Many traders get confused when a token's performance does not add up with its respective index. This article shall dive into why leveraged tokens' performance may differ over time and why they are not a long-term bet.

How do leveraged tokens perform when they are held for longer than one day?

Leveraged tokens are built to multiply the underlying asset's daily return-the main component to remember here is DAILY. The leverage factor of a token will be reset every day. As a result, the performance of a token and its underlying asset can differ over the long term.

While the comparison of daily and total returns can sound trivial, the math behind them differs in contrast. For example, even a non-leveraged portfolio that loses 10% on one day would not be able to break even with a simple 10 % increase on the next day. An investment of $100 that loses 10% on one day is worth $90 at the end of the day. But if the price goes up 10 percent on the second day, that's a 10 percent rise from $90, bringing the price at $99. Clearly, the math didn't add up as you would expect.

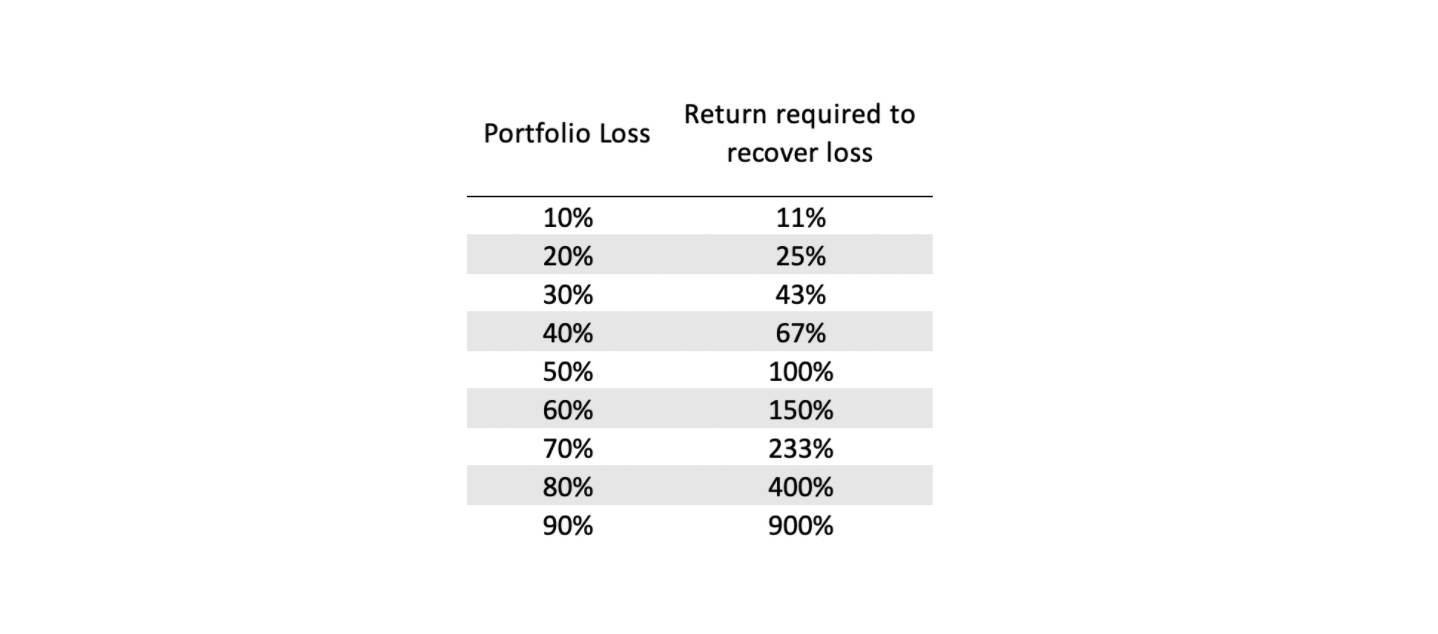

As such, in the event of losses, a portfolio needs a return greater than its loss to break even. The graph below shows the subsequent rate of return needed to break even at varying levels of portfolio losses.

As shown, the greater the portfolio loss, the greater the return needed to break even. With leveraged tokens, this erosion happens regularly. Furthermore, when a fund is leveraged, that erosion is magnified.

Let's consider an example of why leveraged tokens don't always work the way you would expect.

