Bot Trading 101 | What Is Crypto Arbitrage Trading?

The opportunities available in the traditional financial sector are now starting to gain traction in the cryptocurrency market as well. Alongside futures and leveraged trading, arbitrage trading is drawing attention because of the opportunities that it represents. Crypto arbitrage trading specifically is gaining popularity as traders are able to leverage this tool to open new opportunities to profits and returns in the crypto market.

In this article, we look at what is crypto arbitrage trading, three popular strategies, and how can a trader leverage a crypto bot to extract profits through arbitrage.

What is Arbitrage Trading?

The term arbitrage trading may sound mumble-jumble, but it is a pretty straightforward concept. Arbitrage trading essentially involves buying and selling the same asset in two different markets in order to leverage the price difference between these markets.

For instance, buying shares of “ABC company” at $10 from the New York Stock Exchange and selling them at $10.20 at the London Stock Exchange. While the price difference looks trivial for individual stocks, buying the shares in bulk yields higher returns to an investor.

While arbitrage trading is a favorable tool in the traditional markets, the profit margins are less owing to the maturity of these markets. Moreover, trading fees dampens the opportunities of arbitrage trading in the traditional financial markets.

But arbitrage trading is now gaining interest within the crypto community. How do traders benefit from cryptocurrency arbitrage trading? Let’s find out.

Crypto Arbitrage Trading

Currently, there are more than 300 cryptocurrency exchanges across the globe. Cryptocurrency prices of the same coin vary between exchanges due to different trading volumes and liquidity.

In order to leverage the difference in prices, a trader purchases a coin from one exchange and sells it on a different exchange.

For instance, a trader purchases one bitcoin at $10,000 from exchange A and sells at exchange B where the price of one BTC is at $10,300. The trader gains a profit of $300 without putting in much effort.

Arbitrage opportunities in the cryptocurrency market can be even more lucrative to traders. Recently, interest within cryptocurrencies has surged. This growth has resulted in a subsequent rise in the trading volume of cryptocurrencies. Since exchanges are not directly linked to each other, traders can strategically leverage crypto arbitrage opportunities.

Furthermore, because of factors like political unrest, hyperinflation in fiat currency, and a devaluation of fiat currency, cryptocurrencies like bitcoin are trading at premium prices. For instance, amidst economic tensions in Argentina, bitcoin was sold at a premium rate on local exchanges 10% higher than international exchanges.

Additionally, apart from such events, there will always be a certain degree of price difference in the same cryptocurrency between any two exchanges.

Crypto Arbitrage Trading Opportunities

There are three popular arbitrage trading opportunities in the cryptocurrency market.

Spatial Arbitrage

This strategy is the simplest way to extract benefits through arbitrage trading. It involves trading the same cryptocurrency over two separate exchange platforms. In spatial arbitrage, a trader buys cryptocurrency from one exchange and sells it at another exchange where the price of the coin is available at higher rates. The example earlier in this article represents simple arbitrage trading.

Triangular Arbitrage

Unlike spatial arbitrage, a triangular arbitrage strategy is carried out on one exchange platform. In this method, a trader takes advantage of the price difference between trade pairs. On a singular exchange platform, a trader converts BTC to ETH, ETH to XRP, and XRP to BTC again, making a complete triangular loop. In the triangular arbitrage, a trader makes profits by exchanging such trade pairs.

Statistical Arbitrage

This method involves using modern technological tools and algorithms to leverage the price discrepancies between two crypto assets. A popular and emerging way of statistical arbitrage is through cryptocurrency trading bots. These bots calculate a vast amount of data using hi-tech technology and execute cryptocurrency trades within seconds.

