Market participants should note that the former OKEx Quarterly Future (now the weekly futures contract) BTCUSD0925 will expire on Friday morning UTC. There will also be massive quarterly deliveries in the BTC options market, with a current max pain of $10,750, as per CoinOptionsTrack’s data,

Meanwhile, the long/short ratio had made another all-time low before Monday’s sell-off, but Thursday’s rally saw an uptick. Given how fast market sentiment shifts, we need to watch for changes in open interest after Friday’s futures settlements to see if any big whales are opening positions for the next quarter.

OKEx trading data readings

Visit OKEx trading data page to explore more indicators

BTC long/short ratio

The long/short ratio hovered below 0.8 for most of last week. Notably, it fell to an all-time low of 0.65 before the sharp price drop on Monday, suggesting that many retail investors may have taken advantage of Monday’s sell-off.

However, Bitcoin’s quick rally on Thursday afternoon had sent the long/short ratio as high as 0.82, before it corrected slightly to settle around the current 0.75.

The long/short ratio compares the total number of users opening long positions versus those opening short positions. The ratio is compiled from all futures and perpetual swaps, and the long/short side of a user is determined by their net position in BTC. In the derivatives market, whenever a long position is opened, it is balanced by a short position. The total number of long positions must be equal to the total number of short positions. When the ratio is low, it indicates that more people are holding shorts.

It looks like yield farmers hedging their BTC positions via derivatives after moving their assets to Ethereum were not impressed by the price rally.

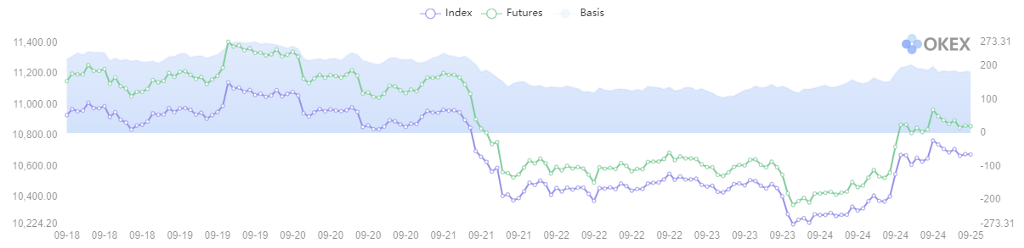

BTC basis

This indicator shows the quarterly futures price, spot index price and also the basis difference. The basis of a particular time equals the quarterly futures price minus the spot index price. The price of futures reflects the traders’ expectations of the price of Bitcoin. When the basis is positive, it indicates that the market is bullish. When the basis is negative, it indicates that the market is bearish. The basis of quarterly futures can better indicate the long-term market trend. When the basis is high (either positive or negative), it means there’s more room for arbitrage.

The quarterly futures premium showed a lot of volatility last week. It fluctuated from $270, or 2.45%, to $120, or 1.17%, and is currently around $180, which is healthy. These fluctuations indicate cautious optimism, at the very least.

Visit https://www.okex.com/ for the full report.

Disclaimer: This material should not be taken as the basis for making investment decisions, nor be construed as a recommendation to engage in investment transactions. Trading digital assets involve significant risk and can result in the loss of your invested capital. You should ensure that you fully understand the risk involved and take into consideration your level of experience, investment objectives and seek independent financial advice if necessary. OKEx Insights presents market analyses, in-depth features and curated news from crypto professionals.

Not an OKEx trader? Sign up, start trading and earn 10USDT reward today!

was originally published in OKEx Blog on Medium, where people are continuing the conversation by highlighting and responding to this story.