Following the 2024 U.S. presidential election, the crypto industry’s legalization and compliance process is anticipated to bring fresh development opportunities. The integration of traditional finance and DeFi is accelerating: Real-world assets (RWAs) like private credit, U.S. Treasury bonds, and commodities are evolving from basic tokenized certificates into yield-generating stablecoins with capital efficiency. This shift offers crypto users seeking stable returns new options and serves as a new growth engine for DeFi lending and trading. Meanwhile, stablecoins have become strategically important in international trade, and the payment sector’s upstream and downstream infrastructure has experienced sustained prosperity. Traditional financial tycoons, including the Trump family, Stripe, PayPal, and BlackRock, are doubling down on their business investments, bringing the industry greater possibilities.

A new generation of crypto trading unicorns is emerging, following in the footsteps of “old DeFi” players like Uniswap, Curve, dYdX, and Aave. They will adapt to the evolving regulatory environment and leverage traditional finance integration and technological innovations to explore new markets and drive the industry toward a new era for DeFi. For new entrants, this means their focus should be shifted away from micro-innovations in traditional DeFi to groundbreaking products tailored to the new environment and demands.

This article delves into this trend and explores potential opportunities and development directions in this new round of transformation within the crypto trading space, providing insights and references for industry participants.

Changes in the Current Trading Environment

Stablecoin Compliance Approved, Boosting Adoption in Cross-Border Payments

Maxine Waters and Chair Patrick McHenry of the U.S. House Financial Services Committee are preparing to introduce a stablecoin bill, marking a rare bipartisan consensus on stable legislation in the U.S. Both parties agree that stablecoins can not only reinforce the dollar’s position as the world’s reserve currency but have also become major buyers of U.S. Treasury bonds, showcasing immense economic potential. For instance, Tether demonstrated its profitability by generating $6.3 billion in profits last year with just 125 employees.

If passed, this bill would become the first comprehensive crypto legislation to clear a Congress chamber in the U.S., enabling widespread adoption of crypto wallets, stablecoins, and blockchain-based payments by banks, businesses, and individuals. In the coming years, stablecoin payments are poised to go mainstream, representing another leap forward for the crypto market following Bitcoin ETFs.

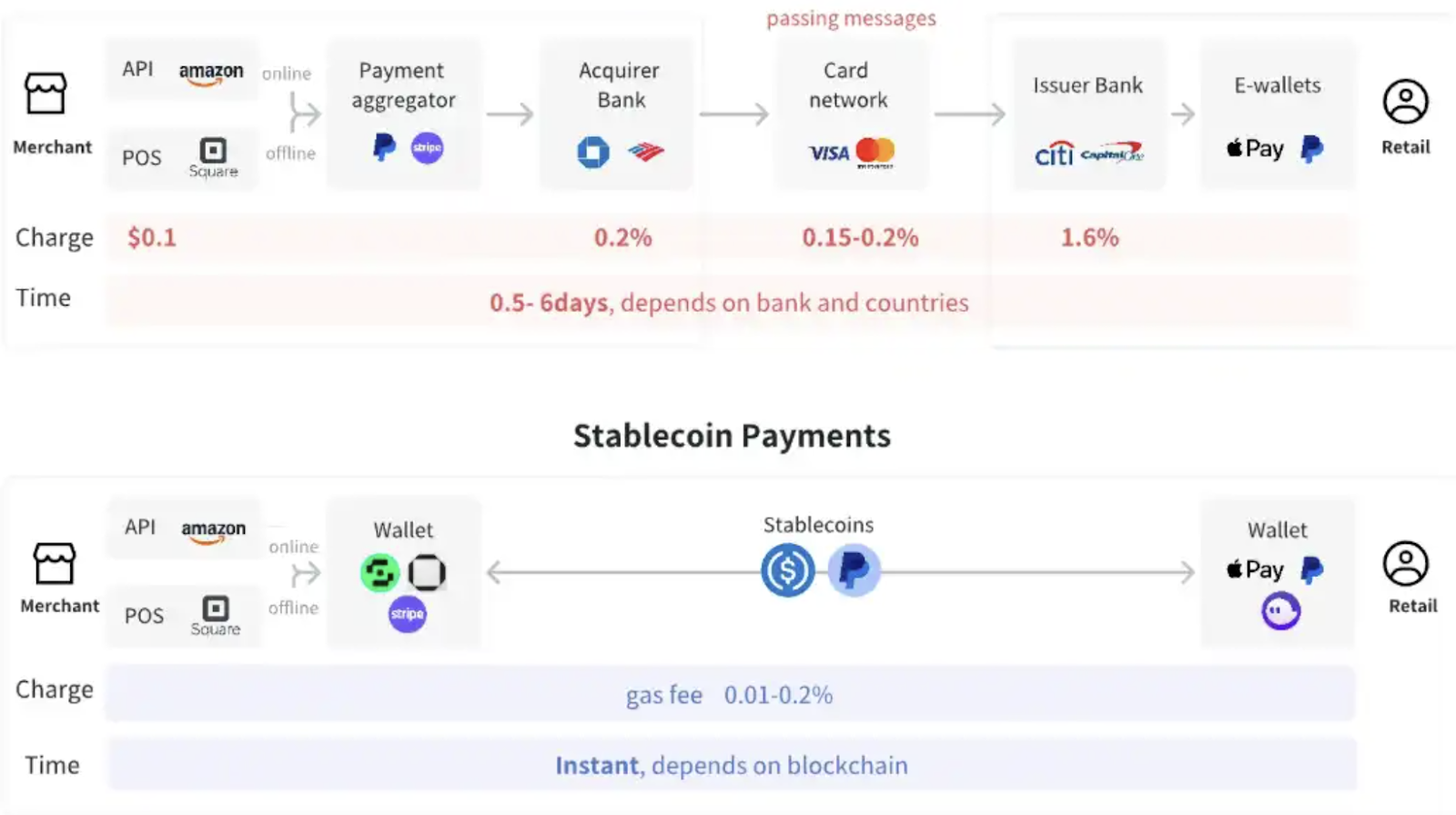

While compliance-focused institutional investors may not profit directly from the appreciation of stablecoins, they can benefit by investing in related infrastructure. For example, mainstream blockchains that support a significant supply of stablecoins (like Ethereum and Solana), as well as various DeFi applications that interact with stablecoins, will gain from this growth. Currently, the share of stablecoins in blockchain transactions has risen from 3% in 2020 to over 50% today. Their core value lies in seamless cross-border payments, a feature that is experiencing rapid adoption in emerging markets. In Turkey, for example, stablecoin transaction volume accounts for 3.7% of GDP, while in Argentina, stablecoin premiums have soared to 30.5%. Innovative payment platforms like Zarpay and MentoLabs are drawing users into the blockchain ecosystem by using grassroots market strategies through local agents and payment systems, further accelerating stablecoin adoption.

