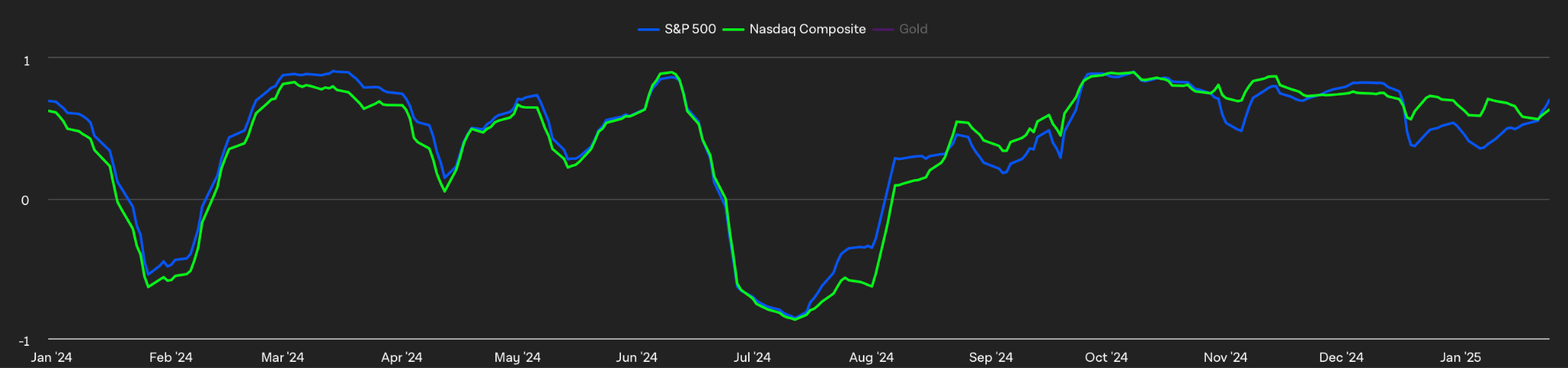

Bitcoin, S&P500 and NASDAQ 30-Day Rolling Pearson Correlation.

Similar to some other equity markets, BTC reacted with caution following last week’s Bank of Japan rate hike and it continues to correlate closely with equities, falling sharply on 27th January as jitters increase about China’s ability to produce cheaper AI models through Deepseek and the threat of tariffs being imposed on Colombia. Bitcoin options implied volatility declined 13 percent over the course of the week, suggesting traders are not expecting to see elevated price action.

In the macro economy, labour market conditions remain steady despite a slight rise in unemployment claims, with continued claims reaching their highest level in over three years. Meanwhile, consumer sentiment has declined, after six-months of continuous improvement. Concerns over rising unemployment and inflation, influenced by expectations of high import tariffs and regulatory changes under President Trump, weigh heavily on household confidence. Inflation expectations have risen, reflecting broader apprehension about the impact on prices from new policies.

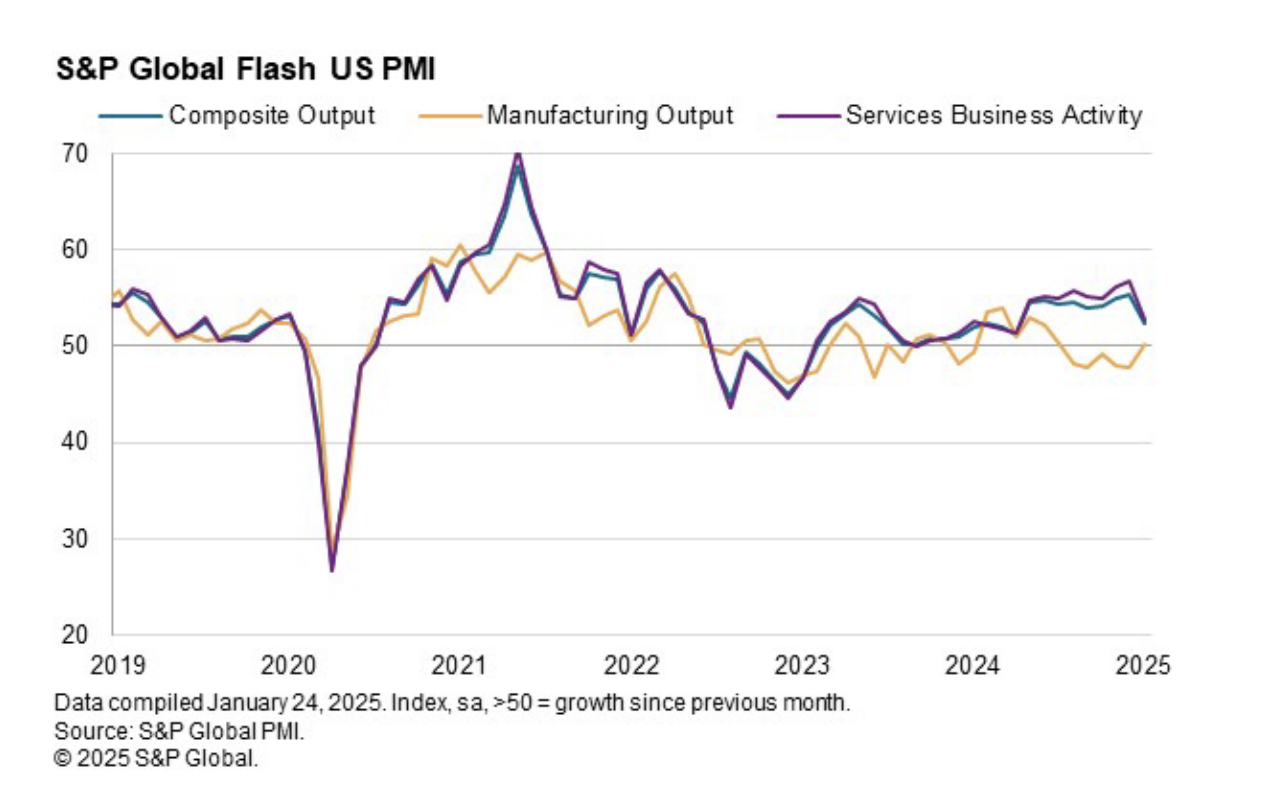

S&P Global US Flash PMI (Purchasing Managers’ Index)

Economic activity, while continuing to grow, has also moderated. The S&P Global Flash US PMI reported services growth decelerating even as manufacturing saw its first expansion in months. Inflationary pressures remain a focal point for businesses, compounded by uncertainties over trade and immigration policies. Across the cryptocurrency industry, we are seeing significant developments, including a surge in ETF filings for Litecoin, XRP, and Solana, reflecting growing institutional interest. Simultaneously, the US House Oversight Committee has launched an investigation into claims of unfair debanking practices targeting crypto-linked entities. On a different front however, FINTRAC issued an alert on the role that crypto still seems to be playing in money laundering – in this case the proceeds of synthetic opioid sales. It has called on financial institutions to implement stronger anti-money laundering measures.

The post appeared first on Bitfinex blog.