Whether you’re just getting started with technical analysis or you’re a seasoned trader refining your edge, understanding moving averages is a fundamental skill that can level up your trading decisions.

Let’s start with the basics: SMA vs EMA.

What Are Moving Averages?

Price charts can be messy and complicated. Every second, prices tick up and down, creating a whirlwind of data that can overwhelm even experienced traders.

Moving averages help you step back from the chaos and spot the real trend.

They smooth out price data over a specific time period, making it easier to identify whether the market is trending upward, downward, or simply consolidating.

At their core, moving averages are used to:

Identify market direction

Highlight potential entry/exit zones

Confirm signals from other indicators

Avoid emotional trading based on short-term volatility

There are two main types of moving averages you’ll see on any trading platform: the Simple Moving Average (SMA) and the Exponential Moving Average (EMA).

Let’s break them down.

Simple Moving Average (SMA): The Calm, Long-Term Lens

On Bitfinex, this appears as: Moving Average (MA)

The SMA takes the closing prices over a set number of periods (e.g. 10, 50, or 200), adds them together, and divides by that number. Every price has equal weight. The SMA doesn’t react to every wiggle, just shows you the average direction over time.

Example: A 50-day SMA adds up the past 50 closing prices and divides by 50.

Common Use Cases:

Swing traders often use the 50-day and 200-day SMA to assess long-term momentum.

Trend followers watch for price crossing above or below the SMA to signal possible reversals.

Pros:

Smooth and stable

Great for filtering out short-term noise

Strong long-term trend confirmation

Cons:

Reacts slowly to sudden price changes

Might miss early signals in fast-moving markets

Exponential Moving Average (EMA): The Agile Trend Tracker

The Exponential Moving Average also calculates an average price, but it gives more weight to recent prices, making it more sensitive to current market movements.

Example: A 20-day EMA still includes the last 20 days of prices, but today’s data influences it more than data from two weeks ago.

EMAs are favored by day traders and scalpers who need to respond quickly to momentum shifts.

Common Use Cases:

Short-term traders rely on 9-day, 12-day, or 20-day EMAs to catch fast-moving trends.

EMAs are often used in crossover strategies, where a short-term EMA crossing a long-term EMA can indicate entry or exit signals.

Pros:

Reacts faster to recent price action

Useful for spotting trend reversals early

Preferred in fast-paced trading environments

Cons:

Can generate more false signals during choppy markets

May be too reactive in sideways markets

SMA vs EMA – Which Should You Use?

There’s no one-size-fits-all answer. The best choice depends on your trading style, time horizon, and goals.

Most experienced traders use both. For example:

