Cryptocurrencies | A Guide To Crypto Exchanges

Cryptocurrency exchanges often seem like new exciting ways to trade digital assets. An avenue to generate passive income, invest in up and coming projects and seek alternative financial sectors.

But what you need to understand is the building blocks for many of these cryptocurrency platforms actually stem from traditional financial markets.

A huge number of cryptocurrency trading platforms use a Central Limit Order Book (CLOB) approach, a technology first introduced into Forex trading in 1992.

That’s 17 years before the Bitcoin launch.

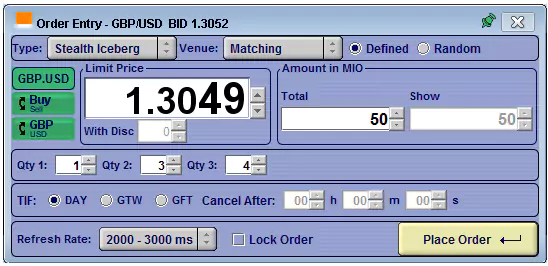

Originally designed to trade traditional currencies before stocks and derivatives, the first iteration doesn’t even look that different from today's ‘futuristic’ digital asset platforms. Granted, there’s a little bit of a 90’s Windows feel to the FX Matching program.

And what about Request for Quotation (RfQ) exchanges, well that’s a technique as old as business. Simply asking a supplier for a price. The internet, blockchains and cryptocurrencies just allow us to do it without even a phone call.

Ok, so it’s all just rebranded more accessible technology, right? Let’s throw in automation, decentralization, smart contracting, blockchains, mix up some innovation and take a look

Central Limit Order Book (CLOB) and Cryptocurrency

You will probably recognize this style of trading as CLOB is used by the biggest cryptocurrency trading platforms be that Binance, Coinbase Advanced, Bittrex or KuCoin.

CLOB brings together buyers and sellers in a central location. It connects traders enabling direct swaps while the trading platform acts as the middle man.

Users can buy from others who have placed sell orders and vice versa. The two parties never actually need to communicate as the exchange takes care of the transactions and transfers.

With two sides to the exchange, half placing ask/sell orders and the other half placing bid/buy orders it literally becomes a book of orders.

Customer orders are actively matched when they overlap. Algorithms help to organise trades, generally using price and time. Effectively it works on the best price in a first come first serve basis.

If CLOB is ‘Central’ how can decentralized CLOB exchanges exist? DCOLB?