At present, the global cross-border B2B payments market processed through traditional channels is valued at approximately $40 trillion, while the consumer remittance market generates hundreds of billions of dollars in annual revenue. Stablecoins offer a new alternative for efficient cross-border payments via crypto channels. As the adoption gains momentum, stablecoins are set to penetrate and disrupt this market segment, becoming a key player in the global payments landscape.

https://mirror.xyz/sevenxventures.eth/_ovqj0x0R_fVAKAKCVtYSePtKYv8YNLrDzAEwjXVRoU

The RLUSD stablecoin introduced by Ripple is designed specifically for corporate payments, aiming to enhance the efficiency, stability, and transparency of cross-border payments while addressing the demands of dollar-denominated settlements. At the same time, Stripe acquired stablecoin platform Bridge for $1.1 billion, marking the largest acquisition in crypto history. Bridge seamlessly bridges fiat and stablecoins for businesses, furthering the adoption of stablecoins in global payments. Bridge’s cross-border payment platform processes over $5 billion in annual transactions and provides global settlement services for high-profile clients like SpaceX, showcasing the convenience and effectiveness of stablecoins in international trade.

Additionally, PEXX, an innovative cross-border stablecoin payment platform, supports the conversion of USDT and USDC into 16 fiat currencies with direct remittance to bank accounts. With streamlined onboarding and instant conversions, PEXX empowers users and businesses to execute cross-border payments efficiently and affordably, breaking down barriers between traditional finance and cryptocurrencies. This innovation not only delivers faster, more cost-effective cross-border payment solutions but also drives the decentralization and seamless integration of global fund flows. Stablecoins are gradually becoming an integral part of the global payment system, enhancing both its efficiency and accessibility.

Regulatory Easing Expected for Perpetual Futures Trading

Since the high leverage inherent in perpetual futures trading often results in clients’ loss, regulators worldwide have enforced stringent compliance requirements. In jurisdictions like the U.S., centralized exchanges (CEXs) are barred from offering perpetual futures services, and perpetual decentralized exchanges (PerpDEXs) face similar restrictions, directly limiting their market potential and user base.

However, with Trump’s resounding electoral victory, the compliance process of the crypto industry is likely to expedite, offering PerpDEXs a chance to thrive. Two recent landmark events are worth noting: To begin with, David Sacks, appointed by Trump as his White House AI and crypto czar, has previously invested in top crypto exchange dYdX. Second, the U.S. Commodity Futures Trading Commission (CFTC) is poised to replace the Securities and Exchange Commission (SEC) as the primary regulator for the crypto industry. The CFTC has gained extensive experience from launching Bitcoin futures on the Chicago Mercantile Exchange (CME) and is regarded as more favorable towards regulating PerpDEXs compared to the SEC. These positive signals may unlock new market opportunities for PerpDEXs, fostering an environment more conducive to their growth under the future compliance framework.

RWAs’ Stable Returns Come to Crypto Users’ Attention

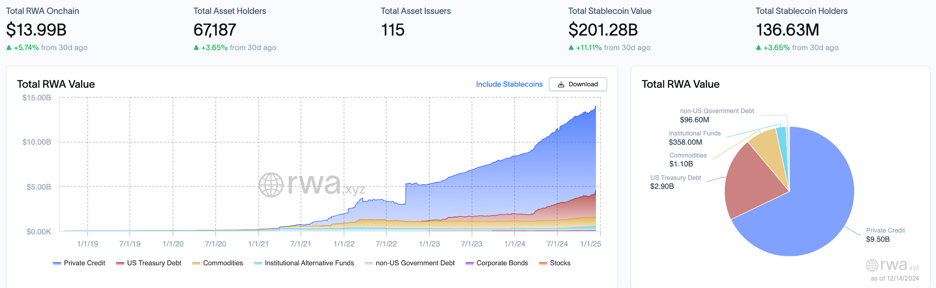

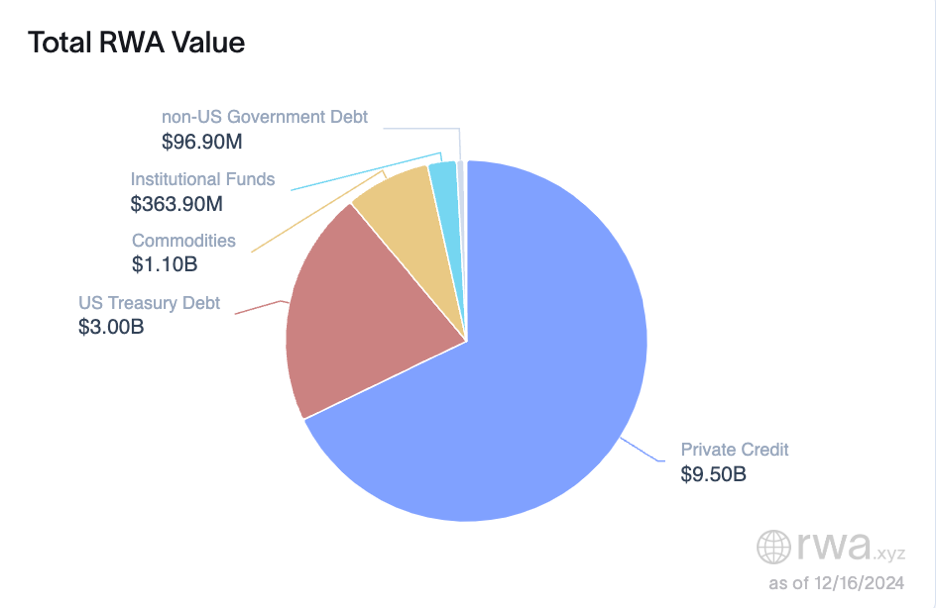

The high-risk, high-reward crypto market once left stable returns from real-world assets (RWAs) overlooked. However, the RWA market saw positive growth during the past bear market cycle, with its total value locked (TVL) skyrocketing from less than $1 million to over $100 billion. Distinct from other crypto assets, the value of RWAs is not subject to the sentiment swings of the crypto market. This feature is essential for building a robust DeFi ecosystem: RWAs not only effectively diversify investment portfolios but also lay a solid foundation for financial derivatives, thus helping investors hedge risks amid market turbulence.

According to RWA.xyz, as of December 14, RWAs had 67,187 holders, 115 asset issuers, and a total market cap of $139.9 billion. Web3 giants like Binance project that the RWA market could expand to $16 trillion by 2030. This immense market potential and investment appeal of stable returns are making RWAs an increasingly indispensable part of the DeFi ecosystem.

