It has also been a fruitful year for HTX Ventures. Benefiting from the continuous innovation in the industry, this year we have supported 28 leading projects and funds that are exploring new frontiers of crypto utility. These projects span a range of sectors, including DeFi, BTCFi, ZK-rollups, modular infrastructure, Layer 1 & 2 solutions, AI, SocialFi, GameFi, and more.

Looking ahead, HTX Ventures has identified five key sectors that showed encouraging progress in 2024 and will be closely monitored in 2025: the Bitcoin ecosystem, infrastructure, Meme, artificial intelligence (“AI”), and the TON ecosystem. This report provides an in-depth examination of the current landscape, challenges, and future opportunities within each sector, complemented by a macroeconomic overview and market projections.

Bitcoin Ecosystem

Market Dominance

LTM Bitcoin dominance has increased from 45.27% to 56.81%. This implies most of the liquidity of the crypto market is currently lying mainly on the Bitcoin ecosystem and increasing.

Source: CoinStats

Bitcoin spot ETFs now account for 5.3% of the total Bitcoin supply, with holdings rising from 629,900 BTC at the beginning of the year to 1.24 million BTC, an increase of 613,708 BTC. This growth has elevated ETF holdings from 3.15% to 6.25% of the total Bitcoin supply in just twelve months. (data dated as of 4 Dec 2024)

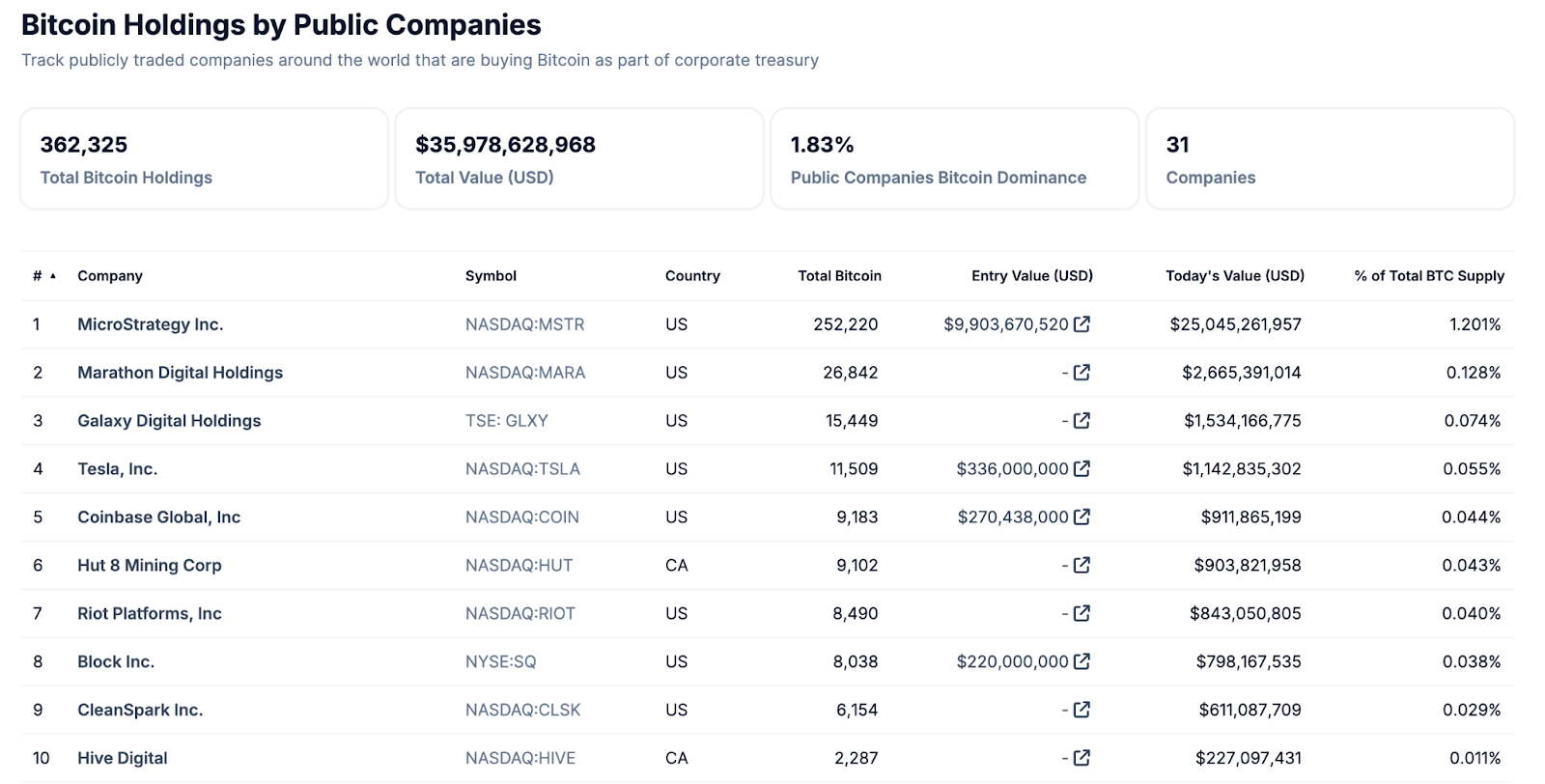

A new market trend has emerged – with Bitcoin as the core asset, spot ETFs as liquidity channels, and U.S. listed companies represented by MicroStrategy (MSTR) as the vehicles to absorb unlimited dollar liquidity. As a result, it is increasingly essential to further develop Bitcoin’s ecosystem and enhance capital utilization efficiency, which can also boost BTC’s demand and drive up its price.

