Crypto.com Alpha Navigator Quest for the month July

in this month's latest issue of Alpha Navigator, our institutional-focused report for the month of July by our official partner Crypto.com.

Bitcoin Historical Drawdowns

Derivatives Pulse

Fund Flow Tracker

Fund Flow Tracker (cont.)

Pair Trader: BTC vs. ETH

Pair Trader: LTC vs. ADA

Screening for Value, Growth, Momentum, Risk

Style-Factor Screen: Layers 1 & 2

Event Driven

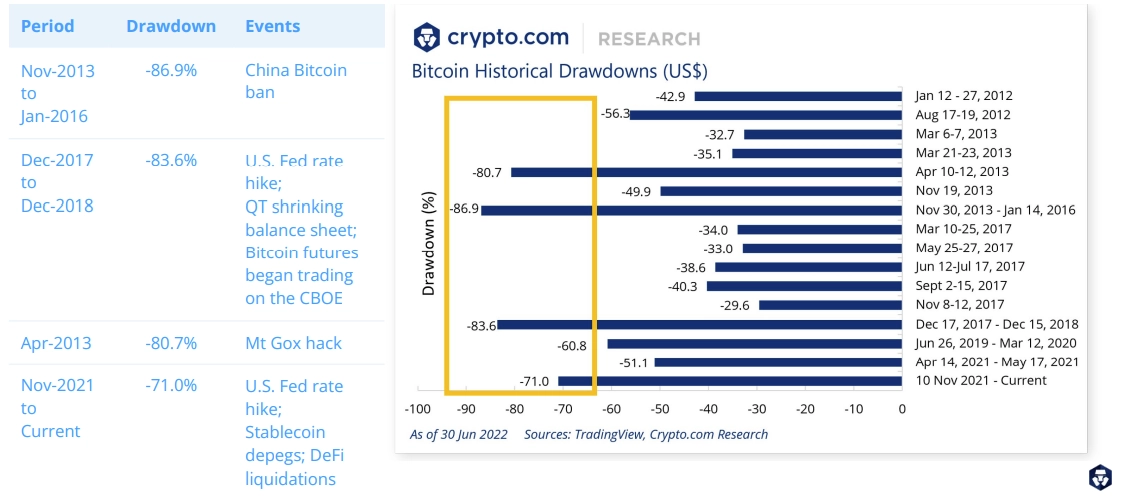

Bitcoin Historical Drawdowns

We continue to track Bitcoin’s current drawdown, which has now reached -71.0%, and is the 4th largest historically.

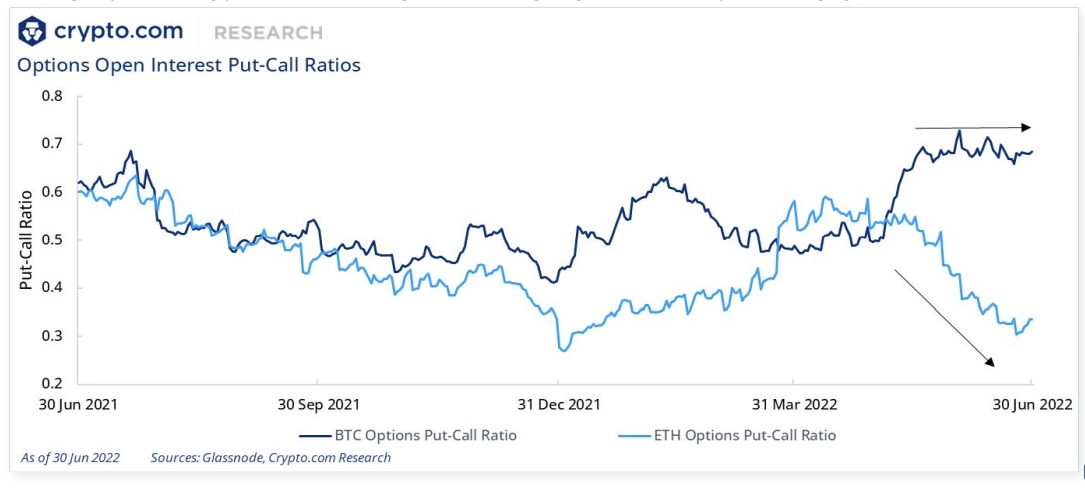

Derivatives Pulse

BTC put-call ratio has levelled while ETH’s continues downward. This could be interpreted as a shift to more positive sentiment for ETH (perhaps a leveraged play on the upcoming Merge) - however, it could also simply be due to investors having fully exited long-positions (cash is king), therefore negating the need for exposure hedging.

