Ultimate Cryptocurrency Investment Strategy | Tested [2019] | Cryptohopper

As June came to a close, markets revealed a stunning reality that many didn’t see coming..

The S&P 500 had its best first half in 22 years. In total, the S&P 500 is up 17% in 2019, an incredible boom that has continued despite persistent signs that a pullback is imminent.

Of course, the stock market isn’t the only one surging this year. In fact, it’s not even issuing the most significant returns. According to The Wall Street Journal, crypto’s rally is outpacing returns on stocks, bonds, gold, and oil.

Consequently, many investors are turning their attention to this advantageous asset class. Of course, as a relatively nascent investment category, building a cryptocurrency investment strategy can be tricky.

Here are five steps that anyone can take to build the ultimate cryptocurrency investment strategy.

Understand the market

Cryptocurrencies may resemble traditional financial assets, but they are undoubtedly unique, serving as both future-minded manifestation of familiar products and an entirely new invention at once.

For starters, cryptocurrencies are infamously volatile.

Erratic and sometimes inexplicable price fluctuations are par for the course for crypto investors. This reality has produced its own additions to the lexicon. “HODL,” a misspelling that became a mantra for crypto investors, is meant to calm investors fears when turbulence inevitably arrives.

What’s more, cryptocurrencies are a global phenomenon, which means that they are subject to the rules and regulations and many different countries at once.

It’s a component of the crypto movement that is becoming more clear with time, but it’s one that investors need to understand before trusting their financial future to the sector.

Of course, the crypto ecosystem is full of idiosyncrasies that will set the parameters for a successful investment strategy.

Develop a diversified portfolio

With nearly 90% name recognition, Bitcoin is the most popular cryptocurrency, but it’s not the only asset available.

Since cryptocurrencies became a global phenomenon in 2017, hundreds of digital currencies have been made available. Each project has its own purpose and functionality, and collectively they represent an opportunity to create a diversified investment portfolio.

Broadly considered to be the most important component of any investment strategy, a diversified portfolio serves as a hedge against volatility while taking advantage of growth markets.

In some ways, achieving diversity in crypto markets can be more challenging than in traditional investment sources. For one, while there are hundreds of cryptocurrencies to choose from, these assets are spread across dozens of different crypto exchanges.

While third-party services can help investors bring these assets into a single screen, the process may not be as intuitive as in other places.

While it can be tempting to bet on the proliferation of a single crypto, wise investors will diversify their approach to minimize risk and embrace opportunity.

Use your resources

Regardless of the market, modern investment strategies have shifted significantly on the digital age. More specifically, it’s becoming more automated.

At investment juggernaut Goldman Sachs, more than 90% of their investment services are based on automated trading mechanisms, making the in-person machination a thing of the past.

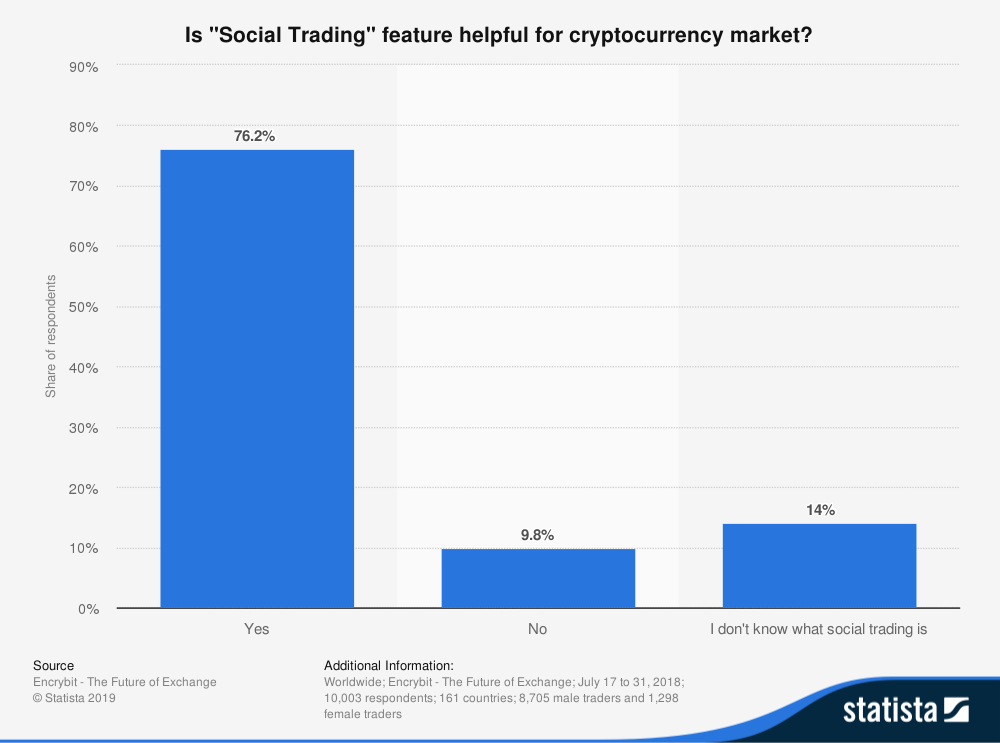

At the same time, things like social trading, a methodology that allows novice investors to automatically execute the moves of more expedited traders are becoming more commonplace.

This is great news for investors looking to build their cryptocurrency investment strategy because many of these same tools are available in crypto markets as well.

For instance, Cryptohopper enables crypto investors with various experience levels to execute algorithmic trading strategies using their automated trading bot. At the same time, investors can subscribe to copy trading methodologies that allow unfamiliar investors to pursue the same approach as more mature market participants.

By using the available resources, it’s easy for anyone to begin developing a comprehensive investment portfolio that includes the burgeoning crypto asset class.

Choose the best platforms

Developing an incredible crypto portfolio requires choosing the exchanges and wallet services that fit your needs.

Fortunately, users have no shortage of options.

Today, there are more than 500 cryptocurrency exchanges that each imbue their own personal touch on the crypto ecosystem.

Similarly, there are countless wallet services that can help any investor store and manage their portfolio.

Each product is replete with its own set of nuances, but, in general, investors should prioritize some things more than others. Specifically, it’s critical to prioritize

security

usability

functionality

interoperability

If you’re struggling to pick a platform, consider some of the resources and reviews that can help you select the platform that’s best for you.

Be consistent

Ultimately, no single component of crypto investment strategy is going to be the linchpin of the plan. Instead, when creating a crypto investment portfolio, like building a traditional investment portfolio, requires consistency.

Therefore, make regular contributions to your allocated assets. Cryptocurrencies may be the hottest investment class today, but they aren’t a get-rich-quick scheme, and buying digital tokens like they are lottery ticket might help some people make lavish headlines, but it won’t allow most investors to build a long-term cryptocurrency investment strategy.

That’s why Fidelity Investments, one of the most prominent investment banks in the world, encourages their customers to make consistent contributions to their portfolios, noting, “If you invest regularly over months, years, and decades, short-term downturns will not have much of an impact on your ultimate performance.”

That same is undoubtedly true for crypto investors as well.

Building the ultimate cryptocurrency portfolio won’t happen overnight, but as investors consider the intricacies of the market, diversify their assets, utilize their resources, and use the best platforms, they can consistently develop this asset, which could deliver incredible returns for the diligent investor.

Check out our last blog: What's Stopping Crypto Markets From Entering the Mainstream.