Expert traders can borrow funds to engage in margin trading on Binance Margin.

Find out the pros and cons of margin trading and how you can get started on leverage trading on Binance Margin.

Wondering how to increase your trading performance? Leverage trading strategies like margin trading can potentially increase your profits. Find out how you can do so with Binance Margin.

As you become more skilled in trading, you may wish to explore the different ways you can increase your trading performance. Consider leverage trading, a trading approach that allows investors to make spot transactions with the help of borrowed funds to amplify trading results. Margin trading is a common leverage trading strategy used by experienced traders looking to increase their purchasing power rather than be restricted by their own capital. Binance Margin lets users borrow funds to engage in margin trading to increase their position size.

Binance Margin Trading grants eligible users access to funds from the Binance Exchange for use in leveraged trades. Experienced traders looking to increase their buying power can use the Margin trading feature to amplify potential returns on long or short positions. However, leverage trading, including margin trading, involves high risks as it could potentially amplify trading losses as well. With the risks involved, it is good to always do your due diligence and read up on the pros and cons before you start leverage trading.

Pros of Margin Trading for Crypto

Maximize profits

With margin trading, you can enter the market with a bigger position, which means bigger gains on successful trades as compared to using just your existing funds. Assuming that your margin trade is successful, high leverage ratios can help you maximize your returns.

Convenience in trading

Margin trading allows you to enter positions quickly without depositing more funds to acquire the same position size. This also allows you to save time and act quickly if you are timing the market.

Portfolio diversification tool

With borrowed funds from margin trading, traders can open multiple positions with relatively smaller amounts of capital without compromising position size. This allows traders to diversify and hedge, reducing the risk of large losses by preventing traders from putting all their proverbial eggs in the same basket.

Con of Margin Trading for Crypto

High Risk

High returns are usually accompanied by high risks, and this is true for margin trading as well. While returns are potentially amplified, potential losses are also multiplied if the tide is not in your favor. With leverage trading, losses can be very damaging for your portfolio as your market exposure is increased. Unlike regular trading, margin trading could result in losses that exceed your initial investment–even a small drop in the market price can be amplified and cause significant losses.

While margin trading can be a viable option for traders looking to fast-track their trading performance, it is always to keep the risks in mind and understand how to use margin trading to your advantage before committing your capital. This includes knowing when and where to margin trade. Below, we have detailed some basic information that you should have before embarking on your margin trading journey.

When Should I Margin Trade?

When you want to increase your buying power

If you are restricted by your current capital, but hope to capitalize further on a potential trade, margin trading can allow you to increase your position in the market for magnified returns. For example, if you are interested in purchasing $1000 of bitcoin, but only have $500, you can use margin trading to do so.

When you want to diversify and hedge

If you are thinking of diversifying your portfolio into other crypto, but only have a small capital to do so, you can use margin trading to increase your buying power. Using margin trading to enter a hedged position against the crypto market can also help protect against major market downturns.

When you understand your potential losses

Because of the high risk involved, it is not recommended for beginners who do not understand the potential losses. Traders who are experienced, have understood the risks and want to attempt margin trading can do so with proper risk management strategies like stop-limit orders. in place. If you’re exploring margin trading, check out these additional resources regarding Margin Trading before you start.

Why People Margin Trade on Binance Margin

Diverse trading pairs

Binance Margin supports 600+ trading pairs, including some trading pairs that are not commonly offered.

Multi-asset collateral

Margin users are able to invest multiple assets as collateral to borrow and trade on leverage. On Binance, this can be done in the cross-margin mode. Instead of investing BTC only into a BTC-based margin trade, investors can use their BTC and ETH, or BUSD, USDT, and so on, to denominate their collateral, allowing traders to operate with more flexibility when opening trades.

Cooling-off period

In order to help users avoid excessive trading, users can temporarily suspend margin-trading-related activities for a specific period by activating the Cooling-off Period function. This is part of Binance’s efforts to encourage responsible trading and prevent compulsive trading behavior.

Insurance fund

Binance Margin has an insurance fund that protects users’ accounts when their equity (i.e. their assets minus liabilities) is less than 0, or when the user is unable to repay debts due to lack of funds in the account.

