Will Crypto Recover?

Dive into crypto's potential recovery, Bitcoin's 4-year cycle, and factors shaping its 2024 forecast. Discover the promising future of digital currencies.

In the world of cryptocurrency, you've probably noticed how it's often a rollercoaster ride with wild price swings, moments of excitement, and then sudden anxiety. When crypto prices take a nosedive, many wonder, "Will crypto bounce back?"

To tackle this question, we'll dive into the factors that can shape the future of digital currencies.

Historical Context

You might find it interesting to note that throughout the history of the crypto market, there have been several crashes and corrections, and each time, some have predicted the downfall of Bitcoin and other digital currencies.

However, what's really intriguing is that following each major correction, there has been a recovery, often resulting in new all-time highs.

Take Bitcoin's journey as a prime example: from its inception to its peak in late 2017, the subsequent dip in 2018, and then its resurgence in 2020 and 2021, followed by another dip in 2022. This pattern has consistently repeated itself - a swift rise, a correction, and then a rebound.

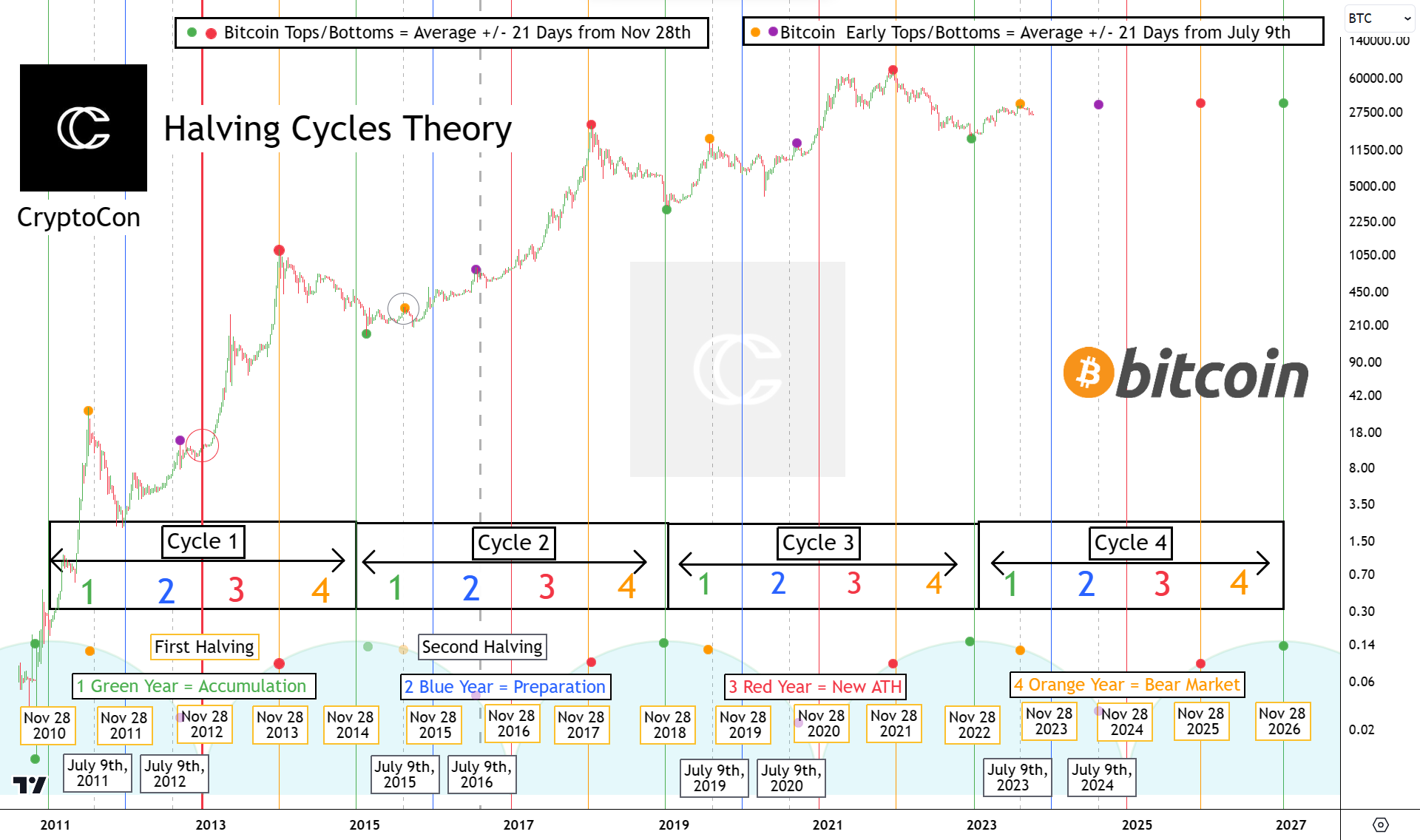

Many experts attribute this broader market trend to Bitcoin's 4-year cycle.

