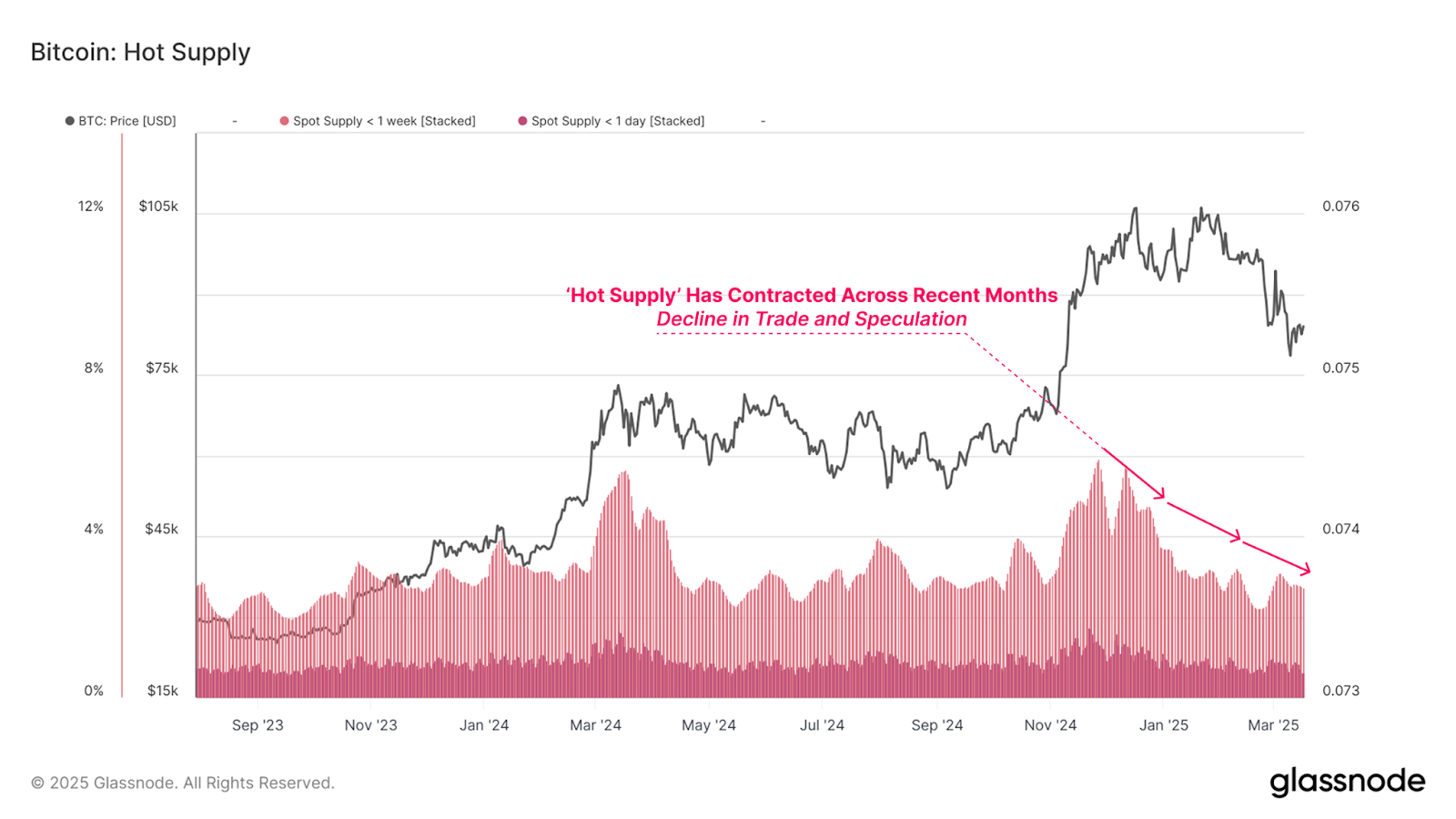

As volatility compresses and liquidity thins, Bitcoin’s short-term price action has increasingly mirrored the behaviour of a macro-sensitive asset. A contraction in the Hot Supply metric—from 5.9 percent in December 2024 to 2.8 percent today—underscores the cooling of speculative participation, with fewer coins changing hands and liquid capital retreating from the market. Similarly, daily exchange inflows have also dropped over 54 percent from their cycle peak, reflecting broader investor hesitancy and declining appetite for near-term risk. As Bitcoin consolidates near the lower end of its range, it remains clear that meaningful price movement will likely depend on renewed institutional flows and macro clarity, particularly around liquidity conditions and central bank policy.

The US economy is also showing signs of mounting pressure. Trade tensions, slowing growth, and cautious consumer sentiment converge to create an increasingly fragile outlook.

The Federal Reserve also held its benchmark interest rate steady at 4.25–4.5 percent, reflecting a wait-and-see approach amid rising uncertainty.

Although industrial production surged in February, this was driven largely by defensive inventory stockpiling ahead of anticipated tariffs. While this bump in manufacturing output appears positive, the Fed views it as temporary and rooted in precautionary actions rather than sustainable demand.