How Binance Margin Works

If you’re ready to explore crypto leverage trading, you can start margin trading on Binance with these four simple steps:

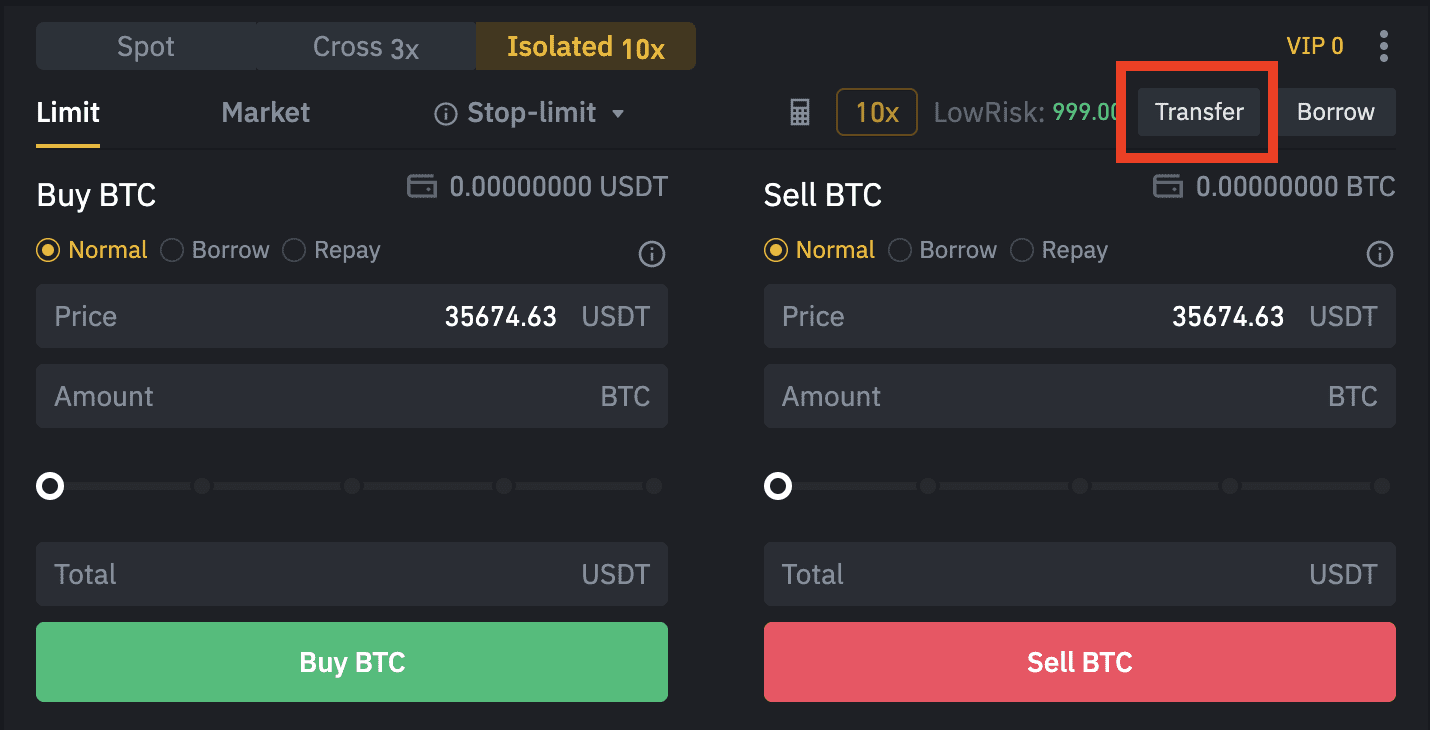

Step 1: Transfer

Under your account balance information, click ‘Margin’. After reading the margin account agreement, select ‘I understand’. Then, you will be able to transfer funds into your new Margin Trading Wallet.

