While Bitcoin’s rally has been remarkable, it has not come without profit-taking from long-term holders (LTHs). Over 461,000 BTC has been spent to date, following the break of the 73,666 ATH last month, as LTHs capitalise on gains far above their realised price of $24,912. While there is elevated distribution pressure, it remains contained compared to historical peaks in March 2021 and March 2024. These movements suggest a healthy, yet temporary, stalling of momentum, with the broader market likely to absorb selling pressure and continue upward in the medium term.

The broader cryptocurrency market, which excluding Bitcoin and Ethereum are known as the Total3 index, has also achieved new cycle highs, driven by surging investor sentiment. Total3 experienced a 23.2 percent trough-to-peak increase last week —the largest move since April 2021. Large-cap altcoins, such as Solana ( SOL), reached new all-time highs, marking a pivotal moment as they surpassed key resistance levels, including the April 2022 high.

Altcoin market capitalisation is now nearing its May 2021 peak of $984 billion, suggesting a shift in speculative capital from Bitcoin to altcoins. Historically, such rotations have signalled the onset of “alt season,” a period characterised by outsized gains in altcoins relative to Bitcoin.

Indeed annualised funding rates for large-cap altcoins are moving past the 45 percent threshold, signifying heightened speculative activity. As retail participation grows, lower timeframe volatility is expected to increase, further fuelling altcoin momentum. However, these conditions call for caution, as extreme funding rates often precede sharp corrections.

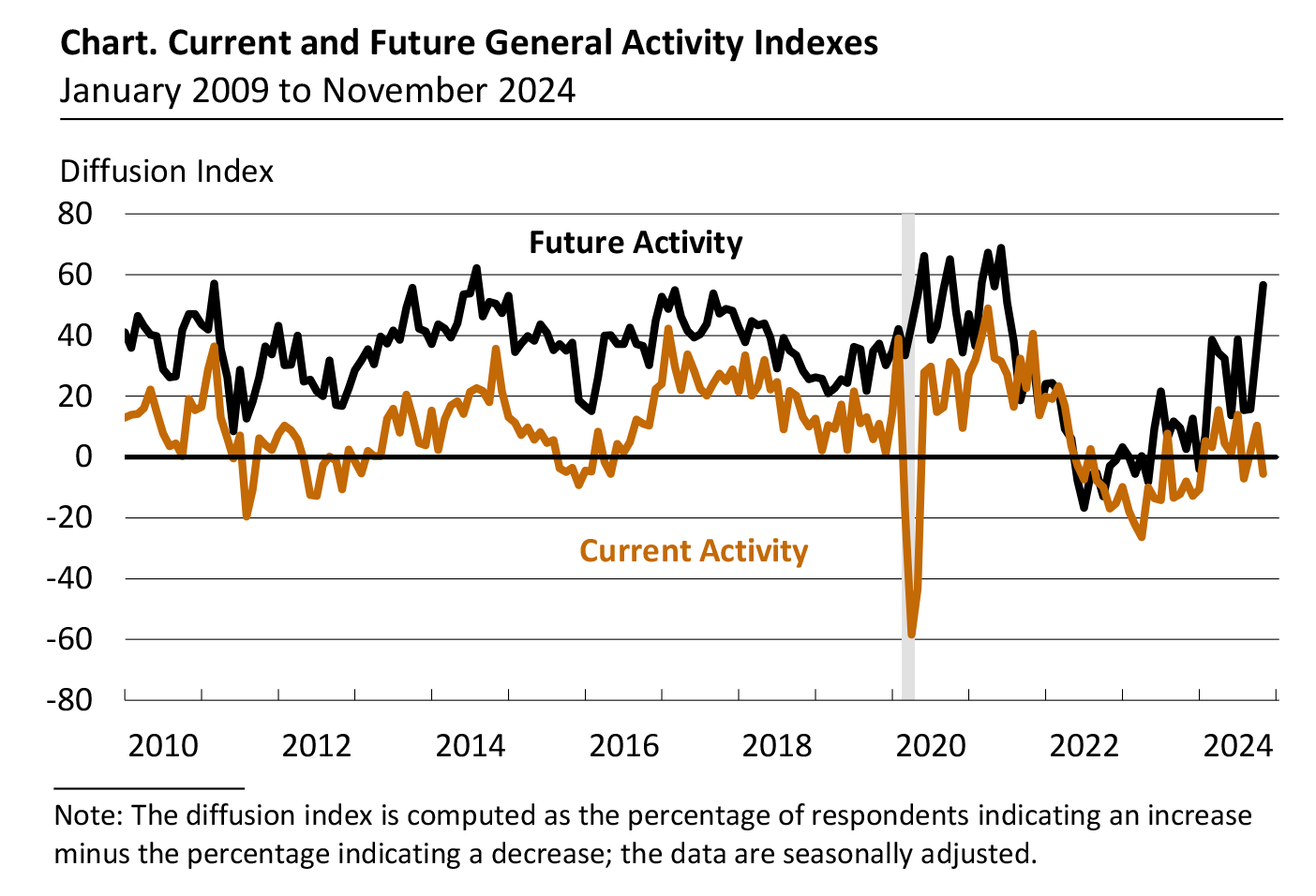

The US economic landscape is also currently shaped by mixed signals, with contrasting data across consumer sentiment, manufacturing activity, and the housing market, reflecting a blend of optimism and persistent challenges. Consumer sentiment rose in November to 71.8, driven by optimism among Republicans following Trump’s election, though longer-term inflation expectations climbed to 3.2 percent, reflecting concerns over his policies. Manufacturing activity softened, with the general activity index dropping to -5.5, but positive trends in orders and employment and strong future growth expectations highlight resilience. The housing market faces significant challenges, with October declines in housing starts and permits due to high mortgage rates and hurricane disruptions, exacerbating the nationwide housing shortage. These trends reveal optimism in some areas but persistent structural challenges elsewhere.

In crypto news last week, the SEC delayed its decision on Franklin Templeton’s proposed BTC-Ethereum combined ETF., despite approval being given for the introduction of BTC ETF options. Meanwhile, South Korea plans to implement a 20 percent cryptocurrency gains tax in 2025, but is raising the exemption threshold to 50 million won (~$35,919) to minimise the impact on small investors. Legislative votes are scheduled this month. And as mentioned, the Cboe will launch cash-settled options tied to spot Bitcoin on December 2, offering efficient tools for price exposure and risk management. These developments underscore the growing integration of crypto into mainstream finance.

Happy Trading!

The post Bitfinex Alpha | BTC Propelled by ETF Flows & Institutional Demand appeared first on Bitfinex blog.