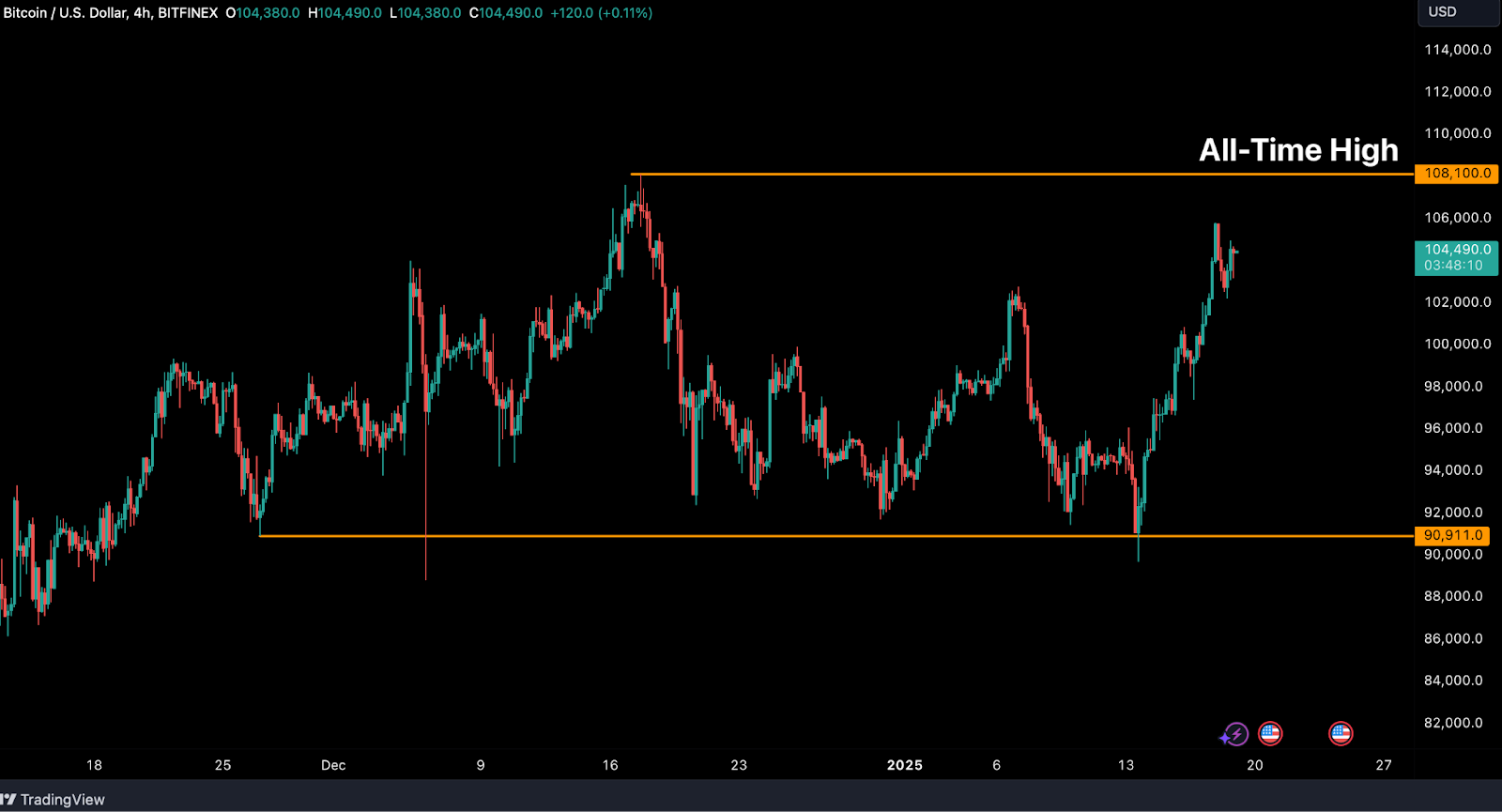

BTC/USD 4H Chart Showing the All-Time High as of Last Week

The dip below $90,000 triggered significant liquidations, with $818 million recorded on January 13th, including $592 million in long positions. Short-term holders (STHs), whose average cost basis is $88,400, played a critical role in defending the price during this correction. Historically, STH cost basis acts as a reliable support level, and last week’s trough aligned closely with this level, triggering a rebound. However, a drop below the STH cost basis could create stress, potentially driving further sell-offs.

The recovery was primarily fuelled by aggressive spot buying, as seen in the sharp rise in the Spot Cumulative Volume Delta. This metric indicated significant taker buy pressure, particularly from US-based exchanges. The buying patterns mirrored previous activity associated with MicroStrategy and ETF purchases, further reinforcing the view that institutional demand remains strong.

However, the spot buying pressure seen last week might require time for bids to replenish, potentially triggering a brief pullback before further upward momentum resumes. Bitcoin’s resilience and sustained demand position it well for continued strength in the medium term.