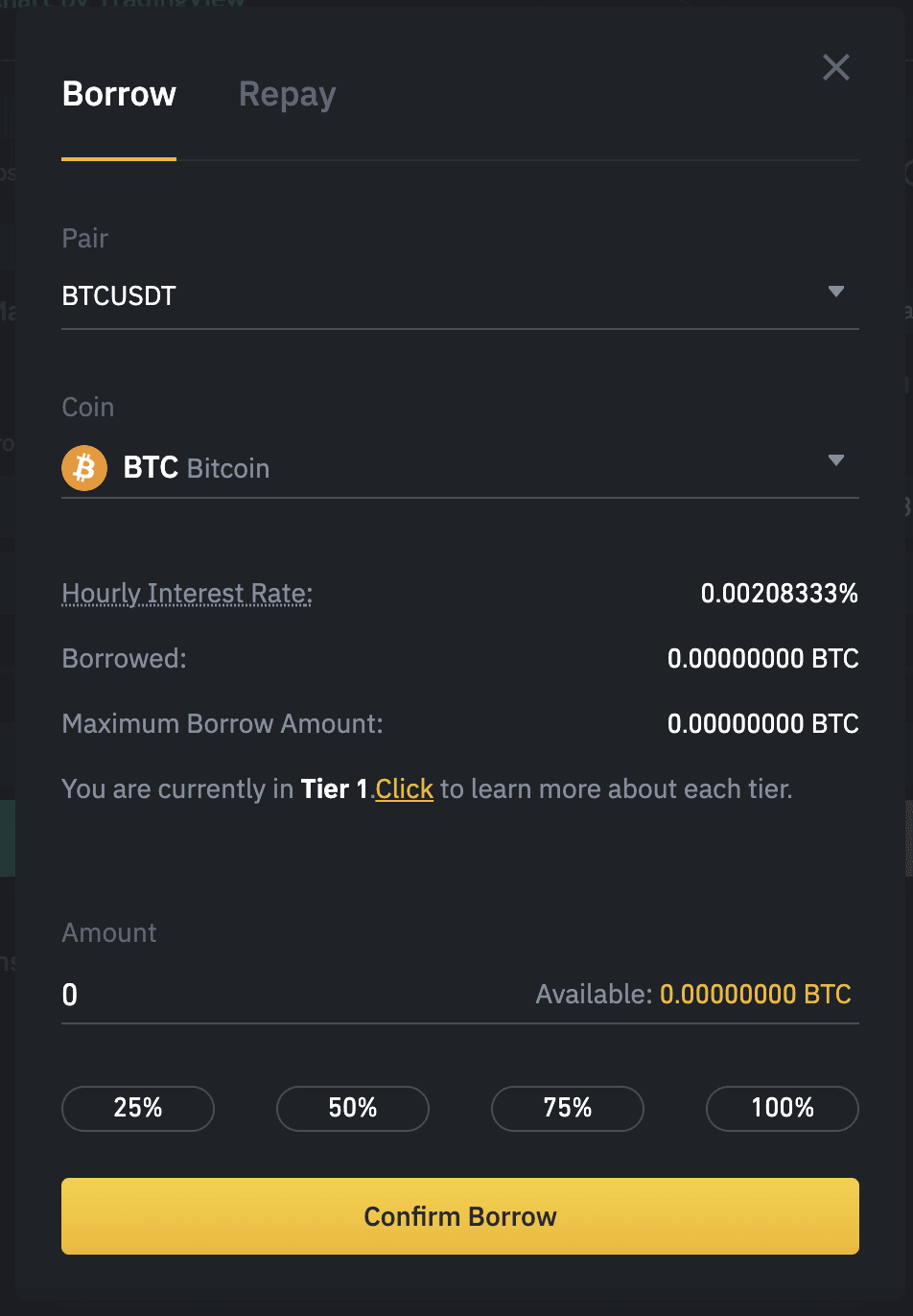

Step 2: Borrow

Click ‘Borrow/Repay’, enter the amount you wish to borrow, note the hourly interest rate, and click ‘Confirm Borrow’. The funds will be credited to your margin account, and you can check this via your Balance/Margin button.

