Perfect Your Trading With Triggers

Master cryptocurrency trading with effective trigger setups on Cryptohopper. Learn to trade with the trend, protect against market crashes, and more!

Understanding triggers is crucial for your trading success. Triggers serve various purposes, like ensuring you trade with the trend, avoiding purchases during market overbought conditions, safeguarding against crashes and price pumps. Let's dive into setting up different triggers to elevate your trading game!

Trade With The Trend (EMA triggers)

If you're a conservative day trader or scalper, trading with the trend is key. To ensure you're trading in the right direction, you can use trend-following indicators on the larger time frames in order to identify the broader trend.

One such indicator is the Exponential Moving Average (EMA) trigger. This EMA-based trigger helps you trade when the trend is in your favor. You can set it up by looking at the cross between a fast 10 EMA and a slow 20 EMA to determine when to buy or not.

On the chart, it would appear like this:

Let’s now look at how you could create the EMA trigger we mentioned on Cryptohopper!

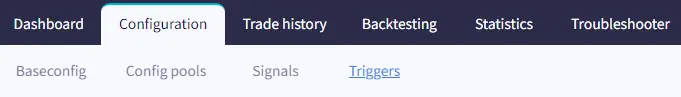

To create a trigger you have to go to config/triggers:

Then, click on New:

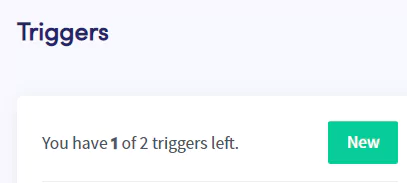

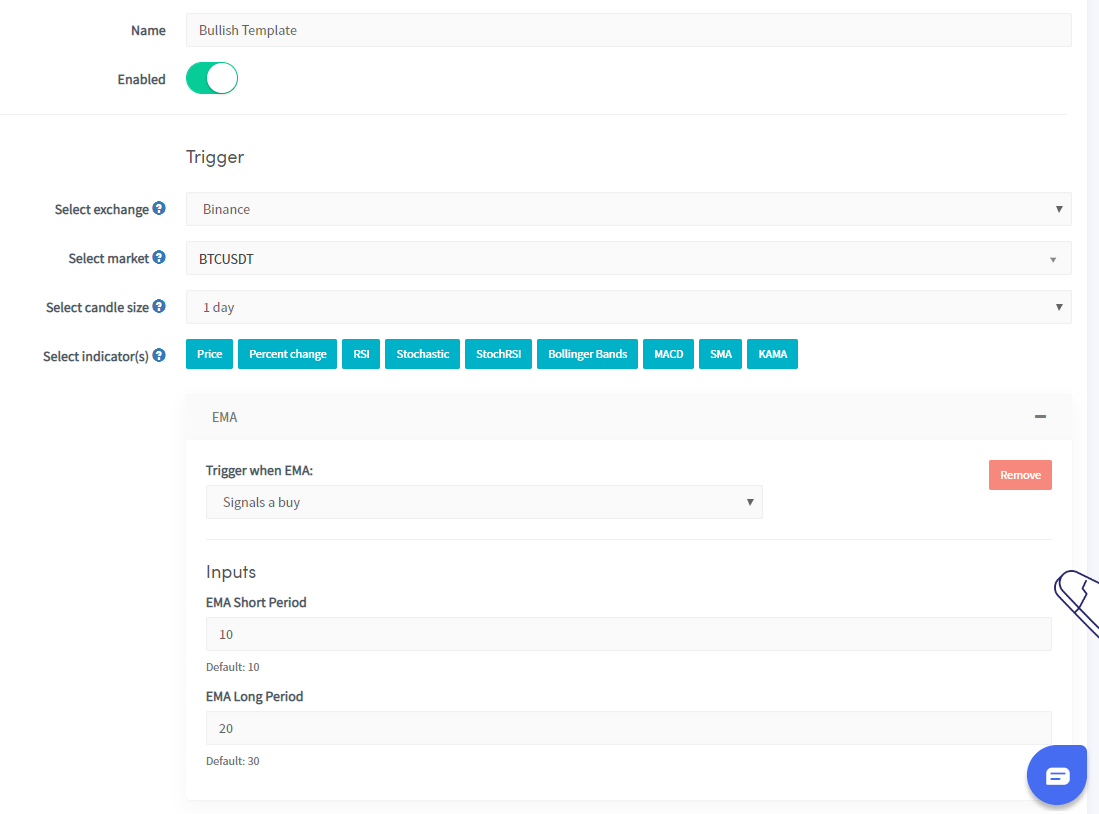

We will start with the bullish trigger: We have named our trigger EMA Trend Bullish. We have selected Binance as our exchange, and BTCUSDT as our market (you can select other exchange and another stable coin if you wish).

We have selected the EMA as our indicator of course, and the candle size of 1 day. Our trigger point, in this case, is when the EMA signals a buy. We have set the EMA short period to 10 and the long one to 20.