Layer 2

77 BTC L2s have been launched/ fundraised over the past 3 years. Existing bitcoin L2s from the previous cycles including Lightning, Stacks and Liquid Network had experienced a significant surge in trading volume and token prices in 1H 2024 with the BTC ETF narrative. Further technical development has also been witnessed from these previous cycle L2s. Various L2 solutions on Bitcoin have emerged, including Spiderchain (Botanix), ZKRollup (Nexio and Critea), EVM compatible chains (BOB and B Squared), Sidechains (Merlin), etc. Current TVL on BTC L2 has reached US$3 billion, contributed by 19 BTC L2 projects. Assuming all Bitcoin L2s are launched in the coming years, approximated TVL on all BTC L2s could reach at least 2 to 4 times further, indicating a TVL of US$6 billion to US$12 billion.

Layer 1/ Execution Layer

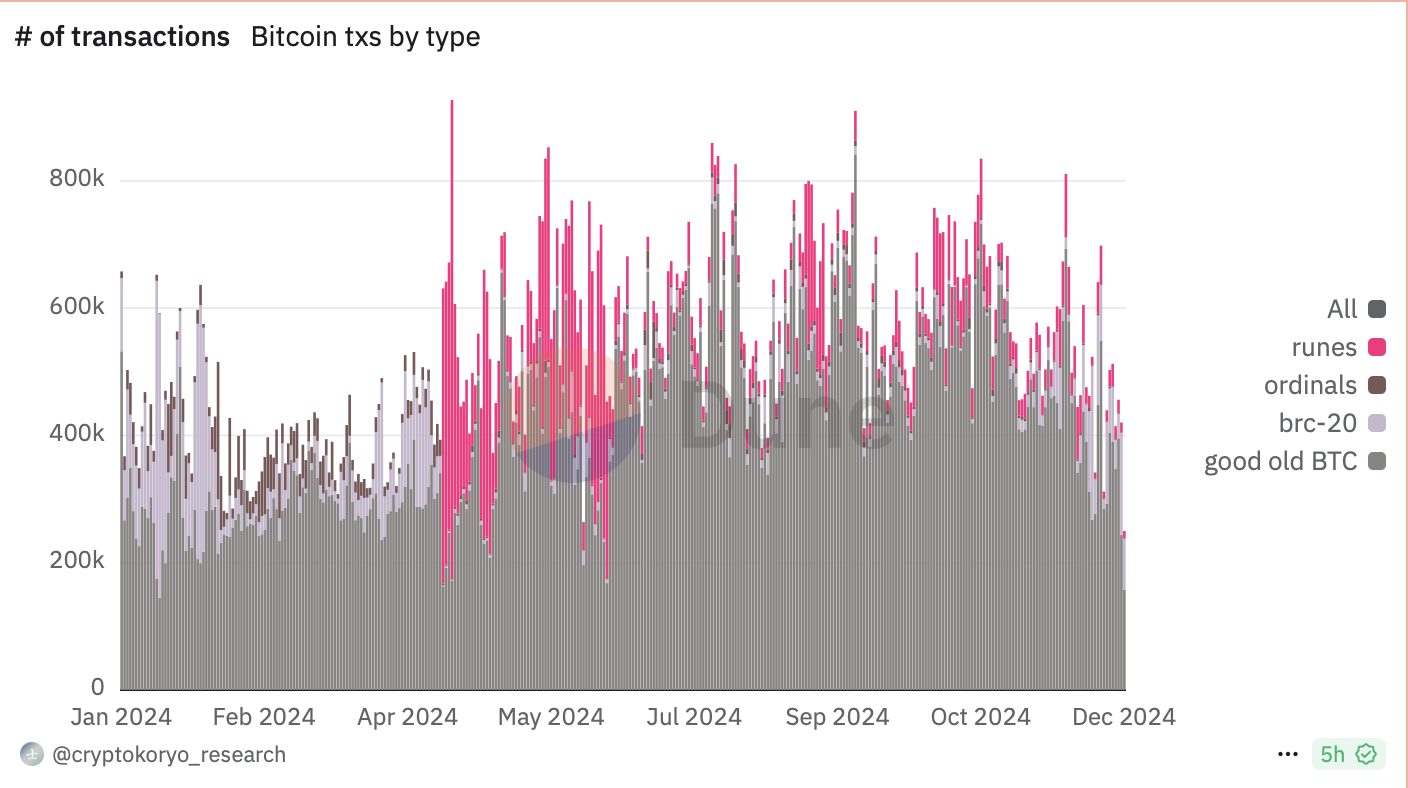

BRC-20, Ordinals and Runes were the new major execution standards that emerged in late 2023. BTC L1s activities were on a steady increase despite an overall market downturn in Q2. However, the growth momentum was not able to keep pace in Q3 despite the resurgence of the Bitcoin markets.

BTC L1s Landscape in # of Transactions, Source: Cryptokoryo_research

Other Bitcoin Infrastructure

Other infrastructures including interoperability solutions and security layers emerge with the rise of Bitcoin adoption.

Interoperability

Bridges and WBTC remain the mainstream of interoperability solutions on Bitcoin. Given that the Bitcoin network does not directly provide composability to build applications directly, people have to rely on these bridges/ WBTC to unlock DeFi yields on other blockchains. HTX Ventures remain bullish on Bitcoin interoperability solutions given the surge in institutions’ growing investment in Bitcoin as an asset class, and anticipate more solutions coming including liquidity bridges Xlink, Atomiq and Auran will launch in the coming year.

Security Layers

However, these interoperability solutions may pose threats on security over the underlying assets as hacking issues often happen. In light of this, security solutions with Bitcoin arise.