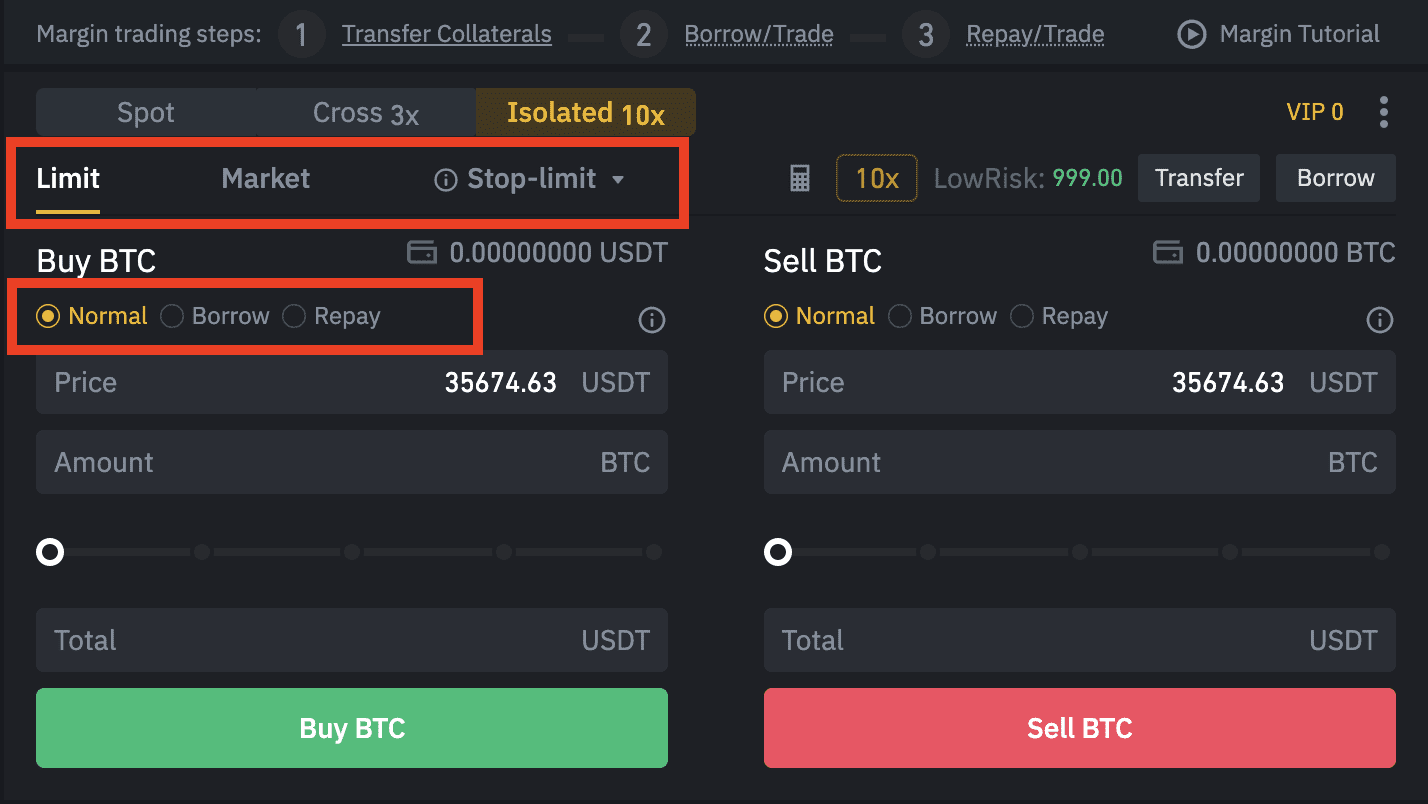

Step 3: Trade

To use your borrowed funds to trade, go to the Exchange page, select the ‘ Margin’ tab, and you can start trading.