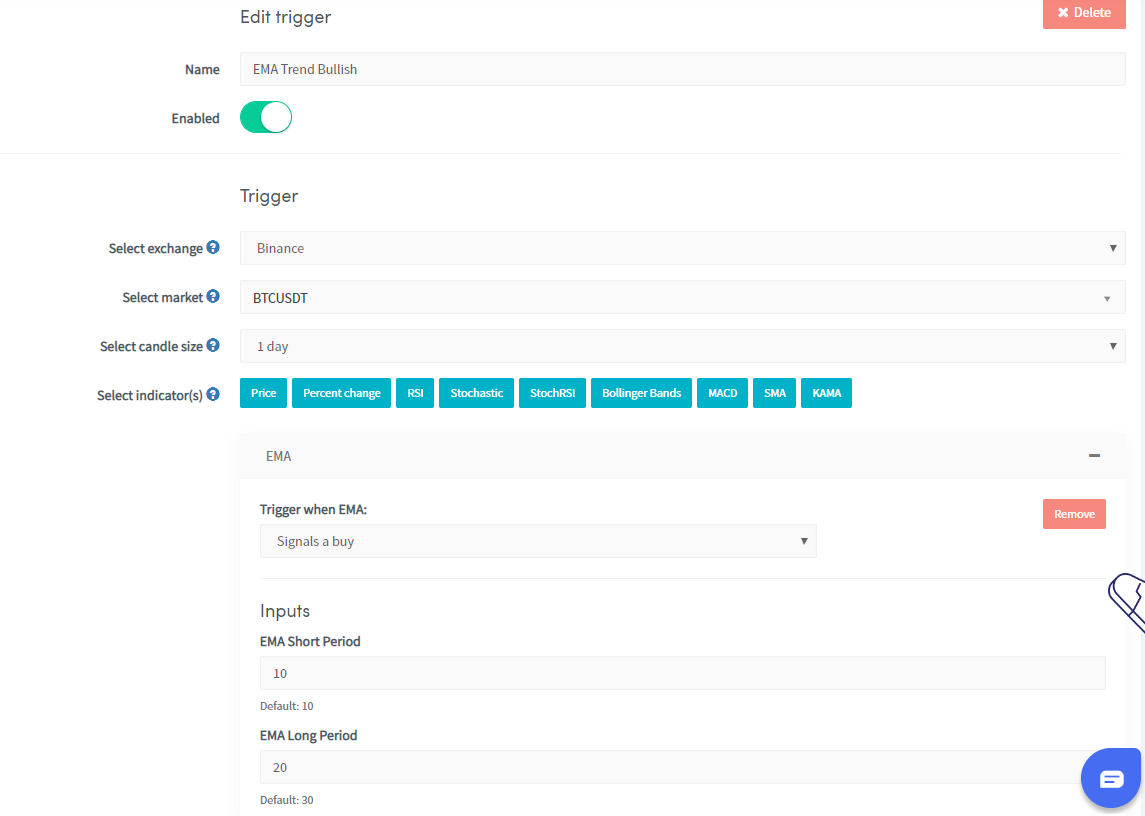

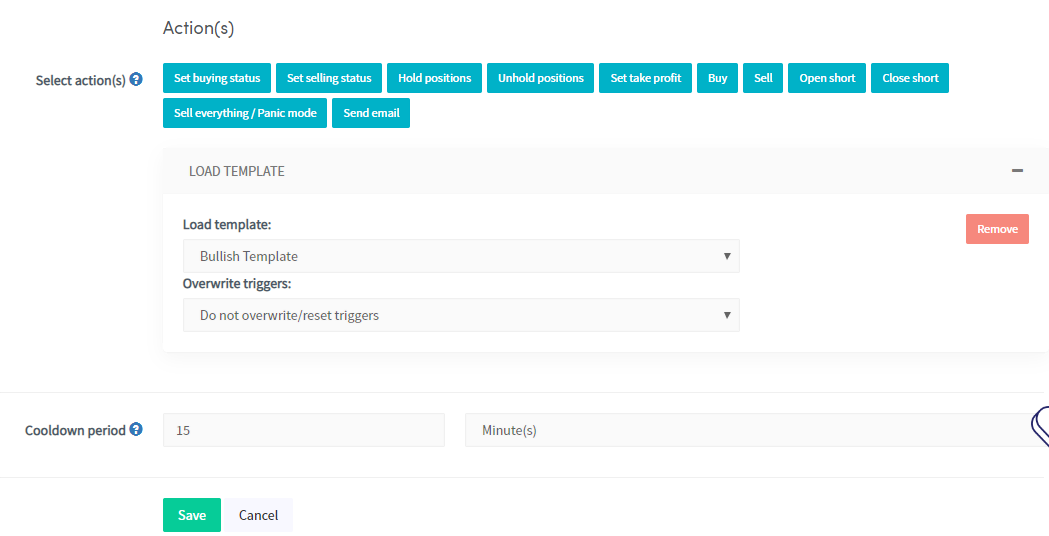

For the “Action”, we have chosen “Set buying status” and then set the status to “enabled”. For the cooldown period, we have chosen 5 minutes as we want a short cool-down period in this case. Then you can hit “save” and we are done!

Our trigger should look something like this:

