2024 can be viewed as a historic milestone. The surge in Bitcoin’s price has reignited the enthusiasm of global investors, giving a strong push to the healthy recovery of the cryptocurrency market. This wave of growth is no coincidence.

Changes in the macroeconomic environment, policy adjustments, ongoing improvements in on-chain data, and the gradual participation of institutional investors have once again highlighted the investment value of crypto assets. As the global economy gradually recovers, traditional finance becomes more closely integrated with the digital asset market, signaling the maturation of the crypto industry. As a result, an increasing number of institutions have begun recognizing and investing in this sector. Crypto assets have truly entered the mainstream, presenting unprecedented opportunities.

For HTX, 2024 represented a crucial year in its journey alongside blockchain technology and a key moment in contributing to the decentralized economy. Over the past year, HTX has driven ecosystem-wide development through technological innovation, market expansion, and user growth on its platform. Additionally, its strategic roadmap and investments have further fostered the prosperity of the Web3 ecosystem. HTX is always committed to creating a more open, transparent, and secure blockchain world for global users while driving the realization and growth of the decentralized economy.

As 2025 unfolds with more mature global regulatory environments, a new round of explosive development in blockchain innovation, and rapid development of various infrastructure and innovation applications, the crypto industry is set to embrace broader investment opportunities. The next few years will be a critical period for accelerated growth, continual technological iteration, and widespread adoption of innovations in the crypto industry. HTX will continue to drive technological innovation and industry development, striving to build a more inclusive, equitable, and open blockchain world and turning the decentralization dream into reality. In turn, it enables global users to enjoy freedom and opportunity within this new economic system.

I. 2024 Global Web3 Blockchain Ecosystem Review

The crypto market in 2024 kicked off with the approval of Bitcoin ETFs in January. From a macroeconomic perspective, the crypto market is currently transitioning from quantitative tightening (QT) to quantitative easing (QE), with QE expected to begin in the second quarter of 2025. Historical trends indicate that the peak of crypto bull markets rarely occurs during rate-cut cycles. Instead, it is more likely to happen at the end of rate-cut cycles, or just as a rate-hike cycle nears its end or even just begins. For example, the extreme easing policies triggered by the 2020 pandemic started a crypto bull run, which reached its peak at the end of 2021 as the Federal Reserve signaled a gradual shift toward tightening policies. Later, rate hikes officially commenced in 2022.

Therefore, the market is still far from its bull market peak. On the whole, this bull market cycle may unfold in various ways. In particular, against the backdrop of Trump’s fiscal expansion policies and unprecedented crypto-friendly signals, a robust bull market is expected. Moreover, with regulatory easing and the entry of traditional financial institutions, Bitcoin will gain stronger support and gradually become a core dollar-denominated asset, aside from those tied to the dollar industry cycles (such as AI). The trend of decoupling between Bitcoin and the traditional altcoin market is expected to intensify.

On the one hand, the benchmark interest rate is expected to decline to neutral levels by mid-2025. Whether there would be further rate cuts or tightening signals will depend on inflation levels at the time, as well as Trump’s ability to influence the Federal Reserve. If the Fed signals tightening measures to address inflation, the market may enter an adjustment phase that may last until May 2026, when Trump could have the chance to assert control over Fed policies.

First, let’s revisit the key events in the global Web3 blockchain ecosystem in 2024.

1. Major Policy Shift

The U.S. Approves Spot Bitcoin ETFs for the First TimeIn January 2024, the U.S. Securities and Exchange Commission (SEC) made a historic decision to approve the first-ever spot Bitcoin ETFs. This move undoubtedly represents a critical shift in U.S. regulatory agencies’ stance on virtual assets and marks a milestone for the Bitcoin market. The approved ETFs include products from 11 well-known financial institutions, including Grayscale, Bitwise, Hashdex, iShares, Valkyrie, Ark 21Shares, Invesco Galaxy, VanEck, WisdomTree, Fidelity, and Franklin.

This move is of great significance because the SEC has long been cautious toward spot Bitcoin ETFs due to concerns over Bitcoin’s price volatility, risks of market manipulation, and investor protection. Since 2013, the SEC has rejected multiple proposals for spot Bitcoin ETFs, especially under the hard-line stance of former chair Jay Clayton and current chair Gary Gensler. Both had clearly opposed the approval of spot Bitcoin ETFs in 2017 and 2019, respectively, on the grounds of market instability and regulatory loopholes.

However, in June 2023, BlackRock filed an application for a spot Bitcoin ETF, which broke the deadlock and quickly drew widespread attention. Later, Grayscale scored a big court win, with the U.S. Court of Appeals for the District of Columbia Circuit ruling that the SEC’s rejection of Grayscale’s application to convert GBTC into a spot Bitcoin ETF was “arbitrary and capricious”. Following this court decision, the SEC reevaluated the possibility of spot Bitcoin ETFs, which ultimately led to this approval.

The approval of spot Bitcoin ETFs represents not only a major step forward for the U.S. market but also a bellwether for the global virtual asset market. The SEC’s decision brings Bitcoin closer to mainstream investment markets and is expected to attract more traditional financial investors. The introduction of spot Bitcoin ETFs will significantly lower the barriers for investors to enter the Bitcoin market, especially for those from traditional finance, as they can trade Bitcoin directly through exchanges without relying on crypto exchanges or keeping Bitcoin in their own custody. More importantly, this approval could potentially have a far-reaching impact and set a precedent for regulatory agencies in other countries and regions, accelerating the compliance process for digital asset products.

2. Innovations in Asia: Hong Kong Pioneers Spot Bitcoin and Ethereum ETFs

In April 2024, the Securities & Futures Commission (SFC) of Hong Kong approved the launch of Asia’s first spot Bitcoin and Ethereum ETFs. This decision underscores Hong Kong’s leading role in advancing the compliance of virtual assets and market innovation while further solidifying its position as a global financial center.

Hong Kong’s move comes shortly after the launch of spot Bitcoin ETFs in the U.S., signaling a gradual shift of the global financial market towards greater openness and legal regulation of virtual assets. According to the Hong Kong Stock Exchange (HKEX), fund companies such as Bosera Funds, ChinaAMC (Hong Kong), and Harvest Global Investments have received in-principle approval from the SFC to launch spot virtual asset ETF products for Bitcoin and Ethereum. These ETFs will track the spot prices of Bitcoin and Ethereum and will be listed on the HKEX, making it easier for ordinary investors to invest in these digital assets.

Hong Kong’s launch of spot Bitcoin and Ethereum ETFs holds substantial significance for the Asian market. As a global financial hub, Hong Kong has been exploring effective ways to regulate and guide the development of the virtual asset market. In recent years, the city has strived to be a front-runner in regulating the crypto space and promoting compliance by actively aligning with international standards. This has offered valuable experiences and set an example for other regions. For instance, in 2022, Hong Kong pioneered virtual asset ETFs for institutional investors. This latest expansion into the retail market represents a continuation and deepening of those earlier policies.

More importantly, Hong Kong’s introduction of spot Bitcoin and Ethereum ETFs provides innovative investment tools for the Asian market as well as consolidating its leading position in the global virtual asset sector. The successful rollout of these products is expected to attract more investors, making Hong Kong’s financial market increasingly diversified and internationally competitive. At the same time, it also offers valuable insights and references for other Asian regions, particularly mainland China, in introducing virtual asset products.

3. Bitcoin’s Fourth Halving: Market Expectations vs. Reality

On April 20, 2024, Bitcoin underwent its fourth halving, reducing the mining reward from 6.25 Bitcoins to 3.125 Bitcoins per block. This halving reignited widespread market discussions, as such events are often viewed as catalysts for Bitcoin’s price hikes. However, while the halving attracted significant attention, the market’s response was unprecedentedly complex.

Historically, post-halving periods have seen substantial increases in Bitcoin’s price. The first halving occurred in 2012 when Bitcoin’s price was just $12.3, which soared to $1,217 by the end of 2013. The second halving took place in 2016, driving the price from $648 to a peak of $19,800 in 2017. The third halving in 2020 saw Bitcoin’s price surge from $8,560 to as high as $67,775.

However, market sentiment was not as optimistic as before ahead of the halving in 2024. Analysts from financial institutions such as JPMorgan suggested that while the halving would draw market attention, Bitcoin’s price might drop instead due to its already high price levels and miners’ increased operational costs. They pointed out that miners potentially face exacerbated cost pressures post-halving and Bitcoin’s futures market might become another potential factor contributing to price volatility.

Nonetheless, Bitcoin’s price did not decline sharply after the halving. Instead, it fluctuated briefly before quickly rebounding to around $66,000. This response indicates that Bitcoin’s long-term potential is still widely recognized. In particular, against the backdrop of growing uncertainty in the global macroeconomic environment and financial markets, more investors have embraced Bitcoin as digital gold and a safe-haven asset.

4. U.S. Officially Approves Spot Ethereum ETFs

On July 22, 2024, the SEC officially approved the listing and trading of spot Ethereum ETFs. This approval makes Ethereum, the world’s second-largest cryptocurrency, the first digital asset after Bitcoin to launch a spot ETF in the U.S. market. This milestone is of great significance for the Ethereum market, as it has broadened institutional investors’ access to the Ethereum market and laid the foundation for listing compliant products of other digital assets.