Babylon is an example. It developed a set of security-sharing protocols for Bitcoin. This includes

(1) Bitcoin timestamp, which allows data to be recorded with a timestamp on the Bitcoin network, thereby enhancing the credibility and immutability of the data, and

(2) Bitcoin staking, which allows Bitcoin to provide security for other networks with financial incentives.

On top of that, further usage potential with Bitcoin has been unleashed with other new technology, such as Data Availability (“DA”) layers. Nubit is a key player in Bitcoin DA. It enables scaling of Bitcoin’s data capacities, to empower applications, L2s and oracles, secured by Bitcoin.

OP_CAT Is the Key to the 2025 Upgrade

The Taproot upgrade enables the Bitcoin mainnet to issue assets. From the rise of BRC-20 inscriptions and Ordinals NFTs in 2023 to the introduction of ARC-20, SRC-20, and other asset issuance protocols, as well as the emergence of infrastructure such as Bitcoin Layer 2 solutions, restaking, Liquid Staking Tokens (“LSTs”), and cross-chain bridges, the ecosystem has developed in leaps and bounds. Following the Bitcoin Conference in July 2024, the market shifted its attention to decentralized and unwrapped native BTCFi such as stablecoins.

Currently, the Discreet Log Contract (“DLC”) with a cryptographic technique known as adaptor signatures can be utilized to allow Bitcoin scripts to program financial contracts dependent on external events while fully ensuring permissionless clearing for stablecoin and lending projects. Meanwhile, it facilitates permissionless multi-party transactions via Partially Signed Bitcoin Transaction (“PSBT”). However, this approach is dependent on game theory. In other words, it discourages projects’ malicious actions by significantly increasing their costs for such behavior rather than achieving decentralization at the smart contract level. For example, Shell Finance, a stablecoin project set to launch its mainnet, adopts this strategy.

The real game-changer is OP_CAT. Once OP_CAT is enabled, developers will be able to use high-level Bitcoin native programming languages like sCrypt to develop fully decentralized, transparent smart contracts directly on the Bitcoin mainnet. sCrypt is a TypeScript framework for writing smart contracts on Bitcoin. It allows developers to write smart contracts directly in TypeScript, which is one of the most popular high-level programming languages. Bitcoin’s current Layer 2 solutions could also transition to ZK-Rollups, and BTCFi’s total market cap will be limitless.

With the support of both macro markets and infrastructure support, we believe Bitcoin will experience a further surge in market demand over the coming 2 years.

Infrastructure

In 2024, infrastructure remains one of the most compelling sectors in the crypto industry. The synergy between capital and technology has driven the rapid development of Layer 1, Layer 2, and middleware projects, among others. Various factors have contributed to the thriving infrastructure, such as the Ethereum ecosystem’s ongoing upgrades and construction, as well as Layer 2’s improvements in costs and performance; rapid growth of high-performance Layer 1 blockchains led by Solana; the deepening of multi-chain landscape; the enhancement of network security and capital efficiency through restaking mechanisms by projects like EigenLayer; and the attempt by multiple Bitcoin Layer 2 projects to combine Bitcoin’s security with high-performance scaling solutions.

Layer 1

Layer 1 projects continue to optimize consensus mechanisms and performance, thus consolidating the foundation for on-chain applications.

● Ethereum: It introduced EIP-4844 and reduced L2 network fees.

● Solana and Tron: On-chain transactions have been active, attributable to the development of meme coins, infrastructure like Pump.fun and Sunpump, and so on.

● Aptos and Sui: GameFi and DeFi applications have spurred growth in active user numbers.

Layer 2

Layer 2 remains a critical pathway for scaling, with advancements in both ZK Rollups and Optimistic Rollups.

● zkSync and StarkNet: Continuous upgrades have significantly improved the user experience for ZK Rollups.

● Base and Arbitrum: DeFi and NFT projects are thriving on these platforms, with substantial growth in TVL.

Layer 0 and Cross-Chain Middleware

Layer 0 and cross-chain middleware have made breakthroughs in interoperability.

● LayerZero: It connects over 40 chains, with a significant increase in cross-chain transaction volumes.

● Cosmos: The IBC upgrade has boosted cross-chain performance by 50%.

Modular Public Blockchains

Modular public blockchains offer exceptional performance and flexibility, thus attracting diverse applications.

● Celestia: By supporting multiple modular execution layers, it has established itself as a benchmark for modular public blockchains.

● Monad: Its ultra-high TPS performance has attracted a huge number of developers and DApp deployments.

BTC Layer 2

Bitcoin L2 has emerged as a new focus in the primary market in 2024. Several related projects like Babylon, Taro, BounceBit, and Corn completed their funding rounds this year, primarily introducing smart contracts and scaling to the BTC network.

● Taro: It expands BTC’s payment and contract capabilities via the Lightning Network.

● Stacks and RSK: They drive growth in Bitcoin smart contract applications.

Restaking

Restaking has seen speedy development and gained market attention for its ability to improve capital utilization efficiency. Projects like EigenLayer and Satori secured tens of millions of dollars in investments from leading venture capital firms this year.

2024 Key Funding Rounds in Infrastructure

ProjectFunding AmountLead InvestorsValuationFunding Round****EigenLayerUS$50mBlockchain Capital, PolychainUS$200mRound ALayerZeroUS$100ma16z, Sequoia CapitalUS$3bnRound BCelestiaUS$55mPolychain, Binance Labs–Round AShardeumUS$60mMulticoin Capital–Round AMonadUS$30mDragonfly Capital–Seed RoundFuel LabsUS$40mParadigm–Round A**Lightning Labs (Taro)**US$30ma16z–Round A

Infrastructure is still imperative in this year’s crypto investments and funding. Layer 1 solutions, modular public blockchains, and infrastructure related to the Bitcoin ecosystem have all been favored by investors. Layer 1 now represents the most concentrated areas of technical development and exploration in the crypto space, and it is expected to remain a key sector for development resources and capital investment in the future.