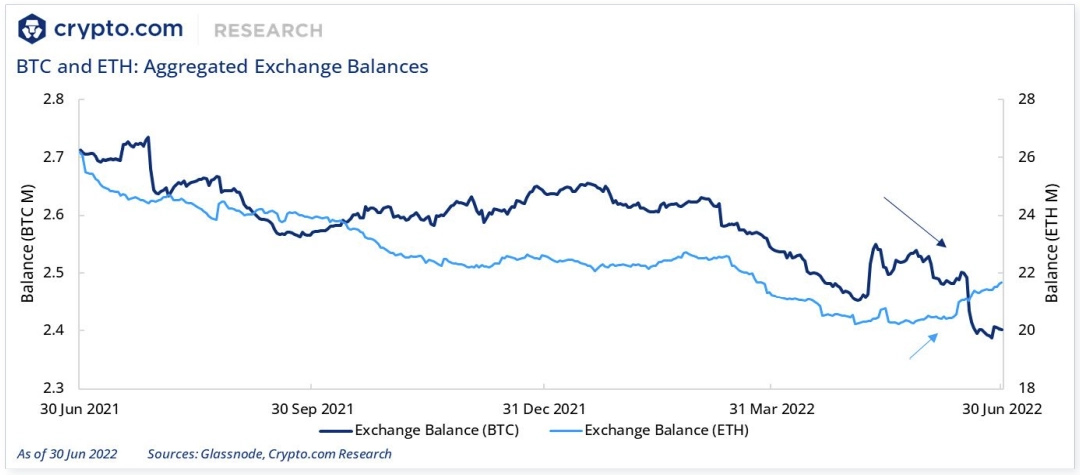

Fund Flow Tracker

Aggregated exchange balance for BTC has fallen, while ETH’s has increased during the past 1 month, implying stronger selling inclination for ETH. The past month saw net outflows of 122.21K for BTC, and net inflows of 1.19M for ETH.

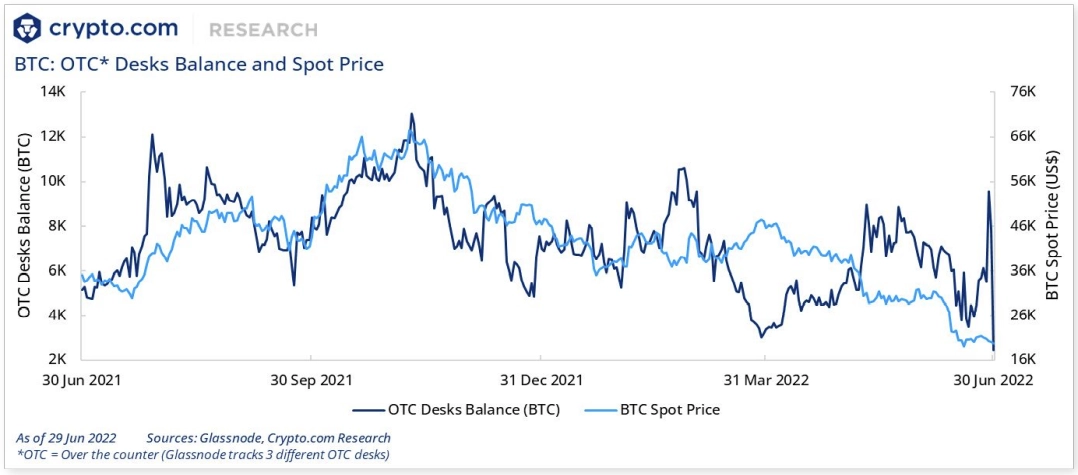

Fund Flow Tracker (cont.)

BTC balance of OTC desks has fallen to a yearly low, potentially implying stronger inclination to hold by larger investors.

Pair Trader: BTC vs. ETH

BTC (Price: US$20,108.5, MCap: US$384.1B, Volume: US$27.5B). ETH (Price: US$1,098.9, MCap: US$133.3B, Volume: US$18.4B).

BTC outperformance vs. ETH resulting in price ratio (BTC price divided by ETH price) breaching the 2-standard deviation (SD) ceiling band.

ETH 2.0 merge catalyst still in play for Q3 or Q4 2022 (estimated). Also, any return to risk-on sentiment could potentially favour ETH over BTC.

Market-neutral pair trade (i.e., long one and short the other) on price ratio touching standard deviation bands.