In fact, the SEC had given preliminary approval for spot Ethereum ETF applications from several companies on May 24, 2024, signaling Ethereum’s formal entry into mainstream financial markets. After months of review and regulatory assessment, the SEC made a final decision on July 22 to approve the listing and trading of spot Ethereum ETFs.

The approval for spot ETFs of these two major cryptocurrencies, Bitcoin and Ethereum, signifies the growing maturity of crypto asset regulation in the U.S. Following the successful rollout of spot Bitcoin ETFs, U.S. regulatory agencies began loosening restrictions on other crypto assets. Meanwhile, the launch of spot Ethereum ETFs reflects a more open policy stance from the SEC toward the crypto space, laying the foundation for the future compliance of more digital assets.

The introduction of spot Ethereum ETFs will make it easier for traditional financial market investors to participate in the Ethereum market. More than that, it will offer robust support for Ethereum’s liquidity and market stability. In addition, this event has undoubtedly injected fresh momentum into the global cryptocurrency market, drawing the attention of many institutional investors. It is expected to drive up Ethereum prices in the coming months and accelerate its market maturation.

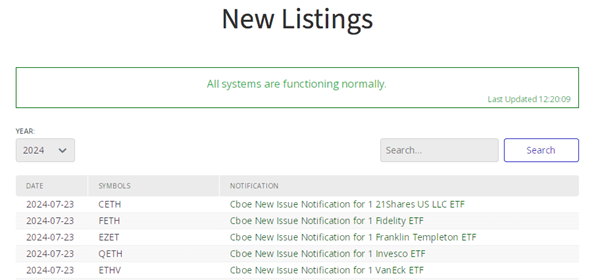

Chicago Board Options Exchange (Cboe) Page on July 23

5. German Government Sells Off Bitcoin: Missing Out on $2.03 Billion in Potential Profits

In July 2024, the German government announced that it had sold its entire Bitcoin holdings. This decision sparked widespread market interest and debate, as this move of the German government cost them approximately $2.03 billion in potential profits based on Bitcoin’s price at the time. In fact, the Bitcoin seized by the German government in 2014 was recovered from illegal activities through auctions, when Bitcoin prices were way lower than today.

The German government held nearly 67,000 Bitcoins at that point. However, the German Ministry of Finance decided to sell these assets due to its limited understanding of digital currencies and concerns over market volatility. While in line with regulatory frameworks and policy requirements of the time, this move seems quite conservative after subsequent surges in Bitcoin’s price.

In addition, this move of the German government also triggered discussions on digital currency management and related strategies. Although Bitcoin is notoriously volatile in price, its role as a long-term store of value has been increasingly recognized by institutions and countries. In the future, whether governments should utilize digital currency more proactively for asset management and appreciation remains a question worthy of serious consideration.

6. Bitcoin Conference 2024 and Trump’s Stance on Crypto

On July 28, 2024, during the Bitcoin Conference 2024, former U.S. President Donald Trump vowed to designate Bitcoin as a strategic reserve asset for the U.S. if re-elected. This statement immediately ignited widespread attention and debate.

In particular, against the backdrop of an increasingly complex global economic landscape, Bitcoin’s potential as “digital gold” again becomes the center of attention.

In his speech at the conference, Trump noted that the decentralized nature of Bitcoin and other crypto assets would make them a new form of global reserve asset. He argued that as the U.S. dollar faces growing challenges to its dominance in international trade and its status as a reserve currency, Bitcoin could help the U.S. government mitigate risks of future financial crises and currency devaluation as a digital asset. Therefore, should he return to the White House, Trump pledged to integrate Bitcoin into the U.S.’s strategic reserve framework so as to further enhance the competitiveness of both the dollar and cryptocurrencies.

This statement not only marks Trump’s public endorsement of crypto assets but also reflects changes in the global financial landscape. In a complex and ever-changing global economy, more and more politicians are beginning to acknowledge Bitcoin’s potential as a non-inflationary asset, with its role as a safe-haven asset increasingly recognized. Trump’s speech has undoubtedly broadened the horizon for Bitcoin’s future development and could foster greater collaboration and exchanges among governments worldwide on crypto asset management and policy formulation.

7. August Sees Circuit Breakers in Japanese and South Korean Stock Markets and a Plunge in Bitcoin Prices

On August 5, 2024, Asian financial markets were hit by a major wave of market turbulence, triggering circuit breakers in Japanese and South Korean stock markets. Investors fled the stock markets to avoid risks. As a result, digital assets such as Bitcoin experienced dramatic price fluctuations. On that day, Bitcoin price plummeted from nearly $60,000 at dawn to $49,000.

The turmoil stemmed from an unexpected monetary policy shift by the Bank of Japan (BoJ). On July 31, the BoJ raised its benchmark interest rate by 15 basis points to a range of 0.15%-0.25%, exceeding market expectations and sparking market panic. Previously, the BoJ had always adopted an ultra-loose monetary policy and maintained negative interest rates to stimulate growth. However, as pressures on Japan’s economic recovery mounted, the BoJ decided to raise interest rates. This policy shift triggered significant volatility in the yen and intensified investors’ concerns over global financial stability.

At the same time, the South Korean stock market faced similar adverse effects, as investors shifted to safe-haven assets, further exacerbating the downward pressure across Asian markets. As risk assets, Bitcoin and other cryptocurrencies are often susceptible to global market fluctuations, so their prices also dropped dramatically. It was universally believed in the market that as global economic uncertainties aggravated, investors might divert more funds from traditional financial markets to cryptocurrencies and other safe-haven assets, further driving the price volatility of cryptocurrencies like Bitcoin.

8. The Fed’s Rate-Cut Cycle Kicks Off in September

In the early hours of September 19, 2024, the Federal Reserve announced cutting the federal funds target rate by 50 basis points to a range of 4.75%-5.00%.

Since March 2022, the Fed had imposed 11 consecutive rate hikes, raising interest rates by a cumulative 525 basis points and pushing the federal funds rate to a 23-year high of 5.25%-5.5%. This decision to cut rates showed that the Fed had started adjusting monetary policy in response to changes in the economic environment after a prolonged rate-hike cycle. This rate cut drew widespread market attention, and investors anticipated further rate cuts in the months ahead to stimulate economic growth and counter potential risks of an economic slowdown.

On November 8, 2024, the Fed announced another rate cut of 25 basis points, bringing the federal funds target rate down to a range of 4.5%-4.75%. The policy statement removed language indicating progress on inflation and greater confidence in achieving targets, instead emphasizing that it would pay continuous attention to dual risks posed by employment and inflation. The Fed reiterated that its primary goal was to maintain inflation at 2% and made it clear that it would not lower inflation below 2% to compensate for past overages.

The October Consumer Price Index (CPI), released on November 13, showed a 0.2% month-over-month increase in the overall CPI, with the annual inflation rate rising from 2.4% to 2.6%. These figures indicated that inflationary pressures still existed and aligned with market expectations. On December 19, the Fed made its final interest rate decision of 2024, lowering the benchmark rate by 25 basis points to a range of 4.25%-4.50%.

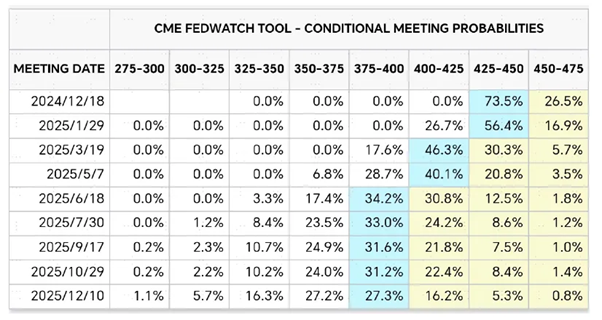

Given that the U.S. real natural interest rate is approximately 1.4%, and short-term PCE inflation is expected to hover around 2%, the next 4 to 5 rate cuts (each by 25 basis points) will bring the rates down to about 3.5%, which is a reasonable level. CME futures data suggests that the market expects 3 more rate cuts, scheduled for December in 2024 and March, and June in 2025. The federal funds rate will reach 3.75%-4% by June 2025. This trajectory largely aligns with the Fed’s description of the neutral rate of interest.

CME Futures Data

9. Trump Declares Victory in Presidential Election

On November 6, 2024, initial projections by multiple media outlets, including Fox News, suggested that Republican candidate Donald Trump was on track to secure the presidency by winning more than half of the electoral votes.

On the day the election results were announced, Bitcoin experienced a significant surge, rising over 8% shortly after the market opened and briefly hitting an all-time high of $75,349 per coin. Although it dipped slightly afterward, Bitcoin’s price remained above $73,000. According to Coinglass data, Ethereum rose 5.99%, Litecoin increased by 3.09%, and Dogecoin, endorsed by Elon Musk, soared by 15.33% in 24 hours.