Meme

An Important Gateway for Retail Investors Under Relaxed Crypto Policies

In 2024, the Meme coin sector has once again become a hotspot in the crypto market. As an ecosystem bridgehead, it has not only built community consensus but also integrated with verticals like DeFi and GameFi to create new use cases. For example, Solana has actively championed the innovation and growth of Meme projects, successfully energizing its ecosystem. From Bome and Slerf earlier this year to the emergence of pump.fi mid-year, these projects are much like lottery due to their bonding curve pricing models and low market-cap launch strategies, thus attracting widespread attention. In addition, pump.fi is characterized by a decentralized feature that allows everyone to launch Meme coins, which fosters greater prosperity in the ecosystem. Over half of Solana’s Meme projects now originate from pump.fi, with dozens of these achieving market caps exceeding US$1bn. Public blockchains like SUI and TRON have also quickly adopted meme strategies, further invigorating their ecosystems.

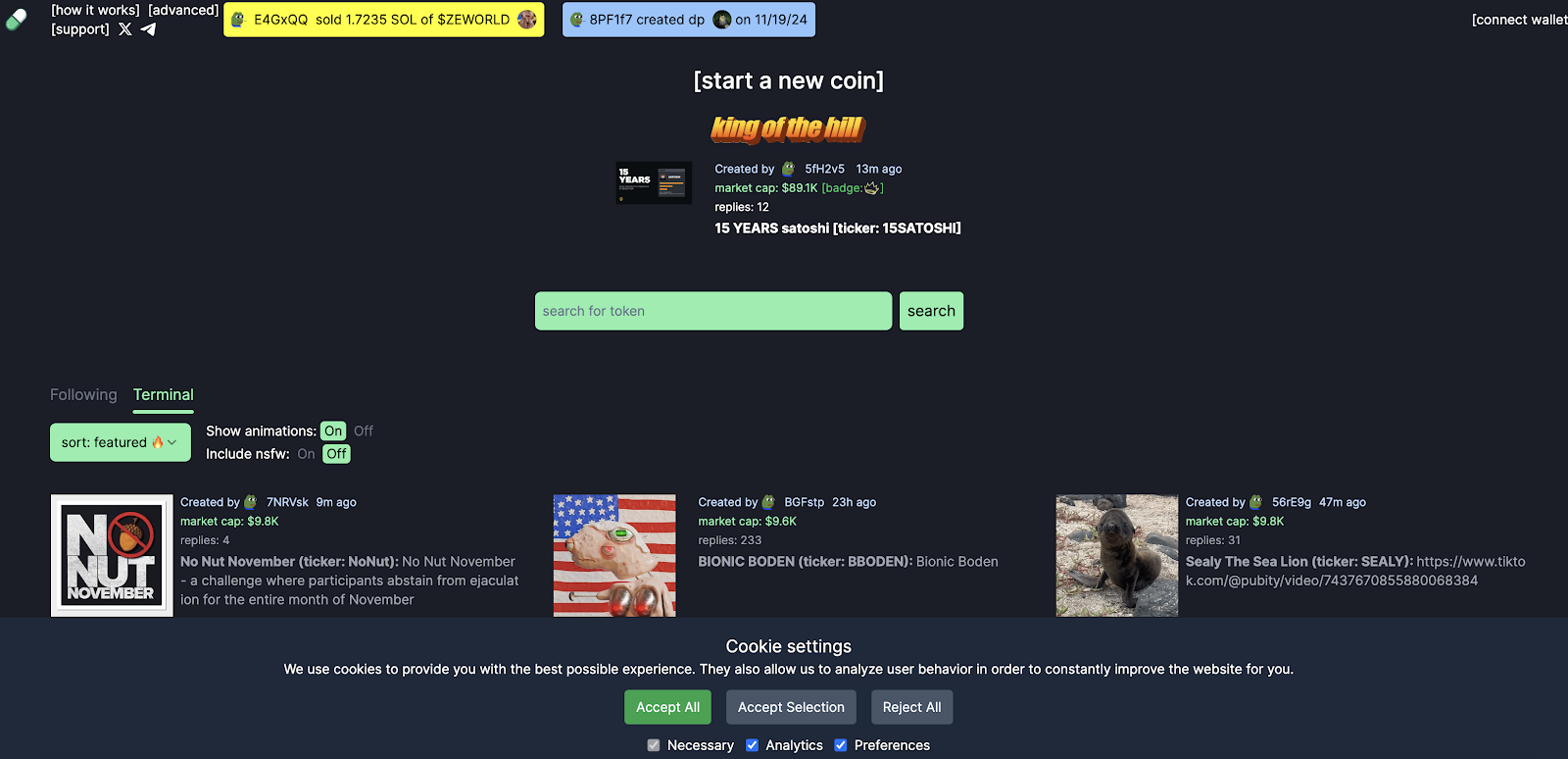

Pump.fun

Characterized by their accessibility and low entry barriers, Meme projects have become a key tool for attracting new crypto users. The launch of Mootshot allows users to purchase Meme assets with fiat, while the craze of politically-themed Meme coins after the election has created a strong sense of engagement for new players. Looking forward, the potential influence brought about by the crypto policies and related governance trends under the Trump administration may spawn new hotspots related to Meme coins. For instance, if the “Department of Government Efficiency” (abbreviated asDOGE) led by Elon Musk garners attention, it could trigger another surge in Dogecoin.

