Crypto Trading 101 | What Is Backtesting?

A detailed guide to what is backtesting in crypto trading, how does it work, and the tools to leverage the maximum gains by backtesting a strategy.

The cryptocurrency trading industry has significantly evolved in the last few years. The rising number of wallets, growing trading volume, and inclusion of traditional financial methods are some of the factors that suggest the rising adoption rate of investment in cryptocurrency assets.

From cryptocurrency bots to CFD instruments - various strategies, tools, and methods are deployed to achieve optimum results from the crypto trading experience.

In this article, we take a look at one such method known as backtesting used in cryptocurrency trading to evaluate the performance of a trade or idea. All things needed to perform a backtest will be covered.

What is Backtesting?

Backtesting is a method used in the financial markets to assess the viability of a trading plan or strategy.

The concept of backtesting is now being used in cryptocurrency trading as well.

Backtesting facilitates the evaluation of a trading strategy by testing it against the past historical market data. By leveraging historical market data, a trader attempts to understand the calculations and performance of a strategy.

At its core, backtesting is a way for traders to try predicting whether or not a strategy will be profitable when implemented with real capital. If the results of backtesting a strategy are good, they can further go ahead and apply it to a live environment. If the results are not good, they can tweak changes into their current strategy and reapply to assess its performance.

Backtesting is one of the tools, along with paper trading and cryptocurrency bots, that has gained popularity in recent times.

It facilitates a trader to thoroughly backtest their strategy before releasing it into the volatile cryptocurrency market.

While the market never moves precisely the same, backtesting relies on the assumption that markets move in similar patterns as they did historically.

Factors to Consider before Backtesting

The central idea of backtesting is that it gives an insight into the current trade using charts, patterns, and graphs from the past.

However, at the same time, it is also necessary to understand that what worked in the past may not successfully work in the future.

A successful backtest must factor in two key aspects: the overall profitability of the trade or strategy and the amount of risk. Here are some of the considerations that a trader should keep in mind so as to effectively backtest in the current market conditions.

Data - To perform effective backtesting, it is important to find the right set of backtesting data that bodes well with the current market situation. This further enables predicting the right outcomes owing to the similar market conditions.

Requirements - It is necessary to understand a trader’s key requirements beforehand. What would make the strategy more viable and which factors will falsify the basic assumptions are some of the questions that a trader should keep in mind so as to effectively use the results or change the current trading strategy.

Costs - It is necessary to factor in all the trading costs associated including brokerage fees, trading fees, slippage charges, etc so as to have a proper estimate of the final costs.

Tools - Traders may either develop their own trading algorithm or use a tool that lets them test their trade. It is necessary to use the proper set of instruments so as to determine the appropriate results.

How Does Backtesting Work?

Step 1: Fill in High-Quality Order Data

In order to effectively test the current strategy against past market data, it is necessary to have high-quality data. Moreover, the data should accurately match with the current conditions in the cryptocurrency market. Without a high-quality data order, the results may be completely inaccurate.

Step 2: Use an Automated Tool/ Build Your Backtesting Tool

Traders may choose to build their own backtesting tool. However, also keep in mind to simulate factors like trading fees, slippage, and bid-ask spread to receive an accurate result.

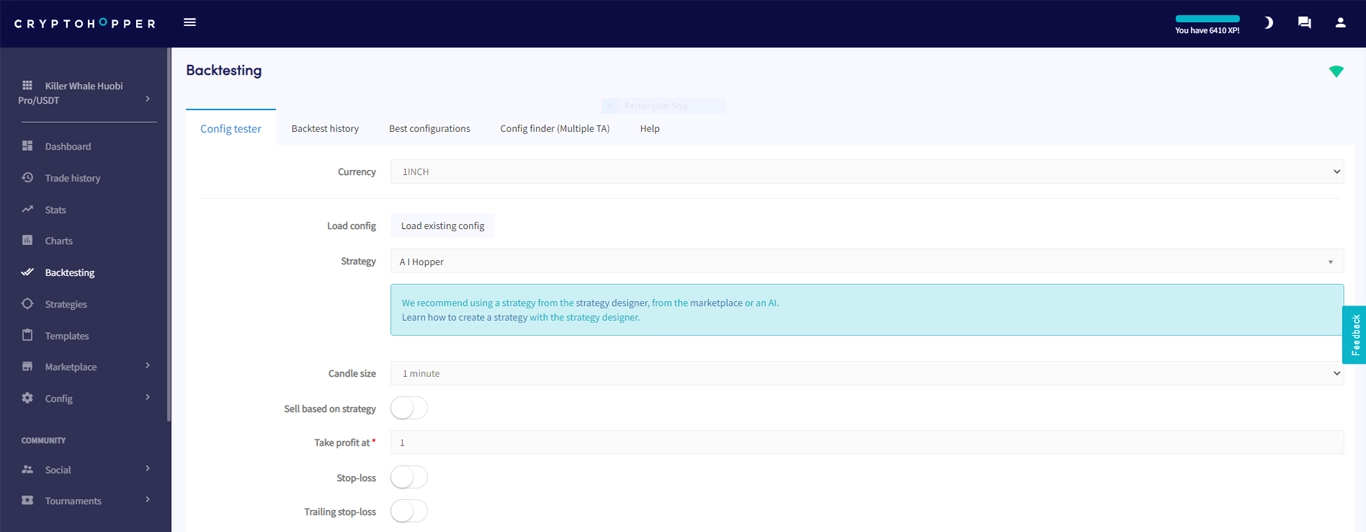

Alternatively, a trader can use automated tools including Cryptohopper to test their strategy in live markets without the hassle of building it manually.

The backtesting tool tests your strategy in combination with your configuration. It scans when your crypto trading bot would've bought and what the result would've been with your current setup. It's a perfect way to analyze if your Stop-Loss, Trailing Stop-Loss, and other settings are set correctly. Click here to learn more about Cryptohopper’s backtesting feature.

Step 3: Test

Before deploying the strategy to the actual markets, make sure that you test it repeatedly. The tool is a great way not only to test the results but also to understand the behavior of a specific strategy. Moreover, it helps in the formation of new strategies or adjusting your current strategy.

Step 4: Deploy

You can now choose to deploy the tested strategy into actual live markets. If you are using an automated bot like Cryptohopper, you can also choose to deploy it in paper trading or simulated trading for testing out its performance in live markets.

Bottom Line

Traders and analysts rely on backtesting as a tool to implement new strategies. Moreover, it helps a trader give much more insight other than a trade’s performance.

However, you should never solely rely on backtesting as a tool to interpret results and deploying them. It should be one of the tools that you can leverage to create effective trading strategies and test their performance.