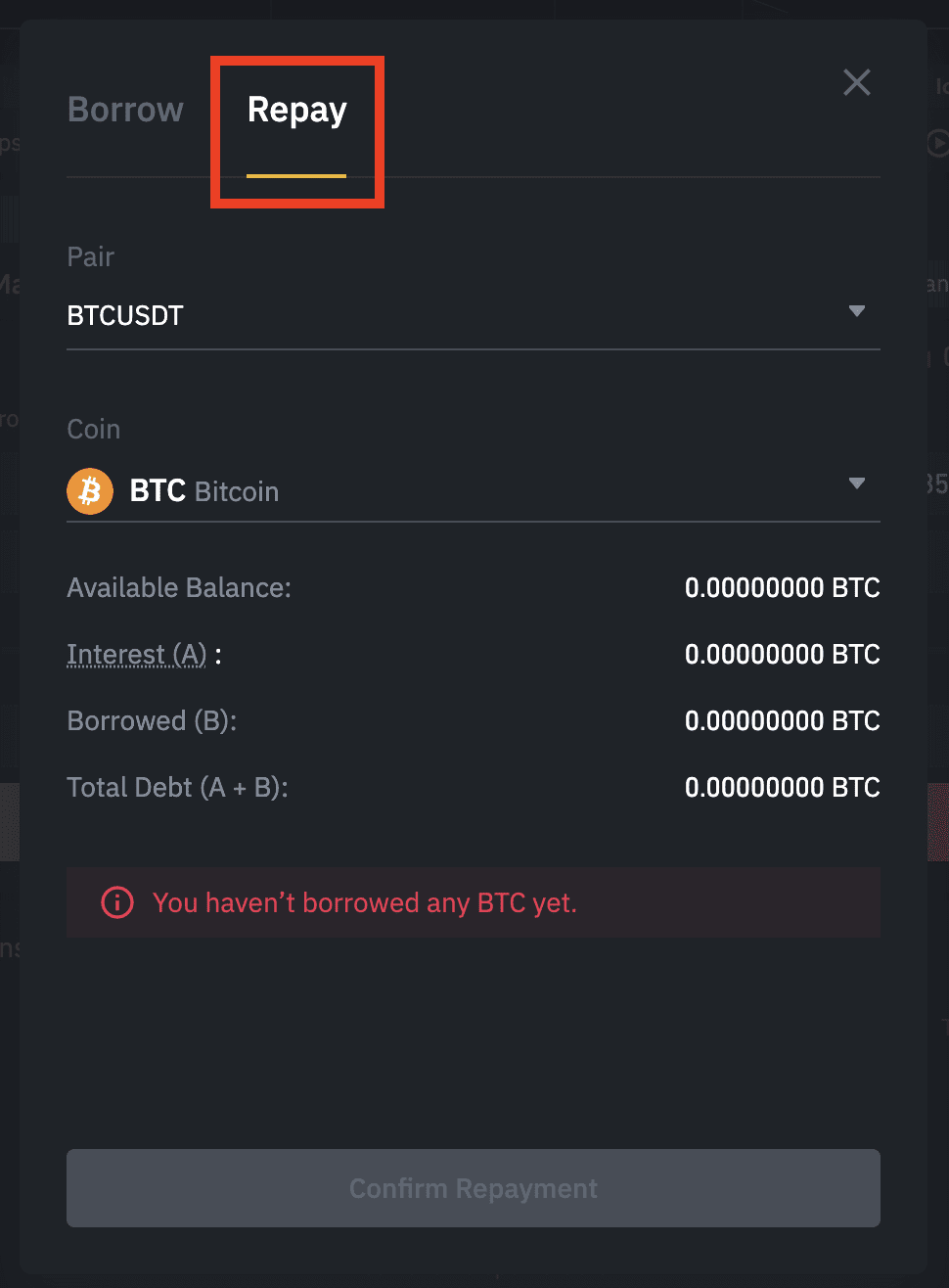

Step 4: Repay

To repay your debt, click the ‘Borrow/Repay’ button and select the ‘Repay’ tab. Select the coin and amount you wish to repay and click ‘Confirm repayment’.

If you have started margin trading, please remember to closely monitor your margin level. If the margin level decreases, you will either need to increase your collateral or reduce your loan. When the margin level reaches 1.1, the loan will automatically be liquidated, which means that Binance will sell the position(s) at market price to repay the loan. For in-depth instructions and a guide to repaying debt, visit our Academy article, Binance Margin Trading Guide.

Conclusion

There are several benefits of margin trading that spot trading cannot offer if you know how to use the tool well. With experience, caution and purpose, margin trading can be an extremely useful strategy to reach your financial goals, although it is important to always be aware of the risks involved in margin trading and leverage trading in general. For experienced traders, Binance Margin offers a wide range of options and functions that can help make your margin trading journey more fun, but more importantly, more responsible.

Read the following support items for more information:

And a complete list of Binance Margin FAQ

Disclaimer: Margin trading is highly subjected to market risk, volatility, and complexity. It is a sophisticated product and you are highly advised to exercise prudence and caution. While Binance will do its best to give you a pleasant and secure trading experience, we will not be responsible for your losses incurred from your trading activities. Please remember to do your due diligence before entering a margin trade.