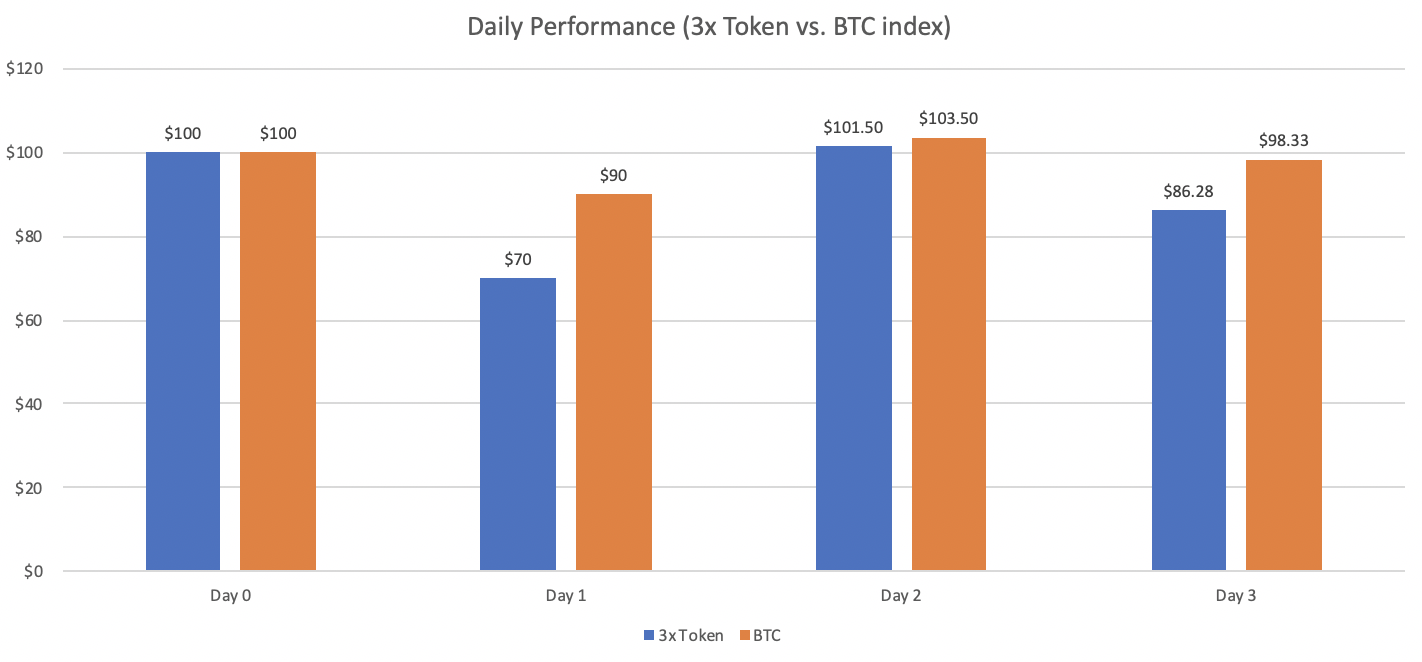

Here's a hypothetical example of a 3x Long BTC token, with a Bitcoin index starting value of $100 and the token’s NAV starting at $100 as well.

Suppose the Bitcoin Index fell by 10% on Day 1. This means that the index closes at $90, while the token closes at $70. So far, so good, right?

On Day 2, the Bitcoin index recovers by 15%, and the index ends at $103.50. At this point, the index is 3.5 percent higher than its initial value.

Given that, you would expect that the 3x token will close at $110.50, or 10.5 percent above its starting value — that is, three times that two-day average index return of 3.5 percent.

In fact, the token actually closes at $101.50, or just 1.5 percent up from its starting point. The explanation for this is that the leveraged token multiplied the regular return of the underlying index by 3x to 45 percent (3x 15 percent). This raises its NAV from $70 to $101.50.

Now let's assume that on Day 3, our hypothetical Bitcoin index declines by 5 percent to $98.33. On a cumulative basis, 1.7 percent down from its starting value.

You can presume one of two things:

because the net index change over three days is equal to 0%, our token will recover to $100; or

that our token closes at $94.90, that is, three times the three-day average index return of-1.7%.

However, the two conclusions are wrong. In fact, the leveraged token would drop to $86.28, which is 3x of -5%, where 5 percent is the index's Day 3 return. Overall, the token has fallen 13.7 percent over the three days.

If the math is confusing, the visual graph below will illustrate the daily price changes of both index and token over the period.

Impact of daily rebalancing

Many investors ignore the fact that leveraged tokens are rebalanced daily. Regular rebalancing raises or reduces exposure and retains the purpose of the fund. As the fund decreases its index exposure, it sells positions on the derivatives market by locking in losses, leading to a lower asset base. Over time, this erosion will influence the original investment of investors in the token.

Since leverage needs to be reset daily, volatility is your biggest enemy. This may sound contrary to common opinion.

Volatility is a trader's best friend in most circumstances. But with leveraged tokens, that's definitely not the case. Volatility can potentially crush you. That's because the compounding effects of daily returns will lead you to an unexpected mathematical outcome.

The more volatile the underlying index/asset, the more value the token would lose over time, even if the benchmark is flat at the end of the year. If the index dramatically moved up and down along the way, if you purchased and kept a leveraged token, it might end up losing considerable value over time.

