Lido solved the problem of Ethereum’s 32 Ether staking requirement, and also lets users access the locked value of their staked tokens through its Liquid Staking innovation. Liquid Staking lets Lido users keep the liquidity of their staked tokens by using a stand-in stToken which can be used to earn additional yield through Decentralised Finance (DeFi) market participation.

Lido’s community governs the direction of the Lido project via decentralised governance using the Lido DAO’s LDO token. Lido is Ethereum-first but has added support for several other Proof of Stake (PoS) blockchains. Lido’s mission is to make staking simple and decentralised, while making staking accessible to as many people as possible.

Lido

Lido was created to allow any user to trustlessly stake their ETH easily, no matter how much they have, in any amount. Lido doesn’t only make it easy to stake ETH and earn rewards, it also solves the problem of accessing the locked value when tokens are staked through a mechanism called Liquid Staking.

Lido makes it simple and convenient to stake and earn interest despite any technological hurdles. By staking with Lido your assets remain liquid and can be used across a range of DeFi applications, earning extra yield. Lido supports Ethereum and several top blockchains.

How Does Lido Work?

By staking via Lido, an ETH holder gains stETH, an stToken which is a placeholder token for the locked ETH. stETH can be used like it was regular ETH at many different DeFi platforms which have integrated support. Lido’s stTokens have support within some of the most popular DeFi apps, like Metamask, AAVE, Uniswap, and others.

stTokens let users increase their yield upon their staked tokens by freeing the locked value of the tokens currently held within the staking pool. Upon staking, a user receives stTokens in return for their locked assets.

stTokens allow a Lido user to hold the stToken almost like a virtual poker chip that represents the value of the underlying staked asset. The stToken can be used for DeFi yield earning, decentralised lending, providing liquidity, trading on decentralised exchanges (DEX), and more.

Lido started out focused solely on Ethereum, but has since added support for several additional blockchains like Polygon, Solana, Polkadot, and Kusama. Its stTokens represent each supported digital asset. So in addition to stETH, there is stDOT, stSOL, and so on. In addition to stTokens, Lido’s DAO also utilises LDO. LDO is Lido’s governance token for decentralised decision making within the DAO.

What Makes Lido Unique?

Lido makes staking simple. Anyone can stake their digital assets to earn the rewards through Lido without minimum deposits and hardware setup and maintenance.

Staked assets remain liquid and accessible. Unlike native staking, Lido lets users stake their assets without locking tokens as users receive stTokens in return, which can be swapped, traded, and transferred at any time. Furthermore, Lido’s stTokens have been integrated by a wide range of DeFi protocols on both Layer 1 and Layer 2 blockchains within the multi-chain ecosystem.

Lido supports fast exit for unstaking. Unstaking in PoS protocols normally requires a waiting period which could be uncertain and see long delays which could be critical in times of market turmoil. Lido stakers are allowed to swap their stTokens to any other assets via secondary markets to fulfil a fast exit

What is the Lido Ecosystem?

The Lido ecosystem is pretty nicely developed, as Lido has successfully made many important partnerships with some of the biggest names in the wider multi-chain Web3 ecosystem. Lido’s managed to successfully integrate stToken and LDO support into many wallets, layer 1 blockchains, Ethereum Layer 2 chains and protocols, DeFi protocols and platforms, Oracles, and Data Analytics tools.

There is simply too much to cover in this article, for more information about the Lido ecosystem, click here.

What is Lido’s LDO token?

LDO is the governance token of Lido’s DAO, the decentralised body which carries out the governance decisions of the Lido community.

LDO is an ERC-20 token which gives holders governance rights and the ability to vote on improvement proposals, upgrades, and network parameters. The more LDO locked in a user’s voting contract, the greater the decision-making power the voter gets.

Lido’s DAO also manages the Lido DAO’s insurance and development funds, and the planned unbonding and withdrawals coming with Ethereum’s Shappella upgrade.