Understanding Bitcoin's 4-Year Cycle

You might be wondering how this "4-year cycle" affects the price of Bitcoin and what it means for investors like you. Well, it's a fascinating phenomenon in the world of cryptocurrency.

This cycle is primarily influenced by something called "halving events". These events occur approximately every four years and have a significant impact on the Bitcoin ecosystem. When a halving event takes place, the rewards for Bitcoin miners are reduced by half.

This has a profound effect on the supply and demand dynamics of Bitcoin, ultimately leading to the recurring pattern of price fluctuations. So, as an investor, understanding this cycle can be crucial for making informed decisions in the crypto market.

Now, let's dive into the specifics of this intriguing "4-year cycle." It's divided into distinct phases, each marked by a different color:

Green Year (Accumulation): This is when you'll find the best buying opportunities, with prices steadily growing toward median levels.

Blue Year (Preparation): Bitcoin starts to approach its fair value and gets closer to achieving new all-time highs.

Red Year (New ATHs): This is the last phase of the bull market, characterized by Bitcoin reaching its cycle peak and often setting new all-time highs.

Orange Year (Bear Market): Bitcoin faces a downtrend during this phase, eventually signaling the start of a new cycle.

It's worth noting that this model has a track record of accurately predicting market movements. For example, it foresaw a bottom at $15.5k in November 2022 and projected an early peak on July 13, 2023. As an investor, understanding these phases can be a valuable tool for navigating the crypto market.

What to Expect in 2024?

As we gaze into the future, historical patterns can provide valuable insights. If history is a reliable guide, we could witness parallels between 2024 and 2020 in the cryptocurrency market.

Looking ahead, it's reasonable to anticipate a substantial bull market in 2024. However, it's crucial to temper our expectations. Unlike the remarkable 700% surge Bitcoin experienced after the 2020 halving, forecasts this time are more conservative.

Experts are projecting a rise in the range of 200% to 300% following the April 2024 halving. Therefore, while optimism is justified, it's prudent to approach these predictions with a balanced perspective as you plan your investment strategies for the upcoming years.

Let’s now look at the factors that can influence the recovery.

Factors Influencing Recovery

Mainstream Adoption: As more businesses and institutions accept cryptocurrencies, their utility and demand increase. Major companies, financial institutions, and even some governments are incorporating digital assets into their operations. This widespread adoption can provide a solid foundation for recovery during downturns.

Technological Advancements: Blockchain, the technology underlying most cryptocurrencies, continues to evolve. As the technology matures and finds applications beyond just currency (like smart contracts, decentralized finance, and NFTs), the crypto ecosystem may see increased demand.

Regulations: Regulatory clarity can be a double-edged sword. On one hand, clear regulations can lead to increased institutional adoption and reduce the risk of scams, benefiting the market. On the other hand, overly restrictive regulations might stifle innovation and deter potential investors.

Economic Environment: Cryptocurrencies, particularly Bitcoin, are often seen as a hedge against inflation. If traditional currencies face devaluation or economic downturns persist, cryptocurrencies might become an attractive alternative for many.

Market Sentiment: Crypto markets are highly influenced by sentiment. Positive news and sentiment can spark rapid recoveries, while negative sentiment can trigger selloffs.

Institutional Investment: The entry of institutional investors, such as hedge funds and publicly traded companies, brings legitimacy and stability to the crypto market. Their involvement can boost confidence and promote recovery.

Investor Behavior: Investor behavior plays a significant role in the crypto market's recovery. The "HODL" mentality, which encourages holding assets during market downturns, has been a common strategy among crypto enthusiasts. The belief in the long-term potential of digital assets can contribute to their recovery.

The Future of Crypto

Attempting to predict the exact future of cryptocurrencies is akin to reading tea leaves. However, there are some general consensus points:

Cryptocurrencies are here to stay: Even if individual coins wax and wane in value, the underlying technology of blockchain has proven its worth and has found myriad applications outside of simple currency.

Volatility will continue: The cryptocurrency market is still relatively young, and it will likely continue to experience significant price swings.

Looking Ahead

Predicting the future of the crypto market with certainty is impossible due to its highly volatile and unpredictable nature.

However, looking at historical patterns, technological advancements, increasing adoption, and expert opinions, one can deduce that while the market may experience short-term corrections, the long-term potential remains promising.

In conclusion, while there's no crystal ball to predict the exact future of cryptocurrencies, the interplay of technology, adoption, regulation, and market dynamics suggests that we haven't seen the last of crypto's all-time highs.