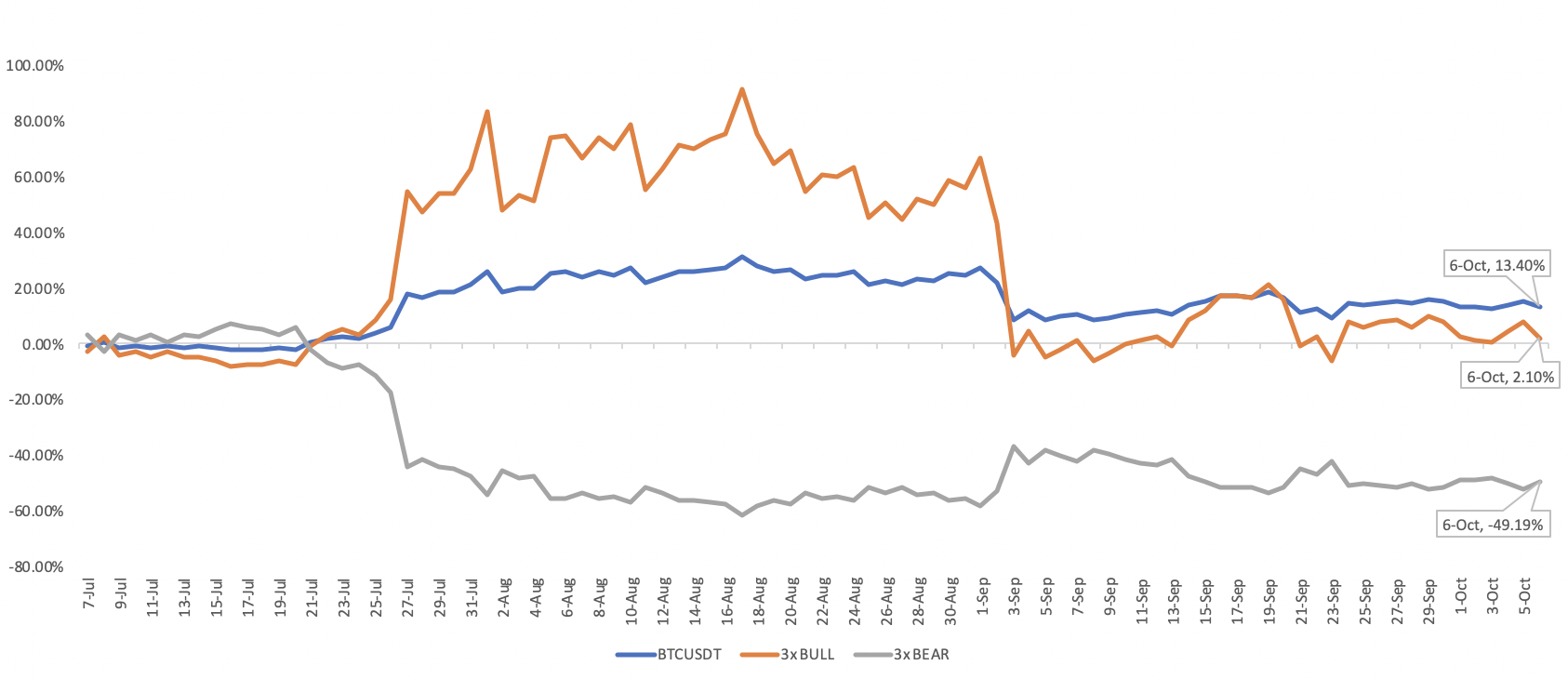

Compounding works both ways - upside and downside. With some analysis, you will find that some bull and bear tokens that track the same index have been performing poorly for the same time period. This can be very confusing to a trader, as they don't understand why these tokens performed the way they do.

Let’s compare the cumulative returns of three securities over a 3-month period from July 6th to October 6th, 2020: BTC/USDT (in Blue), 3x BULL (in Orange) and, 3x BEAR (in Grey).

This real-life example clearly shows why leveraged tokens are not a long-term investment. It demonstrates how day-to-day rebalancing and leveraging can trigger performance variations over time. As a result, leveraged tokens could not closely track their underlying asset under some conditions.

3 rules for trading leveraged tokens

Rule 1: Use leveraged tokens for short-term trades. If you hold leveraged tokens for too long, you’re battling with the potential negative impacts of the token’s daily rebalancing, impacting your performance returns.

Rule 2: Focus on markets that are sharply trending. Leveraged tokens perform best in markets where there are strong trends and momentum. Ensure these factors are in your favor to increase the probability of profit in your trade.

Rule 3: Use leveraged tokens to supplement exposure in your core portfolio. Leveraged tokens are not a substitute for holding assets in the spot market. However, they provide additional options for traders to gain more exposure and profit in short-term trends.

There's nothing wrong with leveraged tokens if held by the right hands. You have to understand how leveraged tokens work so that you can use the right tools for the job. Leveraged tokens can be very powerful for short-term trading but you need to be cautious when holding these tokens over a long period of time.

Related Articles:

Your Essential Guide To Binance Leveraged Tokens

Boosting Returns With Strategic Rebalancing

4 Pitfalls of Trading Leveraged Tokens and How to Avoid Them