In accordance with its governance protocol, HTX DAO allocated 50% of revenue generated by the HTX exchange in Q1 2025 toward this burn. Executions were carried out transparently via Sun.io, with complete on-chain verification available through transaction hashes. Community members can review the full burn transaction here: Burn Hash on Tronscan

Burn Mechanism: Not a Gimmick, but a Governance-Backed Commitment

Unlike short-term, price-focused burns used by many projects as speculative marketing tactics, HTX DAO’s burn strategy is rooted in its “Verified Revenue – Automatic Buyback – On-chain Burn” model, introduced in late 2023. This system ensures consistent and verifiable token reductions aligned with real revenue, not artificially inflated figures.

Key elements of the HTX DAO burn mechanism include:

Revenue-Linked Buybacks: A fixed percentage of exchange income is used to repurchase and burn $HTX;

Full Transparency: All burn addresses and transactions are recorded and publicly accessible on-chain;

Scheduled Execution: Quarterly announcements and hash verifications published for community audit;

Governance Supervision: DAO governance oversees adjustments to burn ratios and policies.

This model makes HTX DAO’s deflationary action a structural economic feature, rather than a temporary performance signal—positioning $HTX for long-term compounding value growth.

Market Volatility Validates Mechanism Robustness

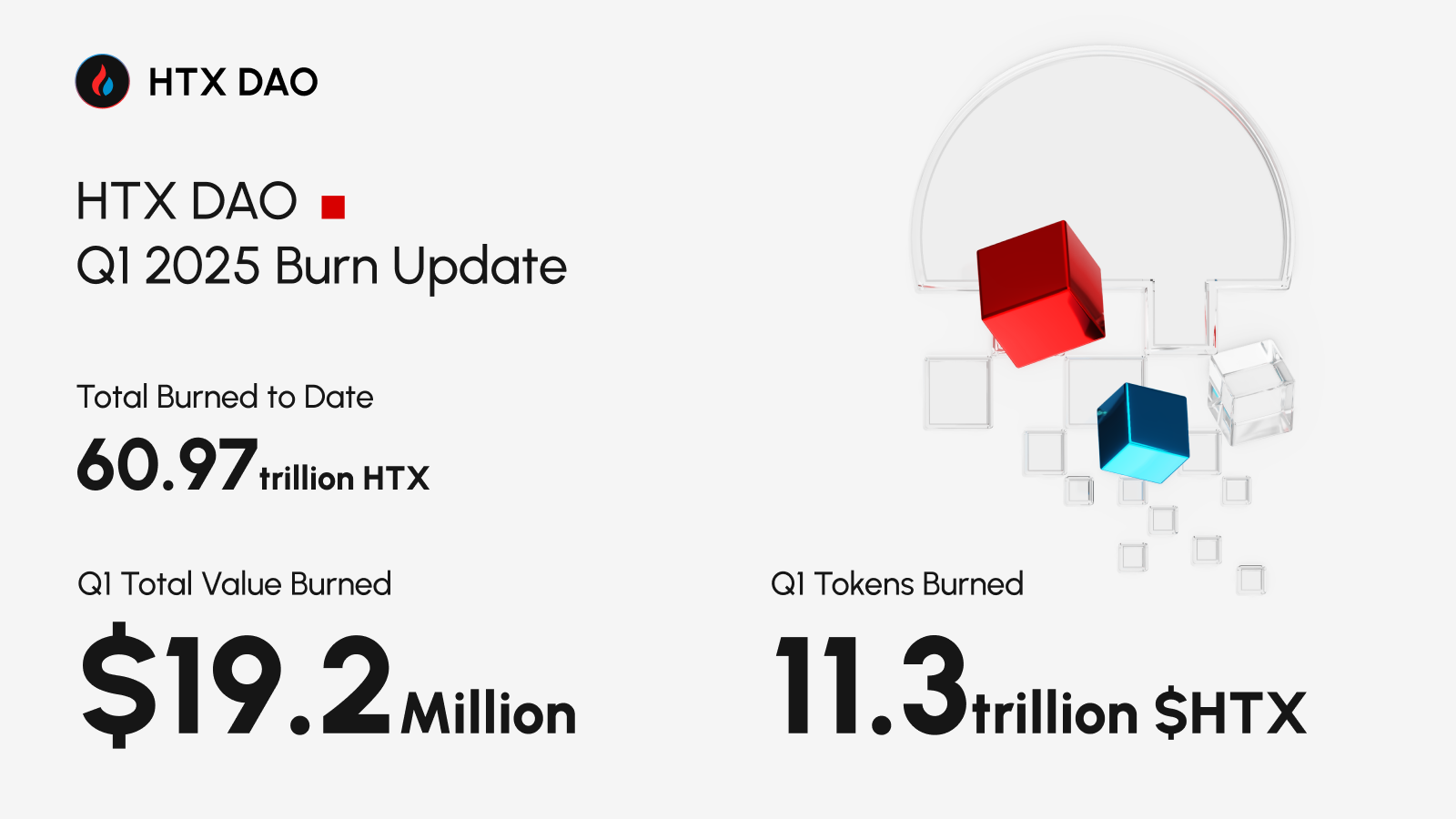

In Q1 2025, despite Bitcoin falling from nearly $110,000 to $70,000—a drop of over 30%—and global crypto trading volumes dropping 27% from $200.7B to $146B (source: Coingecko), HTX DAO’s token burn decreased by only 15% compared to Q4 2024 ($22M to $19.2M).

This measured reduction highlights two important truths:

Burn funding is derived from actual revenue, not reserves or pre-allocated marketing budgets;

Burn volumes follow a systematic, non-manipulative model, unaffected by short-term market panic.

Rather than artificial inflation of value, HTX DAO reflects a rational, data-driven growth model, balancing deflation and ecosystem expansion with real income performance.

Scarcity Effect: Circulating Supply Falls, Value Logic Strengthens

The cumulative impact of HTX DAO’s deflationary system is becoming more pronounced:

Over 60.97 trillion $HTX burned, reducing overall token supply;

Increased scarcity for long-term holders;