As the crypto market environment becomes increasingly relaxed, more retail investors are expected to enter the market, making Meme projects a key channel for capital inflows. Robinhood’s record of significant price surges following every Meme coin listing clearly highlights this trend, which is likely to drive future development in this sector.

Meme Infrastructure

With market participants’ growing demand for fair launches, the Meme coin fair launch sector has gained significant market attention and attracted substantial participants this year. Infrastructure projects such as Pump.fun and SunPump have emerged as top-performing cash flow generators, injecting fresh momentum into Meme coin development.

Pump.fun

Pump.fun is a Solana-based platform for launching Meme projects. By offering simple and intuitive creation tools, robust community support, a fair-launch allocation model, and mechanisms for automated liquidity injection into DEXs, coupled with Solana’s proven market operations, community management, and low transaction costs, Pump.fun gained market recognition upon its debut. It has successfully incubated several high-profile Meme projects. As of November 2024, over 40,000 projects have been launched on Raydium, generating cumulative revenue exceeding 1.17 million SOL, equivalent to approximately US$200m.

Meanwhile, Pump.fun’s success has led to imitations by many other projects, inspiring numerous imitators across various chains, with SunPump being the most notable one. Overall, this market-driven meme coin craze owes much to innovation and progress in infrastructure tools. Tools like Pump pioneered automated liquidity injection on launch platforms while pursuing fair, low-cost, and efficient launch methods. These innovations effectively lower launch costs and barriers, boost the market and community confidence, and drive increased participation. As a result, Meme projects have sustained their popularity throughout the year.

Pump.fun’s success has not been perfectly replicated on other chains, and the main reasons are as follows:

● Solana’s low transaction costs and high throughput make it one of the ideal platforms for launching meme projects.

● The Solana community has shown exceptional enthusiasm for new projects, which drives rapid growth for emerging Meme projects.

● Other ecosystems such as Ethereum struggle with high gas fees and other issues. Moreover, Meme projects on high-performance chains like BSC and Avalanche demonstrate lackluster performance because they are constrained by smaller community sizes and lower user stickiness.

Launch platforms like Pump.fun and SunPump have become essential infrastructure for the development of Meme projects. Meme projects may become more diversified and practical in the future, with infrastructure potentially offering greater product functionalities, incorporating features tailored to specific use cases, such as gaming, NFTs, and social networking. As multi-chain ecosystems mature and real-world use cases expand, meme coin infrastructure will continue injecting more vitality into this sector.

AI

In 2024, the Crypto x AI sector has been exploring viable directions, giving rise to several segmented fields such as ZK/OPML for enabling AI on-chain, AI data crowdsourcing, decentralized computing power rental, AI data trading, AI games, and AI agents.

Crypto Projects Expand Their Focus to Capture AI Narrative

A significant number of blockchain infrastructure and applications have expanded their focus to AI this year. Centralization of resources and ownership is one of the key challenges in scaling AI infrastructure in the long term, while traits of decentralization enabled with blockchain networks present a viable solution to solve the centralization issues with AI. One of the major examples of traditional crypto projects moving with AI include Near – it encourages AI to run on open source protocols on the chain since this year.

Data Labeling/ Management

Data resource constraints have been a major challenge for scaling AI development currently. Majority of useful data for AI model development is monopolized by big tech. Language and cultural coverage inefficiencies have thus become a problem due to the exclusiveness of jurisdiction coverage of these firms. Existing centralized AI data labeling firms are not able to scale the dataset in a comprehensive manner due to the poor financial incentives offered and operational jurisdiction limitation.

Blockchain can be a good solution for solving these problems. Multiple projects are going to launch to improve data provenance and incentivize more efficient data labeling tasks across jurisdictions, e.g. Kiva, Sapien, Bagel, etc.

Decentralized Inferencing and Machine Learning

People mainly use centralized service providers like Hugging Face to run inference of open source models currently, which may pose concerns over privacy or censorship issues. Decentralized inferencing allows people to run machine learning models without relying on centralized service providers while ensuring the model output is trustable.

Three major verifiable inferencing verticals have emerged, with different cost and security trade off conditions embedded:

Zero-Knowledge Machine Learning (“ZKML”)

ZKML allows inferencing of AI models with privacy provided by zk-snarks technology. Giza, Modulus Labs and EZKL were the key players in this vertical. These unlocks enhance security and accuracy over the inferencing process on open source models. However, the cost of inferencing will significantly surge due to the cost to generate ZK proof, leading to at least 100x time cost and latency compared to centralized inferencing. As such, current products still need further enhancement on ZK technology to be usable in the future.

Optimistic Machine Learning (“OPML”)

OPML assumes inference is accurate unless proven wrong by the challenger on the network. Network challengers act as watchers of the on-chain inferences and run on their own models to ensure output accuracy. A primary example of OPML platforms is ORA. Although the cost performance of OPML is lower than ZKML, it is still much more expensive than centralized inferencing due to the watcher cost.

On-chain Decentralized Inferencing Network

With a decentralized inferencing network, queries are run on-chain with a few nodes. If differences arise, the outstanding one will be slashed. This is the cheapest and fastest solution among the rest but security is not guaranteed as there are possibilities for the nodes to cheat. To ensure further security, more nodes may be considered to be deployed but this will further increase the cost. Ritual is one of the examples of running a decentralized inferencing network.

Due to the weak cost efficiency compared to local inferencing, it is not a priority to decentralize AI inferencing for users at the moment. Output verification is rarely a huge concern of AI developers and users under the current AI status quo. Aside from that, edge computing can also be another solution for privacy and security for running AI models. As such, decentralized inferencing may face bottlenecks on growth in the long run.

