Rising US Treasury yields have hit a 14-month high at 4.79 percent, drawing institutional money away from riskier assets like Bitcoin. Historically, BTC reacts quickly to yield spikes, but this time the impact was compounded by the news that the US Department of Justice plans to liquidate $6.5 billion in seized Bitcoin.

Despite macro pressures, Bitcoin remains resilient—still up 42 percent since the US election—outperforming equities, which have erased post-election gains. However, with the Federal Reserve signalling fewer rate cuts and financial conditions tightening, Bitcoin may face more volatility in the short term. Optimism around pro-crypto regulation under the incoming administration of President-elect Donald Trump could, however, still limit deeper losses and keep BTC in a strong long-term position.

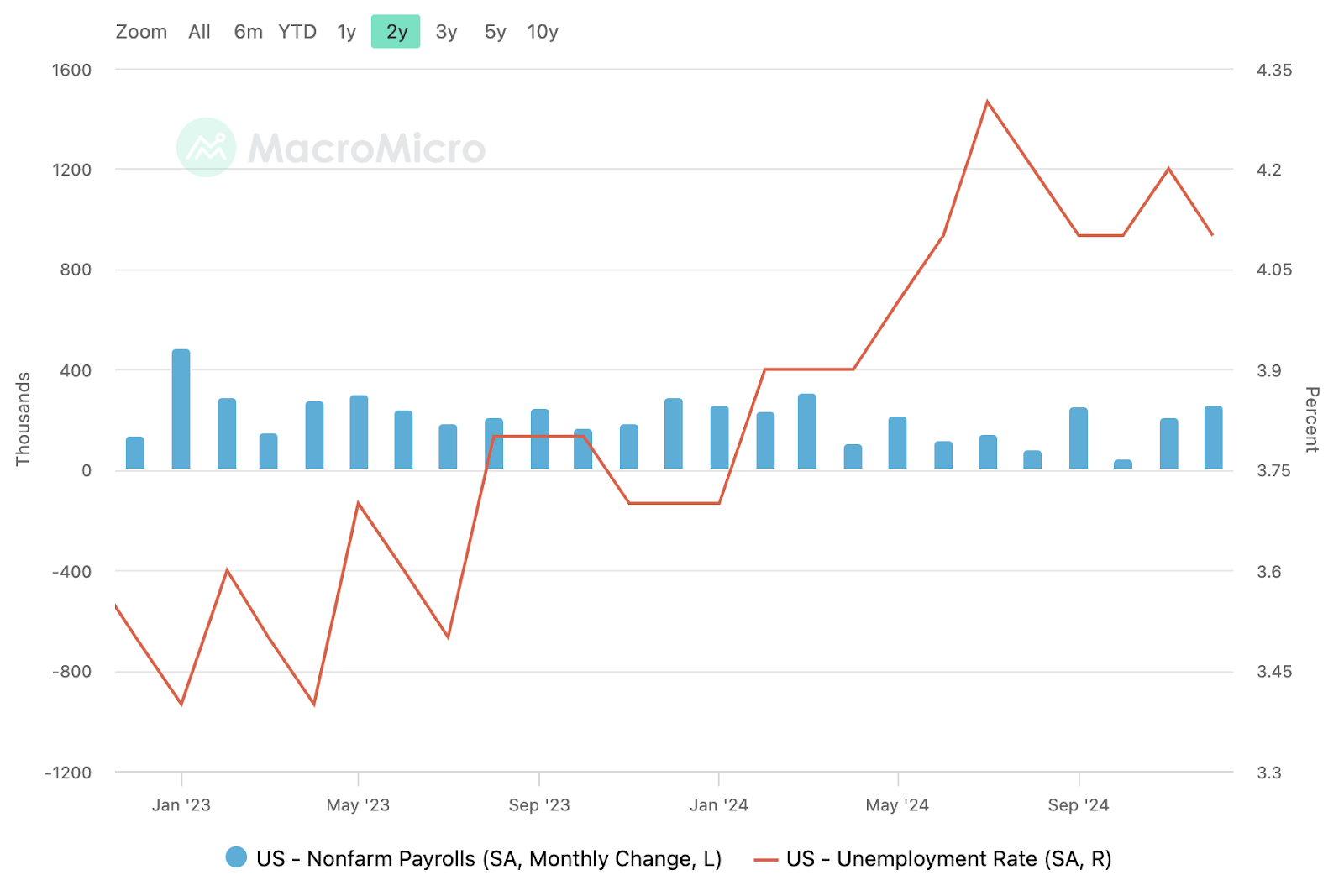

The latest economic data shows that the US economy ended 2024 with a resilient labour market and unexpected growth in the services sector. In December, the labour market added 256,000 nonfarm jobs, surpassing forecasts and marking the strongest monthly gain since March. Key industries such as healthcare, retail, and leisure led the way, with unemployment falling to 4.1 percent and wages rising by 3.9 percent year-over-year. This solid job growth, coupled with steady wage gains, is underpinning strong consumer spending, a cornerstone of the US economy. The resilient labour market has also eased pressure on the Federal Reserve to cut interest rates further, delaying any potential reductions until mid-2025.

The services sector added to this positive momentum, with the Institute for Supply Management (ISM) reporting an increase in its Purchasing Managers’ Index (PMI) to 54.1 in December. This growth was fuelled by rising production and new orders, signalling continued expansion across key industries such as finance, education, and hospitality. However, employment in the services sector dipped slightly, highlighting a nuanced labour landscape with sector-specific challenges.

In the latest cryptocurrency news, the UK Treasury’s decision to exempt crypto staking from collective investment scheme (CIS) regulations offers clarity and flexibility for blockchain businesses, fostering innovation and solidifying the UK as a crypto-friendly jurisdiction. Meanwhile, in Hong Kong, the launch of the Supervisory Incubator for Distributed Ledger Technology by the Hong Kong Monetary Authority provides banks with a structured environment to adopt blockchain solutions like tokenised deposits while managing associated risks, setting a global precedent for balancing innovation and regulation.

Crypto markets still faced some uncertainty, however, following news that the Department of Justice has been authorised to liquidate $6.5 billion worth of Bitcoin seized from the Silk Road marketplace. News of the sale contributed to the 7.2 percent price decline in Bitcoin, amplifying market concerns about potential volatility. This event, to an extent, challenges the pro-crypto sentiment that fuelled Bitcoin’s rally to its recent all-time high and reintroduces regulatory uncertainty, underscoring the delicate interplay between policy decisions and market sentiment.

The post appeared first on Bitfinex blog.