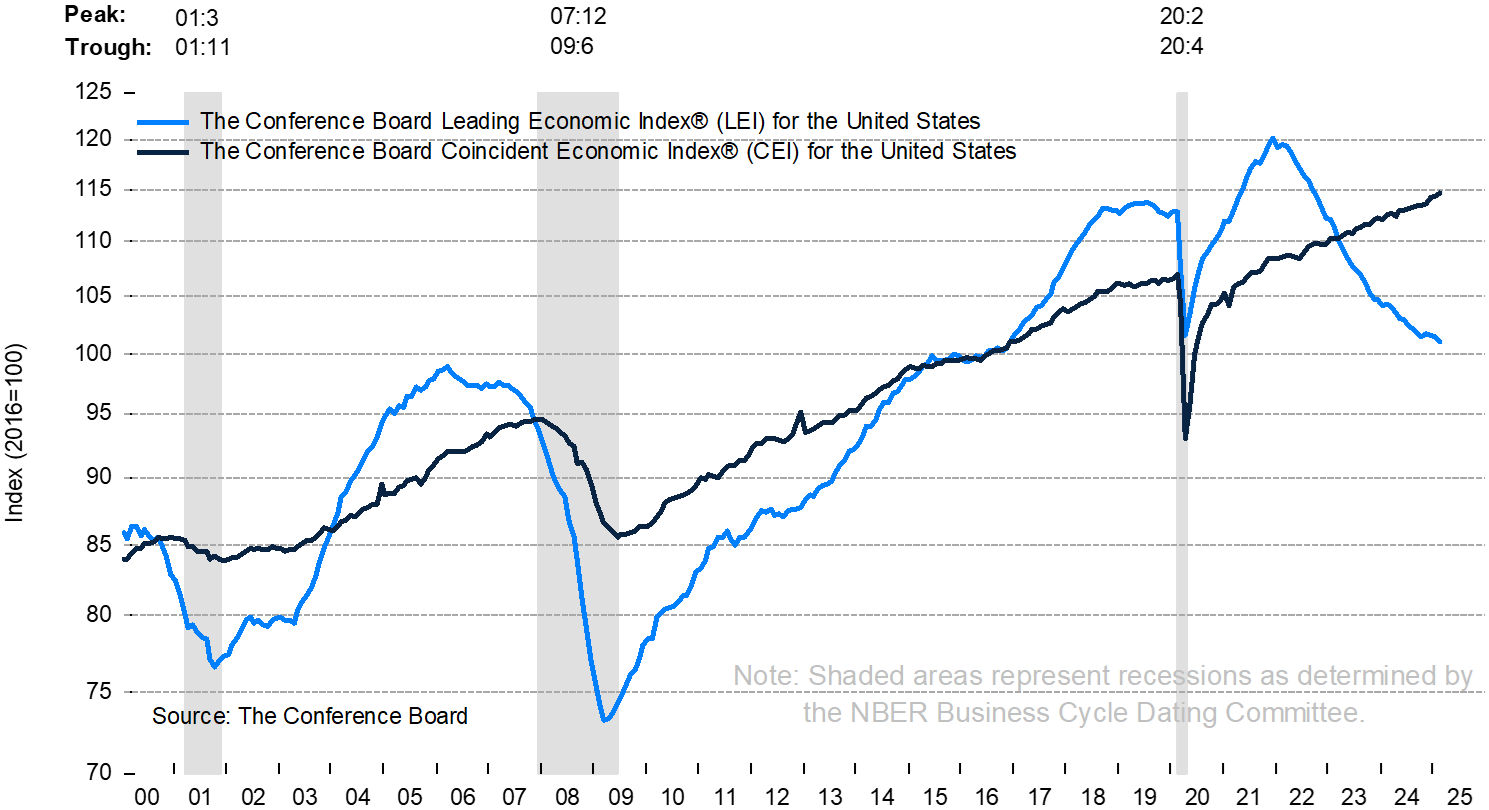

Meanwhile, the Conference Board’s Leading Economic Index fell for the third consecutive month, weakening economic fundamentals. Consumer expectations, new manufacturing orders, and equity market declines—particularly in tech and small-cap stocks—paint a picture of growing risk aversion. Bond yields also slipped following the Fed meeting, reflecting investor expectations for slower growth and a possible policy pivot.

Across the crypto industry, we saw major shifts last week, signalling growing institutional support and regulatory clarity. The SEC officially dropped its lawsuit against Ripple Labs, ending a multi-year legal battle over the status of XRP. The move triggered a 13 percent price surge and renewed investor confidence.

In another legal reversal, the US Treasury lifted sanctions on Tornado Cash after courts ruled that the initial ban overstepped legal bounds. This marks a win for privacy advocates and reignites debate over the limits of financial surveillance.Adding to the momentum, President Donald Trump became the first sitting US president to address a crypto summit, calling for stablecoin legislation, confirming the Strategic Bitcoin Reserve, and pledging regulatory clarity. Together, these developments reflect a maturing industry entering a new phase of legitimacy and growth.

The post appeared first on Bitfinex blog.