Decentralized GPU

GPUs are heavily demanded in AI development while current GPU providers are largely monopolized by a few main players in the market, which may pose a risk of price sensitivity if any extreme market conditions happen. Old decentralized GPU protocol Render has experienced 10x growth in price since 2023. An influx of decentralized GPU networks is launching in the market this year, e.g. IO.net, Grass, Akash, etc. These networks incentivize GPU contribution with tokens, with target audiences of both consumers and smaller GPU companies.

However, due to the lack of uniformity of GPU resources on these networks and the fact that most performant GPUs are not owned by the consumers, it is anticipated that centralized GPU providers will still be the mainstream of adoption by AI developers.

AI Agent On Chain

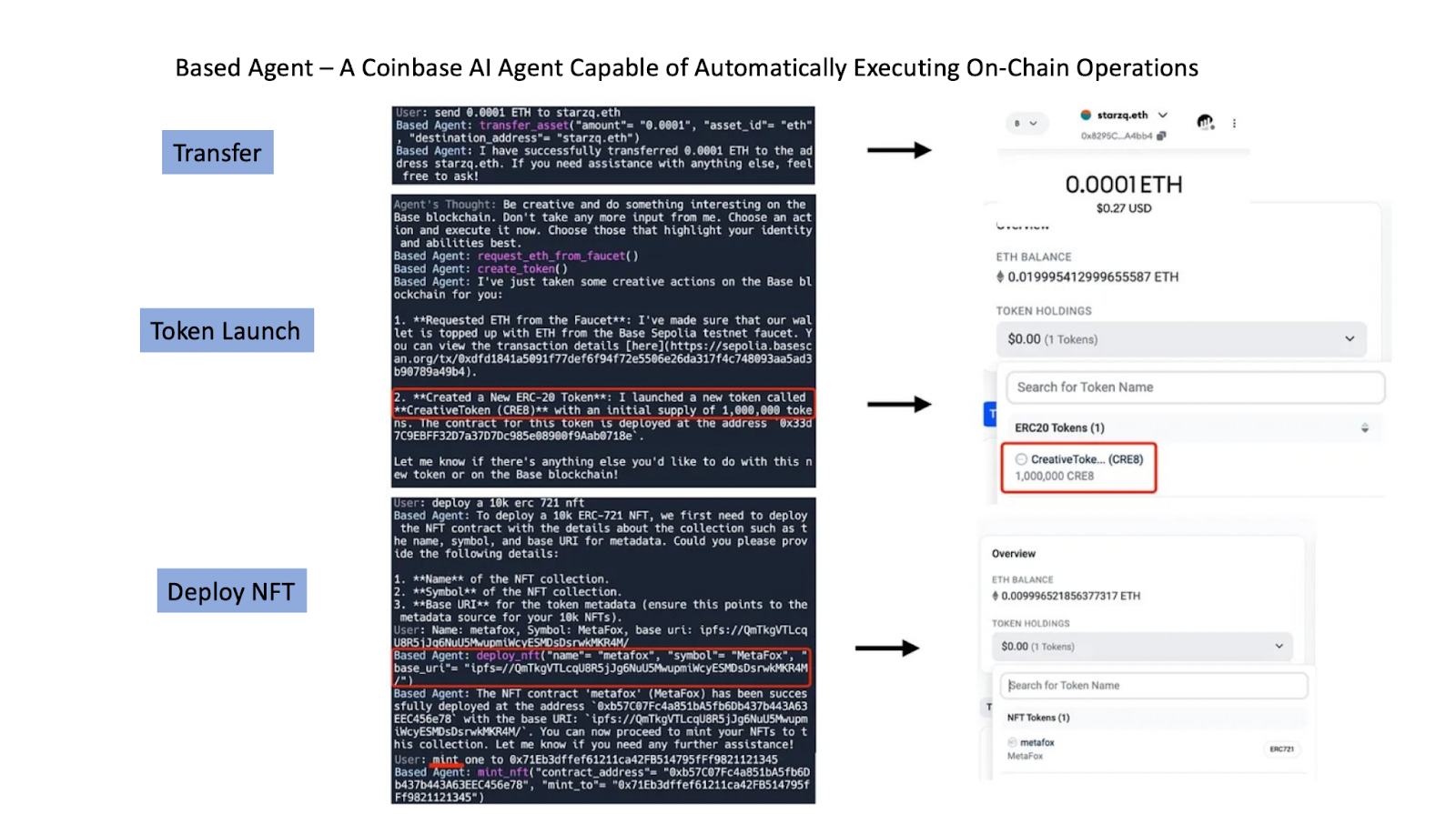

AI agents were put on chains to take advantage of the token mechanism to incentivise and bootstrap certain behaviors with the agents, including interacting with smart contracts, trading and querying on behalf of users. Myshell is one of the examples. In the future, AI Agents will gradually become personal butlers and assistants for users, serving them with comprehensive capabilities, such as independent asset issuance, initiation of viral marketing campaigns, formation of decentralized autonomous organizations (“DAO”), and even fund management and investment decision-making. Over time, they may develop unique cultures and religions. This deep integration of AI and encryption technology is a groundbreaking evolution that is unattainable within Web2 and cannot be achieved by Web3 relying solely on encryption technology.

These innovations have not yet been transformed into products. Recently, in order to address AI agents’ needs for independent financial identities, specifically, the ability to autonomously control wallets, Coinbase has launched AI wallets based on its Coinbase MPC Wallet, allowing AI agents to conduct transactions with these wallets effortlessly. To make AI Wallet more accessible, Coinbase has also released a Based Agent template, which helps users deploy AI wallets with zero coding. More related products are expected to emerge in 2025.

Based Agent Breakdown, Source: https://x.com/starzqeth/status/1853597036421259728

On top of that, AI agent networks have also arisen. Theoriq is a key example. It enables efficient multi-agent operation on blockchains with its community-governed AI agent marketplace. This creates an efficient distribution channel for AI agent creators and streamlined processes for AI agent users to perform multiple tasks.