Trump has long been a supporter of cryptocurrencies, and Bitcoin’s rise was interpreted as part of the “Trump trade” strategy. Trump pledged that if he returned to the White House, he would work to make the U.S. the global crypto hub, advocate for a Bitcoin reserve strategy, and appoint digital asset supporters to regulatory positions. He made it clear that he was the most pro-crypto candidate.

10. Bitcoin Price Surpasses $100,000

On December 5, Bitcoin’s price soared past $100,000, surging over 5% in a single day to reach a historic high. This milestone underscored the flourishing Bitcoin market and signaled that the cryptocurrency industry had entered a brand-new phase. Since the beginning of the year, Bitcoin has risen nearly 140%, making it one of the most closely watched assets in global financial markets. Meanwhile, other mainstream cryptocurrencies like Ethereum and Dogecoin also saw gains to varying degrees, driven by Bitcoin’s rally. The overall market experienced growth across the board, investors displayed unprecedented enthusiasm, and the entire cryptocurrency market was filled with new opportunities and challenges.

Bitcoin’s meteoric rise was fueled by several factors, chief among them the political impact of Donald Trump’s election victory. During his campaign, Trump had publicly vowed that, if re-elected, he would make the U.S. the “crypto capital of the planet” and proposed building a national Bitcoin stockpile to elevate Bitcoin’s role and influence within the global financial system. This promise attracted significant attention from cryptocurrency enthusiasts worldwide and sent a strong market signal that drove up Bitcoin’s price. In addition, the growing global acceptance of Bitcoin and cryptocurrencies, coupled with increased participation from institutional investors and capital inflows, further fuelled the market’s upward momentum, propelling Bitcoin’s price to new highs.

This historic milestone demonstrated Bitcoin’s position as digital gold and indicated that cryptocurrencies were gradually reshaping the global financial landscape as a new asset class. With clearer policies and a maturing market, Bitcoin’s future looks increasingly promising. As more investors and institutions join this investment wave, the potential of the cryptocurrency market is being fully unlocked.

II. HTX Ventures: Key Sectors for 2025

2024 has been a landmark year for the crypto industry. From the approval of Bitcoin and Ethereum ETFs early on, we have witnessed a robust bull market further energized by momentum from the U.S. elections. Cryptocurrencies—especially Bitcoin, which benefited from the significant change in macro conditions —are reaching record-breaking valuations and are increasingly influencing the social and political landscape.

It has also been a fruitful year for HTX Ventures. Benefiting from continuous innovation in the industry, this year we have supported 28 leading projects and funds that are exploring new frontiers of crypto utility. These projects span a range of sectors, including DeFi, BTCFi, ZK-rollups, modular infrastructure, Layer 1 & 2 solutions, AI, SocialFi, GameFi, and more.

Looking ahead, HTX Ventures has identified five key sectors that showed encouraging progress in 2024 and will be closely monitored in 2025: the Bitcoin ecosystem, infrastructure, Meme, artificial intelligence (“AI”), and the TON ecosystem. This report provides an in-depth examination of the current landscape, challenges, and future opportunities within each sector, complemented by a macroeconomic overview and market projections.

Bitcoin Ecosystem

Market Dominance

LTM Bitcoin dominance has increased from 45.27% to 56.81%. This implies most of the liquidity of the crypto market is currently lying mainly on the Bitcoin ecosystem and increasing.

Source: CoinStats

Bitcoin spot ETFs now account for 5.3% of the total Bitcoin supply, with holdings rising from 629,900 BTC at the beginning of the year to 1.24 million BTC, an increase of 613,708 BTC. This growth has elevated ETF holdings from 3.15% to 6.25% of the total Bitcoin supply in just twelve months. (Data as of 4 Dec 2024)

A new market trend has emerged – with Bitcoin as the core asset, spot ETFs as liquidity channels, and U.S. listed companies represented by MicroStrategy (MSTR) as the vehicles to absorb unlimited dollar liquidity. As a result, it is increasingly essential to further develop Bitcoin’s ecosystem and enhance capital utilization efficiency, which can also boost BTC’s demand and drive up its price.

Layer 2

77 BTC L2s have been launched/ fundraised over the past 3 years. Existing bitcoin L2s from the previous cycles including Lightning, Stacks and Liquid Network had experienced a significant surge in trading volume and token prices in 1H 2024 with the BTC ETF narrative. Further technical development has also been witnessed from these previous cycle L2s. Various L2 solutions on Bitcoin have emerged, including Spiderchain (Botanix), ZKRollup (Nexio and Critea), EVM compatible chains (BOB and B Squared), Sidechains (Merlin), etc. Current TVL on BTC L2 has reached US$3 billion, contributed by 19 BTC L2 projects. Assuming all Bitcoin L2s are launched in the coming years, approximated TVL on all BTC L2s could reach at least 2 to 4 times further, indicating a TVL of US$6 billion to US$12 billion.

Layer 1/ Execution Layer

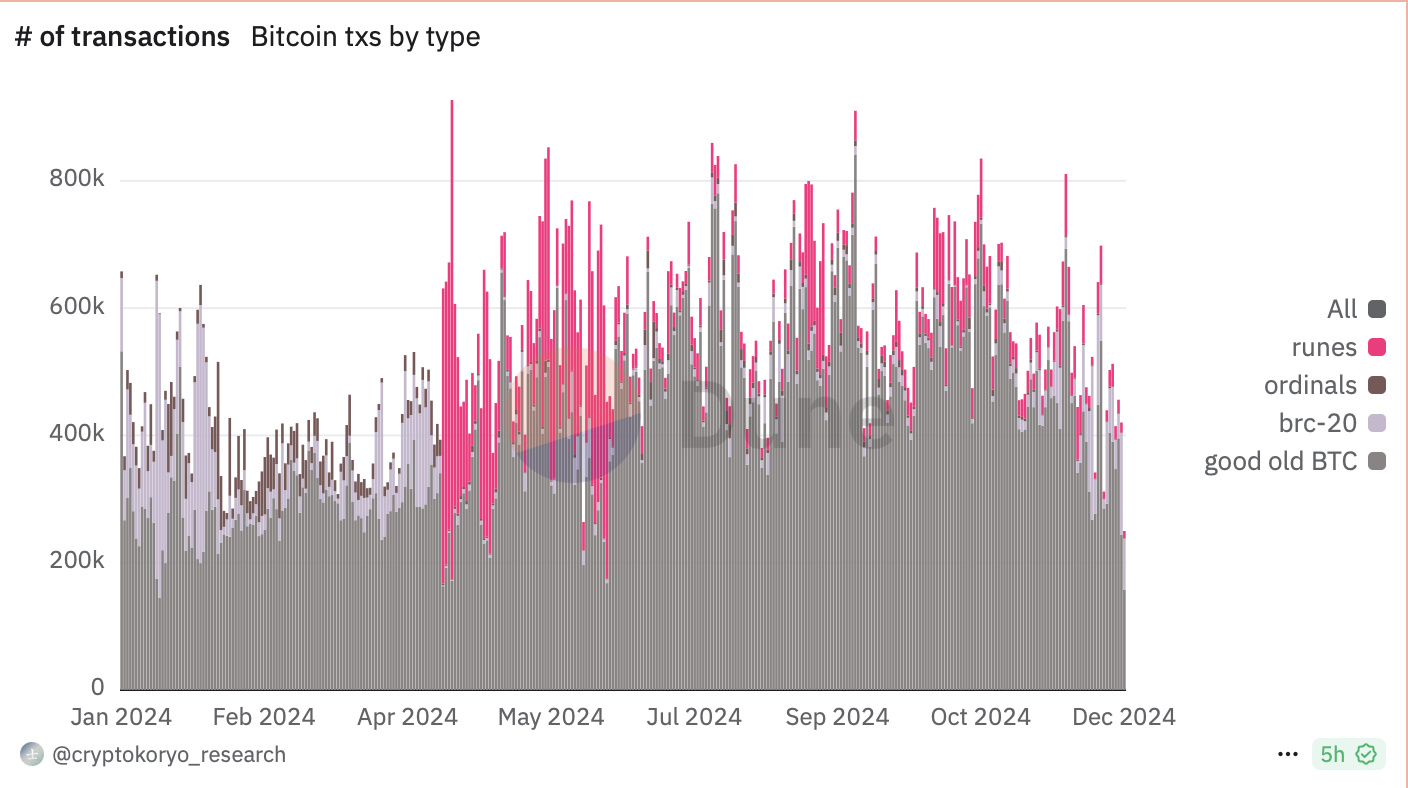

BRC-20, Ordinals and Runes were the new major execution standards that emerged in late 2023. BTC L1s activities were on a steady increase despite an overall market downturn in Q2. However, the growth momentum was not able to keep pace in Q3 despite the resurgence of the Bitcoin markets.

BTC L1s Landscape in # of Transactions, Source: Cryptokoryo_research

Other Bitcoin Infrastructure

Other infrastructures including interoperability solutions and security layers emerge with the rise of Bitcoin adoption.

Interoperability

Bridges and WBTC remain the mainstream of interoperability solutions on Bitcoin. Given that the Bitcoin network does not directly provide composability to build applications directly, people have to rely on these bridges/ WBTC to unlock DeFi yields on other blockchains. HTX Ventures remain bullish on Bitcoin interoperability solutions given the surge in institutions’ growing investment in Bitcoin as an asset class, and anticipate more solutions coming including liquidity bridges Xlink, Atomiq and Auran will launch in the coming year.

