Bot Trading 101 | How To Set a Stop Loss

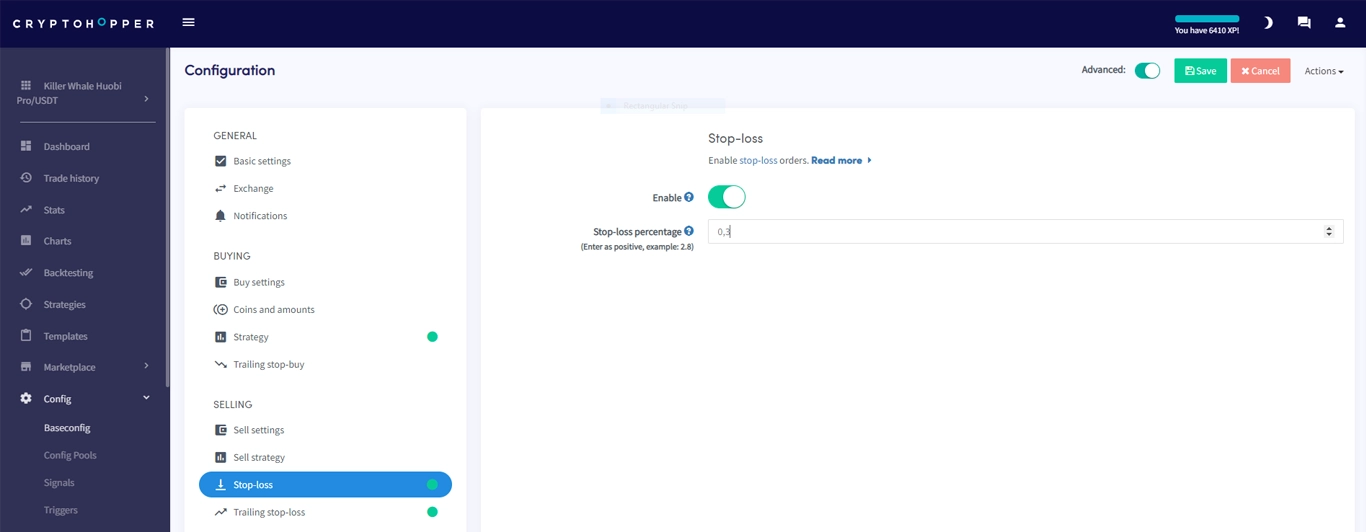

A stop loss is an order that closes negative positions to limit the loss of a trade. In other words, it acts as a life vest, so you don't sink too much under water. They are set below the price for long positions (buys) and above the price for short positions (sells or short-selling), to close the trade when it has lost a specific amount determined by you.

A famous sentence amongst traders is “cut your losses short and let your winners run”. It isn’t a secret that any trader should try to sell the winner trades at its highest point, but what about cutting your losses short? This question can be answered with just one term, stop loss.

Every time that we open a position we have, or we should have, a profit target and a zone where we decide that we have already lost enough and, therefore, we close the position.

This is implemented through stop losses. A stop-loss means that we acknowledge that we have been wrong opening a trade, we accept it and take the loss.

Cutting losses on time is key to avoid burning your trading account and freeing funds that are locked in old and negative positions.

Since it is such an important element that can even determine whether a trading strategy is profitable or not, how do we know where we should place it? Usually, this is determined by two factors: Our strategy and the risk we are willing to take on.

What determines the stop loss position?

Strategy

A trading strategy should not only specify buy points, but also the sells or closing strategy. Depending on it, the stop loss will be set at a different level.

For instance, a strategy might set the stop loss, for instance, right below the last pivot, when the MACD makes a bearish crossover or simply with a fixed percentage. Whatever of both it is, your strategy will determine the sell zone as well.

Risk Management

What commonly differentiates a profitable from a non-profitable trader is risk management.

Having the ability and knowledge to have a risk/reward ratio that will make your strategy consistently profitable is an art.

You might have a strategy that obtains positive trades 70% of the time and still lose money if there isn’t proper management of the risk per trade. On the other hand, a very accurate risk analysis can make profitable a strategy with, for example, 60% of negative trades.

The essence behind it is that your strategy might be obtaining a large number of good trades, but if your risk/reward ratio is 1:3 (meaning that in every negative trade you lose three times as much as for the positive ones), your account will sink deeply into loses.

Stop losses are a fundamental part of your trading strategy, they can be so important that it will even determine your profitability.

Finding a consistent strategy to spot the best buy point through long sessions of backtesting goes hand in hand with accurate placement of the stop loss.

Check out our last blog: Top 10 crypto trading tips 2019.