Sustainable tokenomics, with low inflation and high burn rates—making $HTX one of the few net-deflationary exchange ecosystem tokens on the market.

Following the footsteps of proven models like Ethereum’s EIP-1559 and BNB’s quarterly burns, HTX DAO is establishing a durable path toward value consolidation. Its staking, governance, and node programs are all structurally tied to the burn cycle—creating a positive feedback loop where ecosystem growth triggers further deflation, and vice versa.

Leading by Example: Real DAO Execution in a Sea of Paper DAOs

While many projects claim to be DAOs in name, few consistently execute governance-backed decisions with on-chain transparency. HTX DAO sets itself apart by delivering measurable, auditable outcomes—burns, votes, and revenue allocation—visible to all stakeholders.

In contrast with projects known for inconsistent execution or vague treasury use, HTX DAO demonstrates:

High operational reliability

Transparent financial data

Clear deflationary logic

This makes HTX DAO a standout among modern DAO ecosystems—not merely in philosophy, but in real-world delivery.

More Than a Buzzword: DAO as a Mechanism for Value Fulfillment

This Q1 burn underscores HTX DAO’s continued adherence to its roadmap. Despite macro challenges, it has executed a $19M burn, retained full on-chain traceability, and continued reducing its circulating supply. These attributes collectively validate the DAO’s ability to deliver on promises—not just through whitepapers, but through chain-verified results.

With renewed user growth, ecosystem expansion, and market recovery expected later in 2025, future burn events are poised to become milestones in HTX DAO’s deflationary growth story. For a sector still grappling with the legitimacy of decentralized governance, HTX DAO offers a compelling answer to the question:

Can DAOs truly deliver value?

HTX DAO’s response is already written—on-chain.

About HTX DAO

As a multi-chain deployed decentralized autonomous organization (DAO), HTX DAO demonstrates an innovative governance approach. Unlike traditional corporate structures, it adopts a decentralized governance structure composed of a diversified group, jointly committed to the success of this organization. This unique ecosystem advocates openness and encourages all DAO participants to propose ideas that can promote the development of HTX DAO.

Contact Information

Website: www.htxdao.com Email Address: [email protected]

The post first appeared on HTX Square.