Pair Trader: LTC vs. ADA

LTC (Price: US$51.0, MCap: US$3.5B, Volume: US$577.5M). ADA (Price: US$0.47, MCap: US$15.7B, Volume: US$1.1B).

This trade played out since our last issue, as LTC underperformed ADA, driving the price ratio (LTC price divided by ADA price) down to the 2-standard deviation (SD) floor. It has currently bounced back up to the mean.

Exchange delistings from LTC’s MWEB privacy upgrade remains a risk. ADA’s Vasil hard fork is running into delays, but still estimated to be in 2H2022.

Market-neutral pair trade (i.e., long one and short the other) on price ratio touching standard deviation bands.

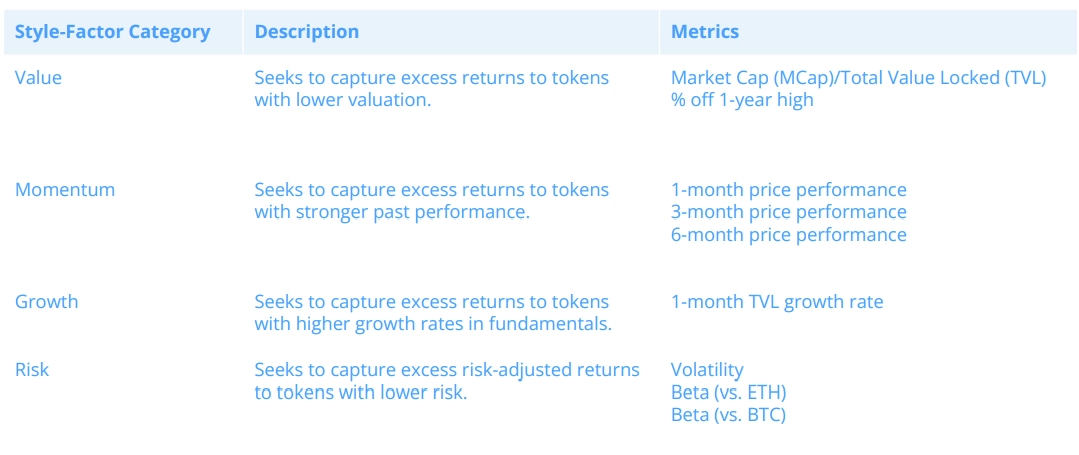

Screening for Value, Growth, Momentum, Risk

We apply style-factor screening based on value, momentum, growth, and risk. Style-factors seek to capture common drivers of return and risk. Metrics used within each style-factor category are shown below:

Style-Factor Screen: Layers 1 & 2

Protocols continued to suffer TVL losses in June, with ADA posting the smallest TVL contraction at -12.8%. In terms of price performance, MATIC was the best performer on a relative basis at -17.3% over the 1-month period.

Create a Crypto.com account and start trading on Cryptohopper

Read the full report here

RESEARCH DISCLAIMER

The information in this report is provided as general commentary by Crypto.com and its affiliates, and does not constitute any financial, investment, legal, tax, or any other advice. This report is not intended to offer or recommend any access to products and/or services. The views expressed herein are based solely on information available publicly, internal data, or information from other reliable sources believed to be true.

While we endeavour to publish and maintain accurate information, we do not guarantee the accuracy, completeness, or usefulness of any information in this report nor do we adopt nor endorse, nor are we responsible for, the accuracy or reliability of any information submitted by other parties. This report includes projections, forecasts, and other predictive statements that represent Crypto.com’s assumptions and expectations in light of currently available information. Such projections and forecasts are made based on industry trends, circumstances, and factors involving risks, variables, and uncertainties. Opinions expressed herein are our current opinions as of the date appearing in this report only.

No representations or warranties have been made to the recipients as to the accuracy or completeness of the information, statements, opinions, or matters (express or implied) arising out of, contained in, or derived from this report or any omission from this document. All liability for any loss or damage of whatsoever kind (whether foreseeable or not) that may arise from any person acting on any information and opinions contained in this report or any information made available in connection with any further enquiries, notwithstanding any negligence, default, or lack of care, is disclaimed.

This report is not meant for public distribution. Reproduction or dissemination, directly or indirectly, of research data and reports of Crypto.com in any form is prohibited except with the written permission of Crypto.com. This report is not directed or intended for distribution to, or use by, any person or entity who is a citizen or resident of, or located in a jurisdiction, where such distribution or use would be contrary to applicable law or that would subject Crypto.com and/or its affiliates to any registration or licensing requirement.

The brands and the logos appearing in this report are registered trademarks of their respective owners.