Options realised volatility surged above 80 percent, signalling heightened instability as traders reacted to shifting macroeconomic conditions. Implied volatility jumped 35.7 percent just ahead of the summit, as traders hedged positions. Despite this, on-chain data revealed that many traders saw significant losses last week, with realised losses across market participants hitting $818 million per day, with February 28 and March 4 ranking among the largest single-day loss events in this cycle. Such widespread capitulation often precedes market stabilisation, though geopolitical and macroeconomic concerns remain a significant overhang.

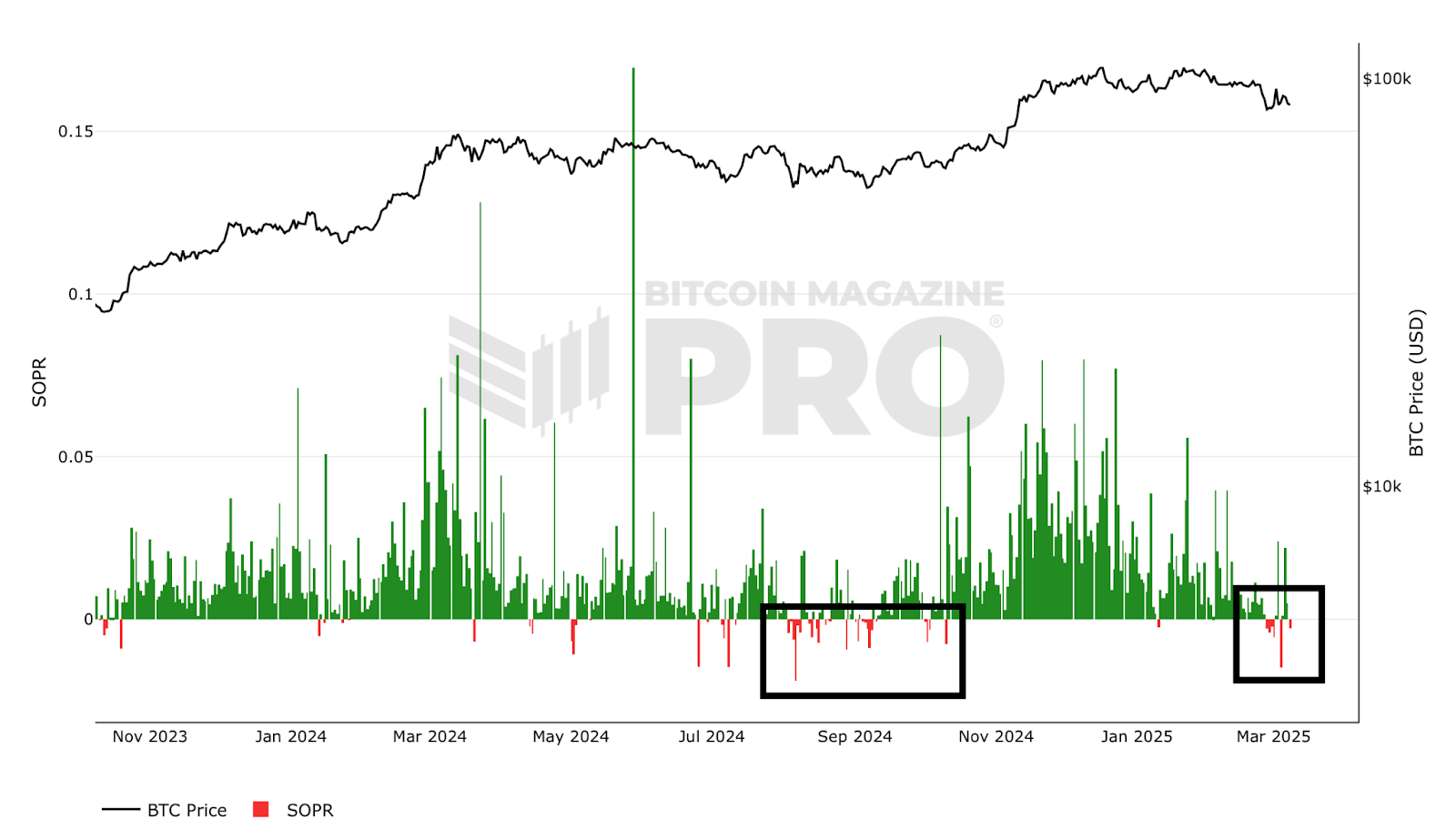

Bitcoin’s Spent Output Profit Ratio (SOPR) dipped into loss territory for the first time since October 2024, indicating significant distress selling. Short-term holder SOPR recorded its second-largest negative print of this cycle at 0.95, signalling that new market entrants are capitulating. Historically, any SOPR measure above 1.0 signals re-accumulation and bullish continuation, while extended weakness below this level could suggest further downside. If the bull market structure remains intact, buyers should begin stepping in at these levels, making SOPR a key metric to monitor in the coming weeks.