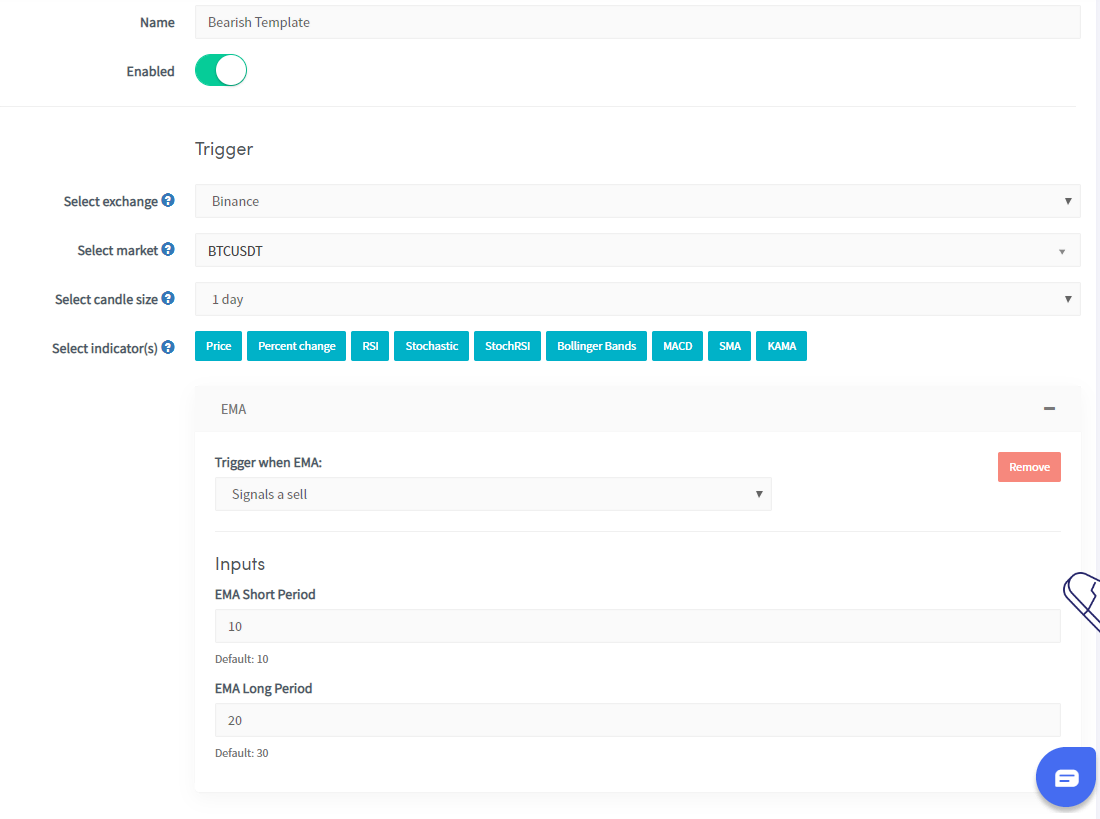

In order to disable buying in a bearish market, you can create a new trigger with the same settings. The only difference would be Trigger when EMA: “Signals a sell” and Set Buying Status: “Disabled”.

Changing Templates Based On Market Conditions:

Rather than turning off buying when the overall Crypto market turns bearish, you can use a trigger to automatically switch to a bearish trading templates you've prepared. Imagine you have two templates—one for bullish market conditions and one for bearish ones.

You would then like your trading bot to change these templates automatically according to the market conditions. Let’s now dive into some examples:

Bullish Trigger

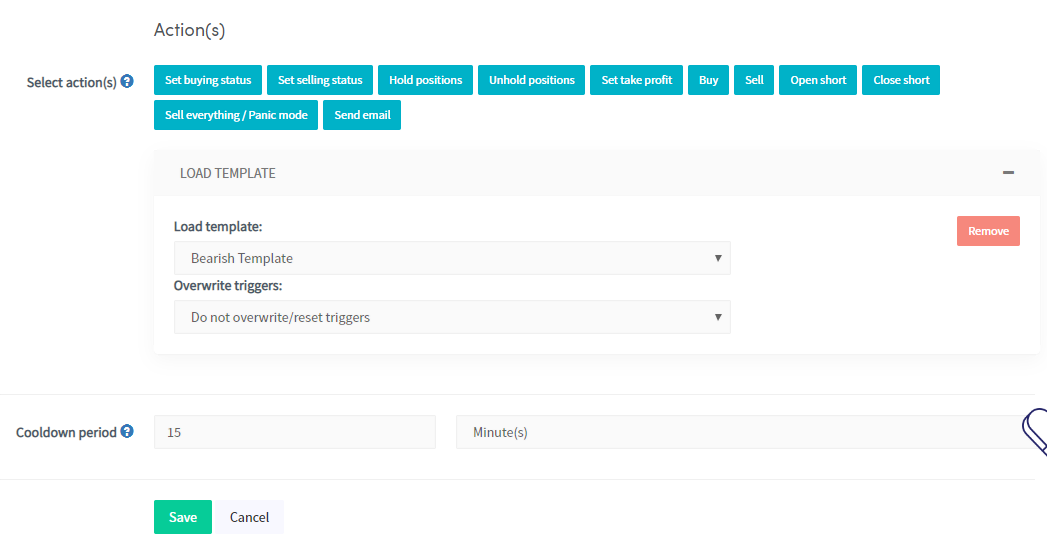

Bearish Trigger

It's crucial to stick with the same indicator and trading pair on the same exchange when loading both bullish and bearish templates. If you use the EMA to load the bullish template, stick with EMA for the bearish one (this rule applies to other indicators like MACD, RSI, Stochastics, etc.).