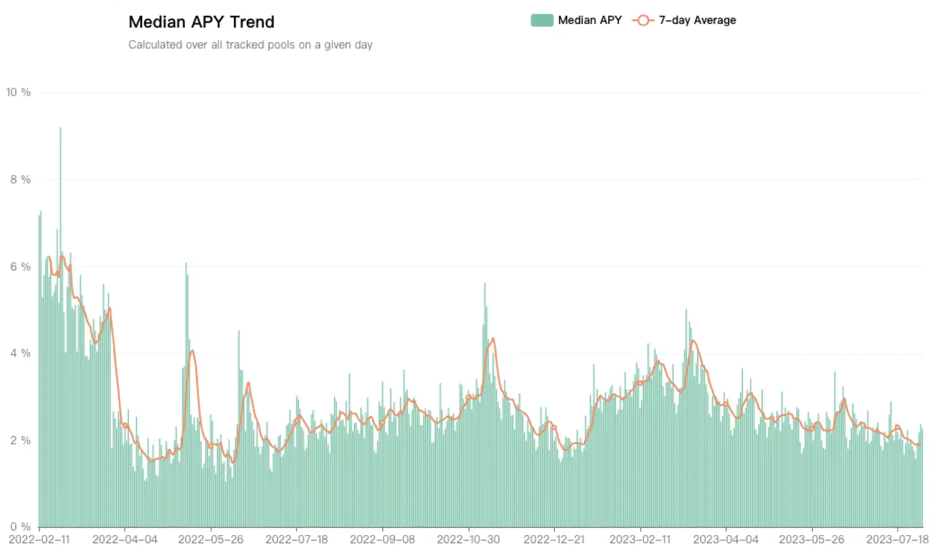

The collapse of Three Arrows Capital exposed a critical issue in the crypto industry: the lack of sustainable yield-generating opportunities for crypto assets.. As the Fed began raising interest rates and global market liquidity tightened, cryptocurrencies, classified as a high-risk asset class, were hit especially hard. In contrast, RWAs (like U.S. Treasury bonds) have steadily increased in rate of return since the end of 2021, drawing market attention. From 2022 to 2023, the median DeFi return dropped from 6% to 2%, falling below the 5% risk-free returns of U.S. Treasury bonds during the same period. As a result, high-net-worth investors lost interest in on-chain returns. With diminishing on-chain returns, the industry began shifting its focus to RWAs, hoping to revive the market by introducing stable, off-chain returns.

https://www.theblockbeats.info/news/54086

In August 2023, MakerDAO reignited the dormant DeFi market by jacking the DAI Savings Rate (DSR) to 8% in its lending protocol Spark Protocol. In just one week, the protocol’s DSR deposits surged by nearly $1 billion, while DAI’s circulating supply grew by $800 million, marking a three-month high. The main driver of this growth was real-world assets (RWAs). Data reveals that over 80% of MakerDAO’s revenue in 2023 came from RWAs. Since May 2023, MakerDAO has accelerated its RWA investments, purchasing U.S. Treasury bonds through entities such as Monetalis, Clydesdale, and BlockTower, while also injecting funds into RWA lending protocols like Coinbase Prime and Centrifuge. By July 2023, MakerDAO’s RWA portfolio had grown to nearly $2.5 billion, including over $1 billion in U.S. Treasury bonds.

MakerDAO’s successful foray has sparked a new wave of interest in RWAs. High yields from blue-chip stablecoins have prompted the DeFi ecosystem to make rapid responses. For instance, the Aave community proposed listing sDAI as collateral, further expanding RWA’s applications in DeFi. Similarly, in June 2023, Compound’s founder launched Superstate, a new company focused on bringing bonds and other RWAs onto the blockchain, offering users stable returns akin to those of the real world.

RWAs have become a vital bridge between RWAs and on-chain finance. As more innovators explore RWA’s potential, the DeFi ecosystem is charting a new path toward stable returns and diversified growth.

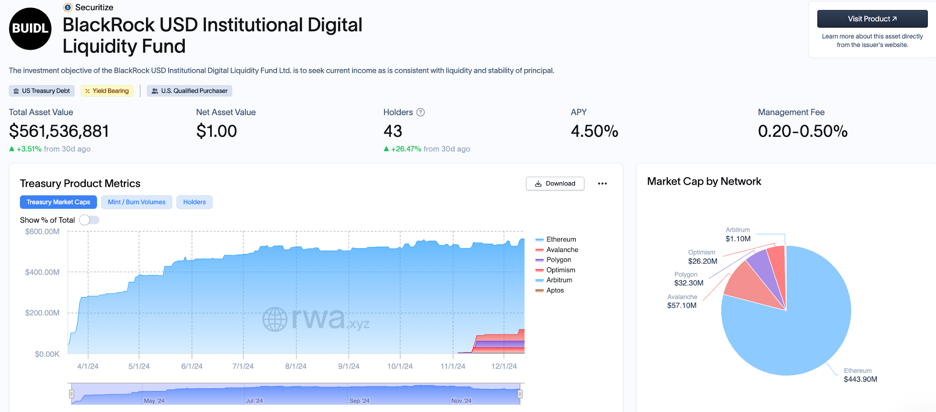

Licensed Institutions’ Entry into Blockchain Expands the Market

In March 2023, BlackRock garnered market attention by launching the first tokenized U.S. Treasury fund, BUIDL, on a public blockchain. The fund provides eligible investors with opportunities to earn yields from U.S. Treasury bonds, initially deploying on Ethereum and later expanding to multiple blockchains like Aptos, Optimism, Avalanche, Polygon, and Arbitrum. At present, $BUIDL functions as a token yield certificate without actual utility, but its groundbreaking debut represents a significant step forward for tokenized finance.

https://app.rwa.xyz/assets/BUIDL

At the same time, Wyoming Governor Mark Gordon announced that the state planned to issue a stablecoin pegged to the U.S. dollar, supported by U.S. Treasury bills and repurchase agreements. The stablecoin is scheduled for release in collaboration with trading platforms in Q1 2025, which marks that stablecoin experiments at the government level will become a new market highlight.

In the realm of traditional finance, State Street, one of the world’s leading asset management companies, is actively exploring ways to integrate into the blockchain payment and settlement systems. Apart from the issuance of its own stablecoin, State Street also plans to introduce deposit tokens representing client funds on the blockchain. As the world’s second-largest fund custodian bank, State Street, which manages over $4 trillion in assets, seeks to improve its service efficiency through blockchain technology, underscoring the significant progress traditional financial institutions are making in their digitalization.

Meanwhile, JPMorgan is rapidly expanding its blockchain businesses and plans to introduce on-chain foreign exchange capabilities in Q1 2025 to enable 24/7 automated multi-currency settlements. Since launching its blockchain payment platform in 2020, JPMorgan has processed over $1.5 trillion in transactions, spanning intraday repurchases, cross-border payments, and more. Its clients include major global companies such as Siemens, BlackRock, and Ant Group. JPMorgan intends to expand its platform, initially supporting automated settlements for USD and EUR, with plans to incorporate more currencies in the future. JPM Coin is an integral part of JPMorgan’s blockchain strategy. As a digital dollar designed for institutional clients, it offers instant global payments and settlements. Its launch has brought financial institutions closer to adopting digital assets on-chain, giving them a first-mover advantage in cross-border payments and fund flows.

In addition, the Hadron platform recently introduced by Tether is also advancing asset tokenization, aiming to streamline this process for multiple assets, including stocks, bonds, commodities, and funds. The platform offers institutions, funds, governments, and private companies services for tokenization, issuance, and burning, among others, while supporting functions like KYC compliance, capital market management, and regulation. These offerings have further driven the digitalization of the asset management industry.

Emergence of Compliance Tools for RWA Token Issuance

Securitize is an innovative platform specializing in fund issuance and investment on the blockchain. Its partnership with BlackRock is rooted in its expertise in the RWA space and the professional services it has provided for numerous large-scale asset securitization enterprises, including the issuance, management, and trading of tokenized securities. Through Securitize, businesses can issue bonds, stocks, and other securities directly on the blockchain while ensuring these tokenized securities are in strict compliance with legal and regulatory requirements across countries by using the full suite of compliance tools provided by the platform.