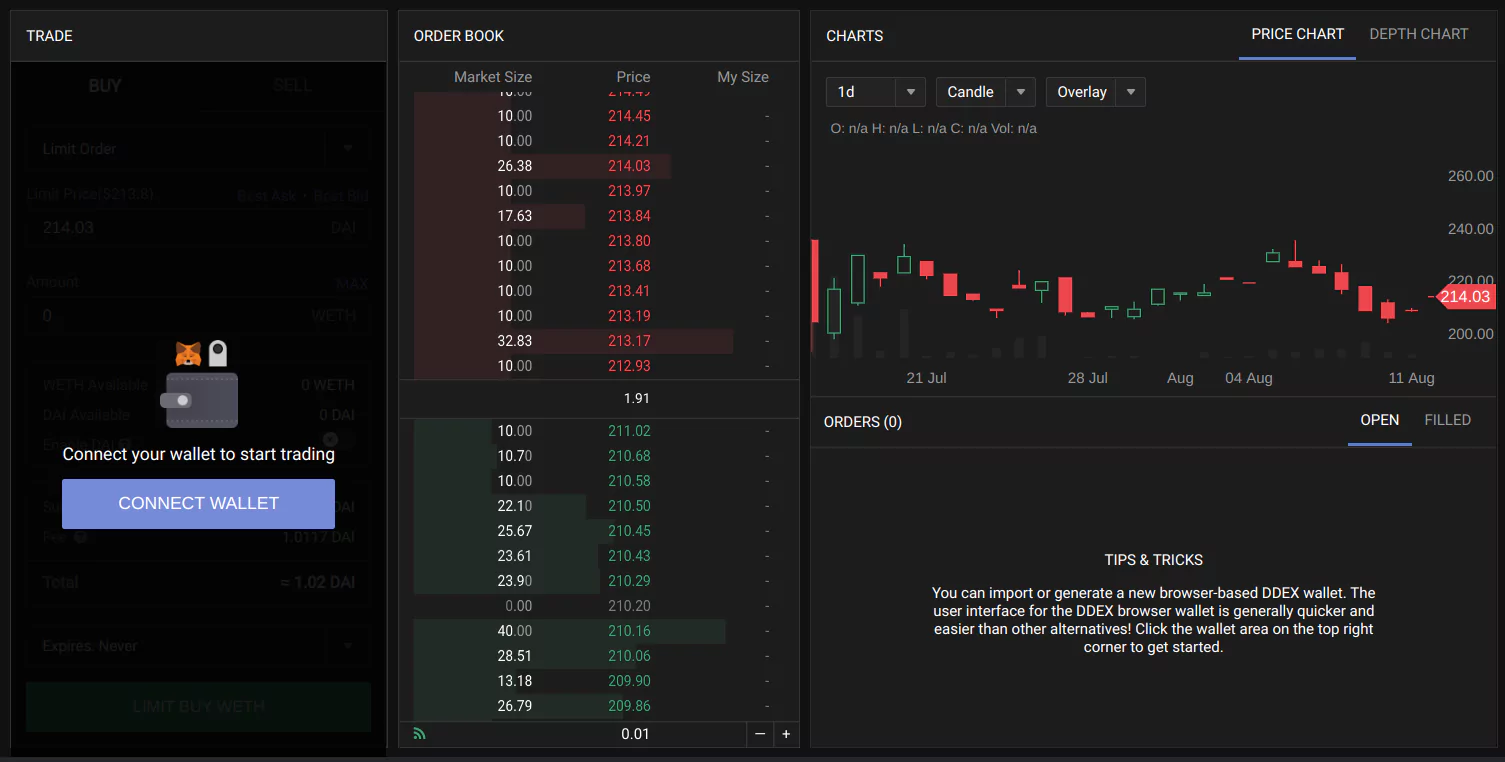

It is important to distinguish what exactly is decentralized about platforms like DDEX. One assumes that decentralization, in regards to blockchain, means no 3rd party company or human interference.

Decentralized CLOB exchanges require a central controlling party to match asks and bids otherwise it would more resemble over the counter trading.

Platforms such as DDEX still provide the order book for traders. The decentralization generally applies to the sovereignty of customer funds. Users link personal wallets directly to the order book creating peer-to-peer traders through the CLOB platform.

There is no need for the exchange to become a custodian of any funds.

Isn’t Request for Quote (RfQ) decentralized peer-to-peer trading though?

Yes, and realistically many decentralized CLOB exchanges almost create a hybrid of RfQ and CLOB approaches.

RfQ is simply asking someone for a price on a product, service or asset. You can think of it in two quite simple ways.

Pricing on-demand - like asking for a price on unmarked items in an antique store.

Personalized prices - often found with price comparison shopping. Something like insurance policies where a customer has specific requests, needs and characteristics.

Generally, RfQ is used for more complex requests with interchangeable parts and multiple transactions. This includes cryptocurrency along with other financial products.

RfQ exchange platforms provide a more distinct style of cryptocurrency peer-to-peer trading. It naturally becomes decentralized as buyers and sellers connect directly to make trades.

Examples like Airswap allow traders to connect personal wallets to the platform enabling fun sovereignty and anonymity.

This peer-to-peer trading method creates more flexibility for users. It provides the opportunity to make custom markets and trades along with added choice in payment methods. For the buyer, it can be as simple as taking the best price offered or it could be working with a regularly used trusted seller.

With cryptocurrency, many RfQ exchange platforms explore using blockchains like Ethereum to help enable extra functionality.

Smart contracting and DApps offer growing options for price makers to build more sophisticated infrastructure to provide regular competitive quotations.

Automated Exchanges: The Rise of Computers

If you’re worried about the rise of machines, computers taking over, then you can keep worrying compadre. Automated exchanges dispose of order books, shirk dealing with other humans and abolish trust issues.

Automated exchanges, like Uniswap, are built on a series of smart contracts backed by a liquidity pool.

As with all smart contracts they are set to run automatically. This means once the parameters and deterministic algorithms are set, human interference is no longer required.

The smart contracts in this case act as the automatic market maker, aka setting the cryptocurrency price backed by a pool of funds. Takers can then trade on this offer without the need for another trader to take his or her bid.

Where does the funding pool come from? Like any smart contract, it requires funds to operate. Users can deposit funds, adding liquidity into the exchange pools and earn money via transaction fees.

These platforms become so automated that no 3rd party is required to control the exchange. Removing unnecessary processes and middlemen creates a faster, more efficient platform.

And what about supply and demand, wouldn’t the price deviate from the market benchmarks? Well, yes, but that is a phenomenon of any exchange and free markets.

Arbitrage remains a key factor in aligning cryptocurrency prices on automatic exchanges. Plus even this can be automated via trading bots now. Does cryptocurrency even need humans? Who knows.

Cryptocurrency exchanges, the future

With nearly $1 billion stolen from cryptocurrency exchanges in 2018, we are still far from the final product.

In this article alone, we almost see a chronology from traditional CLOB to automation. The industry is still searching for the right balance of human interaction, decentralization and security.

The sovereignty of funds is an issue on many peoples mind who want to avoid large scale hacks. But who’s to say us individuals will be any better off safeguarding our money.

Decentralized exchanges continue to grow but remain second fiddle to the centralized powerhouses of Coinbase and Binance.

Innovation is still the primary focus in the blockchain industry, perhaps the launch of Binance DEX moves things towards new accepted features in finance exchange.

Check out our last blog: The Do's And Dont's Of Crypto Trading.