Bot Trading 101 | How To Set Up an Arbitrage Bot

To explain arbitrage and what an arbitrage bot is able to do, it is necessary to explain market inefficiencies first. Market inefficiencies are price differences for a specific asset between different marketplaces.

Taking it to the crypto sphere, this can be translated into buying a cryptocurrency in exchange X, and selling it for a higher price at exchange Y. by doing this, a trader can profit from price differences among exchanges. Inefficiencies, that in the cryptocurrency world, have proven to be significant at times.

However, this is not the only way a trader can carry out arbitrage trading. There is another way to implement this trading strategy, it is called triangular or intra-exchange arbitrage. This practice consists of buying three different coins to profit from market inefficiencies on the same exchange. We will explain this phenomenon more indepth in the section below.

Types of Arbitrage

As explained in the previous paragraphs, there are two types of arbitrage trading strategies that a trader can use: Inter and intra-exchange arbitrage. Let’s dive a bit deeper into each type.

Intra exchange or triangular arbitrage.

You might wonder, how is it possible to spot price differences on a single exchange? however, it is possible and is a very common practice.

It makes use of a third coin as a bridge between the two coins that you want arbitrage. For example, your trading bot finds an arbitrage opportunity between BTC and ADA, and it found it by using a third coin.

That is, BTC can buy ADA for a value of 0.015 BTC (fictitious value) per coin, but XRP can buy ADA cheaper, say, 0.012 BTC. Then, the trading bot will: 1st. buy XRP with BTC; 2nd. Buy ADA with XRP; 3rd. sell ADA back to BTC. This will result in an increase of your BTC balance.

Inter exchange or exchange arbitrage.

Arbitrage among different exchanges, the revolutionary new bot that Cryptohopper has recently launched.

Now, users will be able to take advantage of the big price differences between exchanges. A trading method that has proved to be incredibly effective in the crypto market. Exchange arbitrage consists of buying a coin in an exchange and selling it on another exchange where the pair is more expensive. Profiting from this difference and increasing the portfolio’s value.

Select and configure the Arbitrage bot in your trading bot

In this section, you will learn how to get your Arbitrage bot running in a couple of minutes.

But before we get started, let us highlight something that is key to get your Arbitrage bot up and running. The trading bot will only place arbitrage orders if you already own funds of both coins in the exchanges where the arbitrage opportunity has been found. If any of the exchanges doesn’t own funds for both coins, the order could be canceled.

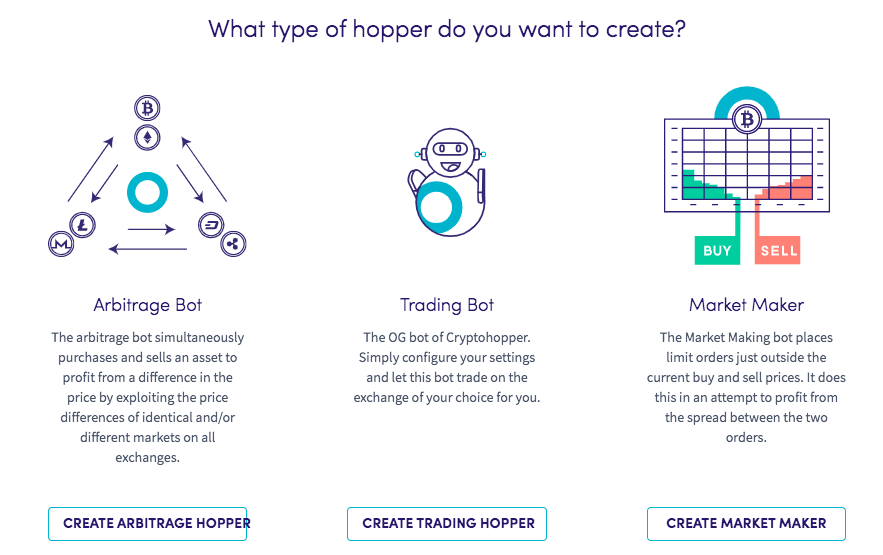

Go to “View all your hoppers”, create a new trading bot and click on Arbitrage bot.

2nd step. Let’s start configuring the Arbitrage trading bot. In Baseconfig → Basic settings, you can name the trading bot and set the maximum open time for buy and sell orders that have not been filled.

3rd step. The exchanges section. Here you select the exchanges in which the Arbitrage bot will trade. Enable and fill in the API keys for any exchange that you would like your trading bot to trade on (at least 2). You can also trade in paper trading mode to test the bot and its profitability.

4th step. Coins and amounts. In this section, you can set the maximum amounts that the arbitrage bot will use for every coin, and the amount per trade.

For instance, if you set your BTC amount at 0.1, the bot will only trade 0.1 BTC of the total BTC in your wallet. Regarding the Percentage sell amount, it is the percentage of the BTC amount that will be traded in every trade. Say that your BTC amount is 0.1 BTC and your Percentage sell amount is set to 15%, it means that the size of every arbitrage trade will be 0.1*0.15, resulting in 0.015 BTC per arbitrage trade.

5th step. Selected markets. Once the exchange has been selected and saved, you need to select all the markets that your arbitrage bot will trade in.

6th step. Exchange arbitrage settings. In this part, you can:

Select the minimum profit that your arbitrage bot will attempt to obtain in every trade

Set the maximum open time for an arbitrage order.

Maximum amount of simultaneous arbitrage orders.

Use buy and sell rate to set the lowest ask, highest bid and last values.

Market arbitrage settings

This section refers to the intra exchange or triangular arbitrage. Here you can configure the specific settings for this different type of arbitrage.

This bot can operate at the same time that the exchange arbitrage bot, and will look for market arbitrage opportunities on the exchanges you selected. It doesn’t matter if you selected two or nine exchanges, the arbitrage bot will work tirelessly to capture any market inefficiency to increase the value of your portfolio.

Last step. Revert and backlog. This section gives the option to revert/retry failed orders. If you would like to retry failed orders and enable this option, these orders will be moved to the backlog to thereafter retry them. On the other hand, if this function is disabled, failed orders will be totally discarded.

And that’s all! It might be a bit difficult to understand all the different concepts at first, but it gets really intuitive sooner than you think. After six easy steps, your arbitrage bots will be ready to pocket any single market inefficiency that will show up in the cryptocurrency market.

The Cryptohopper arbitrage bots provide the trader with a full arsenal of arbitrage tools to take advantage of market inefficiencies. A crypto trader will be able to trade simultaneously with exchange and market arbitrage, trading in any crypto exchange that he/she would like.

A whole range of possibilities that you can automate with an Hero subscription. Start trading crypto automatically to trade any cryptocurrency, any time.