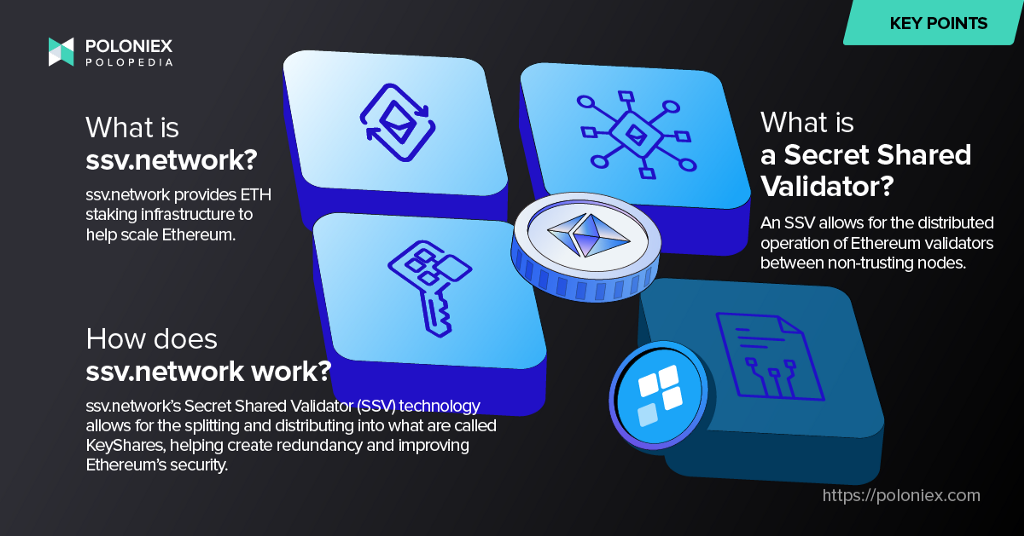

What is ssv.network ?

ssv.network is a Layer 2 solution that provides the infrastructure to run validators for Ethereum between non-trusting nodes. The way it does this is by utilizing Secret Shared Validator technology. So let’s break that down a bit.

When the Ethereum network shifts to a Proof-of-Stake consensus model, running a node on the Ethereum network will require a validator to stake 32ETH, as well as run software validator client alongside legacy node and Beacon Chain node. This situation is not only a bit complex, but once a validator is created, it produces a Validator Key which is responsible for signing transactions.

Definitions

A validator verifies transactions on a blockchain for a reward.

A validator key is how a validator is able to verify transactions, by signing them and sending a vote (called an attestation) that the verification is valid.

Non-trusting nodes

Secret Shared Validators (SSV) encrypt and split a validator key into KeyShares so that they can be trustlessly operated between more than one node operator. SSV technology is also referred to as Distributed Validator Technology, or DVT.

A Validator Key is responsible for signing transactions and earns rewards every time it successfully does so

The thing with validator keys is that they must always be online to do this, lest they go down and the network suffers outages. What’s more, if this happens, the validator is subject to penalties. One of the problems that the network will encounter, and in fact already has encountered, is a network outage from offline validator keys resultant from them only having a single operator.

With ssv.network, a validator key is split into what is called KeyShares, dividing the duty of keeping the key online between more participants and optimizing its uptime.

How does ssv.network work?

As mentioned above, ssv.network utilizes Secret Shared Validator technology in order to encrypt and then split a validator key into 4 KeyShares among non-trusting nodes. This addresses the centralization problem with validator keys. That is, if one goes down or is faulty, the other 3 can operate the node, meaning a more decentralized and reliable Ethereum network.

The network has 3 main participants- stakers, operators, and DAO members:

Stakers lock up their ETH for a period of time to secure the Ethereum network.

Operators are responsible for the management of validators and perform various duties on Ethereum’s Beacon Chain (its Proof-of-Stake execution layer). Operators will often be LLCs.

*It is important to note that both stakers and operators can stake ETH and help others by managing their stake.

DAO Members are responsible for helping govern the network.

There is a reciprocal reward mechanism in place where operators manage validators and generate ETH rewards for stakers, receiving $SSV in return.

In terms of architecture, the ssv.network is made up of 2 layers:

SSV P2P network: This is ssv.network’s execution layer, responsible for operating the network’s validators.

The contract layer is the management/governance layer. This is where changes are implemented and network fees are paid.

What are non-trusting nodes?

A non-trusting node is one that does not have to trust other nodes in order to operate. This makes optimization possible, as a faulty node won’t affect network performance. The decentralization this brings aids Ethereum resisting what is called the “single point of failure” problem, where one component of a network causes the whole network to suffer.

Staking applications

One of the main use cases for ssv.network’s technology is its use in staking applications, making them more decentralized, fault tolerant, and secure.

Applications such as staking pools, staking services, solo stakers, DAOs, those performing institutional staking, as well as bridges would benefit from this type of infrastructure. These operations also become a lot more scalable.

What can you do with $SSV

$SSV, the native governance token for ssv.network can be used, of course, for governance as well as paying platform fees. Right now, as the project is running a grants program for developers to build on the network, it also distributes funding in $SSV. Operators on the network also receive $SSV rewards.

How to acquire $SSV

SSV is available on multiple exchanges like Poloniex! You can acquire SSV through trading a USDD or USDT trading pair: SSV/USDD | SSV/USDT.

Feeling ready to get started? Sign-up is easy! Just hop on over to https://poloniex.com/signup/ to start your crypto journey🚀

was originally published in The Poloniex blog on Medium, where people are continuing the conversation by highlighting and responding to this story.