Sometimes referred to as “bracket” or “conditional*” orders, they are sophisticated methods that enforce discipline, ensuring that profits are realized and losses are contained.

But, what makes them a favorite among advanced traders isn’t just their functionality, it’s their ability to automatically turn strategy into action – letting traders sleep a little easier at night.

*If we’re getting really persnickety, these are OTOCO orders (One-Triggers-a-One-Cancels-the-Other), but that’s a mouthful!

Understanding take profit/stop loss (TP/SL)

So yes, you could already set separate take profit (TP) and stop loss (SL) orders in Kraken Pro. But take profit/stop loss orders make this far more convenient.

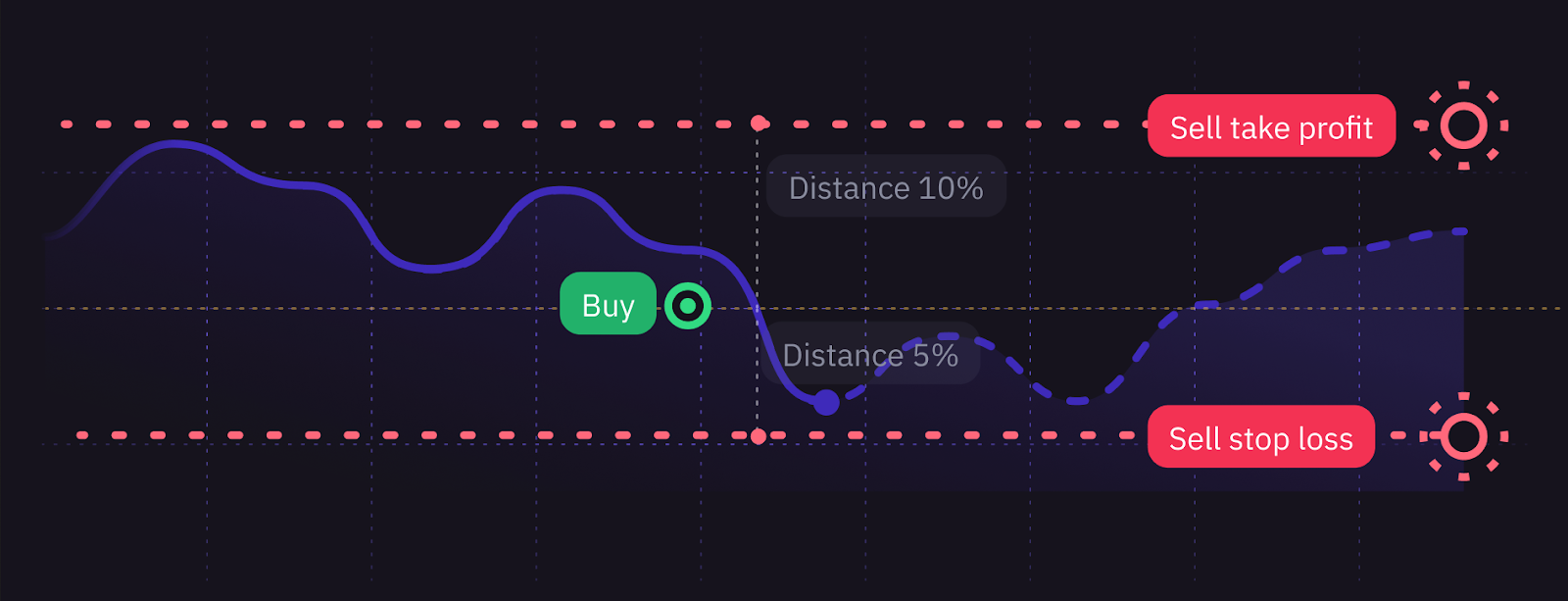

They’re advanced conditional commands that automatically place simultaneous take profit and stop loss orders linked to a primary order. This automation ensures that no matter the market’s direction, exit strategies are already in place to either capture profit or mitigate loss at predefined price points.

Crucially, if either the TP or SL are triggered, it’ll automatically cancel the other order – you do not have to worry about manually canceling yourself. This functionality is known as One Cancels the Other (OCO).

Using take profit/stop loss in Kraken Pro

You can now find the take profit/stop loss option in Kraken Pro’s order form widget when a futures market is selected on both web and in the mobile app:

1. Selecting the trigger price:

Within the order form widget, after selecting a futures market, you can set up your take profit/stop loss orders.

Choose your trigger based on the mark price, last price, or index price, depending on your trading strategy and market analysis.

2. Setting paired distance and trigger price:

Define the paired distances for both TP and SL from the entry point. This simplifies the process of determining how far your targets are from your opening price. Alternatively, you can visually adjust the placement by dragging the order preview levels on the chart.

Utilize the built-in preview feature to see estimated profit and loss scenarios based on your specified settings.

Integrating TP/SL in a futures trading strategy

Here are a couple of examples of how an advanced futures trader might use TP/SL:

Defining entry and exit points based on Technical Analysis

Before entering a position, a Kraken Pro trader develops their thesis on how they think the market will move using technical analysis indicators, and clearly identifies their upside price target for the trade if the market moves favorably.

Conversely, they also identify the downside price level at which their thesis is invalidated.

The trader uses a TP/SL order to set their entry along with preset exit points based on the levels they identified above

Risk-to-reward ratio optimization

A trader tends to follow a strict risk-to-reward ratio for each trade setup.

They identify a market structure that they believe provides a good entry point

Using the estimated PnL feature in TP/SL, they can calibrate the risk they are willing to take on the trade by determining the % offset to their entry, to maintain a favorable risk-to-reward ratio in line with their trading plan.

TP/SL offers Kraken Pro futures traders optimized risk management for capturing profit and mitigating loss. By leveraging TP/SL to preset exit points and evaluating risk-to-reward ratios, clients can plan their strategies ahead and be sure they’re executed precisely – all in one single request.

As always, our dedicated support team is available to provide guidance and answer any questions you may have.

These materials are for general information purposes only and are not investment advice or a recommendation or solicitation to buy, sell, stake, or hold any cryptoasset or to engage in any specific trading strategy. Kraken makes no representation or warranty of any kind, express or implied, as to the accuracy, completeness, timeliness, suitability or validity of any such information and will not be liable for any errors, omissions, or delays in this information or any losses, injuries, or damages arising from its display or use. Kraken does not and will not work to increase or decrease the price of any particular cryptoasset it makes available. Some crypto products and markets are unregulated, and you may not be protected by government compensation and/or regulatory protection schemes. The unpredictable nature of the cryptoasset markets can lead to loss of funds. Tax may be payable on any return and/or on any increase in the value of your cryptoassets and you should seek independent advice on your taxation position. Geographic restrictions may apply.

The post appeared first on Kraken Blog.