Indeed, BTC has been leading US equity markets in terms of response to macro developments. A double-top structure that has been seen in both the Bitcoin and the S&P 500 charts, occurred first in BTC. The latest market catalyst— Trump’s tariff announcements—triggered a 0.5 percent decline in the S&P 500 last Friday and a more pronounced drop in Bitcoin. Bitcoin’s 30-day rolling correlation with the S&P 500 has climbed to 0.8, marking its highest level in five months. This has reinforced the view that Bitcoin is trading more like a macro-driven risk asset.

Despite short-term volatility, Bitcoin remains structurally strong on higher time frames. BTC has outperformed traditional markets since the US election, rallying from $67,000 to over $100,000, while equities have shown a choppy recovery.

BTC/USD 4H Chart. (Source: Bitfinex)

Against this backdrop, the US economy continues to show resilience through solid consumer spending and economic expansion, yet it is also facing headwinds from policy uncertainty, trade disruptions, and stubborn inflation.

The Federal Reserve has held interest rates steady at 4.25–4.50 percent last week, signalling that policymakers are not ready to ease monetary conditions until inflation shows a clear downward trend. Consumer spending surged in December, with real spending rising 0.4 percent, further reinforcing economic growth but complicating the Fed’s path forward.

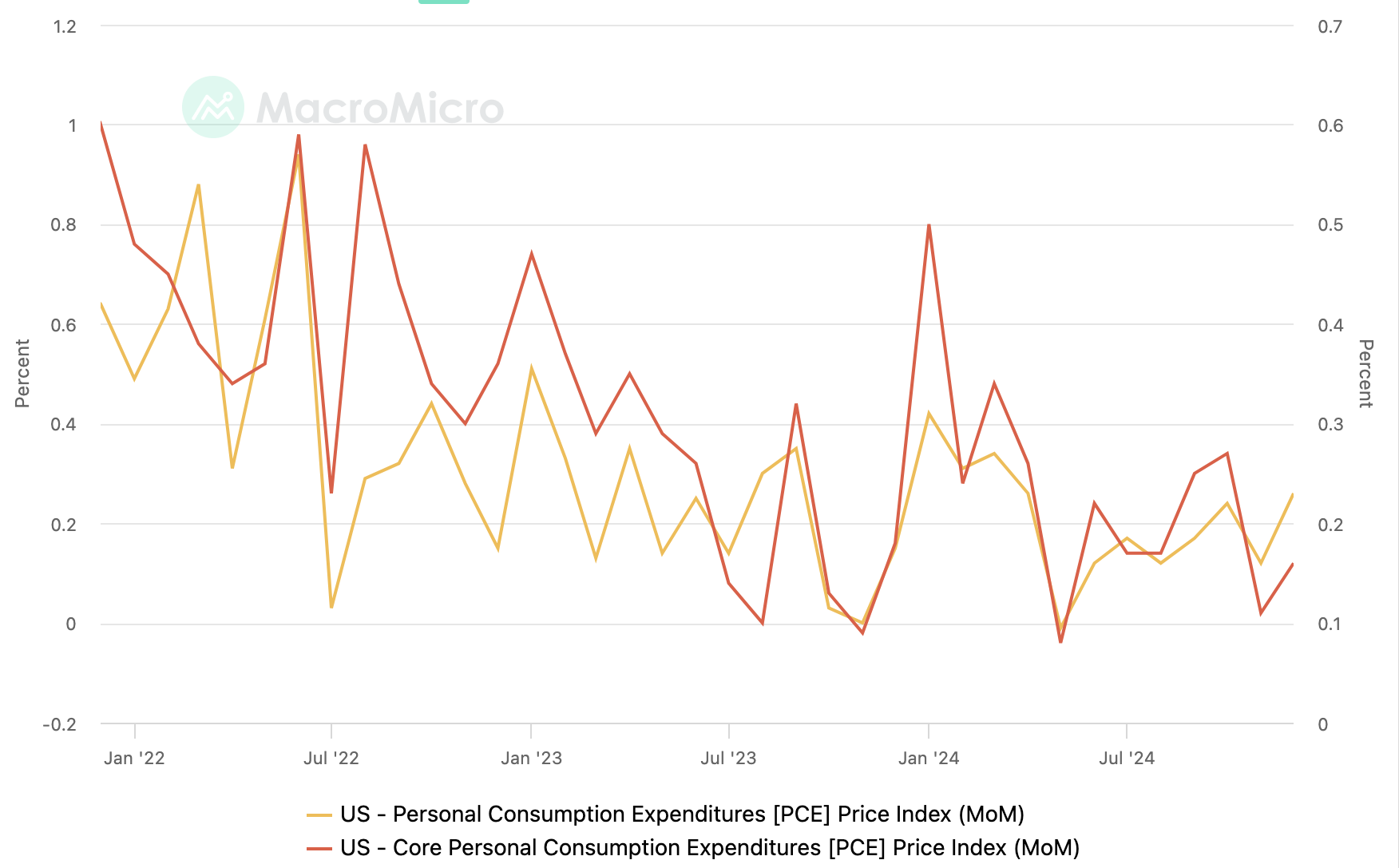

Month-over-Month Percent Change in PCE (Personal Consumption Expenditure) Price Index

Inflation remains above the central bank’s two percent target, with core PCE inflation hovering at 2.8 percent year-over-year. Despite slower wage growth, a tight labour market and potential immigration restrictions could drive labour costs higher, adding to inflationary risks. Meanwhile, economic expansion closed the year at 2.3 percent, supported by robust household consumption and increased government spending, though slowing business investment and trade uncertainties continue to pose risks.

Markets have consequently adjusted rate cut expectations, pricing in a lower probability of near-term easing. With political and economic variables in flux, the coming months will be critical in determining whether the Fed will shift toward policy easing or maintain its restrictive stance to combat inflationary pressures.

As the US economy navigates a period of resilience mixed with policy uncertainty, the cryptocurrency sector is experiencing its own inflection point—one marked by aggressive institutional accumulation, financial innovation, and deeper integration with traditional financial infrastructure. With inflationary pressures keeping the Federal Reserve on hold, market participants are closely watching how digital assets will respond to macroeconomic trends, monetary policy shifts, and increasing corporate adoption.

MicroStrategy continues to double down on Bitcoin, acquiring another 10,107 BTC for $1.1 billion, bringing its total holdings to 158,400 BTC. The firm has also filed a shelf registration with the SEC, allowing it to raise capital efficiently for future Bitcoin purchases. Meanwhile, Metaplanet, a Tokyo-listed company, made history with a $745 million capital raise to expand its Bitcoin reserves, reinforcing its “Bitcoin-first, Bitcoin-only” strategy amid yen depreciation. This signals a growing institutional conviction that Bitcoin serves as a hedge against monetary debasement and economic instability.At the same time, Tether is expanding the utility of its $140 billion USDt stablecoin by integrating it into Bitcoin’s Lightning Network. This move significantly enhances Bitcoin’s financial infrastructure, enabling faster and more efficient global transactions. By leveraging Taproot Assets, Tether is bridging the gap between stablecoins and Bitcoin’s security, making it a more viable payment network rather than just a store of value.

The post appeared first on Bitfinex blog.