Trading Solana with Williams %R like a Pro!

Let's see how you can make a profit by trading Solana (SOL) with Williams %R.

What is Solana?: Solana (SOL) is a popular blockchain platform designed to enable fast, secure, and scalable decentralized applications (dApps).

Solana aims to tackle the scalability issues that plague other blockchain platforms, such as Bitcoin and Ethereum, which have limited transaction throughput and high transaction fees.

By utilizing a unique combination of technologies, Solana can handle thousands of transactions per second at a low cost, making it an attractive platform for developers and investors alike.

What is Williams %R?

When it comes to trading SOL, one popular tool used by traders is the Williams %R indicator.

This technical analysis tool, developed by Larry Williams, measures the momentum of a security by comparing the current price to the highest high and lowest low over a certain period.

Williams %R is a momentum oscillator that ranges from 0 to -100, with readings above -20 indicating overbought conditions and readings below -80 indicating oversold conditions.

The basic strategy for trading with Williams %R is to buy when the indicator is oversold and sell when it is overbought. This means that when the indicator drops below -80, it suggests that the security is oversold and due for a rebound. Conversely, when the indicator rises above -20, it indicates that the security is overbought and due for a correction.

Learn more about the Williams %R and other indicators on our podcast on Spotify and YouTube .

Trading SOL with Williams %R

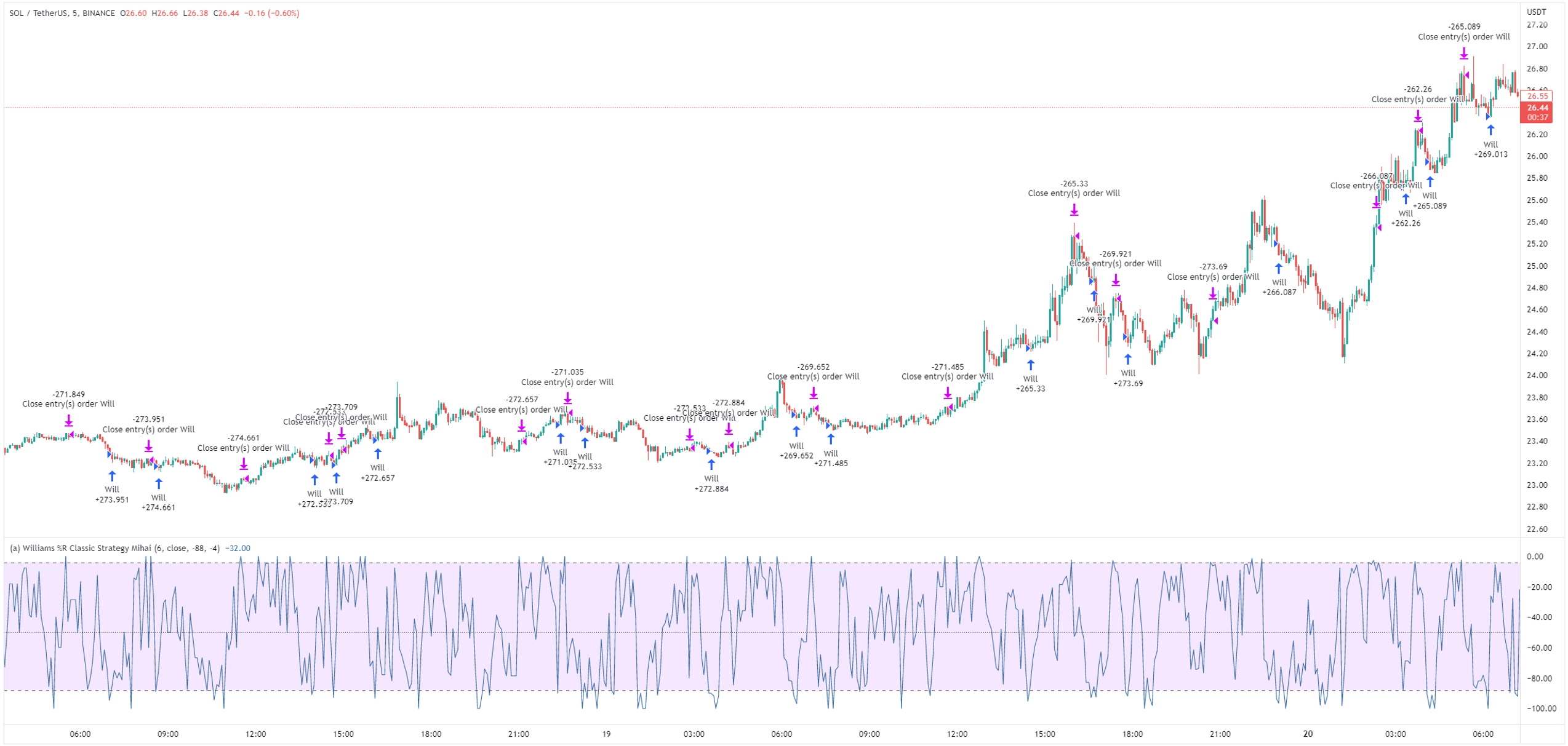

To find the best trading strategy on SOL, we tried multiple settings and found that the following settings on the 5-minutes chart:

Period: 6

Buy signal: less than or equal to: -88

Sell signal: more than or equal to: -4

Using these settings, we tested the strategy from December 12, 2022, to February 20, 2023, on the Binance exchange. We found that the strategy generated a profit of 136.28% with a maximum drawdown of 33%.

