Is High-Frequency Trading Good for Crypto Investors?

Cryptocurrencies have never needed a reason to be an outlier. Born out of the 2009 financial crisis, Bitcoin and the cadre of currencies that would follow, offered a new, trustless system for p2p transactions that was as much of an experiment as it was a promise for things to come.

In many ways, Bitcoin was the antidote to a struggling financial system.

Of course, today, cryptocurrencies are much more closely integrated with the traditional financial system than they were a decade ago.

Many big banks offer Bitcoin derivatives in the form of futures contracts. Others are developing crypto’s underlying technology, the blockchain, as the next iteration of their IT infrastructure.

However, until relatively recently, cryptocurrencies have maintained an independent edge on their assets.

Institutional investors have long-dominated other investment vehicles like stocks, bonds, and commodities, but cryptocurrencies were different. They were a single man’s game as hedge funds and trading houses didn’t assert heavy influence in the market.

Now, crypto markets have more than 150 active hedge funds actively involved in crypto trading, and other institutional investors are entering as well.

This trend became even more prominent as crypto markets, along with most other investment assets, surged throughout 2019.

Since cryptocurrencies outperformed most other investments, many institutional investors saw cryptocurrencies as a way to gain an edge.

While many predict that this transition will be a boon for Bitcoin, it brings many ancillary additions that are profoundly impacting crypto markets.

A Transition Toward Technology

Among institutional investors, technology is the name of the game. Computer-driven algorithmic and high-frequency trading is the dominant expression of investment managers, simultaneously increasing the potential for lucrative returns while limiting participation to those with the best technology.

For instance, JP Morgan Chase estimates that fundamental discretionary traders only execute 10% of its trading volume.

In the US, 60-70% of all trades are algorithmically driven, which means that computers are playing a prominent role in the investment landscape.

Whether or not this is a good thing is a matter of debate. As The Wall Street Journal reported in 2011 when algorithmic trading was near its zenith: “Research has shown that algorithmic trading broadly makes prices less volatile and reduces the overall cost of trading.

But the capacity of the high-frequency-trading firms to buy and sell large amounts of securities in fractions of a second has raised fears that ordinary investors are being left in the dust.”

Indeed, algorithmic trading isn’t entirely a matter of right and wrong, but it is problematic when it comes to attainability since people’s access to powerful technology dictates the likelihood of their investment success.

Now, as institutional investors enter the crypto space, they are bringing this same technology and its accompanying disparity, something that doesn’t sit well with all investors.

To put it simply, high-frequency trading might be a sign of serious investor interest, but it can open an opportunity chasm that artificially creates winners and losers.

This notion is antithetical to the crypto ethos, inviting critical debate about the pros and cons of high-frequency trading.

The Pros and Cons of HFT

In some ways, the presence of algorithmic trading in crypto markets is a sign of legitimacy for the relatively nascent crypto market, placing digital currencies on par with other investment assets that use the same technology.

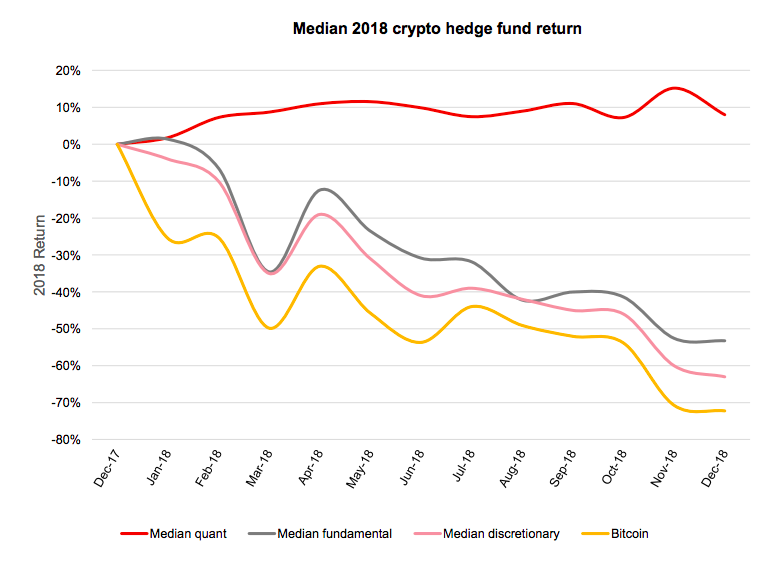

Unfortunately, like in traditional markets, there is evidence that some benefit more than others from this functionality.

Several cryptocurrency exchanges are offering colocation, an arrangement where an investor’s server is placed in the same location or cloud as the exchange, providing them faster trading times that offer an edge when executing high-frequency trades.

According to CoinDesk, colocation “allows investors to execute trades up to a hundred times faster, giving them an edge over the rest of the market.”

With some investment firms executing as many as 800,000 high-frequency trades a day using these services, it’s clear that crypto markets are no longer dominated exclusively by the individual traders that initiated the movement.

Moreover, those with proximity access gain an artificial, potentially unfair advantage when accessing rapidly shifting token valuations.

When some users have an unfair pricing advantage, markets lose some of their credibility as non-algorithmic traders essentially compete on a different playing field than technologically-driven investment entities.

What’s more, these strategies don’t have an unblemished record. Crypto markets, already known for their sometimes incredible volatility, can become even more turbulent when high-frequency trading is deployed.

Crypto investors already struggle with the sometimes opaque and seemingly arbitrary price movements for many crypto assets, and those symptoms can be exacerbated when computers are the leading conduit for crypto pricing.

Conclusion

Regardless, crypto exchanges are unlikely to roll back these features any time soon.

Seeing algorithmic trading as a competitive differentiator in an increasingly crowded exchange market, many platforms are focused on making these features more prominent, not less.

However, that doesn’t mean that individual investors can’t participate in this movement. Different platforms such as Cryptohopper automated trading platform equips individual investors to apply algorithmic trading strategies to crypto assets.

With powerful features, including mirror trading, paper trading, backtesting, and trailing stops, anyone can grow their portfolio while keeping up with the capabilities of bigger trading operations.

High-frequency trading isn’t a moral issue, and many experts carry different beliefs about its merits and efficacy, regardless of the market. However, in our data-driven, technology-oriented investment landscape, it should be regarded as a tool, not a weapon. Most importantly, equal access mitigates the disparity between large, well-resourced investment firms and the individual investors who initiated and still participate in crypto investments.

When everyone can invest with the same advantages, it’s not a matter of good and bad, right and wrong.

Instead, when everyone can access powerful financial tools, crypto investing becomes about skill, ability, and perseverance – traits that undoubtedly define the crypto movement and those who participate in it.

Check out our last blog: The Ultimate Crypto Trading Checklist For Beginners 2019.