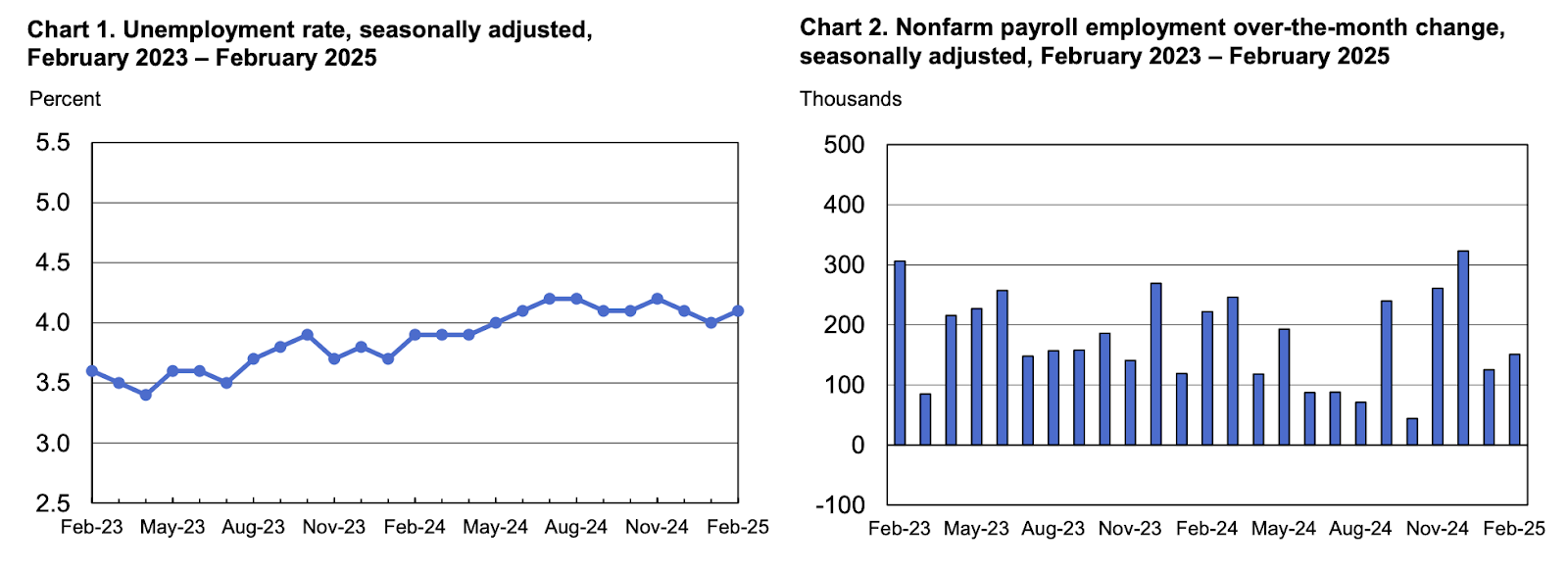

Current macroeconomic indicators, however, are not pointing to a clear direction moving forward. US job market, productivity, and manufacturing sector data are decidedly mixed, with steady employment growth, rising wages, and efficiency gains offset by inflationary pressures, trade disruptions, and cautious business expansion. The US job market remains resilient, with 151,000 jobs added in February, though the unemployment rate ticked up to 4.1 percent due to government job cuts. Wage growth remains strong, but rising labour costs and inflation pressures could challenge expectations of multiple Fed rate cuts this year.

Worker productivity, on the other hand, increased by 1.5 percent in Q4 2024, helping businesses offset rising costs without expanding their workforce, but long-term risks remain if hiring stagnates. Meanwhile, the manufacturing sector faces growing instability as new tariffs drive up production costs and slow new orders, raising concerns about the sector’s ability to sustain growth amid trade uncertainty.

US President Donald Trump’s establishment of a Strategic Bitcoin Reserve, consolidating over 187,000 BTC worth $13 billion, marks a historic shift from auctioning seized Bitcoin to holding it as a national asset. His administration also seeks stablecoin legislation by August and aims to end restrictive policies like Operation Choke Point 2.0, reinforcing the US position as a global crypto leader. With Trump’s Strategic Bitcoin Reserve plan, the US may retain BTC as a long-term financial asset instead of selling it, potentially influencing global crypto policy.

Meanwhile, the SEC’s Crypto Task Force is set to hold a roundtable on March 21 to clarify the security status of digital assets, signalling a shift toward more structured regulatory guidance.In Japan, the Liberal Democratic Party is implementing crypto-friendly tax reforms, reducing the capital gains tax to 20 percent and classifying cryptocurrencies as a distinct asset class. The reforms also propose tax deferrals on crypto-to-crypto swaps and equal tax treatment for derivatives, encouraging digital asset investment.

The post appeared first on Bitfinex blog.