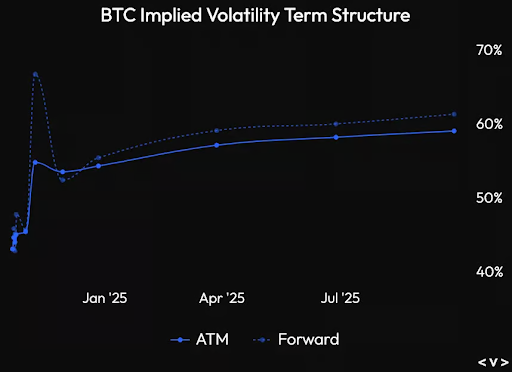

On the eve of election day, markets see a Republican victory as favourable for BTC, while a Democrat win leaves the outlook more ambiguous. Average betting odds for a Trump win have fallen from 64.9 percent to 56 percent. In the options markets, front-end implied volatility for contracts with the earliest expiry is unusually subdued up to election day (November 5th). This muted volatility suggests investors are holding back, waiting for the dust to settle. A spike in volatility is still expected, however, around November 5th to 8th, which could either fuel big moves or, if it fails to materialise, signal a deeper market caution.

There is also apathy in the altcoin markets, with Bitcoin dominance reaching over 60 percent—a new cycle high. Altcoins are now seeing severe drawdowns whenever BTC pullbacks. Ethereum and Solana have both dropped around 12 percent from their recent highs, and ETH is now 40 percent down from its initial ETF rally. The speculative interest that once supported altcoins seems to have vanished, reflected in stable funding rates and muted overall market sentiment. With BTC absorbing most of the capital flow into crypto assets, altcoins are struggling to keep up, and without a fresh catalyst, their prospects for a comeback in the near term appear slim.

Even with last week’s pullback, Bitcoin’s overall resilience since its September low is noteworthy. In a nutshell, the current market dynamics point to an electrifying week ahead. Whether you’re a trader, investor, or casual observer, the road to election day promises to be anything but dull for the crypto market.

The elections also come as the US economy continues to demonstrate resilience despite recent disruptions caused by two hurricanes and ongoing industrial strikes. While there have been modest job losses and downward revisions to jobs market data, underlying labour market strength appears steady with a stable unemployment rate of 4.1 percent and wage growth at 4 percent year-on-year. Consumer spending and personal income also continues to rise, with real spending up and inflation pressures mainly contained within the service sector, suggesting stable demand as the holiday season approaches.

Job openings have declined, reflecting reduced labour demand, but consumer confidence has surged, indicating optimism about job stability.

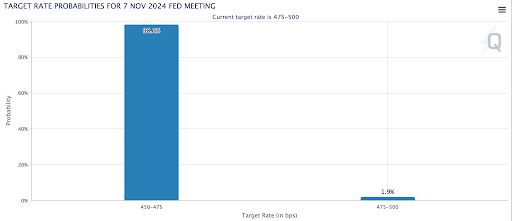

GDP growth in the third quarter was strong at 2.8 percent, driven by robust consumer spending, though high interest rates have constrained residential investment. As inflation remains controlled, the Federal Reserve is expected to proceed cautiously with rate cuts, focusing on sustaining growth. With the labour market, wage growth, and consumer spending holding firm, the economy shows resilience heading into a pivotal election season, balancing steady expansion with moderated expectations.

Recent developments in the cryptocurrency industry reveal both regulatory challenges and notable growth. Immutable, a blockchain gaming platform, announced potential legal action from the SEC concerning its IMX token, as the agency intensifies its scrutiny of crypto assets. Immutable maintains that IMX is not a security and intends to defend its position.

Meanwhile, Tether reported record Q3 profits of $2.5 billion, with over $120 billion USDt in circulation and $102.5 billion in US Treasuries, highlighting its financial stability and extensive reserves. CEO Paolo Ardoino underscored Tether’s strategic investments and commitment to liquidity.

In Florida, the CFO of the state pension fund, Jimmy Patronis has said he supports expanding the state’s $800 million crypto portfolio as a hedge against federal control, suggesting this could increase if former President Trump is re-elected. It is further evidence of the evolving role of cryptocurrency in financial systems and policy debates, emphasising its growing influence on economic stability.

Happy Trading!

The post appeared first on Bitfinex blog.