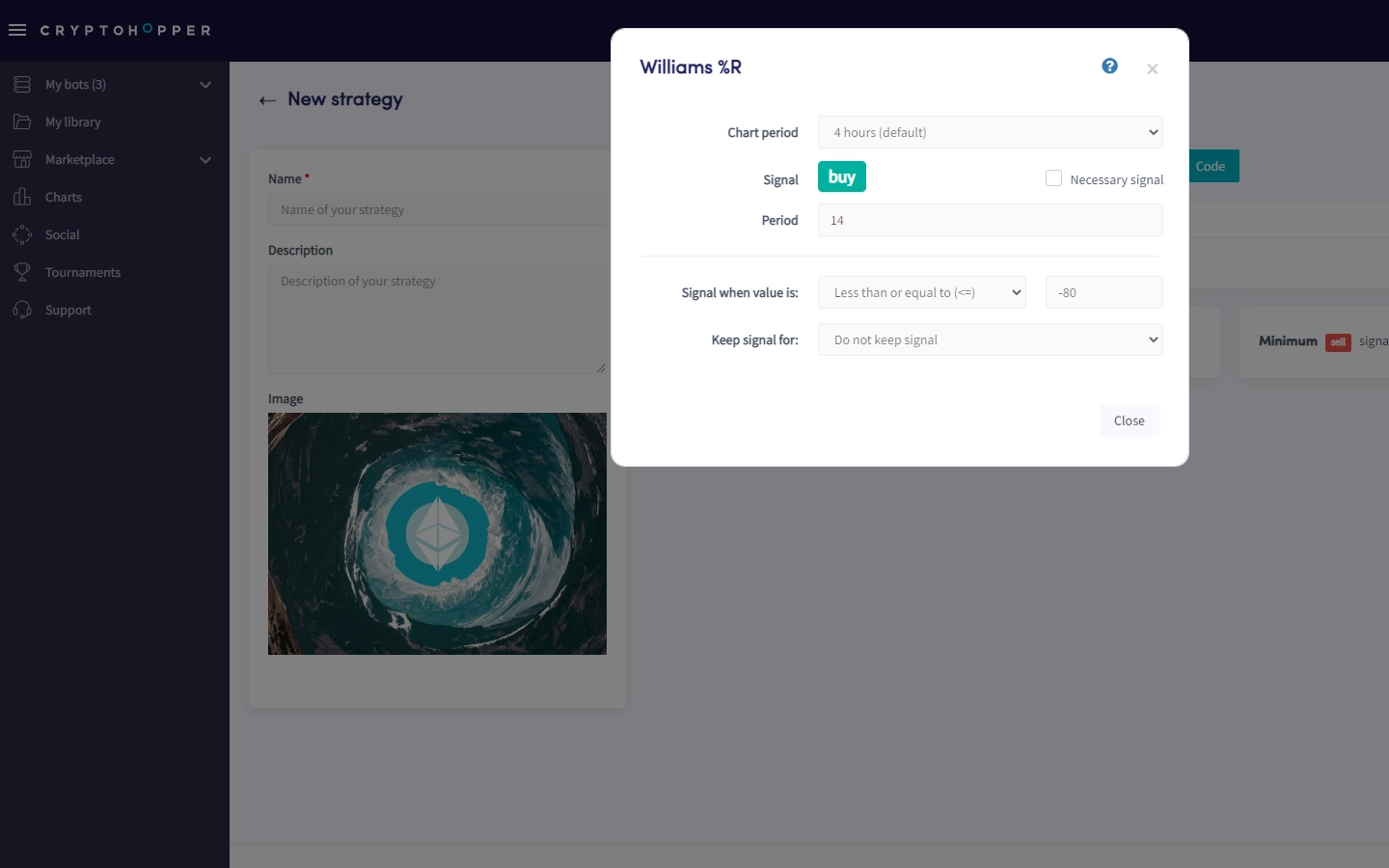

Selecting the Williams %R on Cryptohopper

On Cryptohopper, it’s possible to create your trading strategies using a variety of technical indicators. Inside Cryptohopper, go to Strategy Designer.

Here you can customize your strategy with candlesticks and indicators that fit your trading goals.

Once you open the strategy designer, you can select indicators and search for the Williams %R. Enter your preferred settings. It’s possible to backtest your strategy or use simulated funds to see how it will perform before using your actual funds.

Disclaimer: However, it's important to note that past performance does not guarantee future success. Markets change all the time, and what worked in the past is not guaranteed to work in the future.