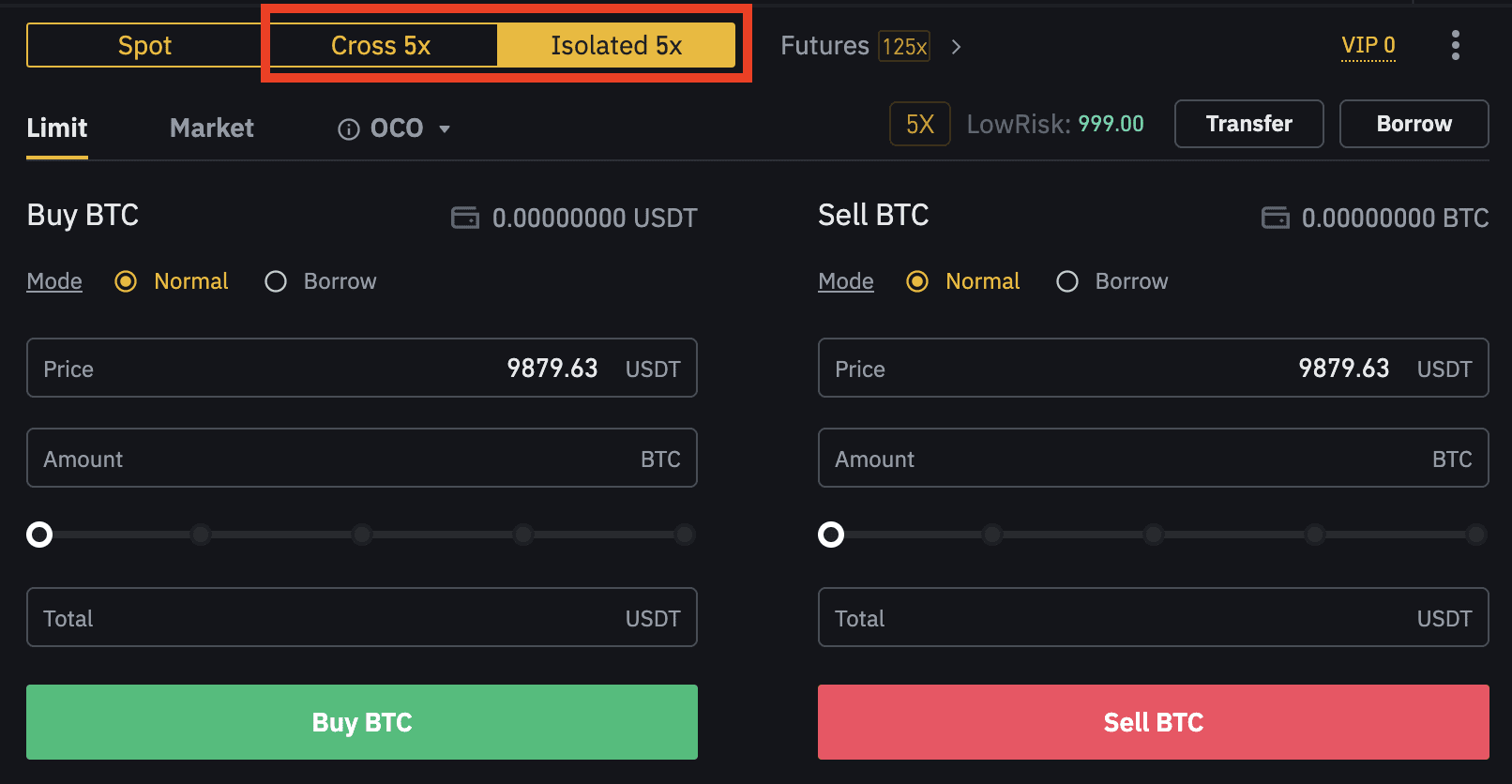

In isolated margin mode, the margin is independent in each trading pair:

Each trading pair has an independent isolated margin account. Only specific cryptocurrencies can be transferred in, held, and borrowed in a specific isolated margin account. For instance, in BTCUSDT isolated margin account, only BTC and USDT are accessible. You may open several isolated margin accounts.

The position is independent in each trading pair. If adding margin is required, even if you have enough assets in other isolated margin accounts or in the cross margin account, the margin will not be added automatically, and you may have to replenish manually.

The margin level is calculated solely in each isolated margin account based on the asset and debt in the isolated.

Risk is isolated in each isolated margin account. Once liquidation happens, it will not affect other isolated margins.

For detailed rules about isolated margin trading, you may refer to Isolated Margin Trading Rules.

In cross margin mode, the margin is shared across the user’s account:

Each user can only open one cross margin account, and all trading pairs are available in this account;

Assets in a cross margin account are shared by all positions;

The margin level is calculated according to total asset value and debt in the cross margin account.

The system will check the margin level of the cross margin account and send a notification to the user about supplying additional margin or closing positions. Once liquidation happens, all positions will be liquidated.

For more detailed rules about cross margin trading, you may refer to Cross Margin Trading Rules.

Example

Day One: The ETH market price is 200 USDT, while the BCH market price is 200 USDT. User A and User B each transferred 400 USDT into their respective margin accounts as margin balance, and purchase ETH and BCH with 5X leverage on average. Provided User A traded in cross margin mode while User B traded in isolated margin mode. (Trading fees and interest are not considered in this example).

DAY ONE

User A (Cross Margin)

User B (Isolated Margin)

Assets

5 ETH

5 BCH

5 ETH

5 BCH

Collateral

400 USDT

200 USDT

200 USDT

Margin Level

(5 ETH * 200 + 5 BCH * 200)

/ 1600

= 1.25

(5 ETH * 200)

/ 800

= 1.25

(5 BCH * 200)

/ 800

= 1.25

Status

Normal

Normal

Normal

Day Three: ETH price rose to 230 USDT, while the BCH price fell to 180 USDT.

DAY THREE

User A (Cross Margin)

User B (Isolated Margin)

Assets

5 ETH

5 BCH

5 ETH

5 BCH

Margin Level

(5 ETH * 230 + 5 BCH * 180)

/ 1600

= 1.28

(5 ETH * 230)

/ 800

= 1.44

(5 BCH * 180)

/ 800

= 1.125

Status

Normal

Normal

(+ 150 USDT Profit)

Margin Call Triggered

(User must add margin)

Day Five: ETH price decreased to 220 USDT, while the BCH price dropped to 120 USDT, provided that both users choose not to add margins.

DAY FIVE

User A (Cross Margin)

User B (Isolated Margin)

Assets

5 ETH

5 BCH

5 ETH

0

Margin Level

(5 ETH * 220 + 5 BCH * 160) / 1600

= 1.06

(5 ETH * 220) / 800 = 1.38

(5 BCH * 120) / 800

< 1

Status

Margin Call Triggered

(User must add margin)

Normal

(+ 100 USDT Profit)

Position Liquidated

To learn more about margin trading on Binance, read the Binance Margin Trading Guide from Binance Academy.