Security Layers

However, these interoperability solutions may pose threats on security over the underlying assets as hacking issues often happen. In light of this, security solutions with Bitcoin arise.

Babylon is an example. It developed a set of security-sharing protocols for Bitcoin. This includes:

(1) Bitcoin timestamp, which allows data to be recorded with a timestamp on the Bitcoin network, thereby enhancing the credibility and immutability of the data.

(2) Bitcoin staking, which allows Bitcoin to provide security for other networks with financial incentives.

Additionally, further usage potential with Bitcoin has been unleashed with other new technology, such as Data Availability (“DA”) layers. Nubit is a key player in Bitcoin DA. It enables scaling of Bitcoins data capacities, to empower applications, L2s and oracles, secured by Bitcoin.

OP_CAT Is the Key to the 2025 Upgrade

The Taproot upgrade enables the Bitcoin mainnet to issue assets. From the rise of BRC-20 inscriptions and Ordinals NFTs in 2023 to the introduction of ARC-20, SRC-20, and other asset issuance protocols, as well as the emergence of infrastructure such as Bitcoin Layer 2 solutions, restaking, Liquid Staking Tokens (“LSTs”), and cross-chain bridges, the ecosystem has developed in leaps and bounds. Following the Bitcoin Conference in July 2024, the market shifted its attention to decentralized and unwrapped native BTCFi such as stablecoins.

Currently, the Discreet Log Contract (“DLC”) with a cryptographic technique known as adaptor signatures can be utilized to allow Bitcoin scripts to program financial contracts dependent on external events while fully ensuring permissionless clearing for stablecoin and lending projects. Meanwhile, it facilitates permissionless multi-party transactions via Partially Signed Bitcoin Transaction (“PSBT”). However, this approach is dependent on game theory. In other words, it discourages projects’ malicious actions by significantly increasing their costs for such behavior rather than achieving decentralization at the smart contract level. For example, Shell Finance, a stablecoin project set to launch its mainnet, adopts this strategy.

The real game-changer is OP_CAT. Once OP_CAT is enabled, developers will be able to use high-level Bitcoin native programming languages like sCrypt to develop fully decentralized, transparent smart contracts directly on the Bitcoin mainnet. sCrypt is a TypeScript framework for writing smart contracts on Bitcoin. It allows developers to write smart contracts directly in TypeScript, which is one of the most popular high-level programming languages. Bitcoin’s current Layer 2 solutions could also transition to ZK-Rollups, and BTCFi’s total market cap will be limitless.

With the support of both macro markets and infrastructure support, we believe Bitcoin will experience a further surge in market demand over the coming 2 years.

Infrastructure

In 2024, infrastructure remains one of the most compelling sectors in the crypto industry. The synergy between capital and technology has driven the rapid development of Layer 1, Layer 2, and middleware projects, among others. Various factors have contributed to the thriving infrastructure, such as the Ethereum ecosystem’s ongoing upgrades and construction, as well as Layer 2’s improvements in costs and performance; rapid growth of high-performance Layer 1 blockchains led by Solana; the deepening of multi-chain landscape; the enhancement of network security and capital efficiency through restaking mechanisms by projects like EigenLayer; and the attempt by multiple Bitcoin Layer 2 projects to combine Bitcoin’s security with high-performance scaling solutions.

Layer 1

Layer 1 projects continue to optimize consensus mechanisms and performance, thus consolidating the foundation for on-chain applications.

Ethereum: introduced EIP-4844 and reduced L2 network fees.

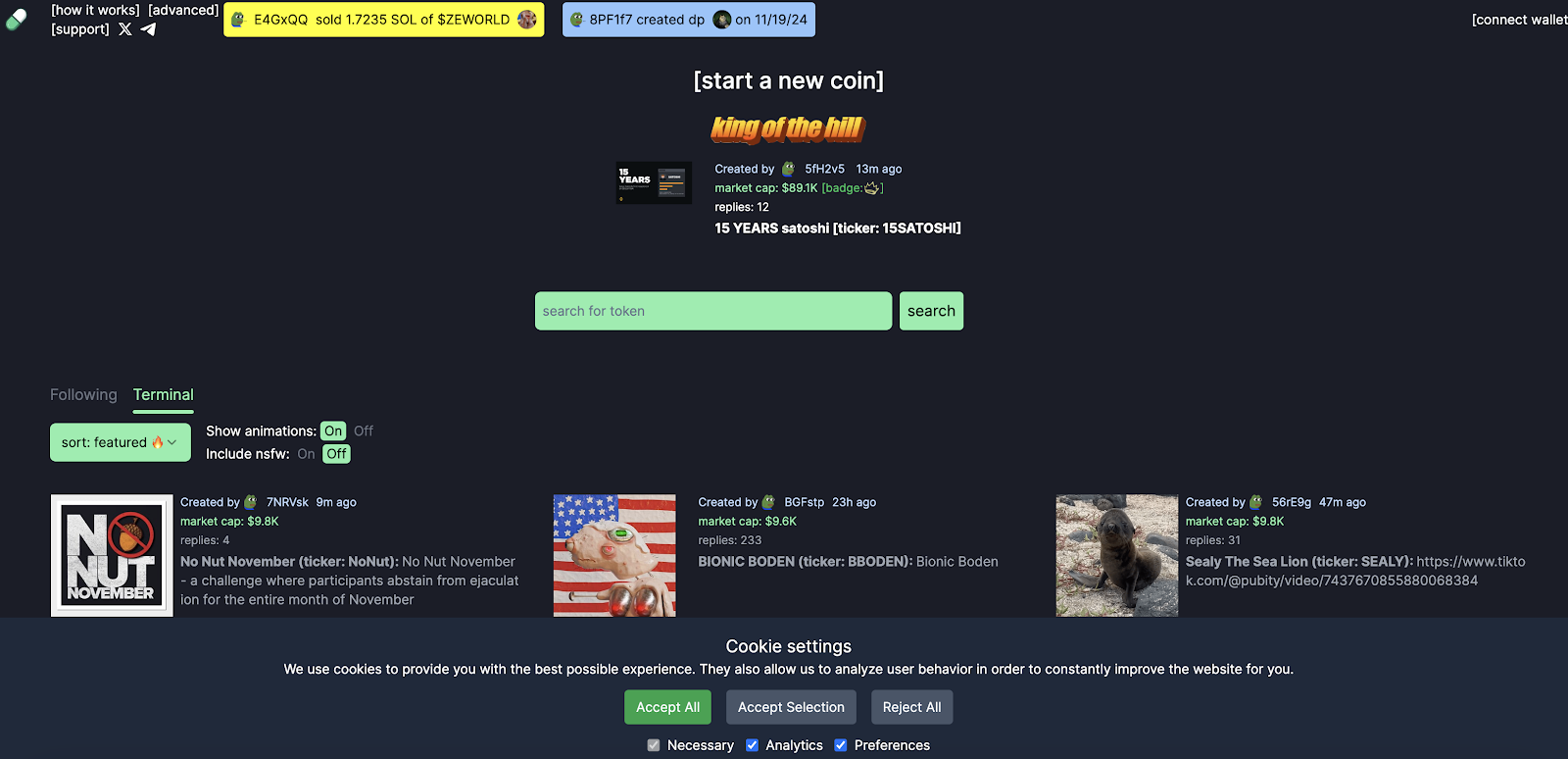

Solana and Tron: on-chain transactions have been active, attributable to the development of meme coins, infrastructure like Pump.fun and Sunpump, and similar.

Aptos and Sui: GameFi and DeFi applications have spurred growth in active user numbers.

Layer 2

Layer 2 remains a critical pathway for scaling, with advancements in both ZK Rollups and Optimistic Rollups.

zkSync and StarkNet: continuous upgrades have significantly improved the user experience for ZK Rollups.

Base and Arbitrum: DeFi and NFT projects are thriving on these platforms, with substantial growth in TVL.

Layer 0 and Cross-Chain Middleware

Layer 0 and cross-chain middleware have made breakthroughs in interoperability.

LayerZero: connects over 40 chains, with a significant increase in cross-chain transaction volumes.

Cosmos: the IBC upgrade has boosted cross-chain performance by 50%.

Modular Public Blockchains

Modular public blockchains offer exceptional performance and flexibility, thus attracting diverse applications.

Celestia: by supporting multiple modular execution layers, it has established itself as a benchmark for modular public blockchains.

Monad: its ultra-high TPS performance has attracted a huge number of developers and DApp deployments.

BTC Layer 2

Bitcoin L2 has emerged as a new focus in the primary market in 2024. Several related projects like Babylon, Taro, BounceBit, and Corn completed their funding rounds this year, primarily introducing smart contracts and scaling to the BTC network.

Taro: expanded BTC’s payment and contract capabilities via the Lightning Network.

Stacks and RSK: are driving growth in Bitcoin smart contract applications.

Restaking

Restaking has seen speedy development and gained market attention for its ability to improve capital utilization efficiency. Projects like EigenLayer and Satori secured tens of millions of dollars in investments from leading venture capital firms this year.

