Tether’s beginnings

In 2012, a whitepaper entitled “The Second Bitcoin Whitepaper” describing the ability to issue new and different tokens on top of the Bitcoin blockchain was published. The reason for pushing this idea forward, the whitepaper stated, was in part to “fix the two biggest barriers to widespread bitcoin adoption: instability and insecurity”.

In 2014, Tether’s co-founders Brock Pierce, Craig Sellars and Reeve Collins would then take that whitepaper concept and build Tether (then known as Realcoin) on top of Bitcoin’s blockchain using the Omni Layer Protocol.

Throughout its existence, Tether has had a bit of an eventful reputation, both enjoying massive adoption within the crypto community- USDT is the third largest cryptocurrency by market cap- as well as facing scrutiny and litigation.

Here we will tell you what it is, a bit about how it works and why it’s used, and go through its trials and tribulations throughout its development.

How does Tether work?

Equally as curious as its use case is how Tether works: how its stability is ensured and how it is treated.

What does Tether do?

Tether handles the issuance of Tether tokens. It is important to note that “Tether tokens” does not just refer to USDT, but Tether’s other fiat-pegged stablecoins like EURt, which is pegged 1:1 to the Euro.

A bit about stablecoins

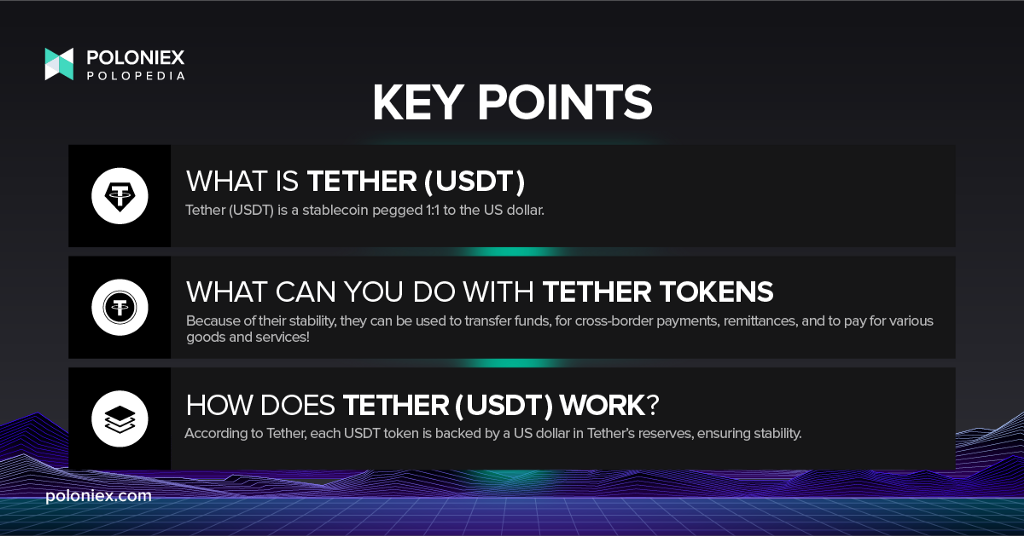

A stablecoin is a cryptocurrency that is pegged 1-to-1 to a stable store of value. In Tether (USDT)’s case, the US dollar. Tether claims that for every USDT token in circulation there is a US dollar in the company’s reserves.

Having the actual fiat currency that a company’s stablecoin is pegged to is what ensures that its value won’t waver.

A bit about the lifecycle of USDT

According to Tether’s website, USDT has a five-stage lifecycle:

A KYC-verified user deposits fiat currency into Tether’s bank account.

Tether then issues USDT to a user’s account.

The user utilizes Tether for transactions.

The user can then redeem tokens for fiat currencies.

And finally, once Tether receives the tokens back from the user, they remove that USDT from circulation.

Why do people use stablecoins?

To someone new to Tether, it may seem confusing as to why someone would hold, or even use, a token that can’t gain value. Especially after witnessing the wealth created by Bitcoin and Ethereum’s meteoric rise in popularity, one might question the usefulness of a stablecoin.

However, USDT actually provides one of the strongest examples of crypto as a common currency, as opposed to a currency that is also a store of value or that is an investment.

To think about why one would use a stablecoin, one should consider the advantages and disadvantages of traditional cryptocurrencies. The advantage of a cryptocurrency such as Bitcoin is that anyone can use it, and it can be sent across a secure blockchain anywhere in the world. Its drawback is that it is highly volatile, making it less dependable to use as a regular currency as opposed to a store-of-value.

Tether takes these advantages and applies them to a currency that is as stable as the fiat currency it is pegged to. This way if someone wants to use crypto to access banking services without having to worry about volatility, they can. For those who want to get paid or pay others in cryptocurrencies, whether that be a merchant or in the case of remittances, a stablecoin is an ideal way to do it.

Issues and scrutiny

Over its tenure, Tether has been the subject of a lot of scrutiny, ranging from allegations concerning its ties with cryptocurrency exchange Bitfinex as well as questions surrounding its claims of backing every USDT token with a US dollar.

Ties with Bitfinex

According to a lawsuit filed by the New York Attorney General’s Office, Bitfinex had used Tether to cover up losses incurred due to previous hacks.

Through the lawsuit and investigations by various governmental bodies, it was found that Tether had made false claims that its tokens were 100% backed by US dollars.

Additionally, Tether’s relationship with cryptocurrency exchange Bitfinex is unclear. The question of relationship, aside from the aforementioned lawsuit, comes from the fact that Tether Limited, which issues Tether tokens, is owned by the owners of Bitfinex.

Tether’s cash reserves

As previously stated, Tether’s claim to have backed every USDT token that is in circulation by a corresponding US dollar has been called into question. Tether has since paid a settlement, but has not admitted that its USDT token is in fact not backed 100% by the US dollar.

Were it found to be conclusively true that USDT isn’t fully backed by its fiat counterpart, the stability of the token would also be greatly damaged. But, for now, USDT is still worth a dollar.

Redeemability

And because the existence of a matching US dollar for every token has been called into question, so has Tether’s claim that users can redeem USDT for fiat currency from the company. Recently, Tether also announced that US customers cannot redeem Tether.

What can I do with Tether?

Because it is a stablecoin, Tether is quite useful in paying for goods and services, remittances, transferring funds between exchanges, and cross-border payments, among other uses.

How to buy Tether

USDT is available to buy on multiple exchanges like Poloniex! You can acquire USDT through trading or through buying directly with your debit or credit card.

Feeling ready to get started? Sign-up is easy! Just hop on over to https://poloniex.com/signup/ to start your crypto journey🚀

was originally published in The Poloniex blog on Medium, where people are continuing the conversation by highlighting and responding to this story.