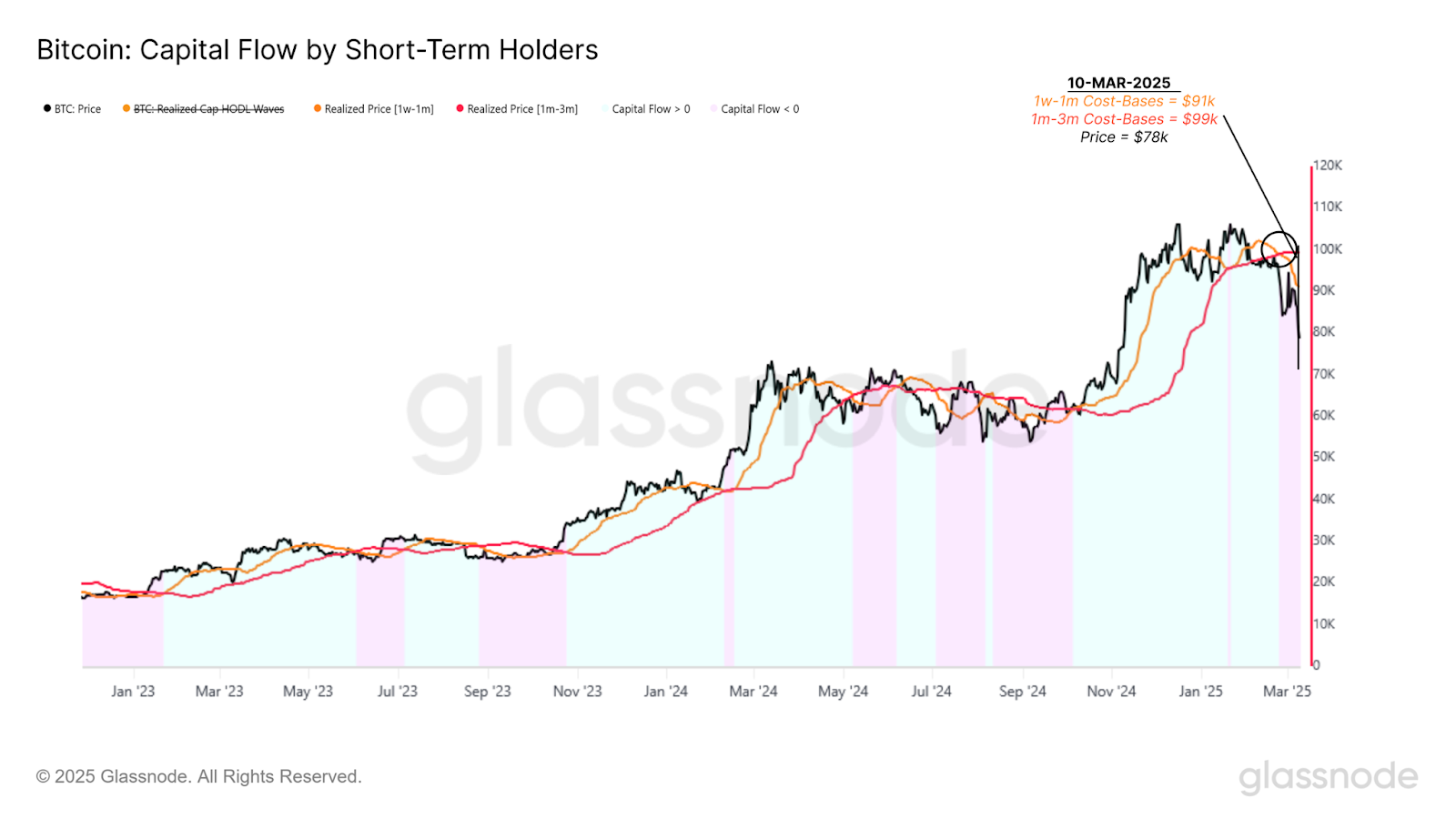

Short-term holders are also continuing to face net unrealised losses, exacerbating sell-side pressure. These investors, particularly those who bought within the past 7 to 30 days, are often the most susceptible to capitulation. Historically, when fresh capital inflows slow and cost basis trends shift, it signals a weakening demand environment. This trend has become increasingly evident as Bitcoin struggles to hold above key levels. Without new buyers stepping in, Bitcoin risks extended consolidation, or even further downside as weaker hands continue to exit their positions.

The key factor to watch is whether long-term holders or institutional demand re-emerge at these lower levels. If deeper-pocketed investors begin absorbing supply, it could signal a shift back toward accumulation, potentially stabilising price action and reversing sentiment.