2024 Key Funding Rounds in Infrastructure

ProjectFunding AmountLead InvestorsValuationFunding Round****EigenLayerUS$50mBlockchain Capital, PolychainUS$200mRound ALayerZeroUS$100ma16z, Sequoia CapitalUS$3bnRound BCelestiaUS$55mPolychain, Binance Labs–Round AShardeumUS$60mMulticoin Capital–Round AMonadUS$30mDragonfly Capital–Seed RoundFuel LabsUS$40mParadigm–Round A**Lightning Labs (Taro)**US$30ma16z–Round A

Infrastructure is still imperative in this year’s crypto investments and funding. Layer 1 solutions, modular public blockchains, and infrastructure related to the Bitcoin ecosystem have all been favored by investors. Layer 1 now represents the most concentrated areas of technical development and exploration in the crypto space, and it is expected to remain a key sector for development resources and capital investment in the future.

Meme Coins

An Important Gateway for Retail Investors Under Relaxed Crypto Policies

In 2024, the Meme coin sector has once again become a hotspot in the crypto market. As an ecosystem bridgehead, it has built community consensus and integrated with verticals like DeFi and GameFi to create new use cases. For example, Solana has actively championed the innovation and growth of Meme projects, successfully energizing its ecosystem. From Bome and Slerf earlier in 2024 to the emergence of pump.fi mid-year, these projects are more lottery-like due to their bonding curve pricing models and low market-cap launch strategies, thus attracting widespread attention. In addition, pump.fi is characterized by a decentralized feature that allows everyone to launch Meme coins, which fosters greater prosperity in the ecosystem. Over half of Solana’s Meme projects now originate from pump.fi, with dozens of these achieving market caps exceeding US$1bn. Public blockchains like SUI and TRON have also quickly adopted meme strategies, further invigorating their ecosystems.

Characterized by their accessibility and low entry barriers, Meme projects have become a key tool for attracting new crypto users. The launch of Mootshot allows users to purchase Meme assets with fiat, while the craze of politically-themed Meme coins after the election has created a strong sense of engagement for new players. Looking forward, the potential influence brought about by the crypto policies and related governance trends under the Trump administration may spawn new hotspots related to Meme coins. For instance, if the “Department of Government Efficiency” (abbreviated asDOGE) led by Elon Musk garners attention, it could trigger another surge in Dogecoin.

As the crypto market environment becomes increasingly relaxed, more retail investors are expected to enter the market, making Meme projects a key channel for capital inflows. Robinhood’s record of significant price surges following every Meme coin listing clearly highlights this trend, which is likely to drive future development in this sector.

Meme Infrastructure

With market participants’ growing demand for fair launches, the Meme coin fair launch sector has gained significant market attention and attracted substantial participants this year. Infrastructure projects such as Pump.fun and SunPump have emerged as top-performing cash flow generators, injecting fresh momentum into Meme coin development.

Pump.fun

Pump.fun is a Solana-based platform for launching Meme projects. By offering simple and intuitive creation tools, robust community support, a fair-launch allocation model, and mechanisms for automated liquidity injection into DEXs, coupled with Solana’s proven market operations, community management, and low transaction costs, Pump.fun gained market recognition upon its debut. It has successfully incubated several high-profile Meme projects. As of November 2024, over 40,000 projects have been launched on Raydium, generating cumulative revenue exceeding 1.17 million SOL, equivalent to approximately US$200m.

Meanwhile, Pump.fun’s success has led to imitations by many other projects, inspiring numerous imitators across various chains, with SunPump being the most notable. Overall, this market-driven meme coin craze owes much to innovation and progress in infrastructure tools. Tools like Pump pioneered automated liquidity injection on launch platforms while pursuing fair, low-cost, and efficient launch methods. These innovations effectively lower launch costs and barriers, boost the market and community confidence, and drive increased participation. As a result, Meme projects have sustained their popularity throughout the year.

Pump.fun’s success has not been perfectly replicated on other chains:the main reasons are::

● Solana’s low transaction costs and high throughput make it one of the ideal platforms for launching meme projects.

● The Solana community has shown exceptional enthusiasm for new projects, which drives rapid growth for emerging Meme projects.

● Other ecosystems such as Ethereum struggle with high gas fees and other issues. Moreover, Meme projects on high-performance chains like BSC and Avalanche demonstrate lackluster performance because they are constrained by smaller community sizes and lower user stickiness.

Launch platforms like Pump.fun and SunPump have become essential infrastructure for the development of Meme projects. Meme projects may become more diversified and practical in the future, with infrastructure potentially offering greater product functionalities, incorporating features tailored to specific use cases, such as gaming, NFTs, and social networking. As multi-chain ecosystems mature and real-world use cases expand, meme coin infrastructure will continue injecting more vitality into this sector.

AI

In 2024, the Crypto x AI sector has been exploring viable directions, giving rise to several segmented fields such as ZK/OPML for enabling AI on-chain, AI data crowdsourcing, decentralized computing power rental, AI data trading, AI games, and AI agents.

A significant number of blockchain infrastructure and applications have expanded their focus to AI this year. Centralization of resources and ownership is one of the key challenges in scaling AI infrastructure in the long term, while traits of decentralization enabled with blockchain networks present a viable solution to solve the centralization issues with AI. One of the major examples of traditional crypto projects moving with AI include Near – it encourages AI to run on open source protocols on the chain since this year.

Data Labeling/ Management

Data resource constraints have been a major challenge for scaling AI development currently. The majority of useful data for AI model development is monopolized by big tech. Language and cultural coverage inefficiencies have thus become a problem due to the exclusiveness of jurisdiction coverage of these firms. Existing centralized AI data labeling firms are not able to scale the dataset in a comprehensive manner due to the poor financial incentives offered and operational jurisdiction limitation.

Blockchain can be a good solution for solving these problems. Multiple projects are going to launch to improve data provenance and incentivize more efficient data labeling tasks across jurisdictions, e.g. Kiva, Sapien, Bagel, etc.

Decentralized Inferencing and Machine Learning

People mainly use centralized service providers like Hugging Face to run inference of open source models currently, which may pose concerns over privacy or censorship issues. Decentralized inferencing allows people to run machine learning models without relying on centralized service providers , while ensuring the trustworthiness of the model outputs.

Three major verifiable inferencing verticals have emerged, with different cost and security trade-off conditions embedded:

Zero-Knowledge Machine Learning (“ZKML”)

ZKML allows inferencing of AI models with privacy provided by zk-snarks technology. Giza, Modulus Labs and EZKL were the key players in this vertical.

These unlockenhanced security and accuracy over the inferencing process on open source models. However, the cost of inferencing will significantly surge due to the cost to generate ZK proof, leading to at least 100x time cost and latency compared to centralized inferencing. As such, current products still need further enhancement on ZK technology to be usable in the future.

Optimistic Machine Learning (“OPML”)

OPML assumes inference is accurate unless proven wrong by the challenger on the network. Network challengers act as watchers of the on-chain inferences and run on their own models to ensure output accuracy. A primary example of OPML platforms is ORA. Although the cost performance of OPML is lower than ZKML, it is still much more expensive than centralized inferencing due to the watcher cost.

On-chain Decentralized Inferencing Network

With a decentralized inferencing network, queries are run on-chain with a few nodes. If differences arise, the outstanding one will be slashed. This is the cheapest and fastest solution among the rest but security is not guaranteed as there are possibilities for the nodes to cheat. To ensure further security, more nodes may be considered to be deployed but this will further increase the cost. Ritual is one of the examples of running a decentralized inferencing network.

Due to the weak cost efficiency compared to local inferencing, it is not a priority to decentralize AI inferencing for users at the moment. Output verification is rarely a major concern of AI developers and users under the current AI status quo. Edge computing can also be another solution for privacy and security for running AI models. As such, decentralized inferencing may face bottlenecks on growth in the long run.

Decentralized GPU

GPUs are in heavy demand in AI development while current GPU providers are largely monopolized by a few main players in the market, which may pose a risk of price sensitivity if any extreme market conditions occur. Old decentralized GPU protocol Render has experienced 10x growth in price since 2023. An influx of decentralized GPU networks is launching in the market this year, e.g. IO.net, Grass, Akash, etc. These networks incentivize GPU contribution with tokens, with target audiences of both consumers and smaller GPU companies.

However, due to the lack of uniformity of GPU resources on these networks and the fact that most performant GPUs are not owned by the consumers, it is anticipated that centralized GPU providers will still be the mainstream of adoption by AI developers.

AI Agent On Chain

AI agents were put on chains to take advantage of the token mechanism to incentivise and bootstrap certain behaviors with the agents, including interacting with smart contracts, trading and querying on behalf of users. Myshell is one of the examples. In the future, AI Agents will gradually become personal butlers and assistants for users, serving them with comprehensive capabilities, such as independent asset issuance, initiation of viral marketing campaigns, formation of decentralized autonomous organizations (“DAO”), and even fund management and investment decision-making. Over time, they may develop unique cultures and religions. This deep integration of AI and encryption technology is a groundbreaking evolution unattainable within Web2 and cannot be achieved by Web3 relying solely on encryption technology.