Trend confirmation with a 200-day SMA

Entry signals with a 20-day EMA

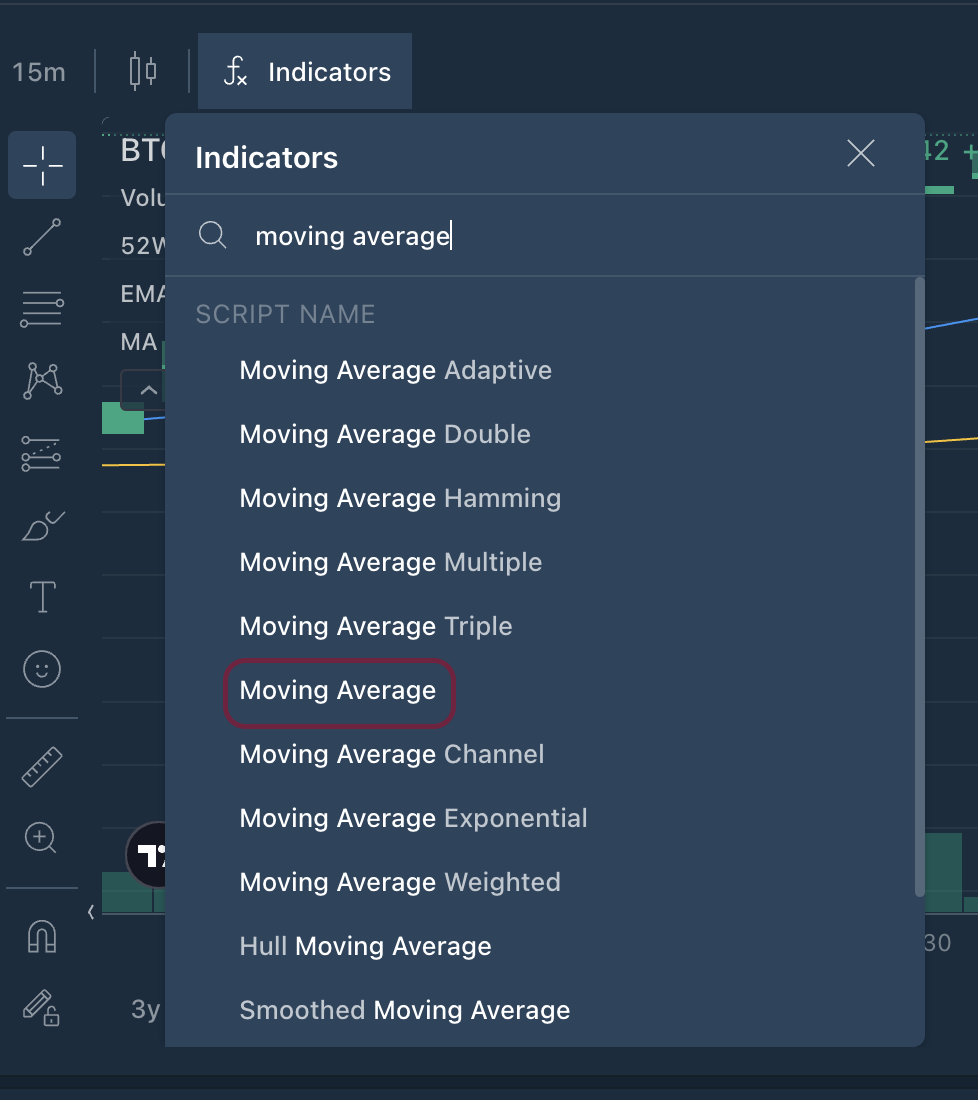

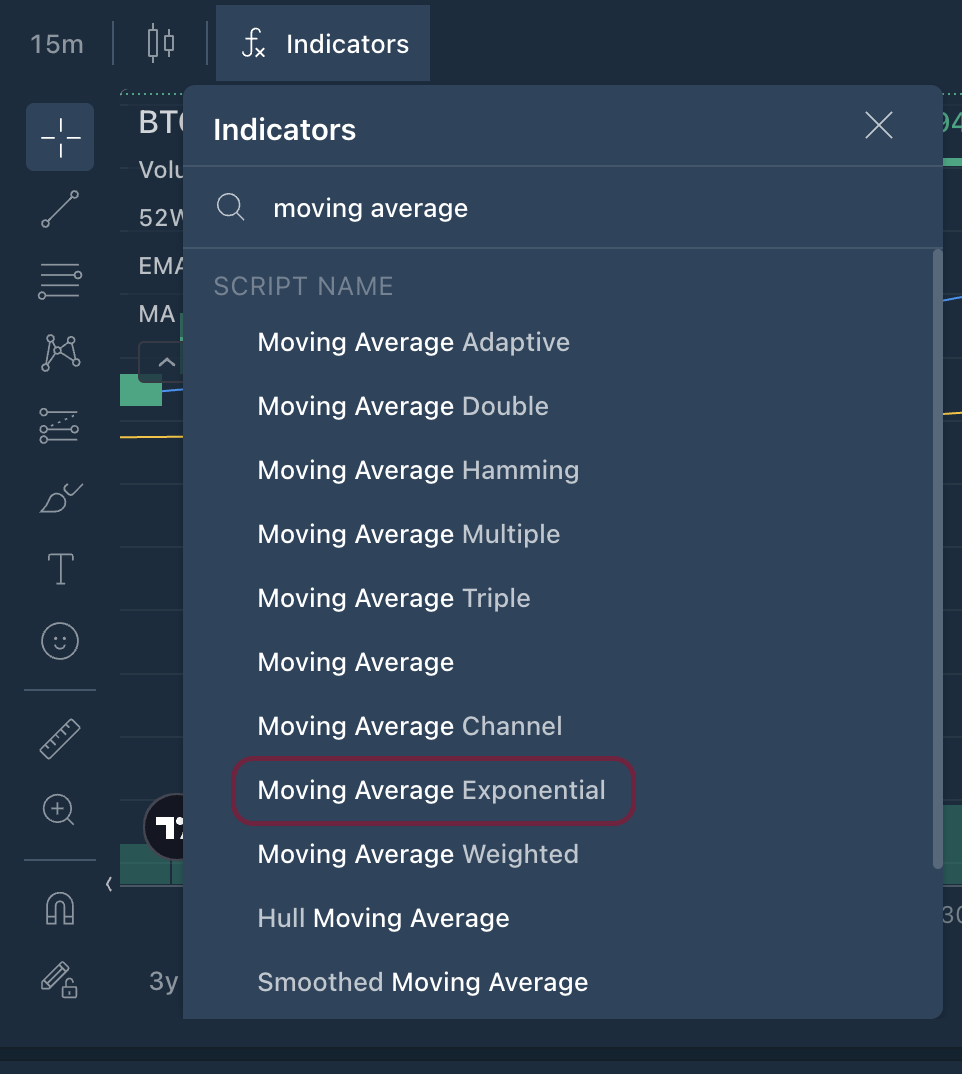

Try This: Apply It On Your Bitfinex Charts

Want to put this into action right now?

Log in to Bitfinex

Choose a chart (e.g. BTC/USD)

From the Indicators tab, add:

A 50-day SMA

A 20-day EMA

Watch how they behave during trends and crossovers.

You’ll start to notice patterns:

20 EMA < 50 MA: Short term price weakness relative to long term trend

Price < 50 MA: Market is still below the long term trend average, proceed with caution

Price slightly < 20 EMA: Trying to reclaim momentum but not fully there yet

This simple practice will sharpen your chart-reading skills more than any theory ever could.

SMA and EMA are the foundation of countless trading strategies. Whether you’re using them as a standalone trend filter or combining them with other tools like MACD or RSI, mastering these indicators gives you a clearer, calmer way to trade.

Coming up next in our series to Master your Charts: How to use MACD to spot momentum shifts before the crowd.

The post appeared first on Bitfinex blog.