Since becoming an SEC-registered transfer agent in 2019, Securitize has rapidly expanded its business. In 2021, the company secured $48 million in funding, led by Blockchain Capital and Morgan Stanley. In September 2022, Securitize helped KKR, one of the largest investment management companies in the U.S., tokenize part of its private equity fund on the Avalanche blockchain. The following year, Securitize issued equity tokens for Spanish real estate investment trust Mancipi Partners, also on Avalanche, becoming the first company to issue and trade tokenized securities under the EU’s new Pilot Regime for Digital Assets.

Recently, top stablecoin issuer Ethena partnered with Securitize to launch a new stablecoin product, USDtb. This stablecoin’s reserves are invested in BlackRock’s Institutional Digital Liquidity Fund (BUIDL), which is pegged to the U.S. dollar. This collaboration further solidifies Securitize’s position in the blockchain financial ecosystem.

In May 2023, Securitize raised an additional $47 million in strategic funding, led by BlackRock. The funding will accelerate the expansion of partnerships within the financial service ecosystem. As part of this funding round, Joseph Chalom, BlackRock’s Global Head of Strategic Ecosystem Partnerships, was appointed to Securitize’s Board of Directors. This partnership marks Securitize’s growing role in integrating traditional finance and blockchain technology.

Opportunities and Challenges

How to Address Defaults as RWA Private Credit Enters the Payfi Era

The private credit market now totals approximately $13.5 billion, with $8.66 billion in active loan value and an average annual interest rate of 9.46%. Within the RWA market, private credit remains the second-largest asset class, with Figure Markets accounting for around 66% of the issuance share.

Figure Markets is a trading platform built on the Provenance blockchain, offering various types of assets such as stocks, bonds, and real estate. In March 2024, the platform secured over $60 million in a Series A funding round from Jump Crypto, Pantera Capital, and others. With a TVL of $13 billion, it now leads the RWA market in TVL. Different from traditional non-standard RWA private credit, Figure Markets focuses on the standardized home loan market, thus having a greater volume and growth potential, as well as more future opportunities.

https://app.rwa.xyz/?ref=ournetwork.ghost.io

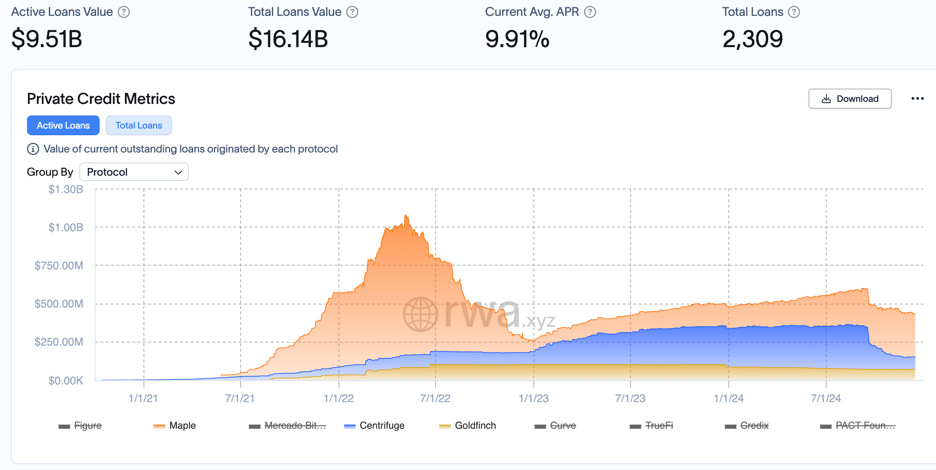

In addition, private credit also includes corporate and institutional loans, with notable players emerging in the previous cycle, such as Centrifuge, Maple Finance, and Goldfinch.

TVL has seen a rebound this year, https://app.rwa.xyz/?ref=ournetwork.ghost.io

– Centrifuge is a decentralized asset financing protocol that tokenizes RWAs (e.g., real estate, bills, and invoices) into NFTs via its Tinlake protocol and uses them as collateral for borrowers. Borrowers can access liquidity from decentralized fund pools through these NFTs, while investors provide capital via these pools in exchange for stable returns. Centrifuge’s core innovation lies in combining blockchain with traditional financial markets, helping businesses and startups access affordable financing, and reducing credit risk and intermediary costs through the blockchain’s transparency and decentralization.

However, Centrifuge is not without challenges posed by market volatility. Although its tokenization model is favored by many traditional institutions, defaults may arise as borrowers struggle to meet repayment obligations when the market is extremely volatile. For instance, assets heavily impacted by market volatility may fail to meet loan obligations. In particular, liquidity shortages in bear markets severely test borrowers’ repayment capacity.

– Maple Finance specializes in offering high-yield, secured loans to corporate and institutional borrowers. Its loan pools often use crypto assets like BTC, ETH, and SOL for over-collateralization. With on-chain credit scoring mechanisms, Maple provides lenders with stable returns by allowing institutional borrowers to create and manage loan pools. This model is especially suited for institutions within the crypto industry, as offering them over-collateralized loans helps mitigate risks and maximize capital returns.

Nevertheless, Maple races daunting challenges during bear markets, suffering several defaults, particularly as the crypto market declines. For example, Orthogonal Trading failed to repay its $36 million loan on Maple Finance, putting the platform under massive default pressure.

– Goldfinch is an on-chain credit lending platform that offers loans to startups and small and micro businesses without access to traditional financing channels. Unlike other RWA lending platforms, Goldfinch uses an unsecured loan model, assessing borrowers’ repayment capacity based on their credit history and third-party evaluators. Through its fund pools, Goldfinch lends money to borrowers in need while delivering fixed returns to fund providers.

Goldfinch’s main issue lies in the selection of borrowers. Many of its borrowers, particularly startups and small and micro businesses in high-risk markets, are prone to default. For example, in April 2022, Goldfinch was hit with a $10 million loan default, with losses largely stemming from high-risk small and micro businesses as well as startups. Even with investments from a16z, these defaults have exposed Goldfinch’s shortcomings in risk management and its ability to address market demands.

https://dune.com/huma-finance/huma-overview

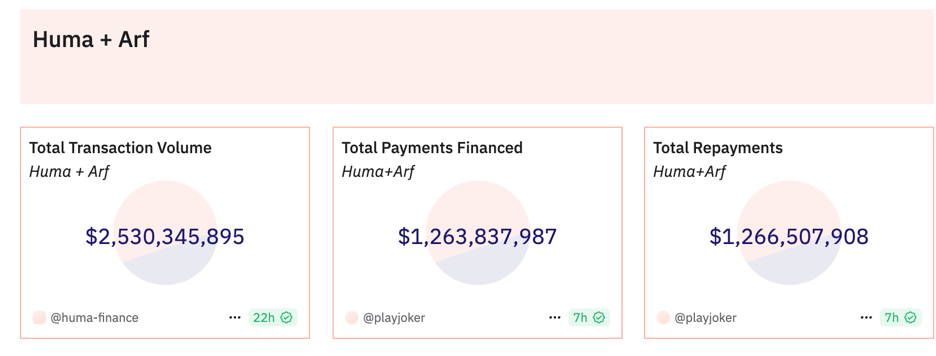

The “Payfi” concept recently proposed by Solana shares similarities with private credit in terms of business logic. It also extends its use cases to cover diverse areas like cross-border financing, lending, and cross-border payment swaps. For example, Huma Finance provides financial services for investors and borrowers, where investors earn returns by supplying funds, and borrowers access loans and make repayments. At the same time, Huma’s subsidiary, Arf, focuses on offering advance funds for cross-border payments, significantly streamlining traditional international remittance processes.

