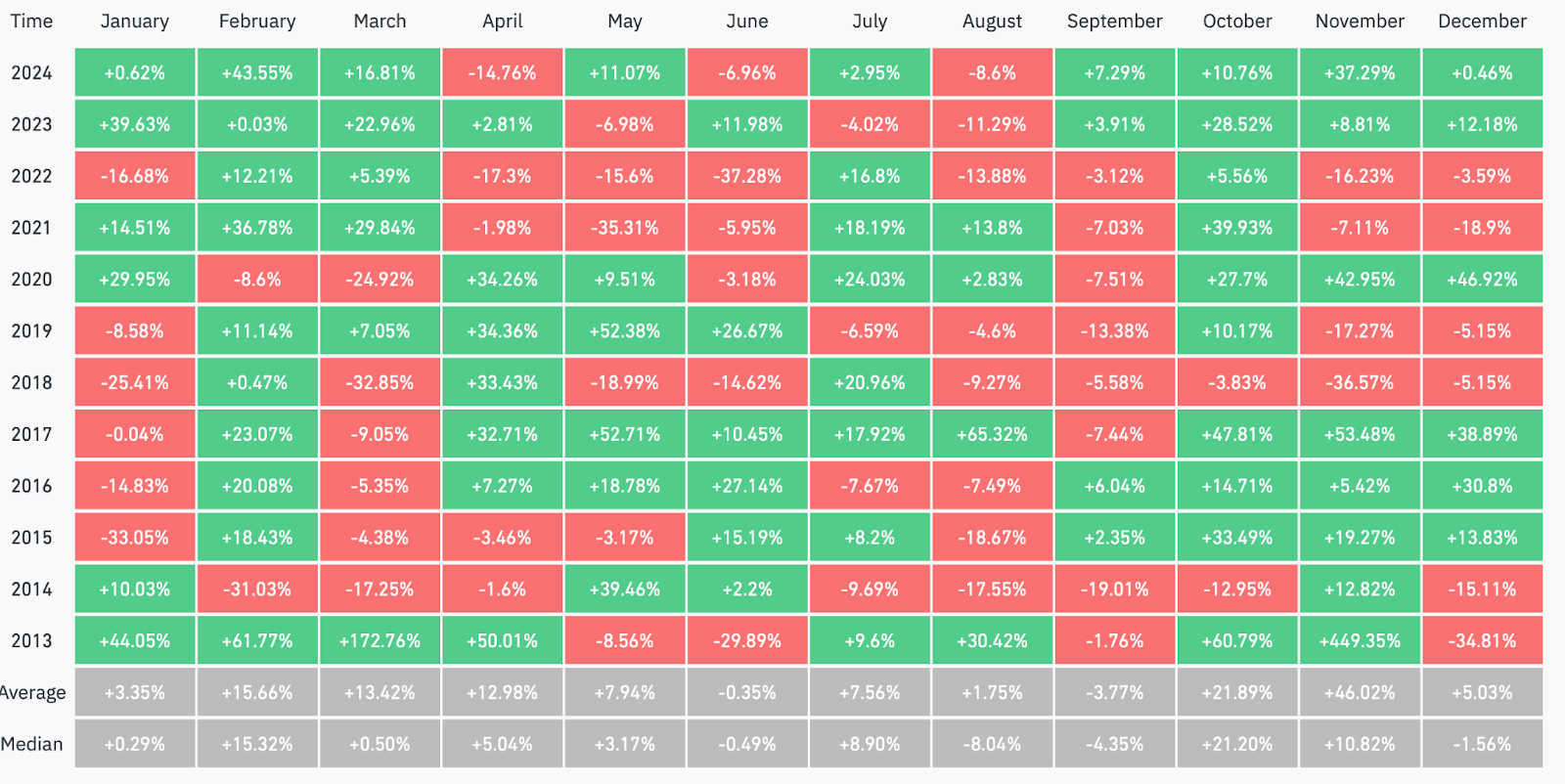

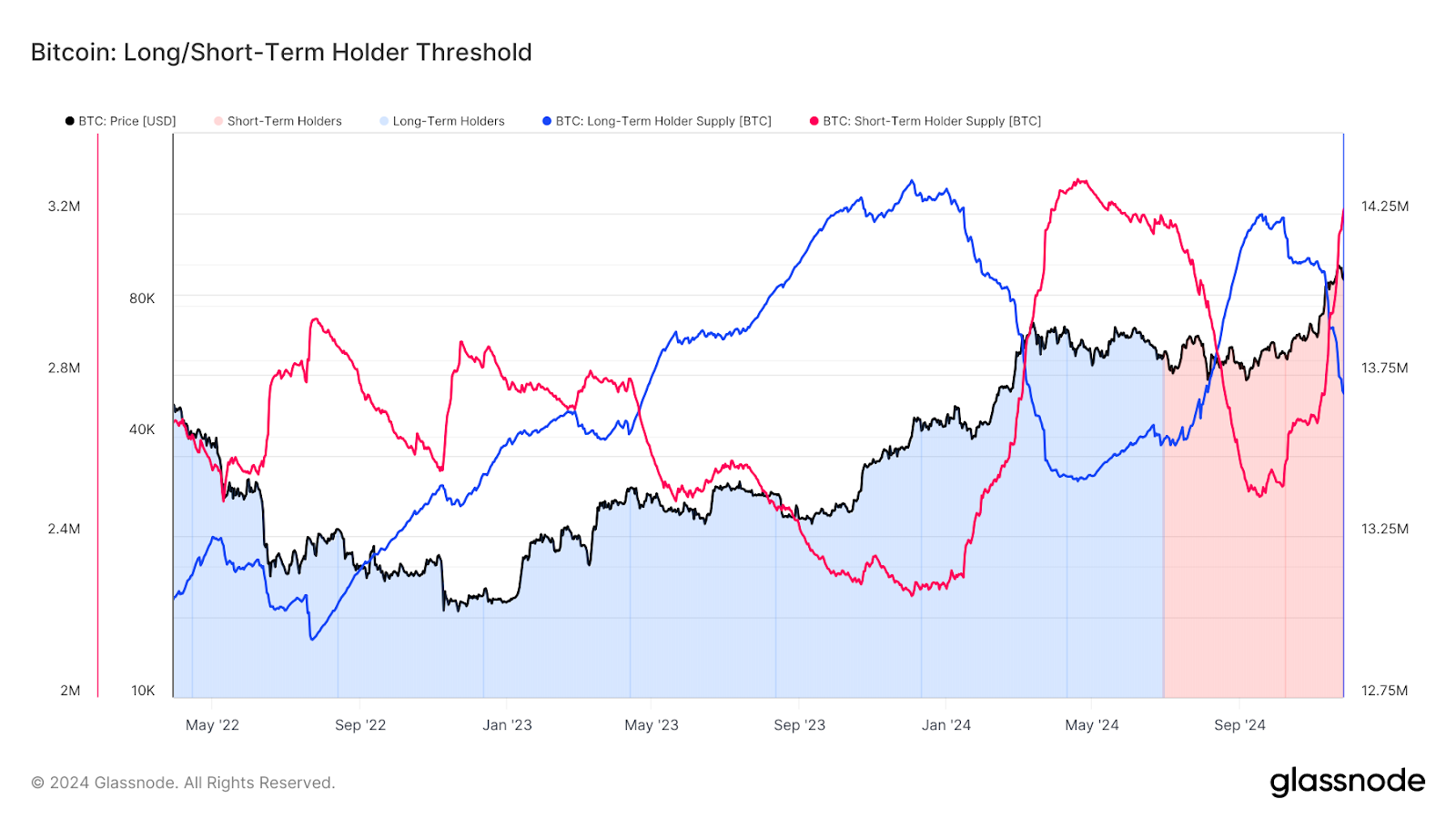

This stellar performance continues to underscore Bitcoin’s robust momentum, positioning it well as we enter December. Historically, December has been a volatile month for Bitcoin, but in halving years, the asset has delivered exceptional average returns of 38.86 percent. Given the current bull market dynamics, we believe Bitcoin is poised for further gains, albeit with potential short-term volatility. Any short-term pullbacks are likely to be triggered by ETF outflows and Long-Term Holder (LTH) profit-taking. Last week, ETFs registered net outflows of $135.1 million, with the bulk of these taking place during the first two trading days. LTHs have distributed a significant 508,990 BTC since September, increasing the supply entering the market. While this remains below the 934,000 BTC distributed before the March 2024 highs, the continued selling pressure requires sustained demand from ETFs and marginal buyers to avoid further pullbacks.

Interestingly, Short Term Holder (STH) supply is nearing its cycle high of 3,282,000 BTC. Historically, the final phase of a bull market begins when STH supply breaches pre-halving cycle highs. This shift indicates increasing retail participation but also highlights the market’s reliance on incoming demand to absorb LTH profit-taking.

As Bitcoin transitions further into its bull market cycle, the current consolidation phase serves as a necessary pause for absorbing profit-taking and realigning market demand. With strong ETF inflows resuming and increasing retail interest, we believe Bitcoin remains well-positioned to break through the psychological $100,000 barrier.

