Founded by Hayden Adams, engineer and Siemens alum, the first version of Uniswap launched on Ethereum in 2018, and was in fact one of the first Decentralized Finance applications (DeFi) in existence. And by virtue of its mere existence- an app that offered financial tools without an intermediary- gave rise to numerous other DEXes like Sushiswap, Curve, and Pancakeswap. Beyond being a flagship DeFi project, Uniswap also introduced the automated market maker (AMM) model. AMMs, in brief, are a decentralized way to facilitate the buying and selling of cryptocurrencies. That is, without the need for human market makers and things like order books in between you and your executed trade. Prices are set and trades are dealt with through the use of mathematical algorithms. Uniswap is the largest DEX today, offering 944 markets and handling >$1billion in daily trading volume.

TL;DR

Uniswap is the most prominent decentralized exchange. It is based on the Ethereum blockchain and has its own governance token, $UNI, that can be traded on numerous exchanges like Poloniex.

How does Uniswap work?

Technologically speaking, Uniswap is a collection of smart contracts deployed on the Ethereum network that work together to act as an automated market maker. This automated market maker model is used to facilitate trades and set prices.

As for the algorithm that Uniswap uses to set prices, it’s actually quite simple: x*y=k

x = the amount of token ‘x’ on one side of the trading pair

y = the amount of token ‘y’ on the other side of the trading pair.

k = describes the pool’s total liquidity

Users called liquidity providers supply ERC-20 tokens to collections of tokens called liquidity pools. Herein lies one of the main differences between DEXes and CEXes. That is, a centralized exchange like Poloniex utilizes human market makers and order books to set prices and match sellers and buyers. In a DEX environment, users give two tokens on either side of a trading pair, so BTC and USDD, for example.

But why would someone want to put their tokens up to give a market liquidity? This is where Uniswap’s reward structure comes into play. Put simply, when users supply tokens, they can earn rewards from trading fees.

The users that deposit their tokens to supply liquidity are straightforwardly called liquidity providers, or LPs. These are users, just like you, that deposit an amount of two tokens on either side of a given trading pair to essentially “make the market” and make sure that traders can actually find matches for their requested trades. How this works is that an LP will deposit tokens into a liquidity pool, which is a collection of assets, and receive an ‘LP token’ which is like a receipt that proves that they own a corresponding amount of assets in the pool. The LP tokens are redeemable for the deposited assets.

Decentralized exchanges

Uniswap is a decentralized exchange that arose out of the concepts presented in a Reddit post by Ethereum co-founder Vitalik Buterin. Part of what Vitalik wrote about, and that Uniswap was created to solve, was the problem of high spreads for illiquid assets. Uniswap was revolutionary when it was founded, quickly garnering funding and inspiring the creation of more DEXs.

There are limitations that have held DEXes back from more aptly competing with CEXes. For all of the increase in popularity they’ve seen, decentralized exchanges only command around ~0.25% of the trading volume that occurs on all crypto exchanges.

One of the more inherent challenges that DEXes face are slow blockchain speeds. Because exchanges like Uniswap are essentially a collection of smart contracts deployed on a blockchain like Ethereum, they are subject to that blockchain’s ability (or inability) to handle network traffic. A slower blockchain like Ethereum can only process so many transactions per second (also referred to as ‘throughput’). And this means slower trade execution. There is also the concept of ‘gas fees’ to contend with. Every time someone wants to execute a transaction on Ethereum, they have to spend a certain amount of ETH to do so. This is the same story on exchanges like Poloniex, except fees on centralized exchanges, barring a decision by the exchange itself, are static. They don’t fluctuate based on any sort of network conditions. By contrast, when there is high enough network traffic and congestion, conducting trades on a DEX can prove to be more costly.

Because DEXes aren’t nearly as popular as CEXes, they suffer from lower liquidity. Without enough liquidity, markets might be too illiquid to execute trades efficiently. And with an inefficient market, less users are likely to adopt a decentralized trading platform. Of course, this is where Uniswap’s incentive structure for liquidity providers (LPs) comes in. But more on that later.

