What beginner traders should know about portfolio management

In this article, we review what portfolio management is, and why it’s so important for crypto investors.

Cryptocurrencies are known for their volatility and instability.

The unpredictable nature of cryptocurrencies can make it a risky investment, but it can also help investors earn huge profits in a short period.

To take full advantage of the market, investors need to use certain tools and strategies to minimize risks and maximize profits.

One such tool that helps investors track their investments and maximize profits is portfolio management.

What is Portfolio Management?

Portfolio management, or asset management, is a relatively broad term.

Overall, it’s the process of using tools and strategies that improve the return on your investment. It includes everything from tracking your investments to monitoring and diversifying your portfolio to meet investment goals based on risk tolerance.

Even though the concept of asset management is adopted from traditional finance investment strategy, it is still relevant and a necessary part to managing crypto investments. By applying the same portfolio management methods to digital currencies, crypto investors can make the most of their investments.

Investors carry out portfolio management in two different methods - active management and passive management.

In active portfolio management, investors frequently buy and sell individual assets to increase their returns. Passive management refers to investors who do not interact with their investments frequently. While some crypto investors manage their portfolios actively and constantly redistribute their funds, other investors buy and hold for a long period of time.

Why is Crypto Portfolio Management Important?

Beginner traders may try to experiment with their funds and invest in different types of cryptocurrencies through different trading platforms, which can make it difficult to, monitor all crypto exchanges and funds.

Users may lose track of some of the assets and as a result, it’s possible to lose some funds through delayed action or missed opportunities. After all, the crypto market is dynamic and volatile.

By using a portfolio management tool, crypto traders can track all their investments in one place. This strategy makes it much easier to identify which investments are performing well and adjust their overall methodology to meet their investment goals. Portfolio management helps investors find out which assets to hold, and which assets to buy or sell based on their risk tolerance.

Diversification of funds is important in the crypto market to distribute risk. While new traders may find it overwhelming to interact with a variety of cryptocurrencies, a crypto portfolio management tool makes it easier to monitor different investments and track their performance all in one place.

How to Choose a Good Portfolio Management Tool

Choosing a good portfolio management tool is as important as choosing the right exchange platform. Let’s look at the features to consider before choosing a portfolio management tool.

Tracking the Entire Portfolio

Diversification of your portfolio is always recommended to minimize risk.

It is essential to maintain a healthy portfolio and to make long-term profits. However, the diversification of funds can also make it difficult to track all your investments and their performance.

A good portfolio management tool helps you track all your investments in one place, and provides the net value in your preferred currency. It helps traders recognize which investments are contributing to the most of a portfolio, so that users can implement trading strategies that work.

Integration with Crypto Exchanges

It’s important to search for a crypto portfolio manager that integrates well with other financial institutions.

Not all portfolio management tools will be compatible with third-party aggregator APIs. When a portfolio manager is integrated with multiple exchanges, investors can easily connect all their investments and manage them in one place. Investors should always test the platform before choosing it to manage their portfolios.

Automation

Portfolio management tools help you track all your investments in one place, and provide at-a-glance portfolio overviews as well. Once a user provides information for their investments, the portfolio management tool should be able to help monitor funds within a few clicks.

Investors should choose a tool that employs at least partial automation to help them track their investments efficiently.

Security

Even though cryptocurrencies and their underlying blockchain technology are highly secure, other crypto-related platforms can be at risk.

Crypto portfolio management tools are connected to their customers’ crypto accounts and funds. Hence, it’s important for these tools to follow security measures to avoid opening up users to risk. It’s important to research and choose a platform that practices highly-robust security measures to keep their funds safe.

Cryptohopper: Manage all Your Crypto Assets in One Place

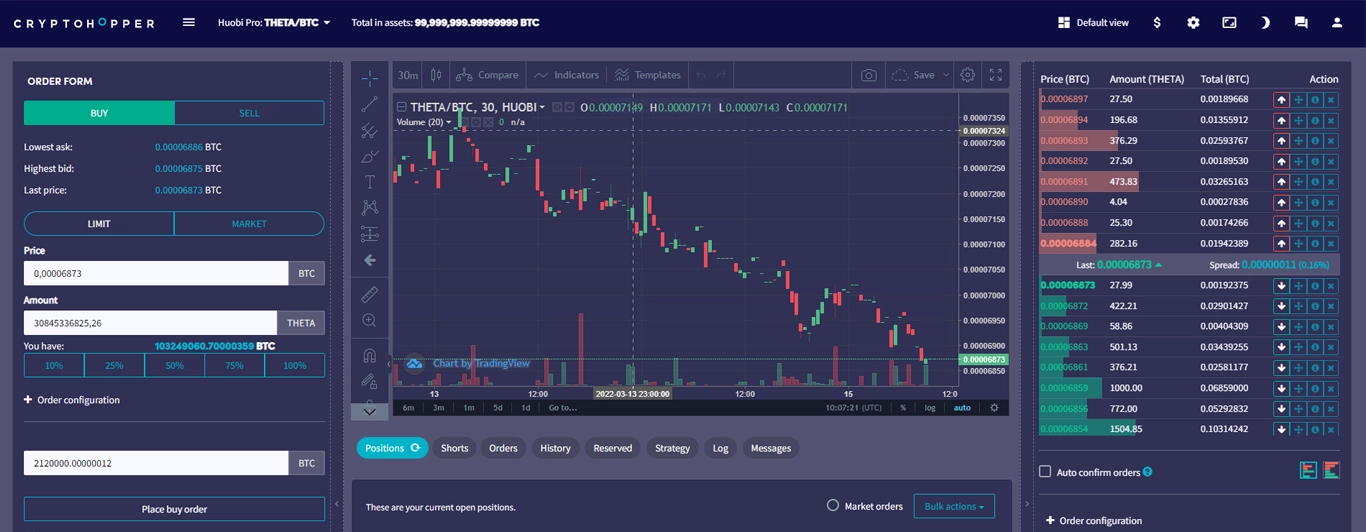

Cryptohopper is an automated trading bot that provides a wide range of services to crypto traders.

From automating trading strategies to providing portfolio management services, it assists customers in trading cryptocurrencies.

Cryptohopper is also a fantastic option for new traders, as investors can use the platform to follow trading experts and copy their trading strategies.

Cryptohopper’s simple and easy-to-use interface helps investors connect to their exchanges and manage portfolios.

The “Advanced View” feature makes it easy to track an investor’s order positions and place new orders. Users with an Explorer subscription can use trading strategies, shorting features, and the Dollar Cost Averaging (DCA) with the Advanced View. The Cryptohopper platform helps you manage all your investments securely and monitor their performance in one place.