Cryptohopper: Crypto Arbitrage Trading Bot

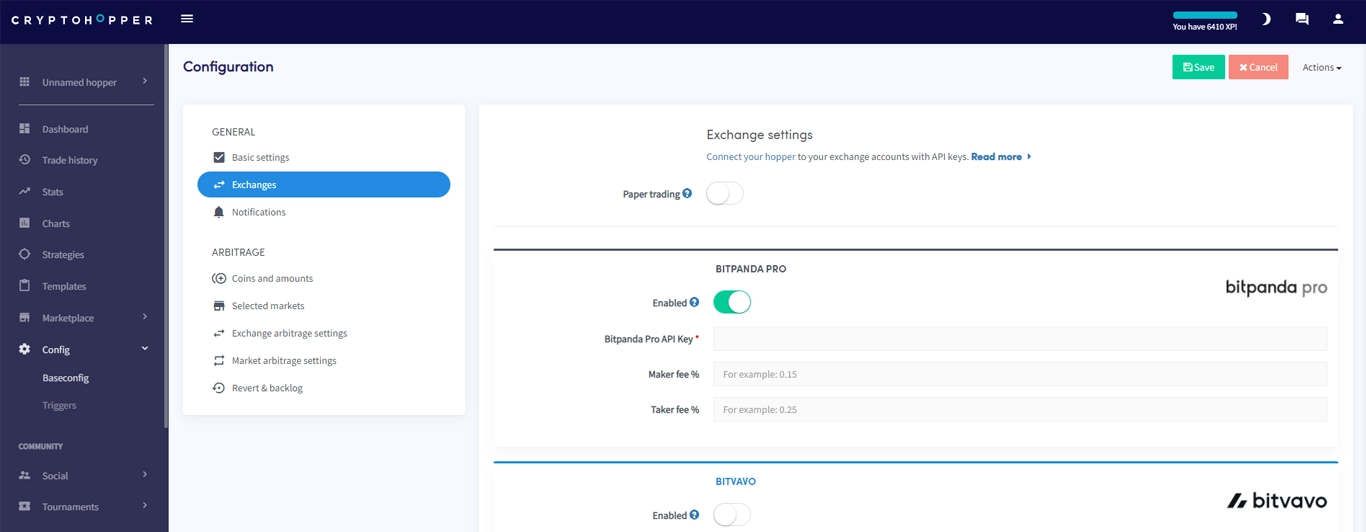

Cryptohopper is a leading cryptocurrency trading bot that facilitates automated trading on the world’s top cryptocurrency exchanges. The Cryptohopper bot uses advanced technological solutions and algorithms to calculate the optimum points of entry and exit in cryptocurrency trades. The bot facilitates a beginner to access the market of cryptocurrencies.

Additionally, it facilitates an experienced trader with a number of tools like backtesting to strengthen their trading strategies.

The platform provides innovative features such as mirror trading and trailing stops to leverage maximum returns in cryptocurrency trading. Cryptohopper also facilitates its users with arbitrage trading opportunities in the crypto market.

You can leverage Cryptohopper platform to seek arbitrage strategies in three ways:

Direct Exchange - A trader can access spatial arbitrage strategy on the Cryptohopper platform by exchanging the same crypto asset on two different exchanges. With Cryptohopper, a trader has the advantage of direct arbitrage without sending the funds from one exchange to another.

Triangular Arbitrage - A trader can make use of price differences between different trading pairs and extract a profit. With Cryptohopper, this process becomes fast, much simpler, and integrated through a single interface.

Multiple Exchanges and Pairs - The platform enables its users to leverage opportunities by connecting multiple exchanges. In addition to this, a trader can select multiple pairs and benefit from extended advantages.

Final Remarks

The current trends and movements suggest that cryptocurrency trading, and the industry in general, is gaining momentum as well as mainstream adoption.

Cryptocurrency arbitrage trading is an emerging strategy for extracting returns on trading crypto assets. Volatility within the market and an increasing number of exchanges open up opportunities for profitable arbitrage trading in the cryptocurrency industry. At the same time, a trader should conduct due diligence and thorough research before investing in the market.