For instance, sending money from Singapore or Hong Kong to South Africa via traditional Swift transfers is often slow and costly. Although many opt for companies like Western Union, these companies must work with local partners in South Africa and rely on substantial local advance funds for same-day settlements. This model places a heavy burden on remittance companies, as they must manage advance funds in various fiat currencies across multiple countries, which compromises efficiency. Arf introduces stablecoins to abstract advance fund services, enabling swift cash flows for payment companies.

For example, when a user remits $1 million to South Africa, Arf ensures the funds are deposited into regulated accounts and settles the cross-border transaction using stablecoins. Huma conducts due diligence on payment companies prior to settlement to ensure safety. Throughout the process, Huma lends and recovers stablecoins, without fiat deposits and withdrawals involved, thus achieving fast, secure, and efficient fund flows.

Huma primarily serves clients from developed countries like the UK, the US, France, and Singapore, where bad debt rates are extremely low. Repayment cycles range from 1 to 3 days, with fees calculated daily. Fund flows are transparent and efficient. To date, Huma has facilitated $2 billion in transactions with a 0% bad debt rate. Its partnership with Arf has delivered impressive double-digit returns, entirely independent of tokens.

In addition, Huma also plans to integrate with DeFi projects such as Pendle to explore token reward mechanisms and broader decentralized finance strategies, thereby boosting user returns and market appeal. Its model might become an innovative way to tackle private credit default challenges.

Who Will Become A Leader in Yield-Generating Stablecoins

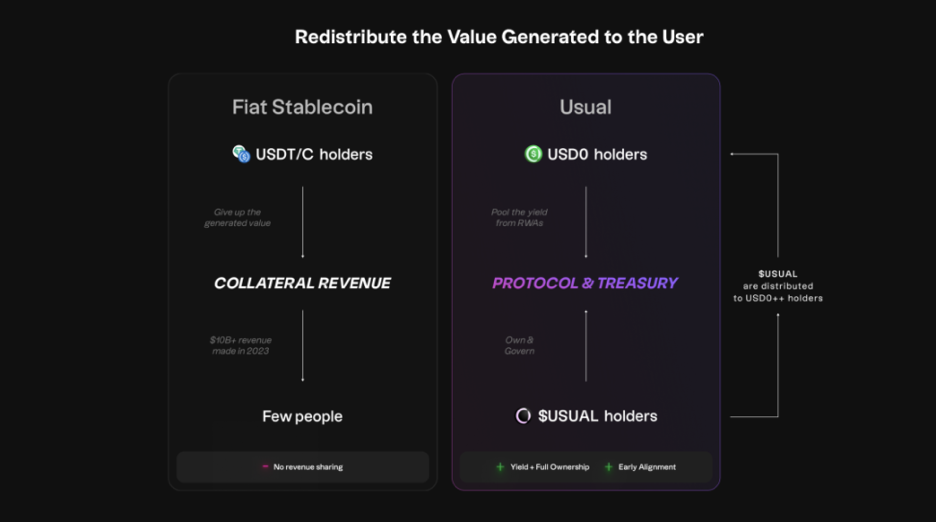

In this market cycle, a stablecoin as secure as USDT/USDC but offering at least 5% sustainable returns might emerge. The market potential is undoubtedly enormous. Currently, Tether, the issuer of USDT, generates nearly $10 billion in annual profit with a team of only about 100 people. Could redistributing this portion of profits to users bring the vision of yield-generating stablecoins to life?

Stablecoins Backed by Treasury Bonds

At present, stablecoins with U.S. Treasury bonds as underlying assets are becoming a new trend in the crypto market. These stablecoins introduce traditional financial assets onto the blockchain through tokenization. This approach preserves the stability and low-risk nature of Treasury bonds while retaining DeFi’s high liquidity and composability. Multiple strategies are adopted to increase risk premiums, including fixed budget incentives, user fees, volatility arbitrage, and leveraging reserve types such as staking or re-staking.

USDY launched by Ondo Finance exemplifies this trend. USDY is a tokenized note backed by short-term U.S. Treasury bonds and bank demand deposits. Designed to comply with U.S. laws and regulations, it can function as collateral in DeFi protocols or as a medium for Web3 payments. USDY comes in two forms: accruing (USDY) for long-term holding and rebasing (rUSDY) that generates returns by increasing token quantities and is thus suitable as a settlement tool. At the same time, OUSG tokens launched by Ondo Finance specialize in offering high liquidity investment opportunities tied to short-term U.S. Treasury bonds. Its underlying assets are stored in BlackRock’s USD institutional fund and can be instantly minted or redeemed.

Additionally, OpenTrade offers various Treasury-backed Vault products, such as fixed-yield U.S. Treasury Vaults and flexible-yield USDC Vaults, catering to the asset management needs of different users. By integrating its tokenized offerings deeply with DeFi, OpenTrade provides holders with seamless deposit and yield experiences.

Comparison between the profit distribution of USDT issuers and Usual profit distribution https://docs.usual.money/

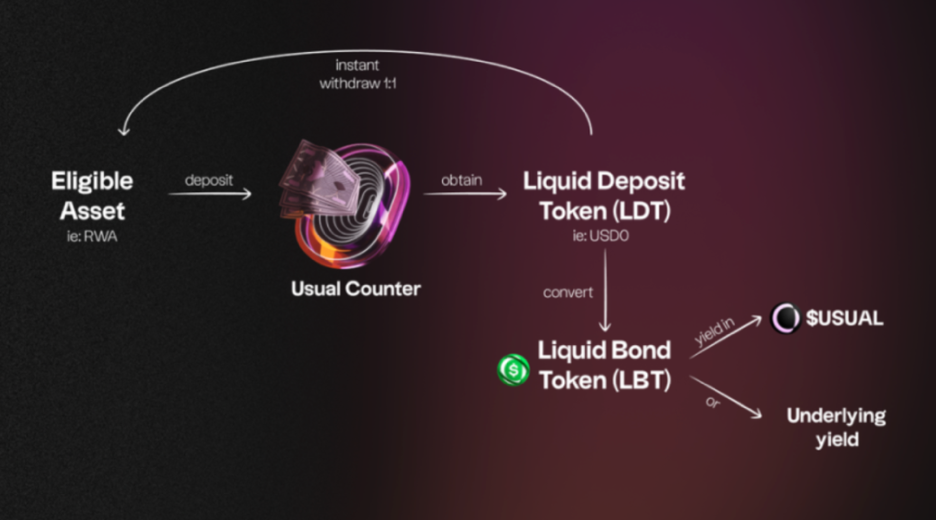

Usual Protocol’s stablecoin, USD0, tokenizes traditional financial assets such as U.S. Treasury bonds and offers two minting options: Users can mint USD0 either directly by depositing RWAs or indirectly by depositing USDC/USDT. At the same time, USD0 can be upgraded to USD0++, which offers higher yields. Through partnerships with DeFi platforms like Pendle, this protocol provides users with extra loyalty rewards.

