Crypto Trading 101 | CoinLedger – An Introduction

Cryptocurrency traders that use automated trading tools like Cryptohopper can easily rack up dozens, hundreds, or even thousands of trades over a relatively short period of time.

This makes the Cryptohopper platform extremely powerful for automating your cryptocurrency trading strategy. It removes emotion from your trading and saves you time and energy by executing trades on your behalf.

You control the trading strategy, and the software executes the strategy.

However, one side effect of high trade volume is that it can also make capital gains and losses tax reporting more than a bit tedious.

Because cryptocurrency is treated as a capital asset or an investment in most countries, capital gains and losses need to be reported on your taxes (see this crypto tax guide).

Each time you make a trade or a sell, you need to calculate the associated amount of gain or loss that you realized on the trade in fiat currency terms, e.g. USD or euros. This is where cryptocurrency tax software can be especially helpful, and why Cryptohopper has partnered up with the team at CoinLedger.

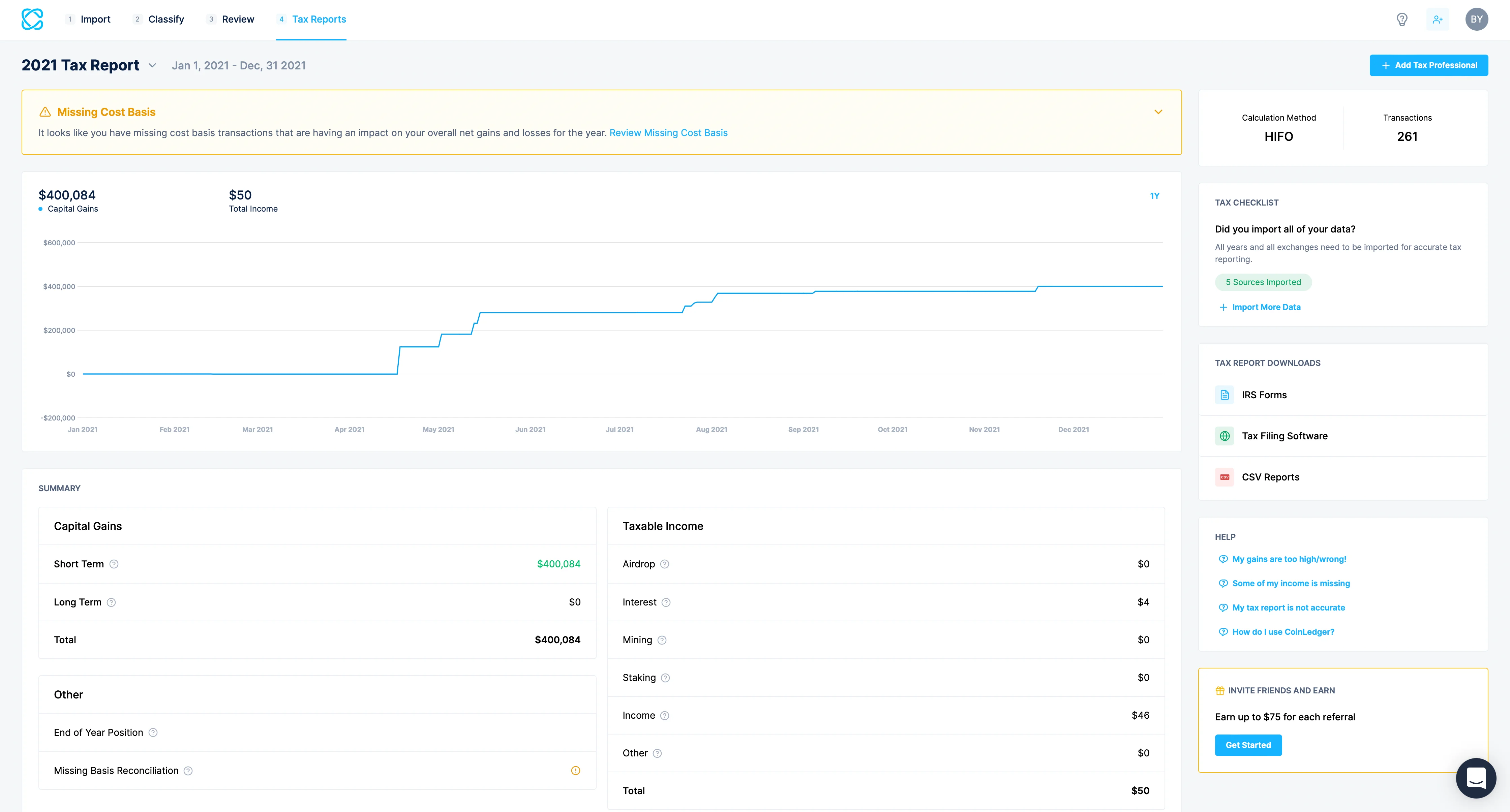

CoinLedger is a tax reporting platform for cryptocurrency investors. It is used by tens of thousands of traders and cryptocurrency users from all over the world to automate all of their necessary tax reporting.