Using different indicators or trading pairs might lead to constant trigger activations.

Also, remember that if you've enabled "do not overwrite/reset triggers", all your new template settings will apply except for the triggers. In our example, we won't overwrite/reset triggers since we're only using two of them.

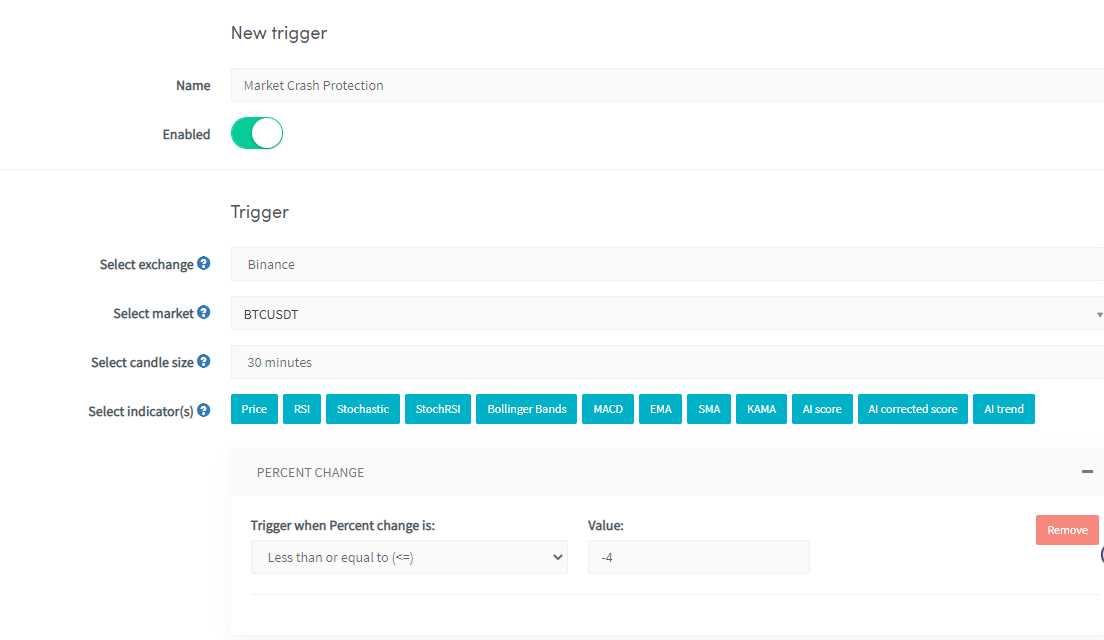

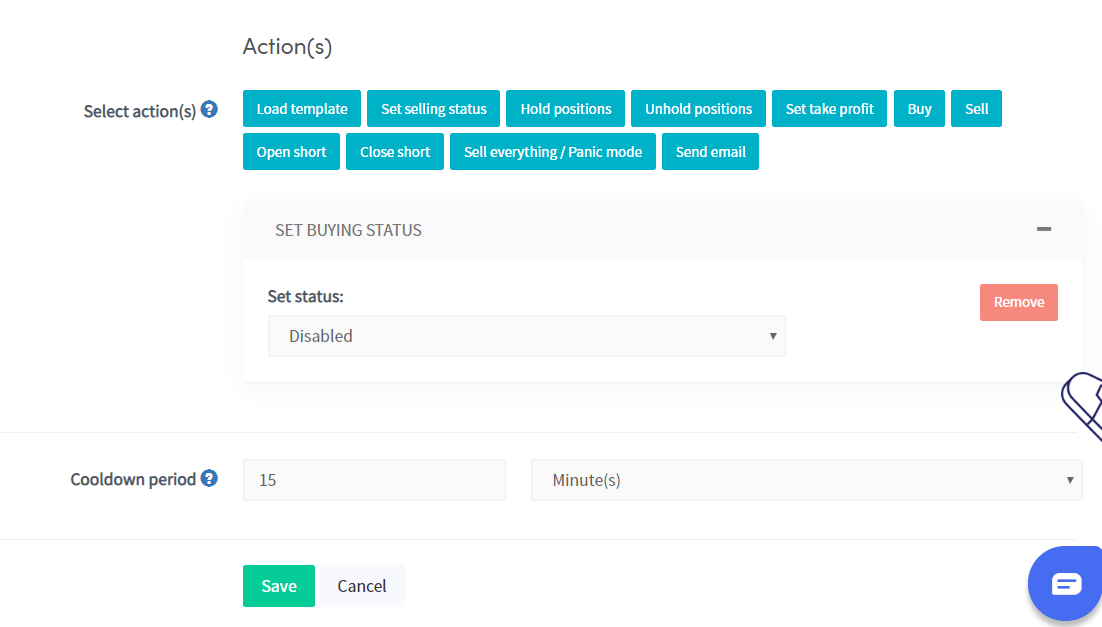

Crash Protection Trigger

If you're a trader who relies on a stable quote currency, safeguarding against market crashes, especially significant ones, is a smart move.

This trigger can be especially useful when coupled with trend-following indicators, and less useful when used with momentum oscillators such as the RSI. A solid way of protecting yourself against general market crashes is to set up a trigger that will disable buying when BTC crashes by a certain % in a certain time frame.

For instance, if you want to disable buying when BTC crashes by 4% in 30 minutes, your trigger would appear something like this:

Make sure the value here is negative!