The sUSD stablecoin introduced by Solayer on the Solana blockchain uses U.S. Treasury bonds as collateral and offers holders 4.33% on-chain returns. Meanwhile, it can be used as collateral to enhance the Solana network’s stability and security. These mechanisms not only boost stablecoins’ ability to generate returns but also improve the DeFi ecosystem’s stability and efficiency, showcasing the immense potential of integrating traditional finance with blockchain technology.

Low-Risk On-Chain Arbitrage Strategies

Apart from Treasury-backed designs, another type of yield-generating stablecoins exploits features like crypto market volatility and MEV to deliver low-risk returns.

Ethena is one of the fastest-growing non-fiat-collateralized stablecoin projects since Terra Luna’s collapse. Its native stablecoin, USDe, has surpassed Dai and ranks third in the market with a valuation of $5.5 billion. Primarily based on the Delta Hedging strategy with Ethereum and Bitcoin as collateral, Ethena mitigates the impact of collateral price fluctuations on USDe’s value by opening short positions on CEXs equivalent to the collateral’s value. This hedging mechanism relies on OTC settlement providers, with protocol assets held by multiple external custodians. This mechanism is designed to stabilize USDe by balancing gains and losses between the collateral value and short positions.

The project generates revenue through three primary channels: Ethereum staking yields from users’ LST collateral; funding rates or basis profits from hedging trades; and Liquid Stables’ fixed rewards, that is, interests from depositing USDC or other stablecoins on Coinbase or similar exchanges. Essentially, USDe is a packaged, low-risk quantitative hedging product on CEXs. It offers up to 27% floating annualized percentage yields (APYs) under favorable market conditions with ample liquidity.

Ethena’s risks primarily stem from potential collapses of CEXs or custodians, as well as price-depegging or systemic risks that could arise from insufficient opposite positions during liquidity runs. These risks are further exacerbated in bear markets with persistently low funding rates. During a mid-year market downturn, Ethena’s market volatility agreement yield fell to -3.3%, though no systemic risks ever materialized.

Despite these challenges, Ethena presents an innovative design that combines on-chain and CEX mechanisms. By leveraging the large quantity of LST assets from the mainnet merge, it supplies exchanges with scarce short-side liquidity, while generating fees and revitalizing the market. In the future, as order book DEXs gain traction and the chain abstraction technology matures, fully decentralized stablecoins based on this approach might become a reality.

At the same time, other projects are also exploring different yield-generating stablecoin strategies. For example, CapLabs incorporates MEV and arbitrage profit models to generate returns. Meanwhile, Reservoir uses a diversified, high-yield asset basket for optimized asset allocation. Recently, DWF Labs also plans to launch the synthetic yield-generating stablecoin, Falcon Finance, which comes in two versions: USDf and USDwf.

These innovations are expanding the range of options available in the stablecoin market and accelerating DeFi’s evolution.

Mutual Reinforcement of RWAs and DeFi Applications

RWAs Enhance the Stability of DeFi Applications

The reserves of Ethena’s recently launched stablecoin USDtb are mainly invested in BlackRock’s tokenized U.S. Treasury fund, BUIDL. Specifically, BUIDL accounts for 90% of USDtb’s reserves, the highest BUIDL allocation among all stablecoins. This design enables USDtb to effectively support USDe’s stability in challenging market conditions, especially during periods of negative funding rates. Ethena’s Risk Committee approved a proposal last week to onboard USDtb as a USDe backing asset. During periods of market uncertainties, Ethena will be able to close the hedging positions underlying USDe and re-allocate its backing assets to USDtb to further ameliorate market risks.

In addition, Collateralized Debt Position (CDP) stablecoins are bringing in RWAs to improve their collateralization and liquidation mechanisms, thereby enhancing their peg stability. In the past, CDP stablecoins mainly adopted crypto assets as collateral, but they faced scalability and volatility challenges. In 2024, CDP stablecoins began accepting more liquid and stable collateral. For example, Curve’s crvUSD has recently introduced USDM (an RWA), which enhances its resilience. Additionally, some liquidation mechanisms have been refined, especially crvUSD’s soft liquidation mechanism that provides a buffer against bad debts, effectively lowering risks.

DeFi Mechanisms Boost the Asset Utilization Rate of Tokenized RWAs

Related assets in Pendle’s new RWA section have reached a TVL of $150 million, covering various yield-generating assets like USDS, sUSDS, SyrupUSDC, and USD0++.

Specifically, USDS operates similarly to DAI, allowing users to earn SKY token rewards by depositing it into the SKY protocol. sUSDS is akin to sDAI, with part of its yield derived from MakerDAO’s investments in Treasury bonds. SyrupUSDC, a yield-generating asset backed by the Maple digital asset lending platform, generates returns by providing institutional borrowers with fixed-rate, overcollateralized loans. Moreover, USD0++’s yields entirely come from 1:1-backed Treasury bonds, ensuring stable returns.

At present, Pendle’s annual percentage yields (APYs) are pretty appealing, with 432.4% for sUSDS LP, 98.88% for SyrupUSDC LP, 43.25% for USD0++ LP, and 22.96% for USDS LP. These high returns have attracted users to invest in RWA stablecoins.

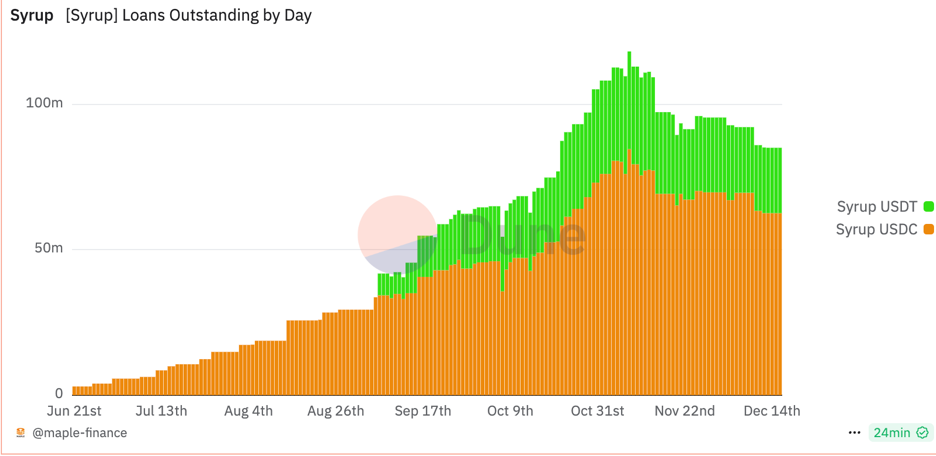

Maple’s Syrup project, launched in May, has leveraged DeFi mechanisms for rapid growth, revitalizing the platform after loan defaults during the bear market.

https://dune.com/maple-finance/maple-finance

In addition, users who purchase USD0++’s YT assets on Pendle are eligible for usual token airdrops. This approach offers fresh yield opportunities from on-chain U.S. Treasury bonds through tokenization.