Although Uniswap itself stands far and above its decentralized contemporaries in terms of user-friendliness, by and large centralized exchanges are regarded as the most user-, and thus beginner, friendly. Furthermore, CEXes tend to offer better security and account retrieval methods. With non-custodial wallets, on the other hand, the risk and loss incurred by a newer investor is more present. If you lose your wallet’s seed phrase, you lose your funds. If funds get stolen, there is no central entity to track your crypto down on your behalf.

How is Uniswap v3 different from its v1 and v2?

As mentioned above Uniswap is an automated market maker, or AMM. This means it uses an algorithm for trade execution and pricing of assets. This was revolutionary when it launched, as it removed the need for a centralized or 3rd party to do so. Doing away with something like an order book makes it possible for an exchange to become decentralized.

Within this solution is, of course, its own problems. In other DEXes, and in the previous versions of Uniswap itself, the constant product market maker formula led to capital inefficiency as well as liquidity fragmentation, which means that the trading volume for an asset is split across multiple different platforms. This, of course, massively affects liquidity and impacts price.

Uniswap v3 improves upon the capital inefficiency of current Constant function market makers (CFMMs). A CFMM is a class of automated market maker that uses a function to determine the price of each asset in a trading pair. Like in any automated market maker, CFMMs use liquidity providers to deposit 2 tokens on either side of a trading pair and then use the aforementioned function to “make” the market.

In earlier iterations of Uniswap, in its v1 and v2, the constant product market maker formula was restricted in its design in that it allowed for only some of the assets in a trading pair to trade at a given price.

Main new features in v3:

Concentrated liquidity: LPs can bound their liquidity within an arbitrary price range.

With earlier versions and the use of the x*y=k reserve curve, the majority of the assets in a pool aren’t used, which is inefficient. With concentrated liquidity, LPs can now offer liquidity between smaller price ranges and earn fees when an asset’s price sits between their designated bounds. How this works is that an LP can open a ‘position’ (and as many positions as they’d like) based on where they think the market is and will be. This allows for greater control, less capital risk, and more opportunity for fee revenue.

Flexible fee structure: In Uniswap v1 and v2, a swap fee of 0.3% was uniformly applied to all pools, regardless of the assets within them. This makes less sense when one considers the wide range of popularity and volatility across different token pairs. Now, there are different fee tiers: .05%, .3%, and 1%.

Fee governance: Since Uniswap is decentralized, UNI holders are the ones that guide the protocol. In v3, holders can opt to choose what fraction of swap fees go to the protocol as well as adding more fee tiers (aforementioned).

Oracle upgrades: In v3, price oracles (sources of price data for any given asset) can be used to calculate the time-weighted average price within the past 9 days. The cost of updating oracles is also cut significantly.

Uniswap plans to further improve its platform by utilizing technology like rollups. What a rollup does is process a bundle of transactions off of, in this case, the Ethereum Mainnet, submitting them back to the mainnet after turning them into one piece of data.