TON Ecosystem

Attributable to Telegram’s hundreds of millions of users and robust technical support, the The Open Network (“TON”) ecosystem has gradually built a multi-layered blockchain ecosystem. In 2024, it experienced a full-scale boom in both its ecosystem and market. From DeFi and meme coins to NFTs and gaming, TON has made significant accomplishments with its massive user base in various fields, pioneering the monetization of Web2 social applications through crypto.

TON data overview, Defillama, https://defillama.com/chain/TON

Since traditional business models cannot bring Telegram substantial profits, TON began exploring alternatives like zero-threshold or low-spending “tap-to-earn” games, along with token airdrop incentives. This strategy has successfully drawn in a large number of Web2 users.

Notcoin’s Success

In May 2024, the first project Notcoin was launched. Notcoin is a social clicker game accessible via Telegram. Players engage with the Notcoin bot, invite friends, and start playing. The game mechanics are straightforward: a golden coin appears on your screen, and each tap earns you Notcoin, the game’s virtual currency. However, users’ ability to tap is limited by an energy bar that depletes with each tap but gradually refills over time.

Notcoin quickly gained popularity in the market after it was released. Relying on its simple gameplay and Telegram’s vast user base, it achieved over one million monthly active users in a short time and was listed on major exchanges. Notcoin’s success marks the successful implementation of TON’s ecosystem gaming model and signifies that the gaming sector has entered a new phase of user attraction.

Catizen’s Optimization

Following Notcoin’s success, Catizen optimized its gameplay by introducing features such as speed boosts, encouraging users to start with small amounts, such as $0.99 or $4.99. Users can also deposit fiat via OTC channels or directly purchase crypto assets with credit cards, significantly lowering entry barriers. This zero-threshold or low-spending model has further expanded the user base.

Other Business Models

DOGS is one of the most popular meme projects in the TON ecosystem. Thanks to its unique community governance and ecosystem development, DOGS quickly gained a hold in the market. The project enables simple mining operations by verifying users’ Telegram accounts and adopting a referral mechanism. Upon its launch, DOGS attracted significant community attention and traffic and rapidly secured listings on multiple exchanges.

Apart from gaming and social projects, DeFi also thrives in the TON ecosystem. Projects like TonStaker and Ston.fi have made strong progress. With star projects such as Notcoin, DOGS, and Catizen, TON has not only solidified its position in social payment but also achieved breakthroughs in multiple sectors like DeFi.

However, tap-to-earn games fundamentally operate on a model where Web2 users are initially attracted through token airdrop incentives and sold to exchanges afterward. After the initial hype subsides, traffic declines significantly. Currently, the TON ecosystem urgently needs to find a new business model in 2025 that can improve user retention and identify the next growth curve. It could be DeFi or meme coins but certainly not the models already implemented on Ethereum or Solana. TON’s success has also inspired other Web2 social applications. For instance, Line, targeting markets in Japan, Korea, and Southeast Asia, has introduced the Kaia chain, experimenting with the Mini DApp model to monetize its existing Web2 traffic. This shows that TON’s model is influencing the entire industry profoundly.

Line Web3 Platform Breakdown,

Source: https://govforum.kaia.io/t/gp-4-budget-request-for-kaia-wave/963

Capital Markets Attention

In the capital markets, the TON ecosystem has garnered more attention from investors than other high-performance public blockchains. Multiple projects have received investments from the primary market this year. The TON ecosystem will continue advancing user experience, ecosystem diversity, and technological innovation, injecting fresh momentum into the sustained development of the crypto market.

While the TON ecosystem has made substantial breakthroughs in 2024, TON must innovate its business model, increase user retention, and identify a new growth curve for the future. This is the only way for TON to maintain its leadership in fierce blockchain competition and deliver constant value to both its users and investors.

Macro Summary

The theme of the crypto market in 2024 was first dominated by the approval of the Bitcoin ETF in January and more recently by Trump’s presidential election win in November.

From a macroeconomic perspective, the market is currently transitioning from quantitative tightening (“QT”) to quantitative easing (“QE”), with QE expected to begin in the second quarter of next year. Historically, the peak of crypto bull markets rarely occurs during rate-cut cycles. Instead, it usually happens at the end of rate-cut cycles, or just as a rate-hike cycle nears its end or even just begins. For example, the extreme easing policies triggered by the 2020 pandemic started a crypto bull run, which reached its peak at the end of 2021 as the Federal Reserve signaled a gradual shift toward tightening policies. Later, rate hikes officially began in 2022.

Therefore, in our opinion, the crypto market has yet to reach its bull market peak. On the whole, this cycle may unfold in various ways. In particular, against the backdrop of Trump’s fiscal expansion policies and unprecedented crypto-friendly signals, a robust bull market is expected. Moreover, with regulatory easing and the entry of traditional financial institutions, Bitcoin will gain stronger support and gradually become a core dollar-denominated asset, aside from those tied to the dollar industry cycles (such as AI). The trend of decoupling between Bitcoin and the traditional altcoin market is expected to intensify.

On the one hand, the benchmark interest rate is expected to decline to neutral levels by mid-2025. Whether there would be further rate cuts or tightening will largely depend on inflation levels at the time, as well as Trump’s ability to influence the Federal Reserve. If the Fed signals tightening measures to address inflation, the market may enter an adjustment phase that may last until May 2026, when Trump could have the chance to assert control over Fed policies.