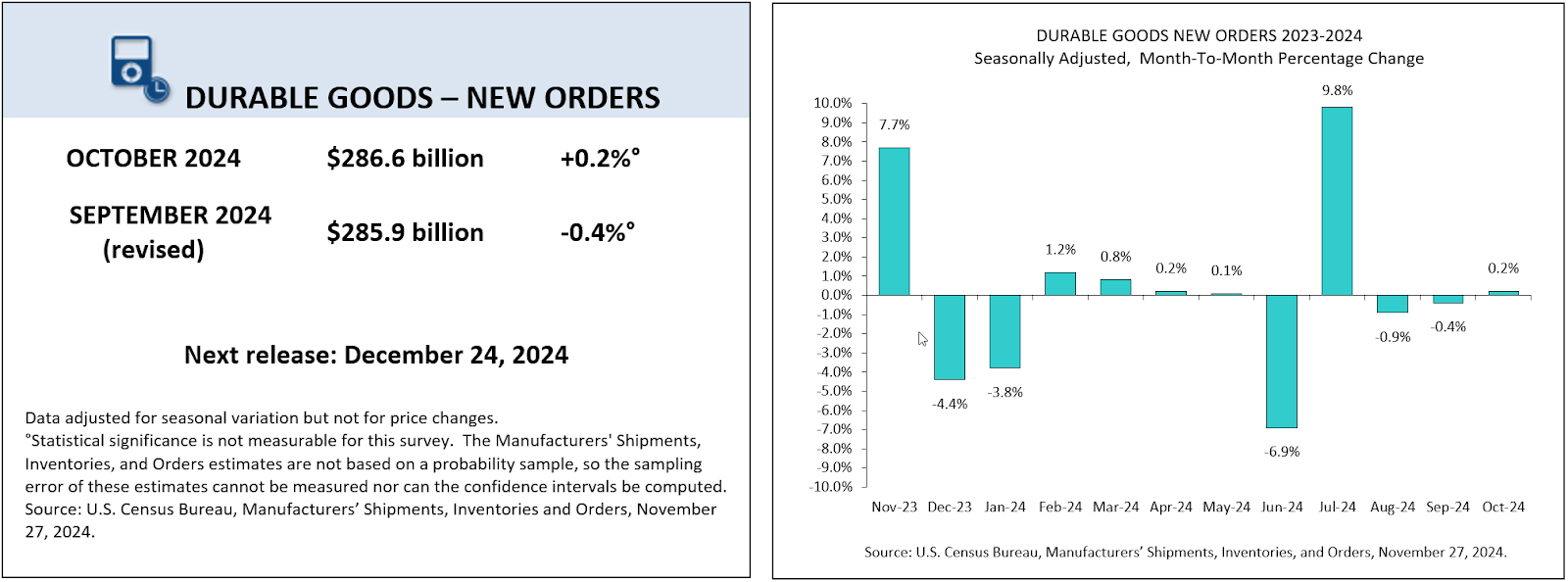

The US economy also displayed resilience in late 2024, driven by strong consumer spending, steady labour market growth, and moderated inflation expectations – though challenges still persist. In October, consumer spending rose 0.4 percent alongside a 0.6 percent increase in income, while inflation climbed modestly, with core PCE up 2.8 percent year-over-year. Business investment showed mixed signals, as durable goods orders rose slightly, and GDP growth held steady at 2.8 percent in the third quarter, supported by strong wages and near-record corporate profits.

November consumer confidence hit a 16-month high, driven by labour market optimism and falling inflation expectations, which declined to 4.9 percent. However, uncertainty remains over inflationary pressures from the incoming Trump administration’s policies. Despite these challenges, robust consumer activity and labour market strength are expected to sustain economic momentum into the year-end.

Hong Kong’s push for innovation in digital finance, Celsius Network’s bankruptcy resolution efforts, and regulatory changes in Russia were in the crypto headlines last week, as stablecoins also continued to gain prominence. The Hong Kong Monetary Authority launched the Digital Bond Grant Scheme, offering subsidies of up to HK$2.5 million per issuance to promote tokenised bonds, strengthening Hong Kong’s position as a hub for virtual assets. Meanwhile, Celsius Network initiated its second $127 million payout to creditors, advancing its bankruptcy proceedings. At the same time, its former CEO faces ongoing legal challenges, underscoring the complexities of corporate accountability in the sector.

In Russia, a new law recognising digital currencies as property and exempting crypto mining from VAT marks a significant step in regulatory clarity, aiming to balance growth in the digital asset market with structured taxation and compliance. Simultaneously, the stablecoin market reached a record $190 billion market capitalisation, with Tether’s USDt accounting for 70 percent of the total. Driven by cross-border payment efficiency and adoption by traditional financial firms like Stripe and PayPal, stablecoins are solidifying their role in mainstream finance. These developments highlight the interplay of innovation, regulation, and market dynamics shaping the cryptocurrency industry.

Have a good trading week!

The post appeared first on Bitfinex blog.