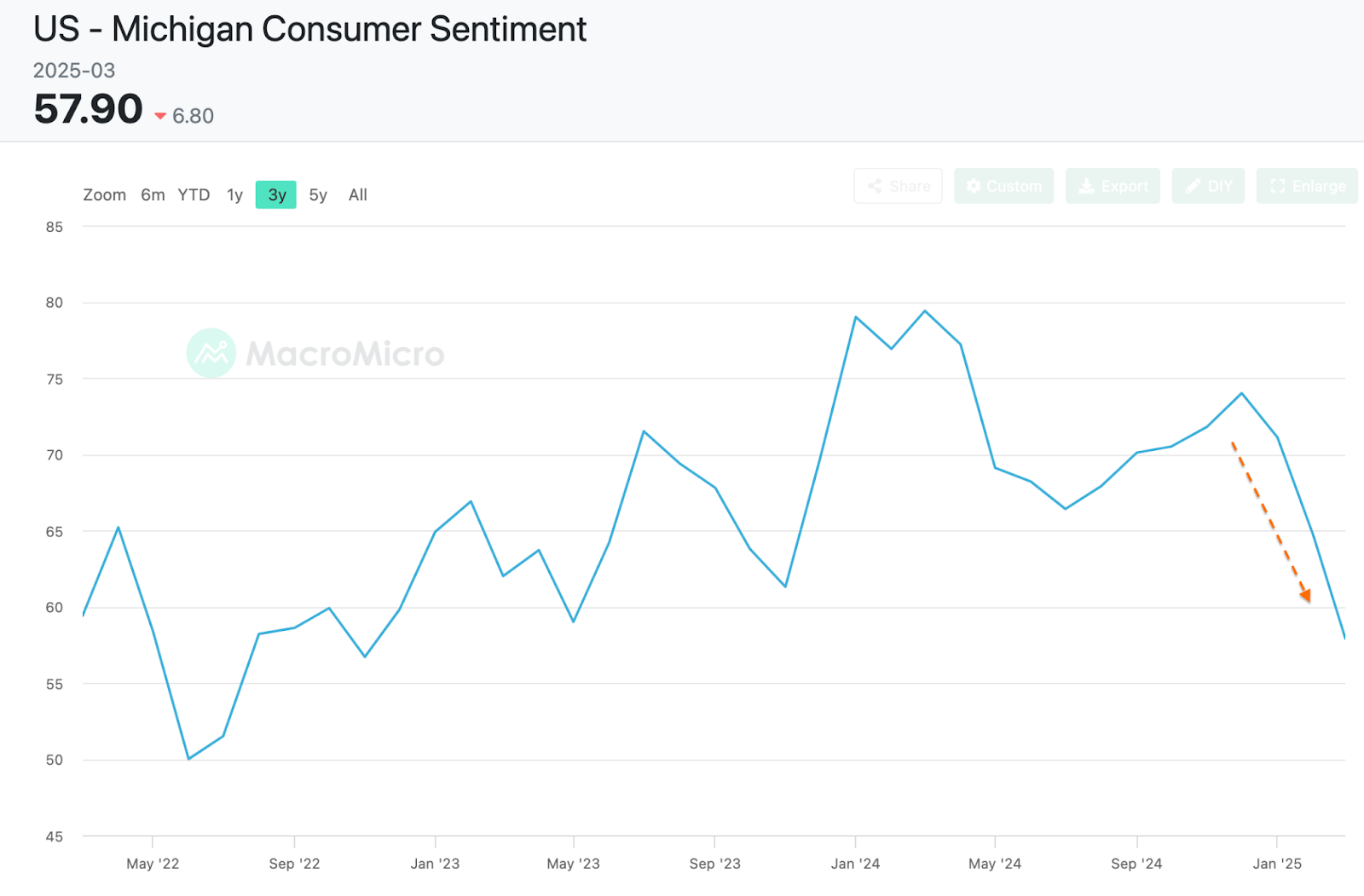

The US economy is also at a crossroads, with a resilient yet cooling labour market, moderating inflation, but declining consumer confidence. Inflation remained subdued in February, with lower airline fares and gasoline prices offsetting higher housing costs, but supply chain disruptions and tariff-related pressures could drive prices higher in the coming months. Job openings rose in January, while layoffs hit a seven-month low, signalling stability. However, underemployment is rising, and trade uncertainty, particularly new tariffs on key imports, is weighing on business sentiment. Consumer confidence has plunged to its lowest level in over two years, with inflation expectations surging and economic uncertainty dampening both household and business outlooks. As trade policies and inflationary risks unfold, the Federal Reserve’s response will be critical in determining whether the economy stabilizes or weakens further.

In cryptocurrency market developments last week, the Cboe BZX Exchange proposed staking for the Fidelity Ethereum Fund. This could encourage greater ETH ETF inflows if staking yields, which amount to 3-4 percent annually, become built in. However SEC scrutiny remains a hurdle. Thailand’s SEC on the other hand, approved USDt and USDC for trading on licensed exchanges, setting a regulatory precedent that may influence global stablecoin policies. In the US., Senator Cynthia Lummis reintroduced the BITCOIN Act to establish a Strategic Bitcoin Reserve, aiming to enhance financial security but facing resistance from banking institutions and the Federal Reserve. Meanwhile, Strategy

The post appeared first on Bitfinex blog.