Justin highlighted the stable performance of $HTX and $TRX over the past year, the HTX team’s unwavering commitment to practical work, and the platform’s leading position in revenue compared to its peers within the industry. He noted that the newly listed assets on HTX have also performed well. Certain tokens, notably $Neiro, experienced price surges exceeding one hundredfold, showcasing HTX’s unique ability to identify high-quality assets.

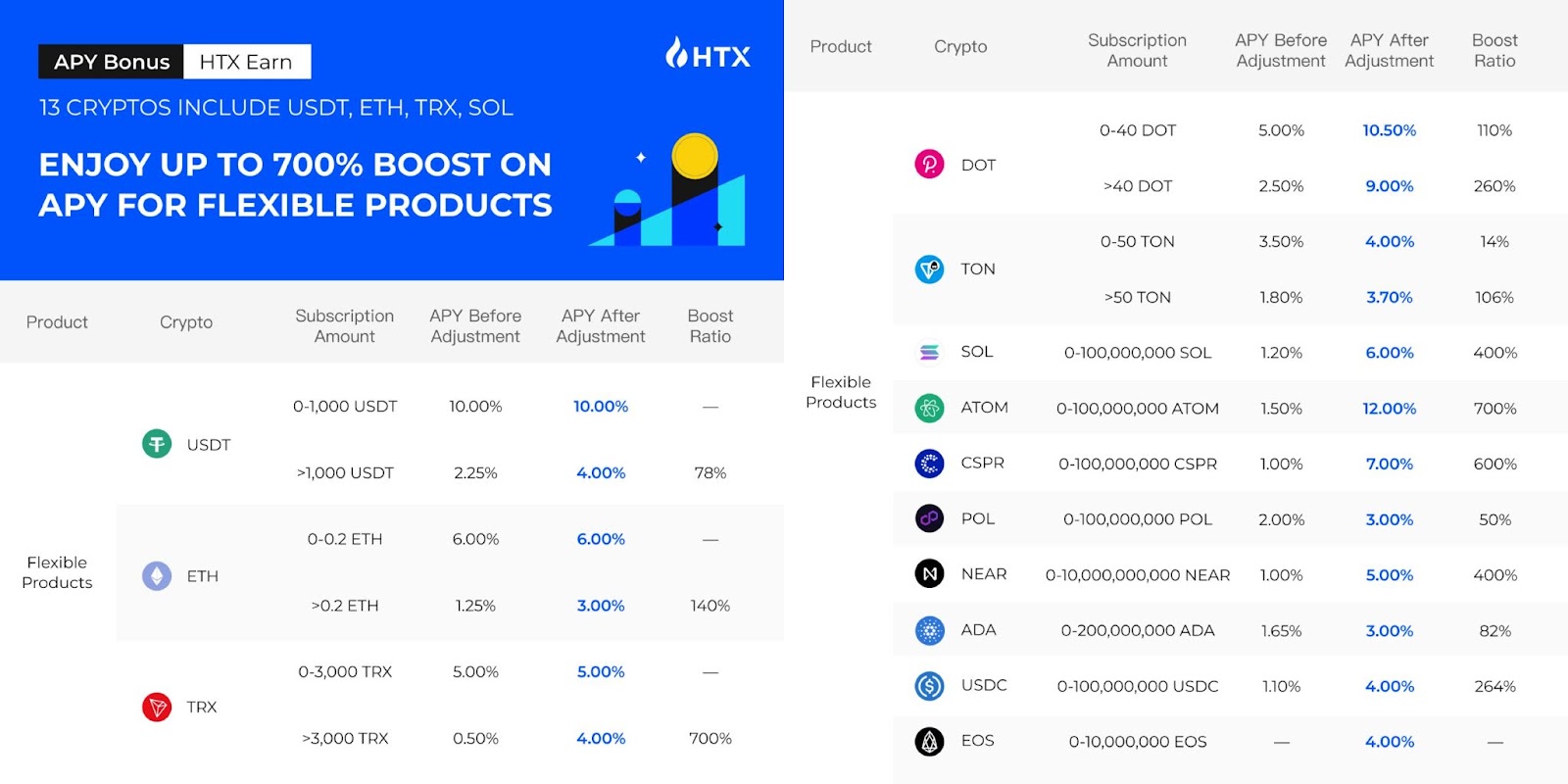

Beyond its success in asset listings, HTX has dedicated greater efforts to advancing its other business lines. Recently, HTX upgraded its Flexible products on HTX Earn, offering limited-time interest rate boosts on 13 major crypto assets as a way to thank users for their support. After the interest rate increase, HTX Earn’s Flexible products now offer industry-leading APYs, including two major stablecoins, USDT and USDC, as well as 11 popular PoS coins like ETH and TRX. Justin stated, “We will continue to deliver more benefits to our users. In addition to the recent Flexible products with interest rate boosts, we will offer daily interest payments on users’ USDT-M futures balances at a 4% APY in our next major initiative. Our goal is not only to generate returns but also to allow users to share in our profits. HTX allocates 50% of its revenue for buybacks and burns, whereas TRON commits 100% to the same purpose.”

Looking ahead, Justin expressed confidence in HTX’s future development, emphasizing the platform’s commitment to improving its overall quality while focusing on steady growth in both asset balances and trading volume. He stressed, “We’ll strive to differentiate ourselves by offering unique features and outperforming competitors in existing ones. Moreover, we will keep enhancing our security measures to ensure the utmost protection of users’ assets and trading safety. By doing so, we can build greater confidence and trust among our users.”

During the discussion, Justin also mentioned his investment strategy in Ethereum. He said, “Some have said that I’m heavily invested in Ethereum. In fact, our investment approach to Ethereum is twofold: first, its potential for value appreciation, and second, its role in the broader blockchain ecosystem, particularly in staking. While Ethereum has not shown significant growth in the current cycle, our main positions remain in $TRX and $HTX.”

This event underscores HTX’s commitment to prioritizing platform users and rewarding them for their support, but also showcases Justin’s strong optimism for the future of the crypto market. HTX will remain dedicated to providing premium services and diverse investment options for users, while driving the healthy development of the entire industry.

The post first appeared on HTX Square.