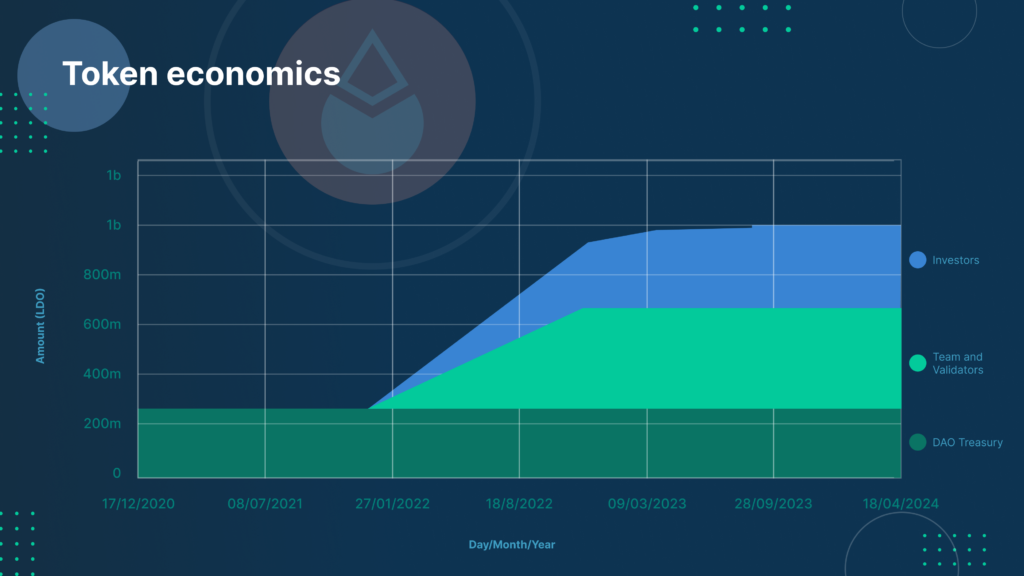

Lido (LDO) Tokenomics

Token Symbol: LDO

Total Supply: 1 billion

Circulating Supply: 865,606,901 (except locked tokens and the tokens in Lido Dao Treasury)

Contract address (Ethereum): 0x5a98fcbea516cf06857215779fd812ca3bef1b32

Lido Roadmap

The Lido development team and community are currently focused on Lido V2, Lido’s most ambitious network upgrade so far. Lido V2 will add compatibility with Ethereum’s Shapella upgrade which allows for withdrawals of staked ETH for the first time, as well as add “Staking Router” support.

Withdrawals: This Lido on Ethereum protocol upgrade allows stETH holders to withdraw from Lido at a 1:1 ratio to unstake directly with Lido. This will be live in approximately May.

Staking Router: Thanks to a new modular architectural design, anyone can develop on-ramps for new Node Operators, ranging from solo stakers, to DAOs and Distributed Validator Technology (DVT) clusters. Together they will create a more diverse validator ecosystem.

The Lido Team

Lido is a contributor-driven DAO with no centralised team. Initial contributors can be found here.

Notable Lido Partners

Lido on Ethereum Node Operators: Certus.One, P2P Validator, Chorus, Stakefish, Staking Facilities, Blockscape, DSRV, Everstake, Kiln, RockX, Figment, Allnodes, Anyblock, Blockdaemon, Stakin, ChainLayer, Simply VC, BridgeTower, Stakely.io, InfStones, HashQuark, Codefi, SigmaPrime, Pragmatic Labs, ChainSafe, Nethermind, Kukis Global, CryptoManufaktur, RockLogic, Attestant.

Lido on Polygon Node Operators: ShardLabs, DSRV, HashQuark, Kytzu, Girnaar Nodes, Matrix Stake.

Lido on Solana Node Operators: Blockdaemon, Block Logic, Forbole, ChainLayer, RockX, Figment, Chorus, Stakefish, P2P Validator, DSRV, Everstake, Staking Fund, Chainode Tech, SyncNode, Stakewith.us, Stakin, Allnodes, Kiln, 01Node, H2O Nodes, Kukis Global.

How to buy LDO on Bitfinex

How to buy LDO with crypto

1. Log in to your Bitfinex account or sign up to create one.

2. Go to the Deposit page.

3. In the Cryptocurrencies section, choose the crypto you plan to buy LDO with and generate a deposit address on the Exchange wallet.

4. Send the crypto to the generated deposit address.

5. Once the funds arrive in your wallet, you can trade them for LDO. Learn how to trade on Bitfinex here.

Also, we have Bitfinex on mobile, so you can easily buy LDO currency while on-the-go.

[ AppStore] [ Google Play]

Lido Community Channels

Website | Twitter | Telegram | Reddit | Discord

The post appeared first on Bitfinex blog.