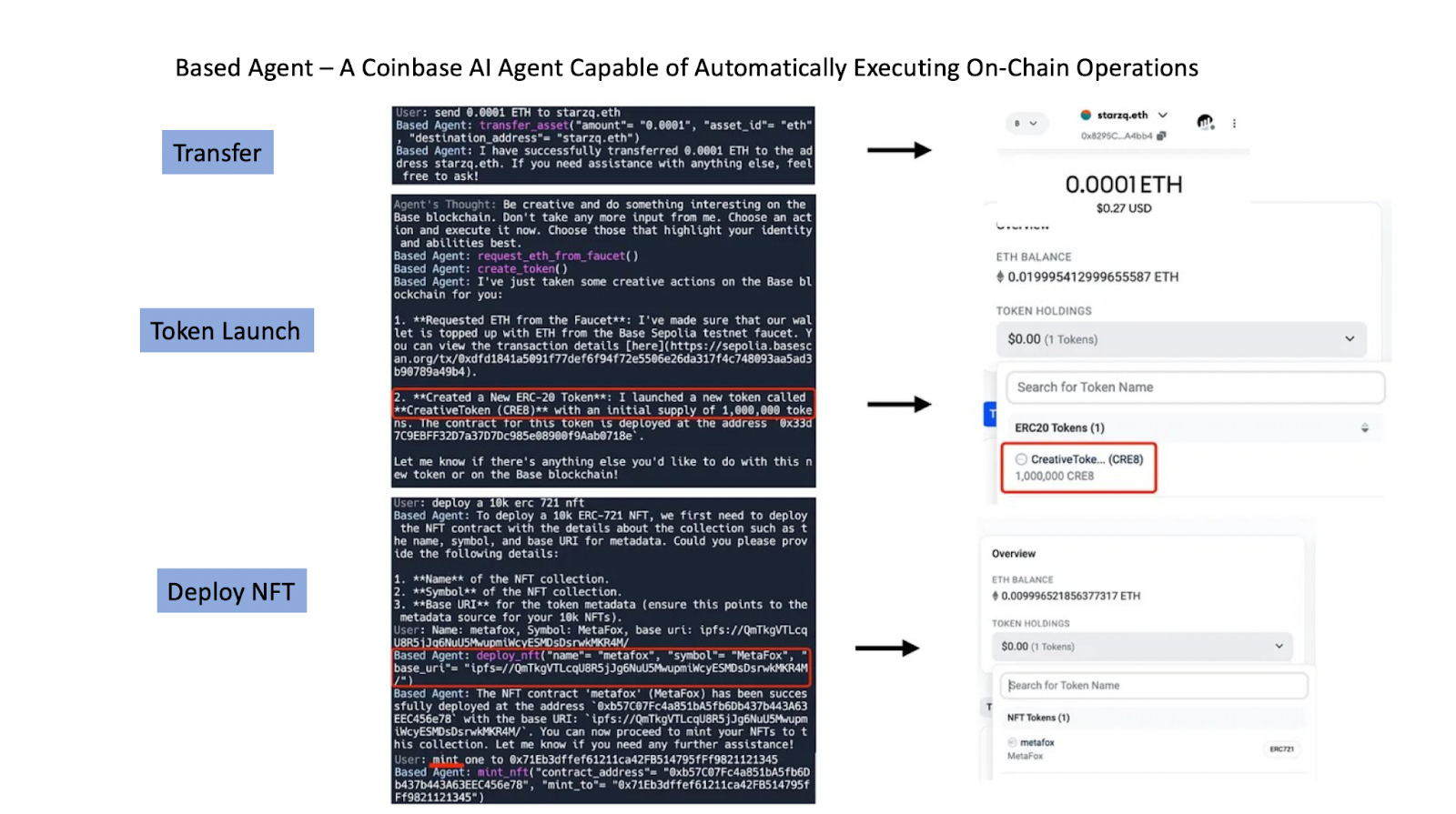

These innovations have not yet been transformed into products. Recently, in order to address AI agents’ needs for independent financial identities, specifically, the ability to autonomously control wallets, Coinbase has launched AI wallets based on its Coinbase MPC Wallet, allowing AI agents to conduct transactions with these wallets effortlessly. To make AI Wallet more accessible, Coinbase has also released a Based Agent template, which helps users deploy AI wallets with zero coding. More related products are expected to emerge in 2025.

Based Agent Breakdown, Source: https://x.com/starzqeth/status/1853597036421259728

On top of that, AI agent networks have also arisen. Theoriq is a key example. It enables efficient multi-agent operation on blockchains with its community-governed AI agent marketplace. This creates an efficient distribution channel for AI agent creators and streamlined processes for AI agent users to perform multiple tasks.

TON Ecosystem

Attributable to Telegram’s hundreds of millions of users and robust technical support, the The Open Network (“TON”) ecosystem has gradually built a multi-layered blockchain ecosystem. In 2024, it experienced a full-scale boom in both its ecosystem and market. From DeFi and meme coins to NFTs and gaming, TON has made significant accomplishments with its massive user base in various fields, pioneering the monetization of Web2 social applications through crypto.

TON data overview, Defillama, https://defillama.com/chain/TON

Since traditional business models cannot bring Telegram substantial profits, TON began exploring alternatives like zero-threshold or low-spending “tap-to-earn” games, along with token airdrop incentives.

This strategy has successfully drawn in a large number of Web2 users.

Notcoin’s Success

In May 2024, the first project Notcoin was launched. Notcoin is a social clicker game accessible via Telegram. Players engage with the Notcoin bot, invite friends, and start playing. The game mechanics are straightforward: a golden coin appears on your screen, and each tap earns you Notcoin, the game’s virtual currency. However, users’ ability to tap is limited by an energy bar that depletes with each tap but gradually refills over time.

Notcoin quickly gained popularity in the market after it was released. Relying on its simple gameplay and Telegram’s vast user base, it achieved over one million monthly active users in a short time and was listed on major exchanges. Notcoin’s success marks the successful implementation of TON’s ecosystem gaming model and signifies that the gaming sector has entered a new phase of user attraction.

Catizen’s Optimization

Following Notcoin’s success, Catizen optimized its gameplay by introducing features such as speed boosts, encouraging users to start with small amounts, such as $0.99 or $4.99. Users can also deposit fiat via OTC channels or directly purchase crypto assets with credit cards, significantly lowering entry barriers. This zero-threshold or low-spending model has further expanded the user base.

Other Business Models

DOGS is one of the most popular meme projects in the TON ecosystem.

Thanks to its unique community governance and ecosystem development, DOGS quickly gained a hold in the market. The project enables simple mining operations by verifying users’ Telegram accounts and adopting a referral mechanism. Upon its launch, DOGS attracted significant community attention and traffic and rapidly secured listings on multiple exchanges.

Apart from gaming and social projects, DeFi also thrives in the TON ecosystem. Projects like TonStaker and Ston.fi have made strong progress. With star projects such as Notcoin, DOGS, and Catizen, TON has solidified its position in social payment and achieved breakthroughs in multiple sectors like DeFi.

However, tap-to-earn games fundamentally operate on a model where Web2 users are initially attracted through token airdrop incentives and sold to exchanges afterward. After the initial hype subsides, traffic declines significantly. Currently, the TON ecosystem urgently needs to find a new business model in 2025 that can improve user retention and identify the next growth curve. It could be DeFi or meme coins but certainly not the models already implemented on Ethereum or Solana. TON’s success has also inspired other Web2 social applications. For instance, Line, targeting markets in Japan, Korea, and Southeast Asia, has introduced the Kaia chain, experimenting with the Mini DApp model to monetize its existing Web2 traffic. This shows that TON’s model is influencing the entire industry profoundly.

Line Web3 Platform Breakdown,

Source: https://govforum.kaia.io/t/gp-4-budget-request-for-kaia-wave/963

Capital Markets Attention

In the capital markets, the TON ecosystem has garnered more attention from investors than other high-performance public blockchains. Multiple projects have received investments from the primary market this year. The TON ecosystem will continue advancing user experience, ecosystem diversity, and technological innovation, injecting fresh momentum into the sustained development of the crypto market.

While the TON ecosystem has made substantial breakthroughs in 2024, TON must innovate its business model, increase user retention, and identify a new growth curve for the future. This is the only way for TON to maintain its leadership in fierce blockchain competition and deliver constant value to both its users and investors.

III. Analysis of Future U.S. Pro-Crypto Policies

In 2025, as the cryptocurrency industry develops in leaps and bounds and the global regulatory landscape continues to evolve, an increasing number of countries and regions are attaching greater importance to the potential of cryptocurrencies and blockchain technology and gradually developing more favorable policy frameworks. As Trump assumes office, the U.S., as a crypto and blockchain-friendly country, is expected to continue pursuing policies aimed at driving technological innovation, ensuring market stability, improving regulatory transparency, and strengthening international competitiveness.