How Can Cryptohopper Users Use CoinLedger?

Just like Cryptohopper, CoinLedger directly integrates with leading cryptocurrency exchanges. To receive your tax reports, simply connect your cryptocurrency accounts and import your trade history.

Once you pull in your trading history to your account, you can generate capital gains and income reports based on your historical data with the click of a button. These tax reports can be taken to your accountant, imported into other tax filing software, or used to file your own taxes for the year.

Additional Trading Features Available to CoinLedger Users

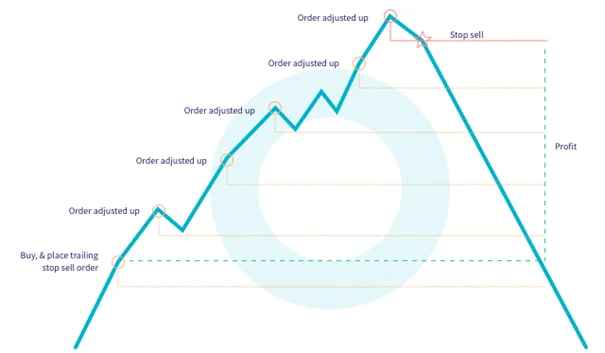

Trailing Stops

Cryptohopper’s trailing features show why trading with a bot is so convenient. When your trading bot is "trailing", it is automatically following the price and waiting for an action to take.

Such actions could be adjusting your take profit when the price drops, placing a buy order when the price goes up, or buying back your position when it was in a short. We call these Trailing Stop-Loss, Trailing Stop-Buy, and Trailing Stop-Short.

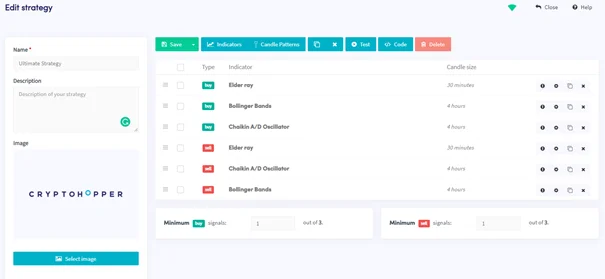

Strategy Designer

The idea of the Strategy Designer is that you choose technical indicators and candlestick patterns, which your trading bot will use to scan the markets to determine if it is time to buy/sell or not.

After you've created a strategy, you can test them to see if it needs any tweaks. There are four different types of Technical Indicators; Trend, Momentum, Volatility, and Volume Indicators.

You can select multiple indicators, including moving averages and momentum indicators, and scan their crossings and values on numerous time frames.

Technical indicators include Moving Averages, Money Flow Index (MFI), On Balance Volume (OBV), Relative Strength Index (RSI), Bollinger Bands, and more!

Copy Trading

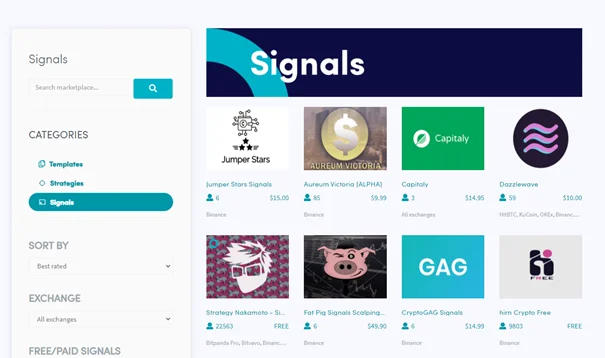

Ever wanted to let a third party analyst take over your trading decisions? With Signals through Cryptohopper you can have just that all the benefits of a third party analyst, without the need to share any personal data.

Let the analyst tell your bot which coin to buy, and when. Cryptohopper will then automatically process the order for you!

Cryptohopper also offers a marketplace where you can buy trading strategies and preconfigured trading bot templates. All marketplace sellers can be contacted when you have questions about their services.

Cryptohopper Users Receive 10% Discount

Cryptohopper users are eligible to receive a 10% discount on any tax plan from CoinLedger with the coupon code HOPPER.