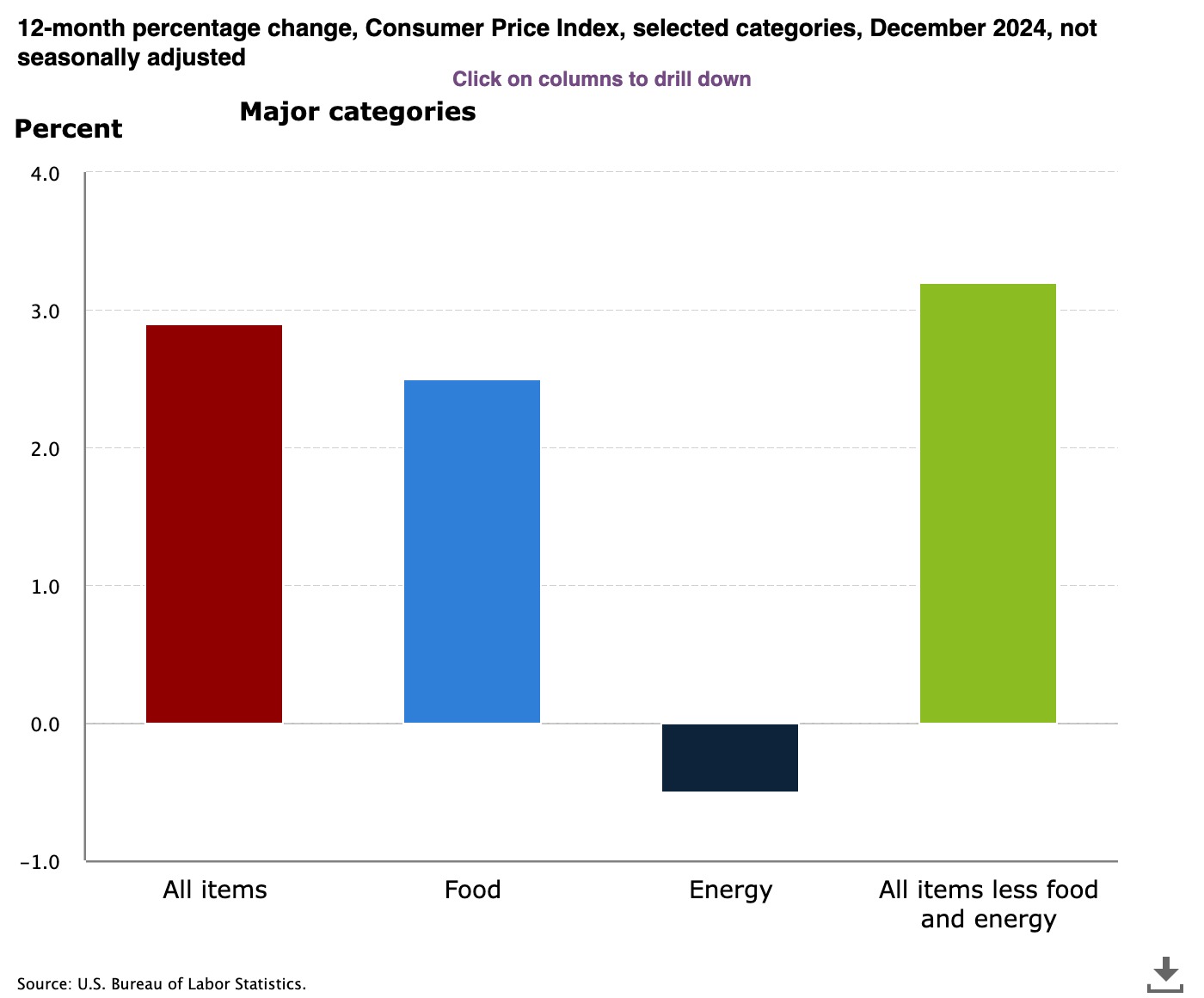

Inflation showed a slight uptick in December, with the CPI rising 2.9 percent on an annualised basis, driven largely by surges in energy prices. While core inflation remains above the Federal Reserve’s two percent target, stabilising import prices and a lower-than-expected Producer Price Index growth offers some optimism for moderating inflationary pressures. Consumer spending remained robust, with retail sales climbing 3.9 percent year-over-year in December, bolstered by wage growth and a strong labour market. However, uncertainties loom as Trump’s proposed tariffs could escalate costs for essential goods, disproportionately impacting lower-income households and potentially disrupting recent progress in inflation control. Meanwhile, the Federal Reserve appears cautious, signalling fewer rate cuts in 2025 to balance inflationary concerns with economic growth. Despite these headwinds, the resilience of consumer activity and employment strength provides a solid foundation, notwithstanding that the risks from tariff policies, labour supply constraints, and seasonal spending fluctuations could pose significant challenges.

In crypto news last week, Trump launched meme coin $ TRUMP on the Solana blockchain, stirring both enthusiasm and scepticism as it rapidly reached a valuation of $15 billion before seeing some significant profit-taking. While marketed as a symbol of support for Trump’s ideals rather than an investment, concerns over its centralisation and transparency persist, with potential implications for regulatory scrutiny and political finance. In the meantime, institutions continue to look for ways to make crypto-related assets available to traditional finance investors, with filings submitted for a spot Litecoin ETF and a proposed Onchain Economy ETF focusing on digital asset infrastructure. These filings reflect a broader push for mainstream crypto adoption following the success of Bitcoin and Ethereum spot ETFs. The OnChain Economy ETF seeks to provide exposure to businesses shaping the blockchain economy, offering a diversified entry point for investors amid growing interest in the sector.

The post Bitfinex Alpha | Markets Rebound but Beware ‘Sell-the-News’ Trading appeared first on Bitfinex blog.