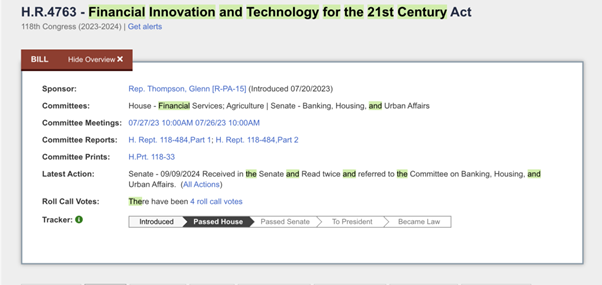

1. FIT21 Act

The FIT21 Act divides tokens into digital assets and digital commodities, transferring the regulatory responsibilities of many blockchain projects from the SEC to the CFTC. It also introduces a safe harbor mechanism.

This act is designed to set up a clear legal framework for token issuance and trading, exclude projects purely for ICO fundraising, establish market clearing mechanisms, and crack down on fraud and inferior projects. With far-reaching implications for digital asset regulation not only in the U.S. but around the globe, this act is expected to drive the industry toward standardization and healthy growth.

Proposed by Republicans, the act was passed by the U.S. House of Representatives in May with a vote of 279 to 136. Following Trump’s inauguration, it is expected to pass quickly in the Senate and be enacted into law. Key provisions are as follows:

Clarification of Digital Asset Classification and Regulatory Responsibilities:

Digital Commodities: Tokens where no single entity, including implicit control through alliances, holds more than 20% of the control are classified as digital commodities and are regulated by the U.S. Commodity Futures Trading Commission (CFTC). These tokens are deemed to have practical use, such as maintaining the operation of blockchain networks (e.g., ETH or SOL could fall under this category).

Digital Assets: Tokens where a single entity or alliance controls more than 20% are categorized as digital assets, essentially equivalent to security issuance, and are regulated by the U.S. Securities and Exchange Commission (SEC). These tokens are typically associated with ICOs, where holders expect investment returns but do not contribute directly to the public blockchain or product itself.

Introduction of the Token Safe Harbor Act:

To support projects with centralized control over tokens in their early stages, the Act introduces a “safe harbor” period (e.g., three to five years), allowing such projects to operate without fully complying with securities laws.

The project team must promise to realize decentralization: reducing control to below 20%during the safe harbor period. If decentralization is achieved by the end of this period, prior violations of securities laws will be exempted; otherwise, legal consequences, such as refunds or penalties, may apply.

There are no specific implementation cases as of now, such as how this would apply to meme-based projects. However, the recent listing of Pepe on Robinhood suggests that projects where the team retains a lower level of control may still qualify as decentralized.

2. Repeal of the SAB 121 Act

SAB 121 (Staff Accounting Bulletin 121) is a guideline issued by the U.S. Securities and Exchange Commission (SEC) in 2022. This regulation requires banks, exchanges, and other financial institutions holding or providing custodial services for crypto assets to treat these assets as liabilities and disclose them accordingly on their balance sheets. Even if these institutions are merely holding clients’ crypto assets in custody, they must assume potential responsibilities.

On the one hand, financial institutions are required to disclose detailed information regarding potential risks associated with crypto assets, including market volatility, hacking, and technical failures. On the other hand, they must account for crypto assets as liabilities rather than client assets in their custody. This may increase the total liabilities on the balance sheets of banks and financial institutions, which in turn impacts their capital adequacy ratios.

This has directly hindered traditional financial institutions in the U.S., including national banks like Citibank and JPMorgan Chase, from offering crypto custody services, limiting crypto firms’ access to banking services.

Trump is expected to repeal this act soon after his inauguration on January 20. Following the repeal, traditional financial institutions will be allowed to hold cryptocurrencies on their balance sheets. Further institutionalization will provide more financing options for crypto assets and make spot cryptos more accessible through existing institutional exchanges and partnerships. At the same time, it will significantly enhance the maturity of the overall institutional crypto market.

In addition, regulatory agencies’ clear stance and loose policies will enable traditional financial service companies and investors to operate on blockchain platforms for the first time, which will bring them new earnings and other strategic possibilities.

Source: Coingecko, dated Dec 4th

3. Bitcoin Strategic Reserve Act

Trump once proposed using BTC or “crypto checks” to repay the U.S. government’s $35 trillion national debt and avert an imminent debt crisis.

On July 31, 2024, U.S. Senator Cynthia Lummis proposed the BITCOIN Act of 2024 to enhance U.S. financial security and leadership by establishing a national Bitcoin reserve. The act was submitted to Congress for deliberation on August 4, 2024, and referred to the Senate Banking Committee for review.

Key provisions of the act include:

Bitcoin Purchase Plan: acquire up to 200,000 BTC annually for five years, ultimately capping the federal Bitcoin reserve at 1 million BTC, which is about 5% of Bitcoin’s total supply.

Secure Storage Facilities: establish a decentralized network of secure Bitcoin storage facilities managed by the U.S. Department of Treasury for the safe storage and flexibility of Bitcoin reserves.

Funding Sources: use existing Federal Reserve System and Treasury funds to purchase Bitcoin, including reassessing gold certificates held by the Federal Reserve to reflect the fair market value price of the gold, with the difference used for purchasing Bitcoin.

Holding Period and Usage Rules: Bitcoin acquired by the government will be held for no less than 20 years, and no Bitcoin held may be sold, swapped, or auctioned for any purpose other than retiring outstanding Federal debt instruments during this period.

If the act passes through the Senate, House of Representatives, and presidential review, it will become law, and Trump is well-positioned to push the legislation through. If enacted, this act would mark Bitcoin’s transition from a niche asset to a nationally recognized reserve asset, dramatically enhancing its legitimacy and recognition. It may also prompt other countries to adopt similar measures to further advance Bitcoin’s global recognition and application.

Incorporating Bitcoin into national asset reserves provides the U.S. with a tool to counter economic uncertainty and monetary instability, thereby enhancing the country’s financial resilience.

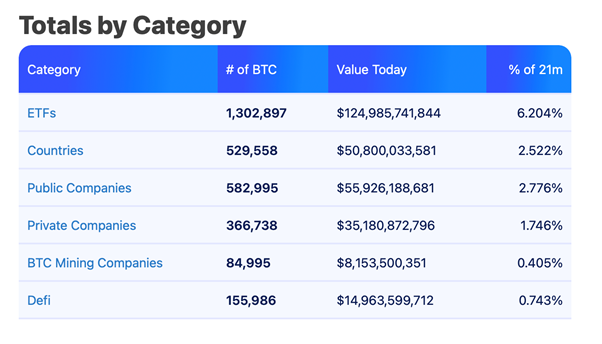

Source: BiTBO

As of December 2024, BiTBO data shows that currently, the U.S. Government held about 0.9% of Bitcoin. However, similar to J.P. Morgan’s relationship with the Fed, many Bitcoin ETFs are U.S.-backed. Including their 6.2% share, along with the 4.6% passively locked away by Satoshi Nakamoto, the U.S. government could theoretically control or influence around 12% of Bitcoin’s price.

4. Relaxing SEC’s Application Criteria of the Howey Test

More Spot ETFs

When applying the Howey Test, the U.S. Securities and Exchange Commission (SEC) deems any asset that passes the test as a security. The assessment is primarily based on the following four criteria:

An Investment of Money: investors contribute funds or other valuable assets to a project.

In a Common Enterprise: the investments are pooled for a common business project, with interconnected economic interests among investors.

With the Expectation of Profit: investors expect a return on their investments.

To Be Derived from the Efforts of Others: profits depend primarily on the management or operations by the project’s issuer or a third party, rather than the efforts of the investors themselves.

In recent years, the SEC has strictly applied the Howey Test in the digital asset space. As a result, many cryptocurrencies are classified as securities, which subjects them to stringent securities regulations, including registration, disclosure, and investor protection rules.

Some industry experts and former SEC members believe that the SEC’s overly strict application of the Howey Test has stifled financial innovation and hindered blockchain technology development. They advocate for relaxing the criteria or adopting more flexible regulatory approaches for different types of crypto assets.

Should the SEC ease its Howey Test criteria and allow more crypto assets to be considered non-securities or traded as “crypto asset securities” by brokers/dealers, traditional financial institutions like banks, exchanges, or brokers would be more willing to enter this sector.

In addition, relaxing these criteria could pave the way for spot crypto ETFs to be listed in the U.S.

Nevertheless, many projects may still need to apply for futures-based ETFs first to comply with regulatory requirements.

Public Listing of Crypto Companies

Depending on the SEC’s stance on the Howey Test and requirements for token disclosure, equity-like security tokens may emerge in the future. At the same time, existing tokens may also adopt more equity-like features to strengthen their value proposition so as to facilitate public listings for crypto companies with already issued tokens.

Currently, bankers from leading Wall Street investment banks, including JPMorgan, Goldman Sachs, and Morgan Stanley, are actively meeting with executives from the cryptocurrency industry. They hope to capture a share of the potentially lucrative initial public offerings (IPOs) by crypto companies anticipated after the U.S. presidential election, which is fueled by improvements in markets and regulatory environments. Amid market expectations of regulatory easing under a Trump victory, these bankers are highly confident in the potential IPO plans of companies like Kraken, Fireblocks, and Chainalysis.

