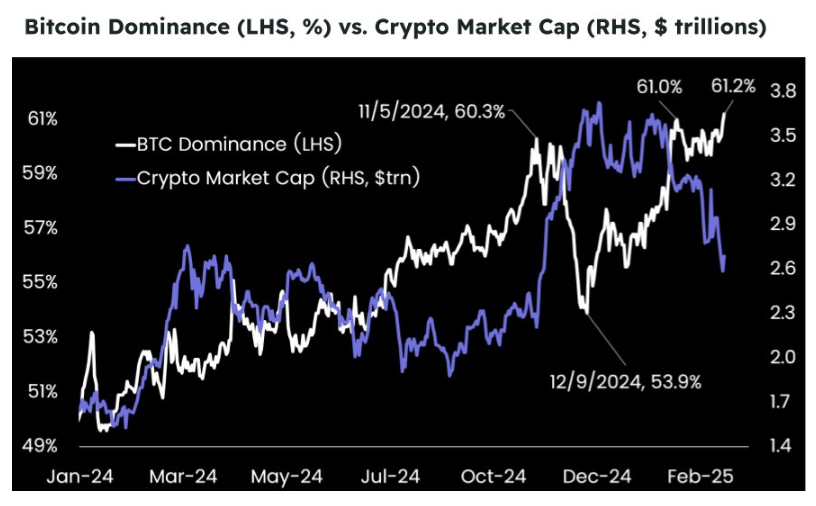

Market breadth, however, continues to favour Bitcoin, with BTC dominance rising to over 61 percent even as the total crypto market cap declined sharply—signalling capital rotation from riskier altcoins into Bitcoin during heightened macro uncertainty. Ethereum and Solana and other altcoins have fallen by more than 35-50 percent from their cycle highs, reinforcing Bitcoin’s status as the reserve asset of the digital market.

As Q2 begins, price action remains reactive to macroeconomic signals, with Fed policy and ETF flows expected to dictate direction. For now, signs of capitulation have eased, but with liquidity still tight, a breakout will likely require a significant catalyst.

In terms of the macro picture, some parts of the US economy are showing signs of resilience—such as a narrowing trade deficit and a rise in durable goods spending—but these bright spots are overshadowed by deeper structural concerns. Inflation is accelerating faster than expected, fuelled in part by rising import costs tied to new tariffs. Core inflation rose 0.4 percent in February, marking its sharpest monthly gain in over a year, while consumer expectations suggest inflation could stay elevated well into the future.

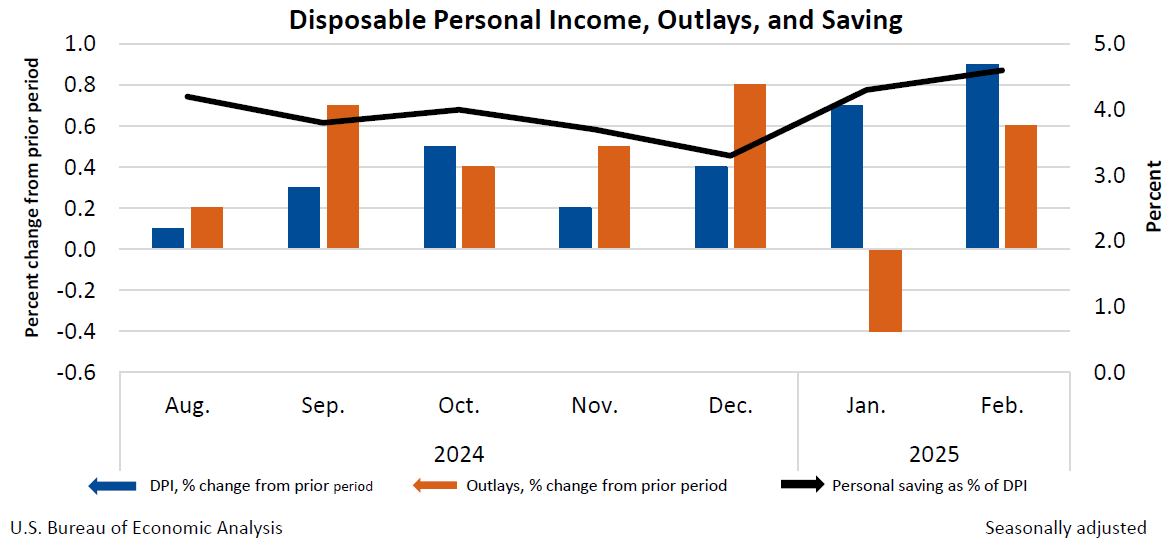

At the same time, growth is slowing. Real income gains remain tepid once government transfers are excluded, and services spending—a key economic driver—has begun to contract. Consumer confidence is eroding, with the Conference Board index falling to a two-year low and more Americans anticipating rising unemployment. These trends point to growing caution among households, reflected in a rising personal savings rate.

Trade policy remains a central pressure point. Recent tariff hikes and expectations of further measures in April and May are prompting businesses and consumers to adjust behaviour, front-loading purchases, delaying investments, or scaling back hiring. While the February trade deficit narrowed, this followed a January import surge that likely distorted GDP forecasts. As a result, first-quarter growth is expected to slow sharply.

Despite these ongoing economic uncertainties, the broader cryptocurrency industry is still benefiting from the increasing commitment to regulatory clarity, underpinned by political support, and growing institutional interest.

The US Securities and Exchange Commission (SEC) has officially dropped its lawsuits against Kraken, Consensys, and Cumberland DRW—three major players in the industry. This move signals a significant shift from the agency’s previous enforcement-heavy stance to a more collaborative regulatory approach. It also foreshadows a commitment to establishing clear, constructive rules for the industry.

Further solidifying this direction, the SEC’s Crypto Task Force announced four upcoming roundtables to be held between April and June 2025. These sessions will engage stakeholders on key issues such as crypto trading regulation, custody of digital assets, tokenisation, and the future of decentralised finance (DeFi). The events are open to the public and reflect the SEC’s intent to foster open dialogue and transparency in shaping crypto policy.

In parallel, Trump Media & Technology Group (TMTG) has announced a high-profile partnership with Crypto.com to launch a series of crypto-focused ETFs. This venture marks TMTG’s expansion into financial products, aiming to tap into the growing demand for digital asset investment vehicles. While the initiative still awaits regulatory approval, it could significantly boost the visibility of both TMTG and Crypto.com within traditional finance circles.

The post appeared first on Bitfinex blog.