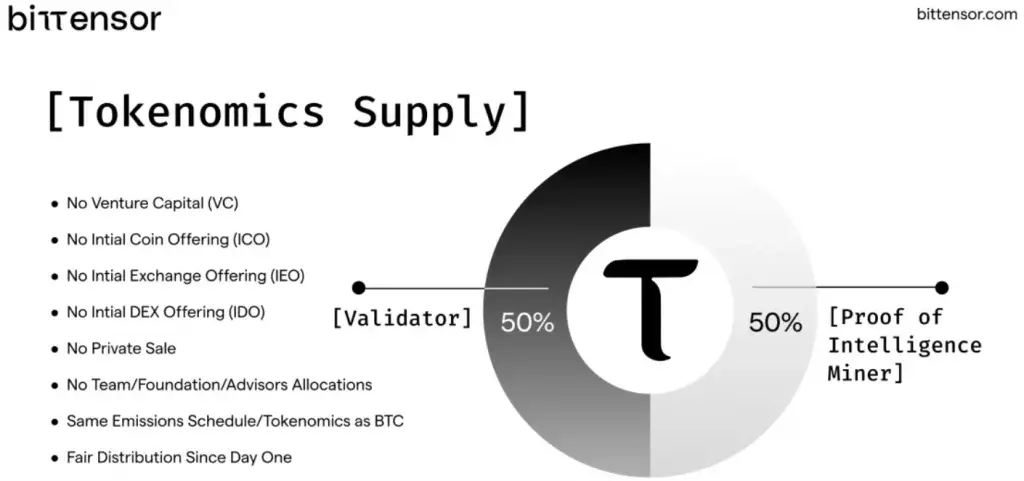

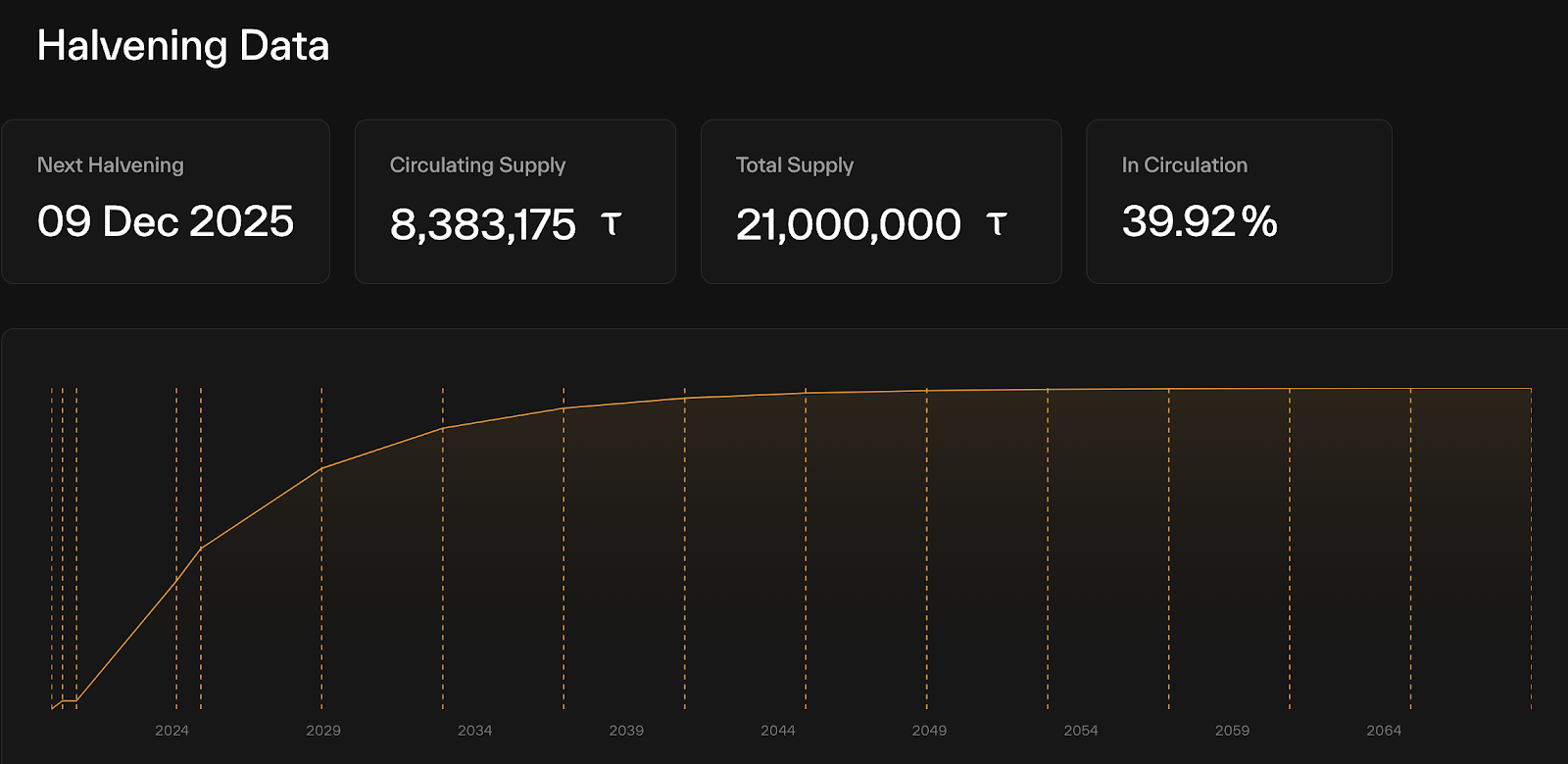

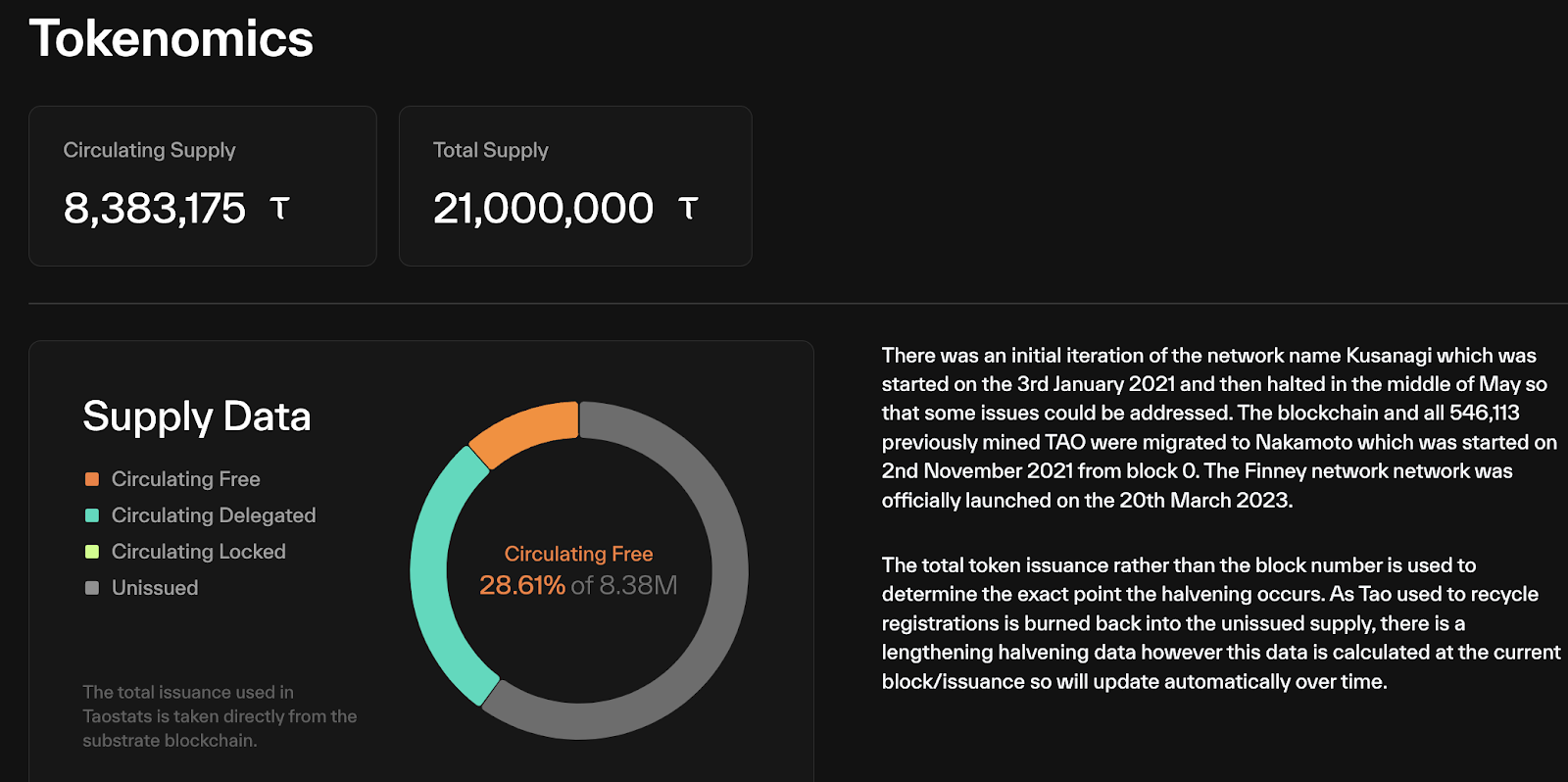

Bittensor follows a fair launch model, meaning there was no pre-mine, ICO, or private sales. Every circulating The network currently mints 7,200 TAO per day (1 TAO per block, with blocks produced approximately every 12 seconds) under a programmatic issuance schedule: once half of the total supply has been distributed, the issuance rate is halved, repeating every four years until all 21 million TAO are in circulation.

Although the TAO issuance curve resembles Bitcoin’s, the introduction of a burn-and-recycle mechanism makes it dynamically adjustable rather than completely fixed.

According to TAOstats token recycling data, the first halving, initially planned for 2025, is now projected to occur in December 2025, based on Bittensor’s network activity since its January 3, 2021 launch.

As of February 2025, approximately 39.9% of the total supply ( 8.33 million TAO) has been minted.

About HTX Research:

HTX Research is the dedicated research arm of HTX Group, responsible for conducting in-depth analyses, producing comprehensive reports, and delivering expert evaluations across a broad spectrum of topics, including cryptocurrency, blockchain technology, and emerging market trends. Committed to providing data-driven insights and strategic foresight, HTX Research plays a pivotal role in shaping industry perspectives and supporting informed decision-making within the digital asset space. Through rigorous research methodologies and cutting-edge analytics, HTX Research remains at the forefront of innovation, driving thought leadership and fostering a deeper understanding of evolving market dynamics.

References:

https://bittensor.com/content/consensus_v2

https://learnbittensor.org/subnets

The post first appeared on HTX Square.