Can the RWAFI Public Blockchain Empower Institutional Finance?

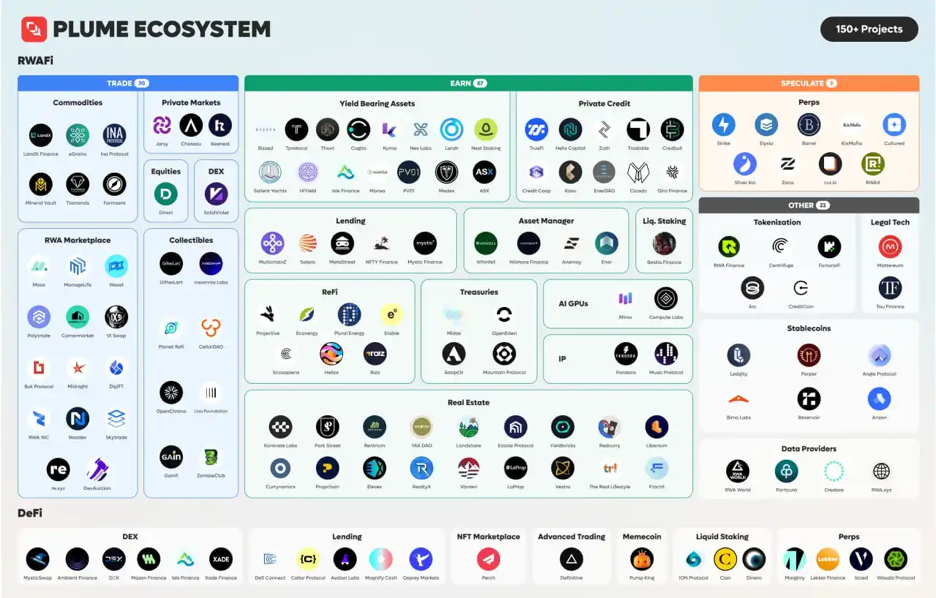

Plume is an RWA-focused Layer 2 ecosystem dedicated to bridging traditional finance (TradFi) and decentralized finance (DeFi) to build a financial ecosystem network that covers over 180 projects. Meanwhile, through the Enterprise Ethereum Alliance (EEA) and the Tokenized Assets Coalition (TAC), Plume has forged industrial alliances with institutions like WisdomTree, Arbitrum, JPMorgan, a16z, Galaxy Digital, and Centrifuge to set industry standards and implement institutional-grade RWA solutions.

Plume utilizes a modular, permissionless compliance architecture, enabling KYC and AML to be autonomously configured at the application level. By embedding anti-money laundering (AML) protocols and working alongside blockchain analytics providers, the platform ensures global security compliance. In the meantime, it partners with regulated brokers/dealers and transfer agents to facilitate compliant security issuance and trading in markets like the U.S. Having introduced the zero-knowledge proof of reserves (ZK PoR) technology, Plume verifies asset reserves while protecting privacy. It additionally supports global security exemptions such as Regulation A, D, and S, serving both retail and institutional investors across jurisdictions.

Plume supports users in the following ways:

● Users can borrow stablecoins or crypto assets with tokenized RWAs (e.g. real estate or private credit) as collateral and provide low-volatility collateral to ensure security;

● Liquid staking has been introduced, which allows users to receive liquidity tokens and participate in other DeFi protocols for compound returns. The platform also offers assets that would generate compound returns like private credit and infrastructure investments, providing steady returns and facilitating reinvestments.

● Plume supports the listing and trading of RWAs on PerpDEXs, allowing users to go long or short on assets like real estate or commodities, thus merging TradFi and DeFi trading.

● In addition, Plume offers stable assets with APYs of 7–15% across areas like private credit, solar energy, and mining to attract long-term investors. For speculative assets, Cultured provides on-chain speculative opportunities based on data such as sports events and economic indicators, catering to users’ demand for short-term, high-yield transactions.

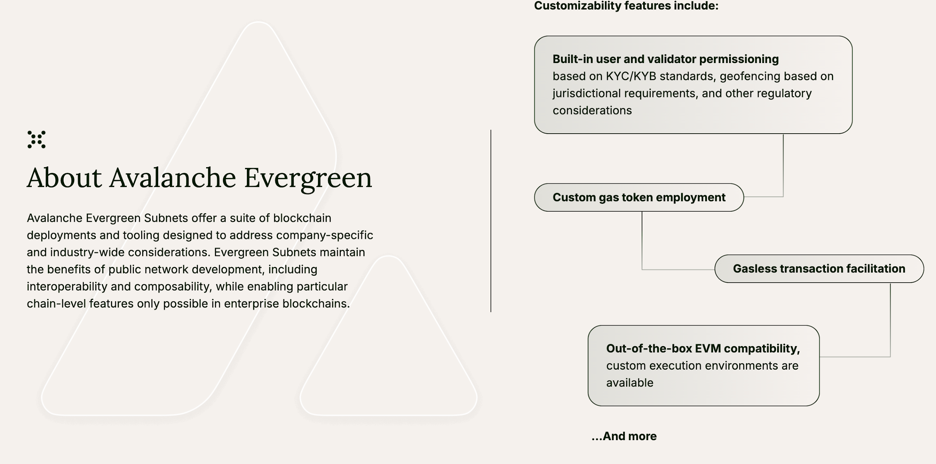

Avalanche is the first L1 public chain to fully embrace RWAs and has been actively exploring enterprise applications since the end of 2022. Its unique subnet architecture allows institutions to deploy custom blockchains optimized for specific use cases while maintaining seamless interoperability with the Avalanche network. It has unrestricted scalability. Between late 2022 and early 2023, entertainment giants from South Korea, Japan, and India began building subnets on Avalanche. Avalanche also keenly captured Hong Kong’s momentum in asset tokenization. In April 2023, it launched the Evergreen subnet during the Hong Kong Web 3.0 Summit, offering financial institutions dedicated tools and services for blockchain deployment. This initiative facilitates settlements with authorized counterparties on private chains while ensuring interoperability through Avalanche Warp Messaging (AWM). Institutions like WisdomTree and Cumberland have been drawn to participate in the Spruce testnet.

https://www.avax.network/evergreen

In November of the same year, Avalanche partnered with JPMorgan’s Onyx platform, using LayerZero to connect Onyx and Evergreen. This collaboration prompted WisdomTree Prime to facilitate the subscriptions and redemptions of tokenized assets and became part of the Guardian Project by the Monetary Authority of Singapore (MAS). Subsequently, Avalanche continued to forge partnerships with more institutions. In November, it helped the financial service company Republic launch the tokenized investment fund, Republic Note. In February 2024, it collaborated with Citibank, WisdomTree, and other institutions to test tokenized private equity funds on the Spruce testnet. In March, it partnered with ANZ Bank and Chainlink to enable asset settlements between Avalanche and Ethereum via CCIP. In April, it integrated with Stripe, the payment giant.