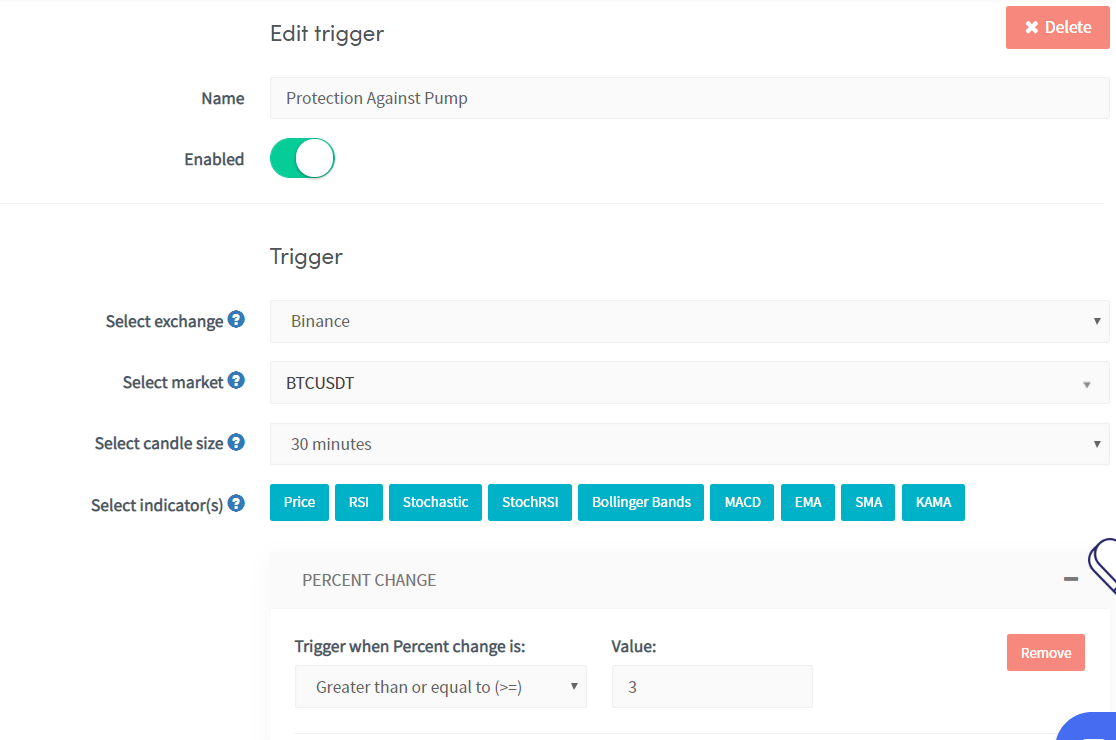

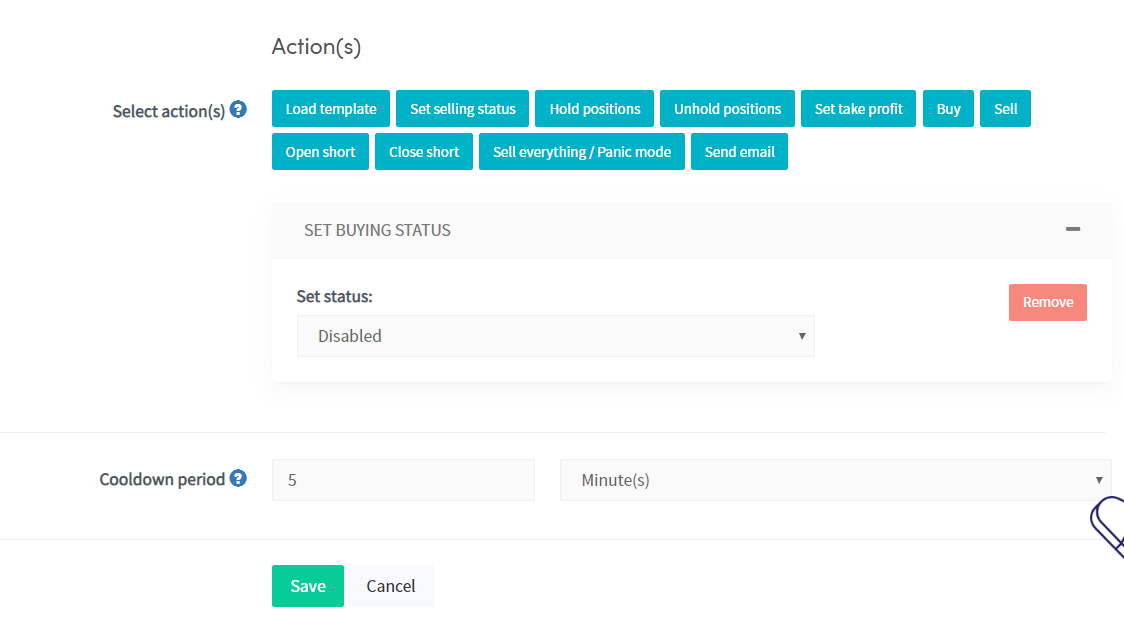

Pump Protection Trigger

If you're trading with an unstable quote currency like BTC, ETH, BNB, KCS, and so on, you might want to guard against sudden surges in your quote currency's value. When your quote currency outperforms other coins significantly, it can be challenging to make a profit.

To mitigate this risk, you can employ a "percent change" trigger. Here's a crucial tip: Make sure to choose your quote currency (it doesn't have to be BTC, as shown in our example) against USDT for this trigger to be effective!

Make sure the value here is positive.

Conclusion

Triggers are an important part of a trader’s arsenal which offers the possibility of trading with the trend, using the right settings according to the right market conditions, and protecting one from crashes or pumps.

Create your trigger today, customize it as you see fit, and take your trading to the next level with Cryptohopper!