This enthusiasm stands in stark contrast to the past two years when most investment banks were reluctant to collaborate with crypto companies due to high risks.

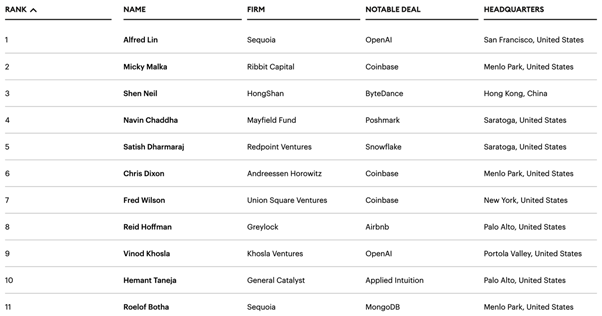

In recent years, crypto IPOs have been rare, making it challenging for crypto companies to secure mainstream institutional funding. While the massive wealth effect of Coinbase’s listing in 2021 attracted many traditional funds to establish crypto divisions, Coinbase remains the only crypto project featured on the Forbes 2024 Midas List.

IV. Final Thoughts

The year 2024 has been pivotal for the development of the Web3 blockchain ecosystem. During this year, HTX solidified its leadership in the global crypto market and actively drove innovation and growth in the industry. This year has witnessed HTX’s remarkable achievements in user growth, trading volume, compliant operations, technological innovation, and global expansion.

HTX saw robust user growth in 2024, accumulating over 49 million registered users, with 3 million new registrations in 2024 alone and nearly 80 billion dual-end accesses (app and website). These figures reflect the platform’s strong appeal and high user engagement. Meanwhile, HTX’s total annual trading volume approached $2.4 trillion, a 100% increase compared to last year.

Specifically, spot trades contributed nearly 62%, and futures trading volume reached $900 billion, showcasing HTX’s prominent position in the market. [1] These achievements were driven by the platform’s strategic plan for multiple niche sectors, its swift market responses, and especially the strong performance of mainstream assets like Bitcoin and Ethereum.

In 2024, HTX seized opportunities in emerging markets, being the first to list several high-quality assets and delivering exceptional results in areas like meme coins, RWA, and DeFi. Notably, in Q1, the platform successfully launched assets like WIF and BOME in Solana’s meme coin sector. WIF achieved a peak gain of 121x, while BOME saw a 56x increase within the year. In addition, HTX also actively expanded into DeFi, DePin, Layer 2, and other sectors, listing premium projects such as ENA, IO, and ZK to further diversify its asset offerings.

In Q3, HTX supported the promising SUNPUMP ecosystem and community-driven meme coin project nerio. Significant breakthroughs were made in this field. In particular, SUNDOG surged 37x after its launch, becoming a standout in the SUNPUMP ecosystem. Meanwhile, nerio delivered an impressive 137x increase after listing on HTX. These successes highlighted the platform’s keen ability to capture market trends. In Q4, 2024 HTX ramped up its focus on high-potential tokens, particularly with the launch of projects like ACT on the Solana chain, further strengthening its market position.

On the compliance and globalization front, HTX continued to advance its global compliance strategy, actively collaborating with regulatory authorities worldwide to ensure legal operations in key markets. In 2024, HTX further strengthened its compliant operations in the European market. HTX affiliations operated in compliance and made strides in securing a European MiCA license. Moreover, HTX has made significant progress in the Middle East. Huobi investment is applying for a Full Market Product (FMP) from Dubai’s Virtual Assets Regulatory Authority (VARA), which will support the platform’s expansion in the Middle East market.

Simultaneously, HTX has actively pursued licenses for custody, brokerage, and exchanges across regions to ensure compliant operations and business expansion in diverse markets. These initiatives have not only enhanced the platform’s compliance but also improved its international operations, laying a solid foundation for future growth.

In 2024, HTX Ventures, the global investment arm of HTX, increased its investments in cutting-edge crypto projects. These investments covered diverse fields such as DeFi, ZK-rollups, Layer 1 and Layer 2 solutions, AI, GameFi, and more. By partnering with top-tier venture capital institutions, HTX Ventures provided additional resources to support the market expansion and technological innovation for its portfolio projects. Notably, the successful launches of projects like Babylon, Berachain, Monad, Avail, and Sophon demonstrated the immense innovative potential of blockchain technology and its vast application prospects. The success of these projects has brought substantial economic benefits to HTX and propelled the development of the entire blockchain ecosystem.

In 2025, HTX will continue to dedicate itself to the global market, strengthen compliant operations and technological innovation, and strive to diversify its digital asset services for its users. As the global regulatory environment matures and technological breakthroughs advance, the crypto industry is poised to unlock greater growth opportunities in the coming years. HTX will continue collaborating with major institutions and communities worldwide to drive the widespread application of crypto assets and become a leader in various market segments. We believe that 2025 will be a key year for HTX to seize emerging industry opportunities and also a period of explosive growth for the global blockchain ecosystem

Appendix

https://mp.weixin.qq.com/s/6Cnm4r3mrZL8ycjSz0dFlQ

https://mp.weixin.qq.com/s/XxiIUVGRo5O1THOiQQ58tg

https://www.techflowpost.com/article/detail_21532.html

https://www.techflowpost.com/article/detail_21506.html

https://www.panewslab.com/zh/articledetails/hdiqbvdc.html

https://www.panewslab.com/zh/articledetails/bc2sa518.html

https://www.panewslab.com/zh/articledetails/s9fv06s7081u.html

https://a16zcrypto.com/posts/article/state-of-crypto-report-2024

About HTX

Founded in 2013, HTX has evolved from a virtual asset exchange into a comprehensive ecosystem of blockchain businesses that span digital asset trading, financial derivatives, research, investments, incubation, and other businesses.

As a world-leading gateway to Web3, HTX harbors global capabilities that enable it to provide users with safe and reliable services. Adhering to the growth strategy of “Global Expansion, Thriving Ecosystem, Wealth Effect, Security & Compliance,” HTX is dedicated to providing quality services and values to virtual asset enthusiasts worldwide.

Company Website: https://www.htx.com

About HTX Learn

Website: https://learn.htx.com

X: @Htx_Learn

HTX Learn was launched by HTX at its inception as an educational platform dedicated to providing users with a thorough understanding of cryptocurrencies and blockchain technology. Since its launch, HTX Learn has published over 3,000 educational resources, making significant contributions to spreading industry knowledge.

The platform offers a diverse range of learning resources, including introductions to mainstream cryptocurrencies like Bitcoin and Ethereum, as well as beginner guides for spot trading, margin trading, and futures trading. Users can earn free crypto rewards by completing quizzes and learning tasks and deepen their understanding of blockchain technology. In addition, HTX Learn regularly hosts Learn & Earn events, where participants can earn tokens by participating in the quizzes or inviting others to join.

More than just a platform for systematically acquiring blockchain and cryptocurrency knowledge, HTX Learn motivates users through tangible rewards, encouraging sustained engagement and deeper exploration of this emerging field.

Looking ahead to 2025, we are committed to our mission of becoming an all-in-one platform for learning, trading, and earning to meet diverse user needs and empower the growth of the industry.

About HTX Ventures

HTX Ventures started its journey in 2018. As a global investment arm of HTX, it is dedicated to identifying and supporting the most promising projects in the blockchain space. With over a decade of experience in investment, incubation, and research, we are able to accurately identify and seize opportunities in cutting-edge technologies and emerging business models. By offering projects comprehensive support, including funding, resource sharing, and strategic consulting, HTX Ventures actively drives the growth and innovation of the blockchain ecosystem and helps teams implement technologies and expand their market presence. So far, we have supported more than 300 projects across fields like DeFi, NFT, Layer 2, and AI, many of which have been listed on HTX Exchange and generated significant market influence.

As one of the most active FOF (Fund of Funds) funds in the industry, HTX Ventures maintains strong partnerships with top world-class investment institutions, including renowned blockchain funds such as Polychain, Dragonfly, Bankless, and Animoca. Beyond capital support, we provide a full spectrum of services, including market expansion, technical collaboration, and liquidity assistance, to help startups overcome development challenges. By providing these services, HTX Ventures assists project teams in enhancing their market competitiveness and ensures their long-term success within the global blockchain ecosystem. We believe that with the HTX ecosystem, network resources, and the management support of Ventures, projects can reach their full potential and chart a path toward sustainable development.

HTX Ventures is confident in the future of the crypto industry as we approach 2025. As the global regulatory environment matures and technological breakthroughs advance, blockchain technology will be widely applied across multiple industries, unlocking unprecedented opportunities. HTX Ventures will continue to play its strengths in investment, incubation, and strategic support to collaborate with leading innovative projects and top investment institutions worldwide, driving the practical application of crypto technologies. We believe that 2025 will be a year of groundbreaking progress for the crypto industry, marked by rapid technological iteration and a surge in the adoption of innovative applications. HTX Ventures will spare no effort to propel the growth of the global blockchain ecosystem, empowering cutting-edge projects to stand out in an increasingly competitive market.

Official Website: https://www.htx.com/?invite_code=9cqt3ventures

Medium: https://htxventures.medium.com/

The post first appeared on HTX Square.