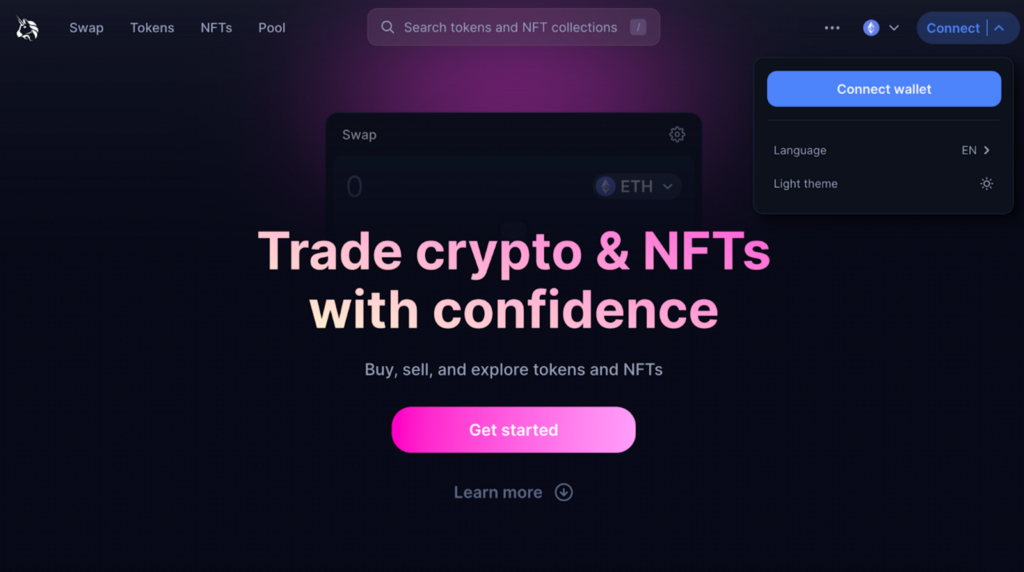

Using Uniswap

To interact with Uniswap, all one needs is an Ethereum wallet, such as Metamask. Uniswap operates on the Ethereum blockchain so gas fees are paid in ETH.

To start using Uniswap, simply click connect to use one of your Web3 wallets.

One of the main functions is the ‘Swap’ function. Simply input the trading pairs you want, and the amount of the token that you want to buy. Then click on the swap button, confirm the transaction details, and that’s it!

Uniswap also has an NFT aggregator so that the exchange becomes more of a one-stop shop for digital assets, and can better compete with its centralized analogs.

One of the really neat things about Uniswap is that users can even create and list their own ERC-20 tokens.

Why use Uniswap?

Being a decentralized exchange grants Uniswap various advantages over its centralized counterparts.

Uniswap doesn’t use any third parties to facilitate its operations. So you never give your money to someone else. You are your own custodian. Money is merely sent from person to person, or P2P as it’s commonly called. This removes the risk of trusting a separate custodian with your assets. As with any decentralized application, there aren’t restrictions on who can use the technology. So no matter where you are, you can use Uniswap.

Being the biggest DEX has its benefits as well. Among its contemporaries, Uniswap excels in user experience, making it relatively easy to interact with. It also means that Uniswap has an ever-growing and already large amount of tokens available for trading on its platform. For developers, it has a number of helpful tools that allow for a smooth experience building dApps.

How to become a liquidity provider on Uniswap?

Through the Uniswap app, it’s quite intuitive to open a position, provide liquidity, and start earning revenue on transaction fees. First, click ‘+ New Position’ on the ‘Pool’ page, select a token pair, and designate the parameters of the position like the fee tier, the price range, and amount of assets you wish to deposit. Review the information and submit the position, and… tadaaaa! You’re done!

Impermanent Loss

One thing to take into account, especially when considering becoming a liquidity provider, is the concept of impermanent loss. So what is impermanent loss?

Impermanent loss occurs when the price of the two assets in the liquidity pool changes relative to each other. If the price of one asset increases significantly compared to the other, traders will swap more of that asset for the other, resulting in the LP having a larger portion of the asset that has decreased in value. This means that when the LP withdraws their assets from the liquidity pool, they will receive fewer of the asset that has increased in value and more of the asset that has decreased in value than when they deposited them. This means that there is an argument NOT to provide liquidity and just HODL. Of course, this is not a realized loss until the asset is withdrawn, and Uniswap incentivizes liquidity provision through trading fees.

What can you do with $UNI?

UNI is Uniswap’s native token. It enables community ownership over Uniswap, serving as the platform’s governance token. With this, UNI holders can determine the future of Uniswap, voting on changes to the protocol as well as guiding the priorities for Uniswap’s roadmap.

How to acquire $UNI?

$UNI is available on multiple exchanges like Poloniex! You can acquire $UNI through trading a USDT/UNI trading pair. You can also trade UNI/USDT Perpetual futures through Poloniex Futures.

Feeling ready to get started? Sign-up is easy! Just hop on over to https://poloniex.com/signup/ to start your crypto journey🚀

was originally published in The Poloniex blog on Medium, where people are continuing the conversation by highlighting and responding to this story.