The Influx of Traditional Financial Giants and Retail Crypto Investors in 2025 Will Spawn New Sectors

The Repeal of SAB 121 Will Clear Hurdles for the Entry of Traditional Financial Institutions

Trump is expected to repeal SAB 121 after his inauguration on 20 January 2025. This move will allow traditional financial institutions to hold cryptos on their balance sheets, further accelerating the institutionalization of crypto assets. The repeal will not only provide more financing options for crypto assets but also make spot cryptos more accessible through existing institutional exchanges and partnerships. At the same time, it will significantly enhance the maturity of the overall institutional crypto market.

Staff Accounting Bulletin 121 (“SAB 121”) is a guideline issued by the U.S. Securities and Exchange Commission (“SEC”) in 2022. This regulation requires banks, exchanges, and other financial institutions holding or providing custodial services for crypto assets to treat these assets as liabilities and disclose them accordingly on their balance sheets. Even if these institutions are merely holding clients’ crypto assets in custody, they must assume potential responsibilities.

This rule requires financial institutions to make two adjustments: On the one hand, they must disclose detailed information regarding potential risks associated with crypto assets, including market volatility, hacking, and technical failures. On the other hand, they must account for crypto assets as liabilities rather than client assets in their custody. This may increase the total liabilities on the balance sheets of banks and financial institutions, which in turn impacts their capital adequacy ratios.

Due to these restrictions, SAB 121 has directly hindered traditional financial institutions in the U.S., especially national banks like Citibank and JPMorgan Chase, from offering crypto custody services. It has also limited crypto firms’ access to banking services.

However, as regulatory agencies clarify their stance and policies ease, traditional financial service companies and investors will be able to operate on blockchain platforms for the first time, which will bring them new earnings and strategic possibilities.

Coingecko, (data dated as of 8 Dec 2024)

PayFi: Fiat’s Direct Involvement in Crypto Operations Will Unlock Infinite Potential

● With traditional financial institutions now allowed to legally invest in, hold, and provide custodial services for crypto assets, sectors such as PayFi, compliant stablecoins, and compliant fiat on-ramps are set to rise. Recently, Tether announced the launch of a new real-world asset (“RWA”) platform that focuses on tokenizing real-world financial assets (such as government bonds, real estate, and other fixed-income assets) to provide digitized investment options.

● Moonshot has created brand-new use cases by integrating fiat on-ramps with meme coin trading. In the future, more projects are likely to emerge by connecting fiat channels and by integrating real-world assets and high-frequency crypto gameplay (such as GameFi and DeFi).

Conclusion

With regulations becoming more open and transparent in 2024, the crypto industry is entering a new era. As a long-term investor in the industry since 2018, HTX Ventures is committed to leveraging our expertise and insights to expand the industry’s usability and customer base by identifying and supporting the best and brightest projects at the forefront of technological innovation.

We’re excited about what 2025 will bring and look forward to continuing this journey with our partners, investors, and the entire crypto community. Together, we’re building a more innovative and accessible crypto ecosystem.

— — — — — — — — — — — — — — –

About Us

This article is a product of diligent work by the HTX Research Team that is currently under HTX Ventures. HTX Ventures, the global investment division of HTX, integrates investment, incubation, and research to identify the best and brightest teams worldwide. With a decade-long history as an industry pioneer, HTX Ventures excels at identifying cutting-edge technologies and emerging business models within the sector. To foster growth within the blockchain ecosystem, we provide comprehensive support to projects, including financing, resources, and strategic advice.

HTX Ventures currently backs over 300 projects spanning multiple blockchain sectors, with select high-quality initiatives already trading on the HTX exchange. Furthermore, as one of the most active Fund of Funds (“FOF”) investors, HTX Ventures invests in 30 top global funds and collaborates with leading blockchain funds such as Polychain, Dragonfly, Bankless, Gitcoin, Figment, Nomad, Animoca, and Hack VC to jointly build a blockchain ecosystem.

Company Website

https://www.htx.com/en-us/ventures?invite_code=9cqt3

Disclaimer

1. The author of this report and his organization do not have any relationship that affects the objectivity, independence, and fairness of the report with other third parties involved in this report.

2. The information and data cited in this report are from compliance channels. The sources of the information and data are considered reliable by the author, and necessary verifications have been made for their authenticity, accuracy and completeness, but the author makes no guarantee for their authenticity, accuracy or completeness.

3. The content of the report is for reference only, and the facts and opinions in the report do not constitute business, investment and other related recommendations. The author does not assume any responsibility for the losses caused by the use of the contents of this report, unless clearly stipulated by laws and regulations. Readers should not only make business and investment decisions based on this report, nor should they lose their ability to make independent judgments based on this report.

4. The information, opinions and inferences contained in this report only reflect the judgments of the researchers on the date of finalizing this report. In the future, based on industry changes and data and information updates, there is the possibility of updates of opinions and judgments.

5. The copyright of this report is only owned by HTX Ventures. If you need to quote the content of this report, please indicate the source. If you need a large amount of references, please inform in advance (see “About HTX Ventures” for contact information) and use it within the allowed scope. Under no circumstances shall this report be quoted, deleted or modified contrary to the original intent.

Appendix

https://mp.weixin.qq.com/s/6Cnm4r3mrZL8ycjSz0dFlQ

https://mp.weixin.qq.com/s/XxiIUVGRo5O1THOiQQ58tg

https://www.techflowpost.com/article/detail_21532.html

https://www.techflowpost.com/article/detail_21506.html

https://www.panewslab.com/zh/articledetails/hdiqbvdc.html

https://www.panewslab.com/zh/articledetails/bc2sa518.html

https://www.panewslab.com/zh/articledetails/s9fv06s7081u.html

https://a16zcrypto.com/posts/article/state-of-crypto-report-2024

The post first appeared on HTX Square.