Furthermore, the Avalanche Foundation is also actively driving RWA development. It has introduced the Avalanche Vista initiative, which allocates $50 million to purchase tokenized assets like bonds and real estate. Additionally, it has invested in RWA projects such as Balcony and Re through Blizzard Fund. Ava Labs President John Wu noted that Avalanche’s mission is to bring the world’s assets on-chain. By leveraging blockchain advantages like instant settlement, Avalanche integrates traditional finance’s highly regulated entities into the on-chain space, empowers the rise of RWAs, and positions itself as the premier platform for institutional tokenization.

Promising New Directions

On-Chain Foreign Exchange

The traditional foreign exchange (FX) system is plagued by insufficiencies and challenges, including counterparty settlement risks (Although CLS has improved security, the process remains cumbersome), high coordination costs in multi-bank systems (for instance, purchasing yen from an Australian bank requires coordination across six banks), time zone mismatches for global settlements (e.g., Canadian and Japanese banking systems overlap for less than five hours daily), and restricted access to the FX market (retail users pay fees up to 100 times higher than large institutions). On-chain FX offers real-time price feeds through oracles (e.g., Redstone and Chainlink and leverages DEXs to ensure cost efficiency and transparency. For example, Uniswap’s concentrated liquidity market maker (CLMM) reduces trading costs to 0.15%-0.25%, nearly 90% lower than traditional FX costs. On-chain instant settlement (replacing the traditional T+2 model) also provides arbitrageurs with more opportunities to correct market mispricing. Moreover, on-chain FX simplifies corporate financial management, allowing companies to access multiple products without the need for multiple currency-specific bank accounts. Meanwhile, retail users benefit from optimal exchange rates via wallets embedded with DEX APIs. In addition, on-chain FX separates currencies from jurisdictions, reducing reliance on domestic banks. Although this approach has its pros and cons, it effectively leverages digital efficiency and safeguards monetary sovereignty.

However, on-chain FX still faces hurdles such as the scarcity of non-USD-denominated digital assets, oracle security vulnerabilities, limited support for long-tail currencies, regulatory issues, and the lack of unified interfaces for on- and off-ramps. Even so, it holds immense potential. Citibank is developing blockchain-based FX solutions under the guidance of the MAS. The daily trading volume in the FX market surpasses $7.5 trillion. In particular, in the Global South, individuals often exchange US dollars in black markets for better exchange rates. While Binance P2P offers options, its order book model lacks flexibility. Meanwhile, projects like ViFi are now developing on-chain AMM solutions for FX, unlocking new possibilities for on-chain FX markets.

Cross-Border Payment Stacks

Cryptocurrencies are increasingly seen as essential tools for the vast cross-border payments market, especially in global remittance markets, which generate hundreds of billions of dollars in annual revenue. Stablecoins have paved new paths for cross-border payments through three primary layers: Merchant layer, stablecoin orchestration, and FX and liquidity. At the merchant layer, by initiating apps and interfaces for retail or commercial transactions, merchants can establish stablecoin flows and create “moats”, thereby upselling additional services, controlling user experiences, and achieving end-to-end customer coverage. This is like Robinhood in the stablecoin ecosystem. The stablecoin orchestration layer provides on/off ramps, virtual accounts, cross-border stablecoin transfers, and conversions between stablecoins and fiat. Licensing will become a key competitive advantage, ensuring the lowest costs and maximum global coverage. For example, Stripe’s acquisition of Bridge exemplifies how to build such a moat. The FX and liquidity layer is responsible for efficient exchanges between stablecoins and dollars, fiat, or regional stablecoins. In addition, as crypto exchanges continue to emerge to serve participants across regions, cross-border stablecoin payment apps and processors tailored to specific markets are likely to proliferate.

Similar to traditional finance and payment systems, building strong and scalable moats is key to maximizing commercial opportunities across these layers. Over time, these layers will likely integrate. Specifically, the merchant layer holds the greatest potential for aggregation. It can bundle services from other layers to further enhance value, expand revenue sources, and control FX transactions, on/off ramp options, and partnerships with stablecoin issuers, ultimately developing a comprehensive and efficient cross-border payment solution.

Multi-Pool Stablecoin Aggregation Platform

In a world where most companies issue their own stablecoins, stablecoins’ fund fragmentation is becoming an increasingly pressing issue. Traditional on- and off-ramp solutions, while offering short-term alleviation, fail to deliver the efficiency promised by cryptocurrencies. To address this challenge, Numéraire on Solana has introduced USD* to provide an efficient and flexible multi-asset stablecoin exchange platform designed to tackle stablecoin fragmentation within the Solana ecosystem.

The platform uses an AMM mechanism to enable seamless creation and exchange of various stablecoins. All stablecoins share a unified liquidity pool to prevent the dispersion of funds, significantly improving capital efficiency and liquidity management. As a core element in the system, USD serves as an intermediary unit, simplifying stablecoin exchanges and facilitating more accurate price discovery, reflecting the real-time market valuation of different stablecoins. Not only can users mint stablecoins directly via the protocol, they can also customize their risk-return profiles through a tiered collateralized debt position system, further enhancing capital utilization. At the same time, the platform’s lending features allow surplus stablecoins to be circulated efficiently within the system, optimizing overall capital operations.

While Numéraire lacks the liquidity of platforms like Raydium, its innovative design provides a visionary solution to the fragmentation in the stablecoin ecosystem. It can more effectively satisfy institutional needs and the growing real-world demand for stablecoin liquidity.

Looking back at the previous market cycle, the stablecoin products adopting the multi-pool model were successfully launched only on Ethereum’s Curve. This model was widely acclaimed for its efficiency in stablecoin swaps. Looking ahead, as the scale of stablecoin issuance continues to grow on other public blockchains, similar products adopting the multi-pool model are expected to emerge in more blockchain ecosystems, further driving the stablecoin market toward greater scalability and maturity.

References:

https://foresightnews.pro/article/detail/73859

https://app.rwa.xyz/?ref=ournetwork.ghost.io

https://www.theblockbeats.info/news/55857

https://www.theblockbeats.info/news/54086

https://www.chaincatcher.com/article/2153443

https://www.chaincatcher.com/article/2153443

https://www.chaincatcher.com/article/2156475

About Us

This article is a product of diligent work by the HTX Research Team that is currently under HTX Ventures. HTX Ventures, the global investment division of HTX, integrates investment, incubation, and research to identify the best and brightest teams worldwide. With a decade-long history as an industry pioneer, HTX Ventures excels at identifying cutting-edge technologies and emerging business models within the sector. To foster growth within the blockchain ecosystem, we provide comprehensive support to projects, including financing, resources, and strategic advice.

HTX Ventures currently backs over 300 projects spanning multiple blockchain sectors, with select high-quality initiatives already trading on the HTX exchange. Furthermore, as one of the most active Fund of Funds (“FOF”) investors, HTX Ventures invests in 30 top global funds and collaborates with leading blockchain funds such as Polychain, Dragonfly, Bankless, Gitcoin, Figment, Nomad, Animoca, and Hack VC to jointly build a blockchain ecosystem.

Company Website: https://www.htx.com/en-us/ventures?invite_code=9cqt3 Twitter: https://x.com/Ventures_HTX

Medium: https://htxventures.medium.com/

The post first appeared on HTX Square.