November saw Bitcoin post a new all-time high as well as its highest monthly return — of 42.71% — since May 2019, as per the OKEx BTC Index price. As a result, we saw volumes amplified and increased enthusiasm among traders, especially as OKEx offered rewards and compensation for its loyal users.

Total derivatives trading volume grew more than 70%

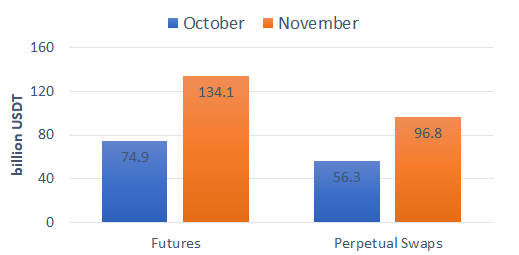

In the midst of the Bitcoin price spike, November brought a significant increase in the total derivatives trading volume on OKEx. The monthly trading volume of futures contracts saw a 79% increase — surging from October’s 74.9 billion USDT to 134.1 billion USDT. Similarly, the trading volume of perpetual swaps rose 72% month-over-month to reach 96.8 billion USDT, while options hit 1.292 billion USDT in trading volume.

OKEx leads with highest daily BTC open interest of $1.285 billion

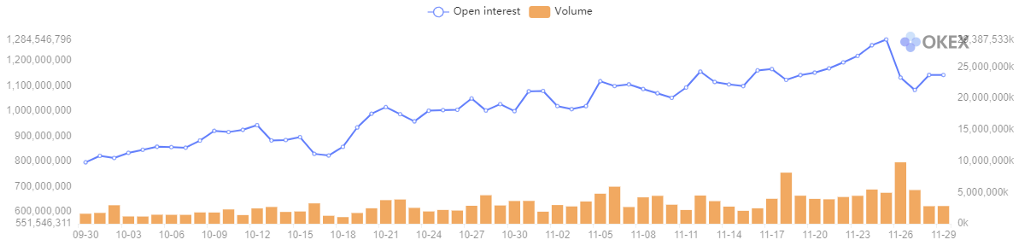

November’s average daily open interest in BTC contracts on OKEx reached $1.123 billion. The highest OI was recorded on Nov. 25, when it topped out at $1.285 billion. Data from blockchain analytics firm skew shows that OKEx leads the industry with the largest open interest in BTC contracts across all exchanges. Meanwhile, the risk reserve for OKEx derivatives reached $256 million.

OKB monthly return crossed 18% in November

The price of OKB hit a monthly high of 6.619 USDT on Nov. 23, and this brought the monthly maximum return on OKB to 65.48%. Overall, OKB realized an 18.31% monthly return in November, with a highest one-day gain of 14.27%.

Major product updates on OKEx

Multiple product optimizations and upgrades were completed in November, such as:

Visit https://www.okex.com/ for the full report.

OKEx Insights presents market analyses, in-depth features, original research & curated news from crypto professionals.

Not an OKEx trader? Sign up, start trading and earn 10USDT reward today!

was originally published in OKEx Blog on Medium, where people are continuing the conversation by highlighting and responding to this story.